Understanding Leverage Trading

Posted:

Leverage is using a smaller portion of your capital to gain larger trading position exposure called margin trading. Margin trading or margin finance allows investors to open a trading position with a broker using a small amount of capital to take a much larger position in the market. Leverage can be used in various financial markets like stocks, indices, Exchange-Traded Products (ETPs), forex markets, treasuries, and commodities.

Leverage trading has been popular amongst traders and investors and is considered a powerful tool for trading and investment. In this article, we will understand what leverage is, how it's calculated and how you can use it to gain enhanced trading exposure across various financial instruments.

What is Leverage Trading?

Leverage Trading is a system where investors and traders can enter much larger positions than what they could open with their capital. It means that investors will need only a percentage of capital for the position they are going to keep open in the market.

Leverage trading and leverage products seem compelling and very appealing for trading where your profits can be immensely multiplied. However, it is a double-edged sword, it is important to remember that losses can also be multiplied just as easily as profits.

How does Leverage Work?

Leverage is using borrowed capital as one of the funding sources when investing in different assets or investing to expand the investor’s asset base and generate return-on-return capital. It is an investment strategy that uses borrowed money specifically primarily to use for various financial instruments as well as to increase the potential return on investment.

With Leverage as an option investor can have increased exposure to the financial market by paying less than the full amount of investment needed.

What is the Leverage Ratio?

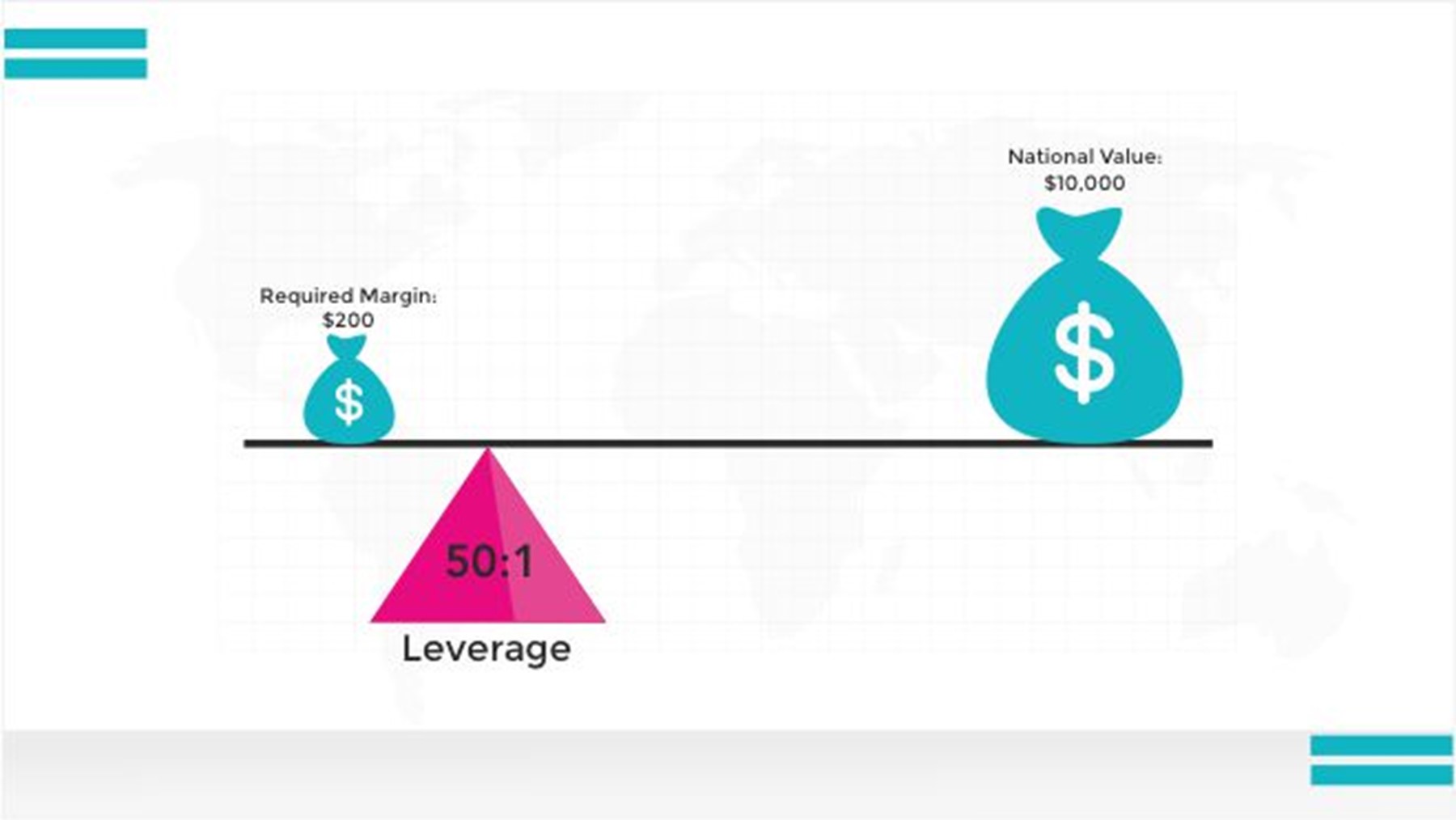

The leverage Ratio is between the amount of money you can trade over the amount of money you have. The formula for the leverage ratio is Total Debt / Total equity. It is a financial ratio that indicates the level of debt incurred by a business entity against several other accounts in their balance sheet, income statement, and cash-flow statement.

