Commoditized Wisdom: Report (Week Ending April 12, 2024)

Posted:

Key point

Energy prices were mixed last week. Crude oil and gasoil prices fell 1% and heating oil prices dropped 2%. Natural gas and gasoline prices increased less than ½ percent.

Energy prices were mixed last week. Crude oil and gasoil prices fell 1% and heating oil prices dropped 2%. Natural gas and gasoline prices increased less than ½ percent.- Wheat prices were mixed with Chicago wheat prices falling 2% and Kansas City wheat prices rising 1%. Corn prices were only slightly higher and soybean prices fell 1%.

- Spot gold and silver prices increased 1% and spot platinum prices rose 5%.

- Base metal prices were all higher except for nickel prices. Zinc prices gained 7%, lead and aluminum prices rose 2% and copper prices increased 1%. Nickel prices edged slightly lower.

- The Bloomberg Commodity Index increased 0.1% with base and precious metals gains offset by energy and agricultural sector losses.

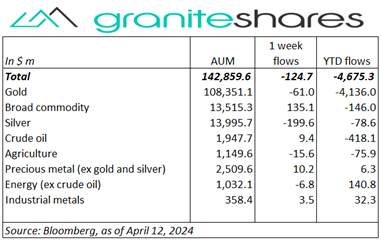

- Net outflows last week predominantly from silver ETPs but also from gold ETPs, offset by broad commodity ETP inflows.

Commentary

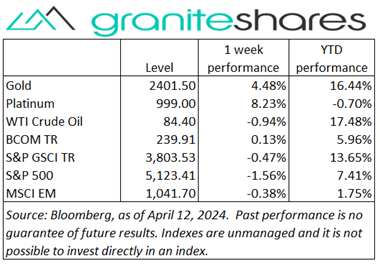

Stock markets finished lower last week, hindered by receding rate-cut expectations in the face of sticky inflation and resilient economic data. Wednesday’s slightly worse-than-expected CPI release worked to reduce rate-cut expectations, driving stock prices lower and Treasury yields higher. Thursday’s slightly better-than-expected PPI release temporarily ameliorated rate-cut concerns (despite FOMC minutes containing hawkish rate-cut comments), with the S&P 500 Index recovering most of Wednesday’s losses and with the Nasdaq Composite Index rallying to a new all-time high. The Dow Jones Industrial Average, however, ended Thursday unchanged. Rate concerns re-emerged Friday, though, driving all 3 indexes over 1% lower with falling consumer confidence, rising inflation expectations and lowered bank profit outlooks (as issued by J.P. Morgan Chase) cooling investor sentiment. For the week, the S&P 500 Index fell 1.6% to 5,123.41, the Nasdaq Composite Index decreased 0.5% to 16,175.09, the Dow Jones Industrial Average dropped 2.3% to 37,983.24, the 10-year U.S. Treasury rate rose 12bps to 4.52% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 1.7%.

Stock markets finished lower last week, hindered by receding rate-cut expectations in the face of sticky inflation and resilient economic data. Wednesday’s slightly worse-than-expected CPI release worked to reduce rate-cut expectations, driving stock prices lower and Treasury yields higher. Thursday’s slightly better-than-expected PPI release temporarily ameliorated rate-cut concerns (despite FOMC minutes containing hawkish rate-cut comments), with the S&P 500 Index recovering most of Wednesday’s losses and with the Nasdaq Composite Index rallying to a new all-time high. The Dow Jones Industrial Average, however, ended Thursday unchanged. Rate concerns re-emerged Friday, though, driving all 3 indexes over 1% lower with falling consumer confidence, rising inflation expectations and lowered bank profit outlooks (as issued by J.P. Morgan Chase) cooling investor sentiment. For the week, the S&P 500 Index fell 1.6% to 5,123.41, the Nasdaq Composite Index decreased 0.5% to 16,175.09, the Dow Jones Industrial Average dropped 2.3% to 37,983.24, the 10-year U.S. Treasury rate rose 12bps to 4.52% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 1.7%.

Oil prices ended the week lower, predominantly driven by reduced rate-cut expectations. Prices were pressured lower early in the week on hopes of an Israel-Hamas ceasefire agreement but those hopes receded on Israel targeted attacks on Hamas and reports of imminent Iran retaliation attacks. Gains on the week, however, were capped by an unexpected rise in U.S. oil inventories.

Spot gold prices moved higher again last week but finished the week off intraweek highs. Higher Treasury yields and a pronounced strengthening of the U.S. dollar (resulting from decreased rate-cut expectations) capped gains. While haven and central bank buying acted to support gold prices during the week, prices fell noticeably Friday after reaching intraday highs.

Copper prices moved higher again last week finding support from a resilient U.S. economy, stronger-than-expected German industrial production and hopes of growing Chinese demand amidst production cutbacks. Price gains, however, were capped by a significantly stronger U.S. dollar resulting from lowered U.S. rate-cut expectations.

Corn prices were basically unchanged last week with lowered South America production estimates offset by a neutral-to-slightly bearish USDA WASDE report (released Thursday). Soybean prices, lower on the week primarily due to a neutral-to-bearish USDA WASDE report, finished the week off intraweek lows after a flash sale on Friday. Wheat prices, higher through Wednesday on reports rising Russia and Ukraine wheat prices, moved lower the remainder of the week after a bearish USDA WASDE report.

Coming Up This Week

Retail Sales, Industrial Production and housing data headline this week’s releases.

Retail Sales, Industrial Production and housing data headline this week’s releases.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.