Commodities & Precious Metals Weekly Report: Dec 24

Posted:

Key points

Energy prices fell last week with natural gas prices decreasing the most. Natural gas prices fell a little over 6% while oil and gasoline prices lost between 1.5% and 2%.

Energy prices fell last week with natural gas prices decreasing the most. Natural gas prices fell a little over 6% while oil and gasoline prices lost between 1.5% and 2%.- Grain prices were all higher last week with wheat, corn and soybean prices increasing between 3% and 3.5%.

- Base metal prices were lower last week. Nickel prices lost the most, decreasing just under 3%, followed by copper prices which fell 2%.

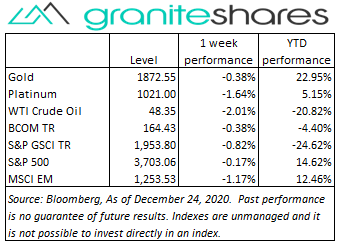

- Precious metal prices moved slightly lower last week. Platinum prices decreased the most falling a little more than 1.5%. Gold and silver prices fell under ½ percent.

- The Bloomberg Commodity Index was down slightly last week, decreasing 0.4%. Negative performance in the energy and base metals sectors was partially offset by positive performance in the grains sector.

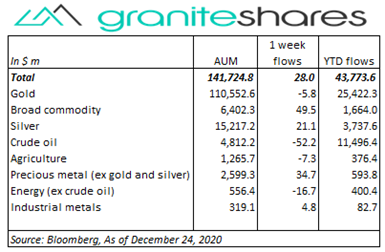

- Total assets in commodity ETPs were practically unchanged last week. Small inflows into broad commodity, silver and precious metal (ex-gold and silver) ETPs were offset by crude oil and energy (ex-crude oil) ETP outflows.

Commentary

U.S. stock markets were practically unchanged last week with congressional passage of a relief package, continued good vaccine news and decent economic data offset by President Trump’s refusal to approve the relief package, concerns regarding a coronavirus mutation and increased U.S. and global Covid-19 related lockdowns and restrictions. Lower-than-expected jobless claims and better-than-expected durable goods orders along with Tuesday’s passage of a relief package helped support stock prices last week while increasing Covid-19 infections, concerns over a new coronavirus strain and President Trump’s refusal to sign the relief package into law helped suppress stock market gains. At week’s end the S&P 500 Index decreased 0.2% to 3,703.06, the Nasdaq Composite Index increased 0.4% to 12,807.73, the 10-year U.S. Treasury rate fell 2bps to 93bps and the dollar (as measured by the ICE U.S. Dollar index - DXY) strenghtened 0.2%.

U.S. stock markets were practically unchanged last week with congressional passage of a relief package, continued good vaccine news and decent economic data offset by President Trump’s refusal to approve the relief package, concerns regarding a coronavirus mutation and increased U.S. and global Covid-19 related lockdowns and restrictions. Lower-than-expected jobless claims and better-than-expected durable goods orders along with Tuesday’s passage of a relief package helped support stock prices last week while increasing Covid-19 infections, concerns over a new coronavirus strain and President Trump’s refusal to sign the relief package into law helped suppress stock market gains. At week’s end the S&P 500 Index decreased 0.2% to 3,703.06, the Nasdaq Composite Index increased 0.4% to 12,807.73, the 10-year U.S. Treasury rate fell 2bps to 93bps and the dollar (as measured by the ICE U.S. Dollar index - DXY) strenghtened 0.2%.

Down almost 4.5% through Tuesday on increased travel restrictions resulting from a new coronavirus variant, WTI crude oil prices rallied almost 2.5% on Wednesday after the EIA reported an unexpected drop in both U.S oil and gasoline inventories. WTI crude oil prices were down 2% on the week with increasing coronavirus concerns and continued uncertainty of a U.S. relief package pressuring oil prices lower despite growing Covid-19 vaccinations, news of a UK-EU trade agreement and relatively decent U.S economic data.

News of a new coronavirus variant and, as a result, a strengthening U.S. dollar, moved gold prices almost 1% lower through Tuesday. Congressional passage of a U.S. relief package, despite President Trump’s refusal to approve it, and news of a UK-EU trade agreement helped weaken the U.S. dollar and move gold prices off their lows of the week to slightly down on the week. Silver and platinum prices followed gold prices.

Base metal prices moved lower last week pressured by news of a new coronavirus strain, increased coronavirus-related lockdowns and travel restrictions and a stronger U.S. dollar. Most base metal prices moved higher on Wednesday and Thursday with increased expectations and news of a UK-EU trade agreement. Copper prices, for example, down 3% through Tuesday, moved 1% higher Wednesday and Thursday to finish the week down 2%.

Grain prices all moved higher last week with soybean and corn prices supported by continued dry weather in South America and lowered harvest expectations in the U.S. and with wheat prices continuing to benefit from concerns of reduced Russian harvests and exports.

Coming up this week

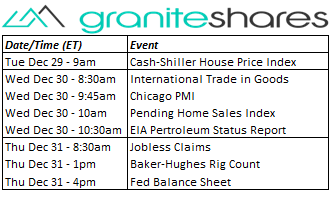

Light holiday-shortened data week with some focus on housing index releases.

Light holiday-shortened data week with some focus on housing index releases. - Case-Shiller House Price Index on Tuesday.

- International Trade in Goods, Chicago PMI and Pending Home Sales Index on Wednesday.

- Jobless claims and The Fed Balance Sheet on Thursday.

- EIA petroleum status report on Wednesday and Baker-Hughes rig count on Thursday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.