December's Inflation Uptick: Annual Rate Surges to 3.4%

Posted:

On January 11, 2024, the US Bureau of Labor Statistics (BLS) stated that prices for a range of goods and services increased more than anticipated. This data underscores the continued influence of inflation on the U.S. economy.

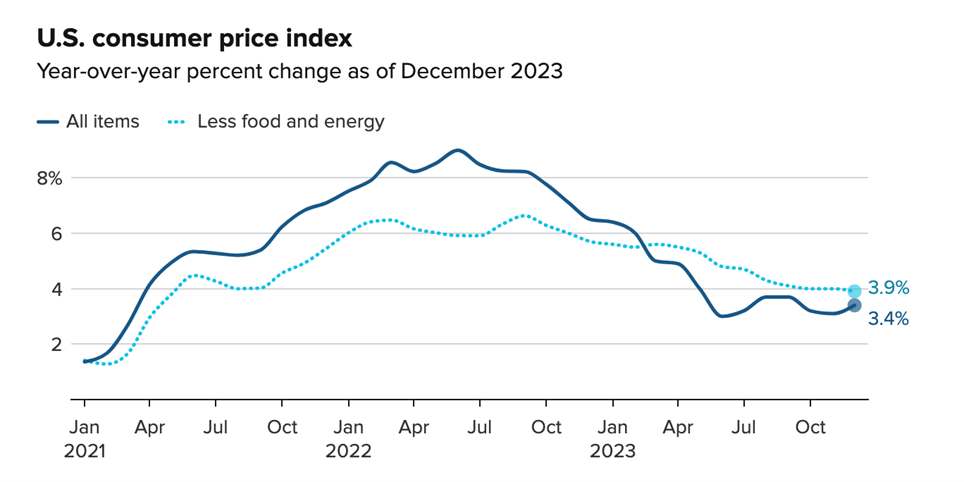

The Consumer Price Index (CPI) increased by 0.3% month-over-month (MoM), closing 2023 with a 3.4% rise on a 12-month basis. In December 2022, the annual CPI gain was approximately 6.4%. Additionally, excluding volatile food and energy prices, the core Consumer Price Index also rose by 0.3% for the month and 3.9% from a year ago, marking the lowest year-over-year core reading since May 2021.

Moreover, the increase in the core inflation was largely attributed to rising shelter costs, which experienced a 0.5% monthly rise, contributing more than half to the overall core CPI increase. On an annual basis, shelter costs surged by 6.2%, accounting for about two-thirds of the overall inflation increase.

In December 2023, the shelter index continued its upward trend, accounting for more than half of the overall monthly increase in all items. The energy index saw a 0.4% rise, driven by increases in the electricity index and the gasoline index, which outweighed a decrease in the natural gas index. The food index increased by 0.2% in December, mirroring the rise observed in November. Specifically, the index for food at home experienced a 0.1% increase for the month, while the index for food away from home rose by 0.3%.

Source: U.S. Bureau of Labor Statistics, CNBC

Data as of Jan. 11, 2024

Food CPI:

In December, the food index increased by 0.2%, mirroring the previous month's trend. The index for food at home saw a 0.1% increase, consistent with the previous month's figure. Among major grocery store food groups, four out of six indexes registered increases. The index for meats, poultry, fish, and eggs rose by 0.5%, primarily driven by an 8.9% surge in the index for eggs. Other food at home and nonalcoholic beverages indexes increased by 0.1% and 0.2%, respectively. The index for dairy and related products saw a 0.3% rise in December.

However, the cereals and bakery products index declined by 0.3%, with the breakfast cereal index experiencing a notable 2.4% decrease—the largest since January 2007. The fruits and vegetables index also decreased by 0.1% in December.

For food away from home, the index increased by 0.3% in December, following a 0.4% rise in November. The full-service meals index rose by 0.3%, while the limited-service meals index increased by 0.4% over the month.

Over the past 12 months, the food-at-home index rose by 1.3%. The index for other food at home increased by 2.8%, while cereals and bakery products, nonalcoholic beverages, and fruits and vegetables indexes rose by 2.6%, 2.6%, and 0.3%, respectively. The dairy and related products index decreased by 1.3%, and the meats, poultry, fish, and eggs index fell by 0.1%.

On an annual basis, the food away from home index increased by 5.2%. Limited-service meals rose by 5.9%, and full-service meals increased by 4.5% over the same period.

Energy Inflation Numbers:

In December, the energy index witnessed a 0.4% increase, rebounding from a 2.3% decrease in November. The gasoline index rose by 0.2% in December, recovering from a 6.0% decrease the previous month (before seasonal adjustment, gasoline prices fell by 5.8% in December). Additionally, the electricity index increased by 1.3% over the month.

In contrast, the natural gas index fell by 0.4% in December, following a 2.8% increase in the previous month. The fuel oil index experienced a notable decrease of 5.5% in December.

Looking at the past 12 months, the energy index declined by 2.0%. The gasoline index decreased by 1.9%, the natural gas index saw a substantial decline of 13.8%, and the fuel oil index fell by 14.7% during this period. In contrast, the index for electricity rose by 3.3% over the last year.

CPI numbers Excluding Food and Energy

Specifically in December, the motor vehicle insurance index rose by 1.5%, following a 1.0% increase in the preceding month. The used cars and trucks index increased by 0.5%, recovering from a 1.6% rise in November. Other indexes that experienced growth in December include recreation, new vehicles, education, and airline fares.

The medical care index rose by 0.6% in December, consistent with the increase observed in November. Within this category, the index for hospital services increased by 0.5%, while the index for physicians' services rose by 0.2%. On the other hand, the prescription drugs index fell by 0.4% in December.

Contrarily, the index for household furnishings and operations decreased by 0.4% in December, mirroring the decline seen in November. The personal care index also decreased, falling by 0.3% over the month.

Looking at the past 12 months, the index for all items less food and energy rose by 3.9%. The shelter index increased by 6.2% over the last year, contributing to over two-thirds of the total increase in all items less food and energy index. Other indexes with notable increases over the last year include motor vehicle insurance (up 20.3%), recreation (up 2.7%), personal care (up 5.0%), and education (up 2.4%).

Outlook

New York Fed President John Williams remarked on Wednesday that inflation has visibly receded from its peak in mid-2022, which marked a more than 40-year high. Mr. Williams acknowledged solid progress in addressing inflation concerns but refrained from indicating when he believes rate cuts might be warranted. He emphasized the likelihood of maintaining a "restrictive" policy stance for an extended period.

Other officials, including Fed Governor Michelle Bowman and Dallas Fed President Lorie Logan, echoed skepticism and asserted their readiness to implement interest rate hikes if inflation shows signs of resurgence.

These comments are made in the context of a resilient economic environment, characterized by unemployment holding below 4% and sustained consumer spending. Despite indications of increasing debt and declining savings, the overall economic backdrop remains robust.