For example, a leverage ratio of 10:1 means that for an investor to open and maintain a position, the necessary margin required is one-tenth of the total transaction size. So, an investor would require £1,000 to enter a trade for £10,000. The margin amount in leverage trading refers to the percentage of the total cost of the trade that is required to open the position. So, if an investor wanted to make a £10,000 trade on a financial asset that had a leverage ratio of 10:1, the margin requirement would be £1,000.

Let’s understand how various leverage ratios can affect investors and traders’ potential to gain profit or losses. Let’s take an example by taking £1,000 as an initial investment:

|

|

Un-Leveraged Trading |

Leveraged Trading |

|||

|

Leverage Ratio |

1:1 |

10:1 |

20:1 |

50:1 |

100:1 |

|

Initial Investment |

£1,000 |

£1,000 |

£1,000 |

£1,000 |

£1,000 |

|

Investment Exposure |

£1,000 |

£10,000 |

£20,000 |

£50,000 |

£100,000 |

Leverage Trading

Leverage Trading for various financial Instruments

Various financial instruments provide leverage trading like stocks, indices, CFDs, forex, treasuries, and ETPs. Primarily, leveraged trading uses derivative products, i.e., you trade a financial instrument that takes its value from the price of the underlying asset, rather than owning the asset itself.

Investors can leverage stock trading through margins. Trading stocks and shares on margin means investors can borrow stocks from their broker to buy or short security, using either other securities in their brokerage account as collateral or maintaining the capital required for the margin. For these trading’s, investors and traders are required to have a margin account. But the drawback of this type of leverage trading is that the cost of leverage is higher than that of other securities.

Leverage Trading through Options Trading is another common way of investing with leverage. Options trading refers to buying and selling options contracts of underlying securities. These contracts provide the holder with the right but not an obligation to buy or sell the underlying asset, at a fixed price. It is also referred to as the strike price on or before a specified future date. The underlying assets include stocks, stock indexes, ETFs, fixed-income products, commodities, and foreign currencies. Instead of borrowing from brokers to trade on margins, options create leverage through their contractual terms.

Furthermore, another common and popular way of trading with leverage is through Leveraged Exchange-Traded Products (ETPs). They are exchange-listed investment vehicles tracking underlying securities like stocks, indices, or other financial instruments. Leveraged ETPs are structured to deliver returns of 2x, and 3x as compared to their benchmark underlying securities.

There are various benefits of trading through Leveraged ETPs as compared to other financial instruments that use leverage. Leveraged ETPs generally have a lower fee than actively managed funds and other leveraged investment options. There is an embedded stop-loss mechanism to limit your losses when the trade moves in the opposite direction from your prediction. As mentioned above, Leveraged ETPs trade on an exchange just like stocks and loss is limited to initial investment.

Leverage ETPs provided by Graniteshares

Granishares offers trading with leverage through Exchange-traded products (ETPs). Graniteshares leveraged ETPs offer 3x multiple for various popular single stocks, indices, and other financial instruments.

Leveraged ETPs usually have a multiplier in their product or funds name or have words such as 3x, “ultra” or “daily” in front of the fund or product's name. These ETPs deliver multiples of an index daily return. Leverage stocks ETPs by the company provide 2x and 3x leverage returns on popular shares like Apple, Tesla, Microsoft etc.

An example of how leveraged stocks trading is if Tesla goes up by 1% intraday and the investor has invested in 3x Tesla Long ETP by Graniteshares will surge by 3%. However, if the same underlying security i.e., Tesla stock instead of going up by 1% goes down by -1% then the 3x Tesla Long ETP will go down by -3%. Leveraged returns allow investors to either use less of their capital to achieve similar investments or to magnify returns using the same amount of capital and increasing their stakes. Please see link to educational section to understand more about Leveraged ETPs .

Bottom Line

Leverage trading enables investors to invest and trade on a much larger scale than otherwise. However, as mentioned above, leverage also acts like a double edge sword which can help magnify investors’ returns but at the same time increase the risk of loss. Before investing in any investment vehicle involving leverage understand the risk and returns of the product as well as your risk appetite.

|

Product name |

Ticker(USD) |

Ticker(EUR) |

Ticker(GBX) |

|---|---|---|---|

|

GraniteShares 3x Short Tesla Daily ETP |

3STS | 3STE | 3STP |

|

GraniteShares 3x Long Tesla Daily ETP |

3LTS | 3LTE | 3LTP |

|

GraniteShares 3x Short FATANG Daily ETP |

3SFT | 3S3E | 3S3P |

|

GraniteShares 3x Long FATANG Daily ETP |

3FTE | 3FTG | 3FTP |

|

GraniteShares FATANG ETP |

FTNG | FTNE | FTNP |

|

GraniteShares 1x Short FATANG Daily ETP |

SFTG | SFTE | SFTP |

DISCLAIMER

This is a disclaimer stating that all trading and investing comes with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents. GraniteShares Limited (“GraniteShares”) (FRN: 798443) is an appointed representative of Messels Limited which is authorised and regulated by the Financial Conduct Authority.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein. Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest. This email contains the opinions of the author and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable. This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested. Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.