Commodities & Precious Metals Weekly Report: Jan 29

Posted:

Key points

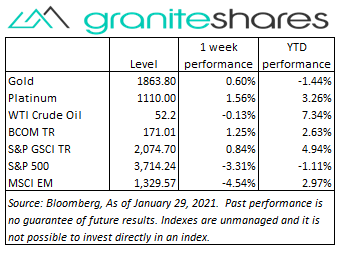

Energy prices were mixed again last week with crude oil prices lower and natural gas and oil derivatives prices higher. WTI crude oil prices fell slightly, losing about 0.1% while Brent crude oil prices lost about ½ percent. Gasoline prices rose ½ percent and heating oil gained 1 ¼ percent. Natural gas prices rose 4.4%.

Energy prices were mixed again last week with crude oil prices lower and natural gas and oil derivatives prices higher. WTI crude oil prices fell slightly, losing about 0.1% while Brent crude oil prices lost about ½ percent. Gasoline prices rose ½ percent and heating oil gained 1 ¼ percent. Natural gas prices rose 4.4%.- Grain prices, this time, recouped most of last weeks losses, increasing significantly last week. Corn prices rose the most, increasing just under 9.5%. Wheat and soybean prices increased 4.5%.

- Base metal prices were all lower last week with zinc prices falling the most. Zinc prices fell over 5%, nickel prices lost over 3%, copper prices decreased nearly 2% and aluminum prices fell 1%.

- Almost a repeat of the previous week with precious metal prices all higher and with silver prices once again leading the way. Silver prices increased almost 5.5%, platinum prices rose about 1.5% and gold prices gained over ½ percent.

- The Bloomberg Commodity Index increased 1.25% last week pulled up mainly by rising grain prices. Lower base metal prices detracted from the index’s performance.

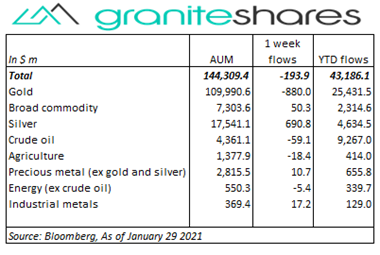

- Another apparently benign week for commodity ETP flows with just under $200 million outflows. However, as with the previous week, commodity ETP flows last week were polarized. Silver ETP inflows of about $700 million almost entirely offset gold ETP outflows of $800 million and broad commodity inflows were negated by crude oil outflows.

Commentary

U.S stock markets finished lower last week after a volatile week marked by steep declines Wednesday and Friday. Wednesday’s FOMC announcement after the end of its 2-day meeting precipitated that day’s decline (and perhaps hedge fund selling of stocks to cover GameStop short positions losses) with the Fed reporting economic activity and employment had recently moderated while leaving monetary policy unchanged. Friday’s as-expected 4th quarter, first estimate GDP growth of 4%, resulted in a YoY GDP contraction of 3.5%, accentuating Wednesday’s FOMC announcement and helped move U.S stock markets 2% lower. Uncertainty regarding the passage of President Biden’s $1.9 trillion stimulus package also pressured stocks lower. At week’s end the S&P 500 Index decreased 3.6% to 3,714.24, the Nasdaq Composite Index fell 3.4% to 13,070.69, the 10-year U.S. Treasury rate fell 2bps to 1.06% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.4%.

U.S stock markets finished lower last week after a volatile week marked by steep declines Wednesday and Friday. Wednesday’s FOMC announcement after the end of its 2-day meeting precipitated that day’s decline (and perhaps hedge fund selling of stocks to cover GameStop short positions losses) with the Fed reporting economic activity and employment had recently moderated while leaving monetary policy unchanged. Friday’s as-expected 4th quarter, first estimate GDP growth of 4%, resulted in a YoY GDP contraction of 3.5%, accentuating Wednesday’s FOMC announcement and helped move U.S stock markets 2% lower. Uncertainty regarding the passage of President Biden’s $1.9 trillion stimulus package also pressured stocks lower. At week’s end the S&P 500 Index decreased 3.6% to 3,714.24, the Nasdaq Composite Index fell 3.4% to 13,070.69, the 10-year U.S. Treasury rate fell 2bps to 1.06% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.4%.

Up over 1% through Wednesday on a much larger-than-expected drawdown in U.S. inventory levels and hopes of quick passage of Pres. Biden’s $1.9 trillion stimulus package, WTI crude oil prices fell Thursday and Friday with growing coronavirus-related demand concerns, increased resistance to passage of the stimulus package and a stronger U.S. dollar. WTI and Brent crude oil prices finished the week down 0.1% and 0.5%, respectively.

Gold prices moved slightly higher last week despite a stronger U.S. dollar and decreased expectations of the passage of Pres. Biden’s $1.9 trillion stimulus package. Wednesday’s FOMC announcement stating growth had deteriorated while leaving monetary policy unchanged combined with a “risk-off” market environment helped strengthen the U.S. dollar. Gold prices also may have been supported by reports of a short-squeeze on silver, sending silver prices over 5% higher for the week.

Base metal prices moved lower throughout the week, pressured by coronavirus-related demand concerns (especially regarding new and increased lockdowns in China), decreasing expectations of the passage of Pres. Biden’s stimulus package and a stronger U.S. dollar. Copper prices also suffered from the start of the Chinese New Year. Zinc prices also moved lower on supply concerns with LME inventory levels unexpectedly increasing by over 100,000 tons on Friday.

Grain prices moved sharply higher last week, reversing most of the previous week’s losses. Historically large corn sales to China l (as well as to Japan) were the primary reason for the increase in corn prices last week. Soybean prices also continue to be supported by stronger-than-expected exports to China as well as by concerns rain in Brazil will hamper soybean harvests. Wheat prices moved higher over Russian export restrictions and on concerns Argentina may restrict exports as well.

Coming up this week

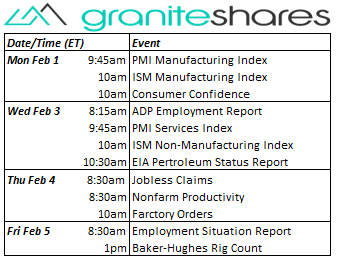

Lighter data-week this week characterized by PMI and ISM Mannufacturing and Non-manufacturing Index releases and accentuated by Friday’s Employment Report.

Lighter data-week this week characterized by PMI and ISM Mannufacturing and Non-manufacturing Index releases and accentuated by Friday’s Employment Report.- PMI and ISM Manufacturing Indexes and Consumer Confidence on Monday.

- ADP Employment Report, PMI Serivices Index and ISM Non-Manufacturing index on Wednesday.

- Jobless claims, Nonfarm Productivity and Factory Orders on Thursday.

- Employment Situation Report on Friday.

- EIA petroleum status report on Wednesday and Baker-Hughes rig count also on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.