Commodities & Precious Metals Weekly Report: Jul 22

Posted:

Key points

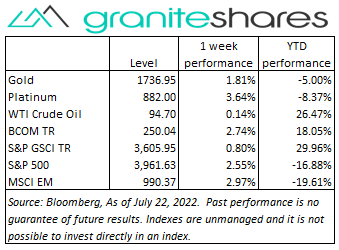

Energy prices were mixed last week with natural gas prices surging and gasoline prices falling. Natural gas prices surged over 18% and WTI and Brent crude oil prices were up between 0.1% and 1.5%. Gasoline and heating oil prices fell 3% and 6%, respectively.

Energy prices were mixed last week with natural gas prices surging and gasoline prices falling. Natural gas prices surged over 18% and WTI and Brent crude oil prices were up between 0.1% and 1.5%. Gasoline and heating oil prices fell 3% and 6%, respectively. - Grain prices were all lower. Wheat prices fell 2%, corn prices dropped 6.5% and soybean prices lost 2%.

- Precious metal prices were mixed. Spot gold prices increased 1.2% and spot platinum prices rose 3.5%. Spot silver prices decreased ½ percent.

- Base metal prices were all higher. Nickel prices surged 14%. Aluminum prices rose 6%, copper prices rose 4% and zinc prices increased 3%.

- The Bloomberg Commodity Index was up 2.7% with the energy sector – driven by surging natural gas prices – primarily responsible for the increase. Gains in the base metals sector were offset by losses in the grains sector.

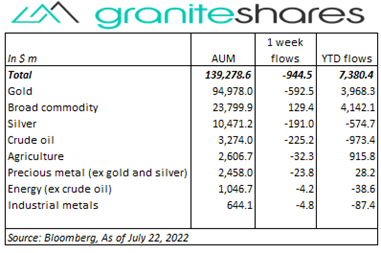

- Almost $1 billion outflows from commodity ETPs last week with over half coming from gold ETPs. Silver and crude oil ETPs saw outflows of about $200 million each while broad commodity ETPs registered about $125 million of inflows.

Commentary

Stock markets ended the week higher with all 3 major indexes increasing 2% or more and with the tech-heavy Nasdaq Composite Index outperforming. Better-than-expected earnings reports were the primary driver for higher stock prices, assisted by a weaker U.S. dollar and falling Treasury rates. Stock markets moved lower Friday, however, following a batch of weaker-than-ex pected earnings reports. The Nasdaq Composite Index, for example, up over 5% through Thursday, fell almost almost 2% Friday to end the week up 3.3%. The 10-year Treasury rate fell again last week, decreasing 18bps with 10-year real yields responsible for almost the entire move lower. 10-year real yields ended the week at 41bps, down 14bps from the previous week’s close of 55bps. At week’s end, the S&P 500 Index gained 2.5% to close at 3,961.63, the Nasdaq Composite Index climbed 3.3% to 11,834.11, the Dow Jones Industrial Average increased 2.0% to 31,900.61, the 10-year U.S. Treasury rate fell 18 bps to 2.75% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 1.3%.

Stock markets ended the week higher with all 3 major indexes increasing 2% or more and with the tech-heavy Nasdaq Composite Index outperforming. Better-than-expected earnings reports were the primary driver for higher stock prices, assisted by a weaker U.S. dollar and falling Treasury rates. Stock markets moved lower Friday, however, following a batch of weaker-than-ex pected earnings reports. The Nasdaq Composite Index, for example, up over 5% through Thursday, fell almost almost 2% Friday to end the week up 3.3%. The 10-year Treasury rate fell again last week, decreasing 18bps with 10-year real yields responsible for almost the entire move lower. 10-year real yields ended the week at 41bps, down 14bps from the previous week’s close of 55bps. At week’s end, the S&P 500 Index gained 2.5% to close at 3,961.63, the Nasdaq Composite Index climbed 3.3% to 11,834.11, the Dow Jones Industrial Average increased 2.0% to 31,900.61, the 10-year U.S. Treasury rate fell 18 bps to 2.75% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 1.3%.

Up over 6% through Tuesday on supply concerns, oil prices ended the week almost unchanged on weakening demand concerns. Russia’s invoking of force majeure to curtail natural gas deliveries to Europe along with unchanged OPEC production increased supply concerns and moved oil prices higher early last week. Wednesday’s EIA report showing sharply falling gasoline demand in the U.S., Thursday’s ECB 50bp rate increase revived demand concerns, pushing prices lower the remainder of the week. Libya’s oil production resumption also pressured prices lower. Chinese stimulus measures and a weaker U.S. dollar, however, helped support prices. Natural gas prices surged 18%, boosted by low inventory levels, lower-than-expected injections and hot weather throughout the U.S.

Gold prices increased last week supported by a weaker U.S. dollar. Decreasing expectations of a 100bp Fed rate hike this week combined with a greater-than-expected 50bp ECB rate increase worked to weaken the U.S. dollar, push Treasury rates lower and move gold prices higher. 10-year Treasury rates fell 18bps with most of that move lower due to a decline in 10-year real rates from 55bps to 41bps.

Base metal prices, too, moved higher last week, led by a sharp increase in nickel prices. Reports Monday that China encouraged banks to lend to real estate developers pushed base metal prices noticeably higher Monday. Lower copper production forecasts from a series of major mines combined with drought conditions in Chile also supported prices as did a weaker U.S. dollar.

Grain prices moved lower with corn prices falling the most. Improved weather forecasts of more rain the remainder of this month and early August and of cooler temperatures helped move prices lower. Reports of fund selling and increased expectations of increased Ukraine wheat sales also helped pressure prices lower.

Coming up this week

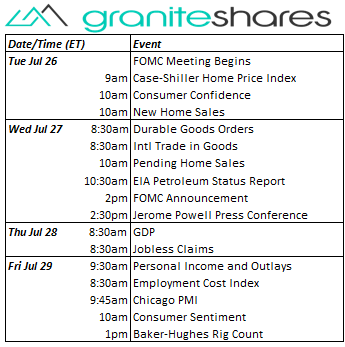

Busy data week highlighted by an FOMC rate decision Wednesday.

Busy data week highlighted by an FOMC rate decision Wednesday.- FOMC Meeting Begins, Consumer Confidence and New Home Sales on Tuesday.

- Durable Goods Orders, Intl Trade in Goods, Pending Home Sales and FOMC Announcement on Wednesday.

- GDP and Jobless Claims on Thursday.

- Personal Income and Outlays, Employment Cost Index, Chicago PMI and Consumer Sentiment on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.