Commodities & Precious Metals Weekly Report: May 13

Posted:

Key points

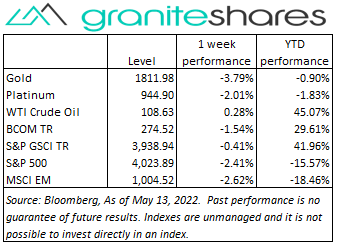

Energy prices were mixed with natural gas and Brent Crude oil prices lower and gasoline and WTI Crude oil prices higher. Natural gas prices fell 4.5% and Brent crude oil prices fell 1%. Gasoline prices rose almost 3.5% and WTI crude oil prices edged 0.3% higher.

Energy prices were mixed with natural gas and Brent Crude oil prices lower and gasoline and WTI Crude oil prices higher. Natural gas prices fell 4.5% and Brent crude oil prices fell 1%. Gasoline prices rose almost 3.5% and WTI crude oil prices edged 0.3% higher.- Grain prices were mainly high with only corn prices registering a slight loss. Wheat prices again were sharply higher, gaining between 6% and 9%. Soybean prices were up 1.5%. Corn prices were down ½ percent.

- Precious metal prices were all lower. Spot gold prices fell 3.8% and spot silver prices dropped 6.1%. Spot platinum prices fell 1.9%.

- Base metal prices were all lower. Aluminum and copper prices fell 2% while zinc and nickel price were down 7.5% and 9.4%, respectively.

- The Bloomberg Commodity Index fell 1.5%. Losses in the energy, base metals and precious metals sectors were partially offset by gains in the grains sector.

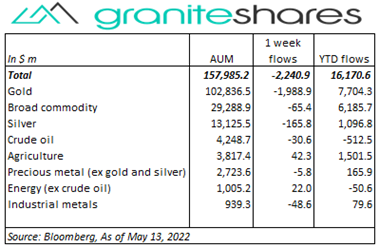

- Larger outflows from commodity ETPs last week with gold ETP outflows comprising most of the outflows. Gold ETPs saw outflows of almost $2 billion followed by silver ETPs with outflows of $165 million.

Commentary

U.S. stock markets finished lower last week while experiencing another bout of volatility. Investor trepidation focusing on continued elevated inflation, aggressive Fed tightening, Chinese Covid-related lockdowns and the Russia-Ukraine war combined to push stock markets sharply lower through Thursday with the Nasdaq Composite Index, for example, falling nearly 6.5%. Lower than the previous month’s levels but higher than expected, Wednesday’s CPI release enforced inflation and aggressive Fed tightening concerns causing markets to falter, with the Nasdaq Composite Index reacting the worst, falling over 3%. Stock markets rallied sharply Friday on no new news but perhaps benefiting from investors believing the market was oversold. Interestingly, the 10-year Treasury rate decreased 21bps over the week, with 2/3 of the decline coming from falling 10-year inflation expectations and the remaining 1/3 from falling 10-year real rates. Falling inflation expectations may possibly reflect market sentiment that inflation has peaked. The U.S. dollar continued to strengthen. At week’s end, the S&P 500 Index lost 2.4% to close at 4,023.89, the Nasdaq Composite Index dropped 2.8% to 11,805.00, the Dow Jones Industrial Average fell 2.1% to 32,195.94, the 10-year U.S. Treasury rate decreased 21 bps to 2.93% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.9%.

U.S. stock markets finished lower last week while experiencing another bout of volatility. Investor trepidation focusing on continued elevated inflation, aggressive Fed tightening, Chinese Covid-related lockdowns and the Russia-Ukraine war combined to push stock markets sharply lower through Thursday with the Nasdaq Composite Index, for example, falling nearly 6.5%. Lower than the previous month’s levels but higher than expected, Wednesday’s CPI release enforced inflation and aggressive Fed tightening concerns causing markets to falter, with the Nasdaq Composite Index reacting the worst, falling over 3%. Stock markets rallied sharply Friday on no new news but perhaps benefiting from investors believing the market was oversold. Interestingly, the 10-year Treasury rate decreased 21bps over the week, with 2/3 of the decline coming from falling 10-year inflation expectations and the remaining 1/3 from falling 10-year real rates. Falling inflation expectations may possibly reflect market sentiment that inflation has peaked. The U.S. dollar continued to strengthen. At week’s end, the S&P 500 Index lost 2.4% to close at 4,023.89, the Nasdaq Composite Index dropped 2.8% to 11,805.00, the Dow Jones Industrial Average fell 2.1% to 32,195.94, the 10-year U.S. Treasury rate decreased 21 bps to 2.93% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.9%.

Recession and weak demand concerns, prompted by global central bank tightening and Chinese Covid-related lockdowns, pushed crude oil prices almost 10% lower through Tuesday. Russia’s sanctioning of European natural gas firms and dramatically reduced pipeline flows of Russian natural gas, drove WTI crude oil prices almost 6% higher Wednesday. Prices then rose another 5%, powered by soaring gasoline prices and indications China was diminishing lockdowns. For the week, WTI crude oil prices edged slightly lower, decreasing 0.3%.

Gold prices dropped every day last week, except Wednesday, pressured by rising real rates and easing inflation expectations. 10-year real rates fell 8bps and 10-year inflation expectations moved 13 bps lower to 2.73%. Extreme stock market volatility, continued elevated inflation levels and geo-political risks, however, have helped limit down moves.

Base metal prices moved lower again last week with prices continuing to be pressured by demand concerns due to China’s Covid-related lockdowns and by central bank tightening policies. A strengthening U.S. dollar also contributed to weaker prices.

Wheat prices were markedly higher last week supported by below average planting progress, adverse weather conditions and lower-than-expected world ending stocks as released Thursday in the USDA WASDE. Corn and soybean price were also supported by below average planting progress but USDA WASDE ending stocks were near expectations.

Coming up this week

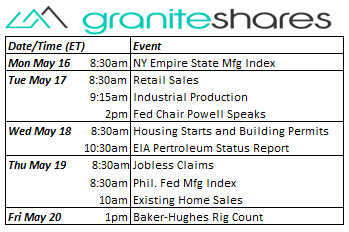

Retail Sales, Housing Starts and Fed Chair Powell Speaking highlight this week’s data and events.

Retail Sales, Housing Starts and Fed Chair Powell Speaking highlight this week’s data and events.- NY Empire State Mfg Index on Monday.

- Retail Sales, Industrial Production and Fed Chair Powell Speaks on Tuesday.

- Housing Starts on Wednesday.

- Jobless Claims, Phil. Fed Mfg Index and Existing Home Sales on Thursday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.