3LMO

GraniteShares 3x Long Moderna Daily ETP Securities

3LMO Descrizione del prodotto

GraniteShares 3x Long Moderna Daily ETP Securities est un produit collatéralisé et négocié en bourse (Exchange Traded Product - ETP).L'ETP suit, hors frais et autres ajustements, la performance de l'indice Solactive Daily Leveraged 3x long Moderna Index qui vise à fournir 3 fois la performance quotidienne de l'action Moderna shares.

Par exemple, si Moderna augmente de 1 % durant une journée, alors l'ETP augmentera de 3%, hors frais et autres ajustements.Cependant, si Moderna baisse de 1 % durant une journée, alors l'ETP augmentera de 3%, hors frais et autres ajustements.

Cos'è Moderna (MRNA)?

Moderna, Inc. opera come azienda biotecnologica. La società si concentra sulla scoperta e sullo sviluppo di terapie e vaccini a base di RNA messaggero. Moderna sviluppa medicinali a mRNA per malattie infettive, immuno-oncologiche e cardiovascolari.

Aspetti principali

GraniteShares 3x Long Moderna Daily ETP Securities PANORAMICA

ISIN e ticker di for GraniteShares 3x Long Moderna Daily ETP Securities

| Borsa | Commercio Valuta |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| Borsa Italiana | EUR | 3LMO | XS3069877556 | ||

| London Stock Exchange | GBP | MOL3 | XS3069877556 | BQ82BH3 | |

| London Stock Exchange | USD | 3LMO | XS3069877556 | BQ82BC8 |

INDICE E PRESTAZIONI of GraniteShares 3x Long Moderna Daily ETP Securities

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

Dettagli del collaterale di GraniteShares 3x Long Moderna Daily ETP Securities

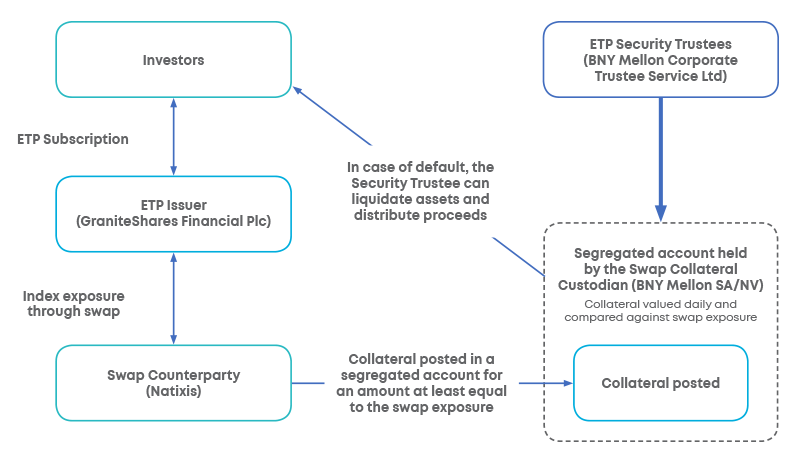

Understanding Collateral

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.