Commodities & Precious Metals Weekly Report: May 6

Posted:

Key points

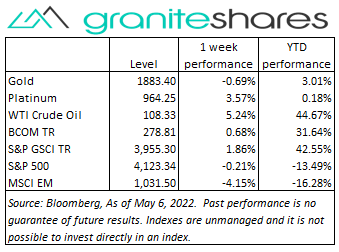

Energy prices were higher again last week. Natural gas prices rose the most climbing 10.5%, followed by gasoline prices, up 8.5%. heating oil prices increased 2.5% and WTI and Brent crude oil prices rose 5%.

Energy prices were higher again last week. Natural gas prices rose the most climbing 10.5%, followed by gasoline prices, up 8.5%. heating oil prices increased 2.5% and WTI and Brent crude oil prices rose 5%. - Grain prices were mixed. Wheat prices were sharply higher, gaining between 5% and 6%. Corn and soybean prices fell 3.5%.

- Precious metal prices were mixed as well. Spot gold prices fell 0.7% and spot silver prices decreased 1.7%. Spot platinum prices increased 3.6%.

- Base metal prices were all lower. Aluminum and zinc prices fell 7.0% and 8.2%, respectively. Nickel and copper prices were down 3% and 3.2%, respectively.

- The Bloomberg Commodity Index increased 0.7%. Energy sector gains were primarily offset by losses in the base metal, precious metal and grains sectors.

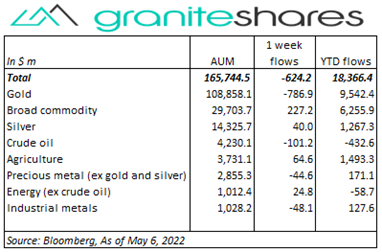

- Net outflows last week for commodity ETPs. Gold (-$787m) and crude oil (-$101m) outflows were partially offset by broad commodity ($227m) inflows.

Commentary

Another volatile week with major stock market indexes finishing lower. The volatility last week, however, was concentrated in large offsetting moves Wednesday and Thursday following the FOMC decision to increase the Fed funds target rate by 50bps. The sharp rally Wednesday came as the Fed excluded 75bp rate increases – a possibility the market had considered highly probable – pushing all 3 major stock market indexes 3% higher. Thursday’s sharp selloff occurred on no new news but as investors reassessed their market outlooks given the Fed’s apparent rate-hike path and rising longer-term interest rates. Friday’s better-than-expected Non-farm Payroll Report offered no reprieve from falling stock markets, with some analysts saying it provided evidence the economy remained strong and could withstand aggressive Fed tightening without the risk of recession. Concerns regarding China’s Covid-related lockdowns and the Russia-Ukraine war also weighed on markets. 10-year U.S. Treasury rates rose 20bps to levels not seen in over 3 years. The increase was due entirely to rising real yields (up 27bps to 0.27%) and offset partially by falling 10-year inflation expectations (down 7bps to 2.87%). The U.S. dollar continued to strengthen. At week’s end, the S&P 500 Index decreased 0.2% to 4,123.34, the Nasdaq Composite Index fell 1.5% to 12,144.66, the Dow Jones Industrial Average decreased 0.2% to 32,901.08, the 10-year U.S. Treasury rate rose 20 bps to 3.14% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.7%.

Another volatile week with major stock market indexes finishing lower. The volatility last week, however, was concentrated in large offsetting moves Wednesday and Thursday following the FOMC decision to increase the Fed funds target rate by 50bps. The sharp rally Wednesday came as the Fed excluded 75bp rate increases – a possibility the market had considered highly probable – pushing all 3 major stock market indexes 3% higher. Thursday’s sharp selloff occurred on no new news but as investors reassessed their market outlooks given the Fed’s apparent rate-hike path and rising longer-term interest rates. Friday’s better-than-expected Non-farm Payroll Report offered no reprieve from falling stock markets, with some analysts saying it provided evidence the economy remained strong and could withstand aggressive Fed tightening without the risk of recession. Concerns regarding China’s Covid-related lockdowns and the Russia-Ukraine war also weighed on markets. 10-year U.S. Treasury rates rose 20bps to levels not seen in over 3 years. The increase was due entirely to rising real yields (up 27bps to 0.27%) and offset partially by falling 10-year inflation expectations (down 7bps to 2.87%). The U.S. dollar continued to strengthen. At week’s end, the S&P 500 Index decreased 0.2% to 4,123.34, the Nasdaq Composite Index fell 1.5% to 12,144.66, the Dow Jones Industrial Average decreased 0.2% to 32,901.08, the 10-year U.S. Treasury rate rose 20 bps to 3.14% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.7%.

Nearly 2% lower through Tuesday on China Covid-related demand reduction concerns, WTI crude oil prices rallied the remainder of the week, fueled by EU efforts to ban imports of Russia crude oil and refined products by year end. OPEC+’s decision to not increase production beyond its scheduled increase also supported oil prices. Natural gas prices moved sharply higher again, supported by growing LNG exports and low inventory levels.

Gold prices dropped nearly 2% Monday, pressured by a strong U.S. dollar and concerns of faltering global growth in the face of Chinese Covid-related lockdowns and aggressive Fed tightening. Those concerns diminished the remainder of the week with the Fed increasing rates 50bps (as expected) but ruling out 75bp rate increases and with growing inflation concerns. Concerns surrounding the Russia-Ukraine war and the EU possibly banning Russia oil imports elevated inflation concerns, lending support to gold prices.

Base metal prices moved lower last week pressured by continued demand concerns due to China’s Covid-related lockdowns and by central bank tightening policies. A strong U.S. dollar also contributed to weaker prices.

Wheat prices were higher last week buoyed by India’s ban on exports due to drought-like conditions damaging crops. Corn and soybean prices fell on slightly weaker-than-expected exports and expectations of good planting progress in the US over the next week or so.

Coming up this week

Very light data-week highlighted by CPI (Wed) and PPI (Thu) releases.

Very light data-week highlighted by CPI (Wed) and PPI (Thu) releases. - CPI on Wednesday.

- Jobless Claims and PPI on Thursday.

- Import Export Price Indexes and Consumer Sentiment on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.