Apple Leverage Shares

Posted:

Apple (AAPL) has been the first company to reach a market capitalization of $3 trillion mark (Source: nbfc news). Also, in August 2020 it was the first company to reach the $2 trillion market cap (Source: Cnbc). This was the first company to ever ignite the personal computer revolution. The biggest driver of Apple’s success at that time was the iPhone which was introduced in 2007. This led to colossal growth for the company as well as a loyal customer base. The technology behemoth continued the winning streak by launching iPad, iTunes, iMac, iPod, and Appstore thereby creating a whole tech ecosystem.

The company released its quarter 2 earnings for 2022, the revenue rose by 9% on a year-on-year basis to $97.3 billion (Source: Apple Investor Relations). The company witnessed an all-time revenue record in the service segment of the company with service revenue that rose by 17% to $19.82 billion. The services segment of Apple includes App Store, Apple Care, Apple Music, Apple TV+, Apple Arcade, and other offerings.

The macro-economic factors including the rising inflation and the Russia-Ukraine war have led to a volatile market. Due to these reasons the company has been losing its market capitalization. There are numerous factors affecting the prices of Apple that including the expected rise in the cost of production led by inflation, the company is facing anti-trust scrutiny in the US, European, and Asia for its App Store policies, and being amidst the change to 5g upgrade cycle. There are numerous ways to invest or trade in the stock market based on the risk appetite.

There are diverse ways to invest in the company whether long or short, below are ways to invest to gain maximum returns.

Ways to Invest in Apple (long or short):

Direct Equities:

Investors can invest by either going long or holding the stock by purchasing it in full. For the investor to purchase the stock they should first analyze the company’s risk and return as well as their own goals and overall financial health before investing in the long term. Another option is to swing trade by catching the trend either long or short to earn profit based on volumes. Further, another option while inviting in the equities is to intra-trade in the stock, here you will not be required to invest 100% of the stock price, the margin investment will be depending on the stock and the brokerage through which the investor is investing. On average 30% of the stock price is the margin requirement either on the long or the short side of the trade. In this case, the trade needs to be settled with that trading session itself. The problem with investing directly through equities for swing trading and intraday is the cost I.e., the brokerage cost, taxes, and the leverage is lower as compared to other instruments.

Derivatives:

It is a contract where two or more parties I.e., the buyer, the seller, and the value are derived from the value of the performance of the underlying asset or entity. It can be equity, asset, or an index. Derivatives include futures, options, forwards, and swaps. In these contracts, the margin required for trading is comparatively less than that of the equity intraday. But there is a minimum margin requirement for the contracts. These are leveraged products where traders can earn profits based on the trend and volumes as well as news. In futures and options contracts, the loss is not necessarily limited to the initial investment and there is no embedded stop-loss mechanism to curb the loss if the price goes in the opposite direction of the expected trade. Since derivatives are leveraged, investments there is some inherent risk involved while investing. Investors must analyze the market trends as well as technical before trading through derivatives.

Leverage ETPs:

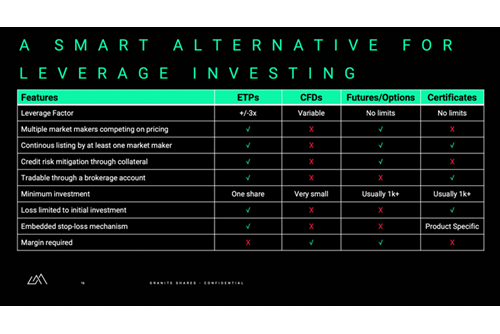

It is like derivatives that attempts to multiply the returns using the underlying index and single stocks. Leveraged and inverse ETPs mark returns based on the daily performance of the underlying index as well as single stocks. Leveraged ETPs usually have a multiplier in their name on the contract like 3x or words such as ‘ultra’ or ‘daily’. These ETPs attempt to deliver the multiples of the index or stock’s return daily (positive or negative). The 3x are the multiplier of returns on both the upside and the downside based on the underlying asset. Inverse ETPs are negative numbers like -3x or the term like short or inverse in their names. These ETPs move in the opposite direction of the underlying index. People can also invest in a basket of popular single stocks called FANG, GAFAM, and FATANG

Leveraged ETPs have a minimum investment of just one share and in terms of transparency as well as risk it is less compared to the derivatives contract. Investors trading on indexes or some single stocks can opt for ETP trading to earn returns for short-term trading. The ETPs also have an embedded stop-loss option to curb the losses if the trend goes south.

Investors can choose various investment options to earn profits on the Apple stock based on the trends and technical analysis as well as global macro-economic factors affecting the stock prices. Apple has been one of the top names in the technology sector and it plays a huge role in the broader markets.

Different types of Leverage Investments:

|

Product name |

Ticker(USD) |

Ticker(EUR) |

Ticker(GBX) |

|---|---|---|---|

|

GraniteShares 3x Long Apple Daily ETP |

3LAP | 3LAE | 3LWP |

|

GraniteShares 3x Short Apple Daily ETP |

3SAP | 3SAE | 3SWP |

|

GraniteShares 3x Long FATANG Daily ETP |

3FTE | 3FTG | 3FTP |

|

GraniteShares 3x Short FATANG Daily ETP |

3SFT | 3S3E | 3S3P |

|

GraniteShares FATANG ETP |

FTNG | FTNE | FTNP |

|

GraniteShares 1x Short FATANG Daily ETP |

SFTG | SFTE | SFTP |

DISCLAIMER

Please note that GraniteShares' short and leveraged Exchange Traded Products are suitable only for sophisticated investors.

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. GraniteShares Limited (“GraniteShares”) (FRN: 798443) is an appointed representative of Messels Limited which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.