Commodities & Precious Metals Weekly Report: Mar 25

Posted:

Key points

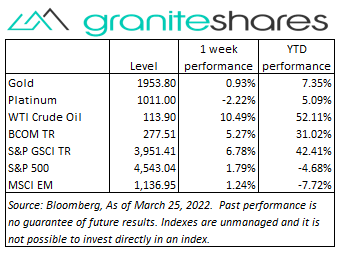

Energy prices were all higher last week. May WTI and Brent crude oil and heating oil futures prices gained close to 11%. Gasoil prices rose over 12% and gasoline prices increased 7%. Natural gas jumped 15% higher.

Energy prices were all higher last week. May WTI and Brent crude oil and heating oil futures prices gained close to 11%. Gasoil prices rose over 12% and gasoline prices increased 7%. Natural gas jumped 15% higher.- Grain prices were also all higher. Chicago and Kansas wheat prices increased 3.7%. Corn and soybean prices rose 1.7% and 2.5%, respectively.

- Precious metal prices were mixed. June gold futures prices increased 1.3% and May silver futures prices increased 2.1%. Spot Platinum prices fell 1.8% and palladium prices lost close to 7%.

- Base metal prices were mixed. Nickel prices fell 4% (though prices were limit up Monday, close to limit up Tuesday and limit down both Wednesday and Thursday) and copper prices decreased about 1%. Aluminum and zinc prices increased close to 7%.

- The Bloomberg Commodity Index rose 5.3%. Almost ¾ percent of the gain came from the energy sector. The grains sector was the next largest contributor providing about 12% of the gain. All sectors had positive performance.

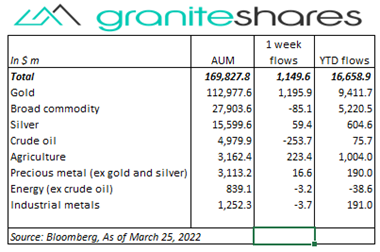

- Good flows into commodity ETPs continued last week though crude oil ETPs saw some outflows. Inflows into gold ($1,196m) and agriculture ($223m) ETP inflows were partially offset by outflows from crude oil (-$254m) and broad commodity (-$85m) ETPs.

Commentary

Another up-week for U.S. stock markets with growth/tech stocks outperforming value/cyclical stocks. As in previous weeks, volatility remained high with the all three major stock indexes experiencing +/- 1% moves 3 days last week. Stock prices moved lower Monday following Fed Chair Powell’s comments inflation was too high and the Fed would not hesitate to raise rates by more than 25bps if deemed necessary. Stock markets reacted positively to these comments the remainder of week, however, choosing to interpret the comments as a vote of confidence on the ability of the U.S. economy to withstand larger rate increases. Stock markets did move lower with strongly increasing oil prices (Monday and Wednesday), perhaps indicating investor concerns of stagflation. The 10-year Treasury rate moved markedly higher last week, jumping 33bps, propelled by Chairman Powell’s hawkish comments. Interestingly, though, 10-year inflation expectations continued to move higher, climbing 8bps to just under 3% while 10-year real rates increased 25bps (to -0.5%), comprising the remainder of the 10-year Treasury rate increase. At week’s end, the S&P 500 Index increased 1.8% to 4,543.04, the Nasdaq Composite Index rose 2.0% to 14,169.30, the Dow Jones Industrial Average increased 0.3% to close at 34,861.7, the 10-year U.S. Treasury rate increased 33bp to 2.49% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.6%.

Another up-week for U.S. stock markets with growth/tech stocks outperforming value/cyclical stocks. As in previous weeks, volatility remained high with the all three major stock indexes experiencing +/- 1% moves 3 days last week. Stock prices moved lower Monday following Fed Chair Powell’s comments inflation was too high and the Fed would not hesitate to raise rates by more than 25bps if deemed necessary. Stock markets reacted positively to these comments the remainder of week, however, choosing to interpret the comments as a vote of confidence on the ability of the U.S. economy to withstand larger rate increases. Stock markets did move lower with strongly increasing oil prices (Monday and Wednesday), perhaps indicating investor concerns of stagflation. The 10-year Treasury rate moved markedly higher last week, jumping 33bps, propelled by Chairman Powell’s hawkish comments. Interestingly, though, 10-year inflation expectations continued to move higher, climbing 8bps to just under 3% while 10-year real rates increased 25bps (to -0.5%), comprising the remainder of the 10-year Treasury rate increase. At week’s end, the S&P 500 Index increased 1.8% to 4,543.04, the Nasdaq Composite Index rose 2.0% to 14,169.30, the Dow Jones Industrial Average increased 0.3% to close at 34,861.7, the 10-year U.S. Treasury rate increased 33bp to 2.49% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.6%.

Oil prices moved sharply higher last week, rising 7% and 5% Monday and Wednesday, as oil markets remain volatile. EU discussions regarding joining the U.S. embargo of Russian oil moved oil prices sharply high Monday while news of storm-related Caspian pipeline outages affecting the flow of over 1 million barrels/day of Russia and Kazakhstan oil exports pushed oil prices over 5% higher Wednesday. Falling U.S. oil inventory levels, stalled Iran nuclear talks and Houthi attacks Monday and Friday on Saudi oil facilities also contributed to higher oil prices. May WTI and Brent crude oil futures prices rose just 11% last week.

Gold prices moved higher last week supported by the Russia-Ukraine war (haven-investment demand) and inflation/stagflation concerns. Though the 10-year Treasury rate rose 33bps last week, 10-year inflation expectations also rose, increasing 8bps to just under 3%. 10-year real yields, up 25bps on the week, remain negative at -0.5%. Silver prices rose with gold prices. Platinum and palladium prices moved lower again last week perhaps due to declining auto production (a consequence of chip shortages).

Another volatile week for nickel prices. Nickel prices traded limit down Monday (-15%), fell another 11% Tuesday (as LME prices sought equilibrium with Shanghai prices) and then traded limit up (+15%) Wednesday and Thursday. Though the intraday price range was wide Friday, LME nickel prices end the day just under 5% lower, finishing the week 4% lower. Zinc and aluminum prices moved higher with increasing energy prices (zinc and aluminum production is highly energy intensive). Aluminum prices also rose on news Australia was banning exports of alumina to Russia exacerbating already tight supply conditions. Copper prices were slightly lower, perhaps over concerns of Chinese Covid-19 lockdowns.

Wheat prices moved higher again last week supported by expectations Ukraine will only be able to plant a portion of its normal wheat and corn acreage. Soybean prices continue to be supported by good export demand and rising oil prices. Lean hog prices rose 8% last week on very strong demand from Mexico resulting from outbreaks of deadly hog diseases reducing herds.

Coming up this week

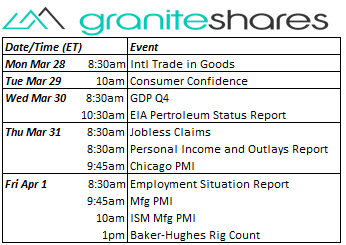

Lighter data-week with the PCE Price Index on Thursday and the Non-Farm Payroll Report on Friday.

Lighter data-week with the PCE Price Index on Thursday and the Non-Farm Payroll Report on Friday.- International Trade in Goods on Monday.

- Consumer Confidence on Tuesday.

- GDP (Q4 final estimate) on Wednesday.

- Jobless Claims, Personal Income and Outlays Report and Chicago PMI Thursday.

- Employment Situation Report, Mfg PMI and ISM Mfg PMI on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.