Commoditized Wisdom: Report (Week Ending March 28, 2024)

Posted:

Key points

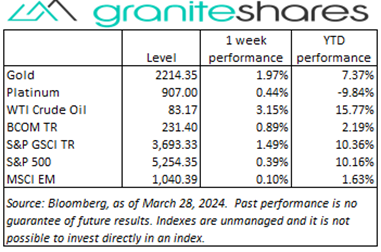

Another mixed week for energy prices. Crude oil prices rose 2% to 3% and gasoline prices finished only slightly higher. Gasoil and heating oil prices fell less than 1% and naturagal prices dropped 3%.

Another mixed week for energy prices. Crude oil prices rose 2% to 3% and gasoline prices finished only slightly higher. Gasoil and heating oil prices fell less than 1% and naturagal prices dropped 3%.- Wheat prices were mixed with Chicago wheat prices rising 1% and Kansas City wheat prices falling 1%. Corn prices rose 1%. Soybean prices were unchanged.

- Spot gold prices rose 3% and spot silver and platinum prices 1% and 2%, respectively.

- Copper prices were unchanged, aluminum and lead prices rose 1% and zinc and nickel prices fell 2% and 3%, respectively..

- The Bloomberg Commodity Index increased 0.9%, benefiting primarily from rising oil and precious metals prices.

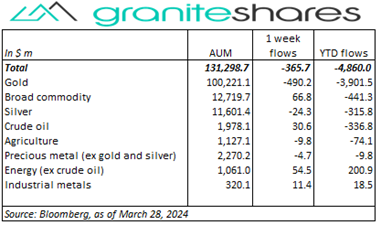

- Net outflows last week primarily due to gold ETPs but partially offset by broad commodity and energy ETP inflows

Commentary

A relatively restrained week for stock markets last week. The Dow Jones Industrial Average led the pack-of-three gaining slightly less than 1% on the week, followed by the S&P 500 Index rising less than ½ percent (but to another record close). The Nasdaq Composite Index, the laggard of the group, ended the week down by about 1/3 percent. Lukewarm Fed officials’ comments, seemingly trying to moderate easing expectations, combined with decent economic data (i.e., better-than-expected Q4 GDP, durable goods orders and home prices) acted to restrain stock market performance. 10-year Treasury yields and the U.S. dollar, reflecting this same restraint, ended the week unchanged. For the week, the S&P 500 Index rose 0.4% to 5,254.35, the Nasdaq Composite Index decreased 0.3% to 16,379.46, the Dow Jones Industrial Average increased 0.8% to 39,807.18, the 10-year U.S. Treasury rate was unchanged at 4.20% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) marginally appreciated 0.1%.

A relatively restrained week for stock markets last week. The Dow Jones Industrial Average led the pack-of-three gaining slightly less than 1% on the week, followed by the S&P 500 Index rising less than ½ percent (but to another record close). The Nasdaq Composite Index, the laggard of the group, ended the week down by about 1/3 percent. Lukewarm Fed officials’ comments, seemingly trying to moderate easing expectations, combined with decent economic data (i.e., better-than-expected Q4 GDP, durable goods orders and home prices) acted to restrain stock market performance. 10-year Treasury yields and the U.S. dollar, reflecting this same restraint, ended the week unchanged. For the week, the S&P 500 Index rose 0.4% to 5,254.35, the Nasdaq Composite Index decreased 0.3% to 16,379.46, the Dow Jones Industrial Average increased 0.8% to 39,807.18, the 10-year U.S. Treasury rate was unchanged at 4.20% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) marginally appreciated 0.1%.

Crude oil prices moved higher last week, bolstered by Russia production cutbacks, Ukraine drone attacks on Russian oil refineries and economic data pointing to a resilient U.S. economy. An unexpected rise in oil and gasoline inventories as reported by the EIA sent prices lower Wednesday, capping the weekly increase. Gasoline prices were practically unchanged and heating prices finished slightly lower on the week. Natural gas prices, down almost 6% through Wednesday on oversupply concerns, rallied almost 3% Thursday on a larger-than-expected drop in storage levels.

Spot gold prices moved higher again, rising each day last week. Growing expectations of Fed rate cuts following the previous week’s FOMC meeting and Powell press conference combined with continued central bank and haven demand acted to move prices higher. Silver and platinum prices also moved higher but less so than gold prices.

Copper prices were practically unchanged last week, restrained by uncertainty surrounding China smelter production cutbacks and a weaker Chinese yuan versus the U.S. dollar. Aluminum prices, up a little more than 1%, benefited from China smelter cutbacks due to power supply shortages. Zinc and nickel prices fell (between 2% and 3%) due to falling stainless steel demand.

Corn prices, down 3% through Wednesday in front of Thursday’s USDA Planting Intentions and Grain Stocks report, jumped almost 4% higher Thursday following the report’s release resulting from lower-than-expected acreage planted and ending stock estimates. Soybean prices were unchanged, giving up early-week price increases (due to lowered Brazil production estimates) following improved South America weather forecasts and a slightly bearish USDA Planting Intentions and Grains Stocks report. Wheat prices, down early in the week, rallied to finish off intraweek lows after a greater-than-expected decline in winter wheat stock estimates.

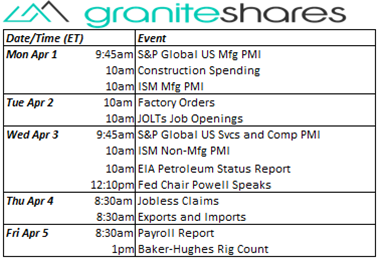

Coming Up This Week

Manufacturing, services and composite PMIs this week capped off by Friday's Jobs Report.

Manufacturing, services and composite PMIs this week capped off by Friday's Jobs Report.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.