The US Employment Report Insights from December

Posted:

The U.S. labor market ended 2023 in strong shape, with the pace of hiring proving to be even more powerful than anticipated, as reported by the Labor Department on January 5th.

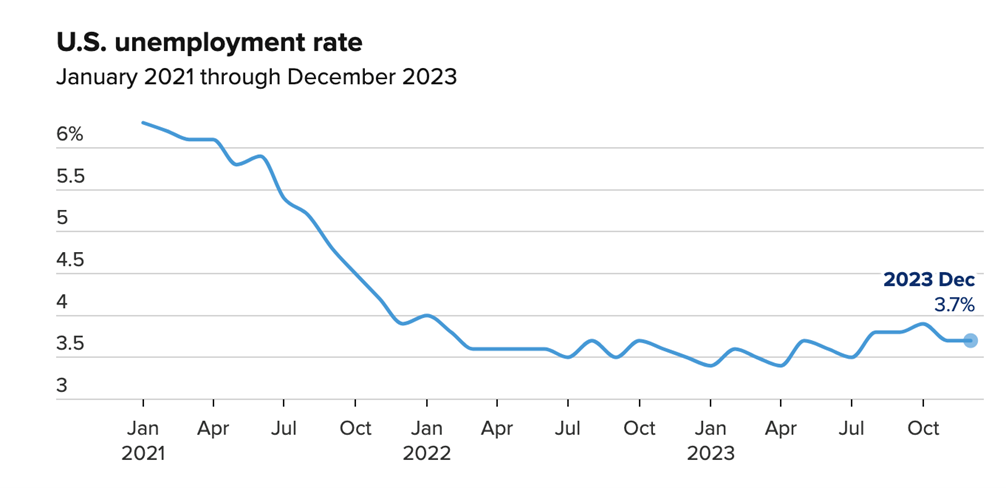

In December, the U.S. economy saw an increase of 216,000 jobs, maintaining a steady unemployment rate of 3.7%, according to the report from the Bureau of Labor Statistics on January 5, 2023. The surge in hiring was driven by an increase of 52,000 government jobs and an additional 38,000 positions in healthcare-related sectors, including ambulatory healthcare services and hospitals. The leisure and hospitality sector contributed 40,000 to the overall total, while social assistance saw a rise of 21,000, and construction added 17,000 jobs. Retail trade expanded by 17,000, although the industry has largely maintained a flat trend since early 2022, as reported by the Labor Department.

Also, The report highlighted that inflationary pressures persist in the labor market, even as they recede in other areas. Average hourly earnings increased by 0.4% on a month-on-month (MoM) basis and demonstrated a year-on-year (YoY) growth of 4.1%. Meanwhile, the average workweek slightly decreased to 34.3 hours.

Furthermore, The payroll growth showed a sizeable gain from November's revised 173,000. October also was revised lower, to 105,000 from 150,000, indicating a slightly less robust picture for growth in the fourth quarter.

Moreover, a more comprehensive unemployment measure, which includes discouraged workers and those holding part-time jobs for economic reasons, inched higher to 7.1%. This rise in the "real" unemployment rate occurred concurrently with the household survey, used to calculate the unemployment rate, indicating a decline in job holders by 683,000, while the number of individuals working multiple jobs increased by 222,000.

Additionally, The labor force participation rate, representing the proportion of the civilian working-age population either employed or actively seeking employment for December 2023, declined to 62.5%, marking a 0.3 percentage point decrease. This drop is the lowest recorded since February and reflects a monthly decrease of 676,000 individuals.

In December 2023, total nonfarm payroll employment witnessed a growth of 216,000. Employment maintained an upward trend in government, health care, social assistance, and construction, while the transportation and warehousing sectors experienced job losses. Throughout 2023, payroll employment increased by 2.7 million, with an average monthly gain of 225,000. This figure represents a decrease compared to the 4.8 million increase in 2022, which had an average monthly gain of 399,000. (Source: U.S. Bureau of Labor Statistics).

The data from Friday further supports the argument that the U.S. economy is defying expectations of a slowdown. This is notable considering the Federal Reserve's campaign to combat inflation, which has led to 11 interest rate hikes since March 2022, totaling 5.25% points. This marks the most aggressive monetary policy tightening in the past 40 years.

Source: U.S. Bureau of Labor Statistics and CNBC

Data as of Jan. 5, 2024

Moreover, Last year employers contributed 2.7 million jobs at a monthly rate of 225,000, a decrease from the 4.8 million jobs added at a rate of 399,000 per month in 2022, as the post-COVID economic surge diminished. This reduction aligns with the Federal Reserve's objective to moderate job and wage growth sufficiently to curb inflation without triggering a recession—a strategic achievement often referred to as a "soft landing."

On January 5, 2023, after the U.S. Job report, there was an upward movement in U.S. Treasury yields, with the 10-year benchmark reaching a 4.05% yield, and the longer-dated 30-year yields surged to 4.20%.

In reaction to these developments, bond-related Exchange-Traded Funds (ETFs) experienced declines. The widely followed iShares 20+ Year Treasury Bond ETF (NASDAQ: TLT) recorded a 1% drop, while the US Treasury 10-Year Note ETF (NYSE: UTEN) fell by 0.4%.

The two-year Treasury yield, which is sensitive to changes in interest rate expectations, is down sharply, around 0.06% points. (Source: NASDAQ)

Additionally, U.S. stocks on January 2nd initially experienced a decline, but by the end of the day, they rebounded slightly. The Dow Jones Industrial Average (Dow) registered a 0.07% increase, the Standard & Poor's 500 (S&P 500) saw a gain of 0.2%, and the Nasdaq Composite recorded a modest increase of 0.09%. (Source: CNN)

Leverage ETPs by GraniteShares

Leverage ETPs by GraniteShares

| Product name | Ticker | ||

|---|---|---|---|

| USD | EUR | GBX | |

| 3LTS | 3LTE | 3LTP | |

| 3STS | 3STE | 3STP | |

| 3SFT | 3S3E | 3S3P | |

| 3FTG | 3FTE | 3FTP | |

| FTNG | FTNE | FTNP | |

| SFTG | SFTE | SFTP | |

DISCLAIMER

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.