Commodities & Precious Metals Weekly Report: Jul 1

Posted:

Key points

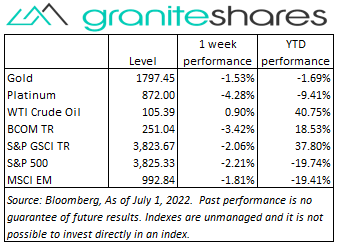

Energy prices, except for crude oil prices, were all lower last week. Natural gas prices fell the most, losing 9%. Heating oil prices fell 7% and gasoline prices dropped 2%. WTI and Brent crude oil prices increased 0.9% and 2.3%, respectively.

Energy prices, except for crude oil prices, were all lower last week. Natural gas prices fell the most, losing 9%. Heating oil prices fell 7% and gasoline prices dropped 2%. WTI and Brent crude oil prices increased 0.9% and 2.3%, respectively.- Grain prices were sharply lower again. Wheat and corn prices fell between 9% and 10%. Soybean prices decreased 2%.

- Precious metal prices were all lower. Spot gold prices decreased 0.9%, spot silver prices fell 5.8% and spot platinum prices fell 1.8%.

- Base metal prices, too, were all lower. Zinc prices ell 9.5%, copper prices fell 3.8% and nickel prices lost 2.6%. Aluminum prices fell less than ½ percent.

- The Bloomberg Commodity Index decreased 3.4% with every sector contributing to the drop. Once again, the grains and energy sectors were responsible for 70% of the decline.

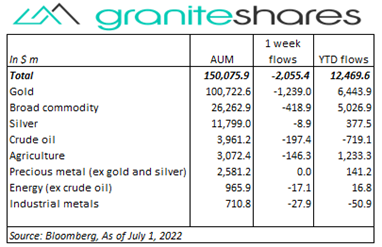

- Another $2 billion outflows from commodity ETPs with over half coming from gold (-$1,239m) ETP outflows. Broad Commodity ETPs saw $419 million outflows and crude oil and agriculture ETPs saw $200 million and $150 million outflows, respectively. No sector had inflows last week.

Commentary

U.S. stock markets ended the week lower with the S&P 500 Index recording its worst first-half performance since 1970 (the first half ended Thursday). Weak consumer confidence levels combined with earnings misses, unexpected lowering of earnings and revenue guidance and hawkish comments by Fed Chairman Powell helped pushed the S&P 500 Index over 3% lower and the Nasdaq Composite Index 5% lower through Thursday. Concerns of slowing growth and recession, however, receded Friday with all three Indexes increasing close to 1%. A slightly lower increase in the PCE price index compared to the previous month (Thursday release) combined with lower-than-expected Chicago PMI and ISM Manufacturing levels as well as falling household spending helped support stock prices on hopes of peaking inflation and sooner-than-expected Fed easing. Supporting this sentiment, the 10-year Treasury rate fell 25bps last week, this time with almost all the decline coming from falling inflation expectations. 10-year real yields climbed as high as 70bps through Wednesday, but ended the week 3bps lower at 53bps. At week’s end, the S&P 500 Index fell 2.2% to 3,825.33, the Nasdaq Composite Index dropped 4.1% to 11,127.84, the Dow Jones Industrial Average decreased 1.3% to 31,0977.46, the 10-year U.S. Treasury rate fell 25 bps to 2.89% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.9%.

U.S. stock markets ended the week lower with the S&P 500 Index recording its worst first-half performance since 1970 (the first half ended Thursday). Weak consumer confidence levels combined with earnings misses, unexpected lowering of earnings and revenue guidance and hawkish comments by Fed Chairman Powell helped pushed the S&P 500 Index over 3% lower and the Nasdaq Composite Index 5% lower through Thursday. Concerns of slowing growth and recession, however, receded Friday with all three Indexes increasing close to 1%. A slightly lower increase in the PCE price index compared to the previous month (Thursday release) combined with lower-than-expected Chicago PMI and ISM Manufacturing levels as well as falling household spending helped support stock prices on hopes of peaking inflation and sooner-than-expected Fed easing. Supporting this sentiment, the 10-year Treasury rate fell 25bps last week, this time with almost all the decline coming from falling inflation expectations. 10-year real yields climbed as high as 70bps through Wednesday, but ended the week 3bps lower at 53bps. At week’s end, the S&P 500 Index fell 2.2% to 3,825.33, the Nasdaq Composite Index dropped 4.1% to 11,127.84, the Dow Jones Industrial Average decreased 1.3% to 31,0977.46, the 10-year U.S. Treasury rate fell 25 bps to 2.89% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.9%.

Energy prices were pushed and pulled by vacillating supply and demand concerns but ended higher on the week as supply concerns ruled. Up over 4% through Thursday on vows of new G7 sanctions on Russian oil, a G7 proposal to cap Russian oil prices as well as production setbacks in Libya and Ecuador, oil prices then moved lower south of 5% over Wednesday and Thursday as fears of recession, highlighted by by an unexpected increase in gasoline and distillate inventories, increased demand concerns. Prices rose on Friday as supply concerns returned to the forefront as Norway oil workers prepare to go on strike. Natural gas prices fell just shy of 9%, plummeting 17% on Thursday alone, as longer-term weather forecasts predicted cooler weather for the Plains states and Southeast.

Gold prices moved lower last again last week reacting, perhaps, to falling inflation expectations. Thursday’s lower-than-expected PCE Price Index release, boosted peaking-inflation expectations with spot gold prices falling almost ½ percent on the day. 10-year inflation expectations fell 22bps over the week, perhaps reflecting investor sentiment of an increased possibility of a Fed-induced recession. Losses on the week were most likely floored, however, by those same recession concerns causing the Fed to lower rates sooner than expected. 10-year real rates reached 70bps Wednesday, up 14bps from the previous Friday, but closed the week down 3bps at 53bps.

Base metal prices moved lower again last week with zinc prices dropping almost 10%. Easing Covid-related restrictions in China moved base metal prices higher through Wednesday. Those gains were erased over Thursday and Friday following hawkish comments by Fed Chair Jerome Powell stating price stability was more important than economic growth. Prices fell sharply Thursday and Friday despite increased Chinese factory activity with copper prices ending the week down 4%.

Grain prices again moved sharply lower last week with wheat prices and corn prices posting the biggest declines. Higher through Wednesday on lower-than-expected crop ratings and China’s easing of Covid-related restrictions, prices fell sharply over Thursday and Friday due to sizeable fund selling, favorable weather forecasts and recession fears. Lower-than-expected weekly soybean and corn export numbers also pressured prices lower.

Coming up this week

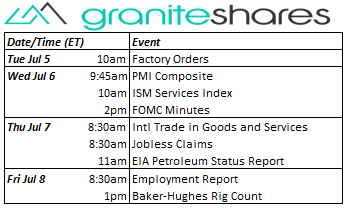

FOMC Minutes Wednesday and Friday’s Employment Report headline this week’s data releases.

FOMC Minutes Wednesday and Friday’s Employment Report headline this week’s data releases.- Factory Orders on Tuesday.

- PMI Composite, ISM Services Index and FOMC Minutes on Wednesday.

- Intl Trade in Goods and Services and Jobless Claims on Thursday.

- Employment Report on Friday.

- EIA Petroleum Status Report Thursday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.