Commodities & Precious Metals Weekly Report: Apr 7

Posted:

Key points

Energy prices, except for natural gas prices (again), were all higher. WTI and Brent crude oil price rose 7% and 6%, respectively, and gasoline prices increased 5%. Heating oil and gasoil prices rose between 2% and 3%. Natural gas prices fell 9%.

Energy prices, except for natural gas prices (again), were all higher. WTI and Brent crude oil price rose 7% and 6%, respectively, and gasoline prices increased 5%. Heating oil and gasoil prices rose between 2% and 3%. Natural gas prices fell 9%. - Grain prices were all lower. Chicago and Kansas City wheat prices fell 2%, corn prices dropped 3% and soybean prices lost 1%.

- Spot gold prices rose 2% percent, spot silver prices rose 4% and spot platinum prices increased 2%. Palladium prices rose 1%.

- Base metal prices were all lower. Zinc prices fell 5%, aluminum and nickel prices dropped 4%, copper prices lost 2% percent and lead prices decreased 1%.

- The Bloomberg Commodity Index increased 0.8%. Gains in the energy, precious metals and softs sectors were partially offset by losses in the grains and base metals sectors.

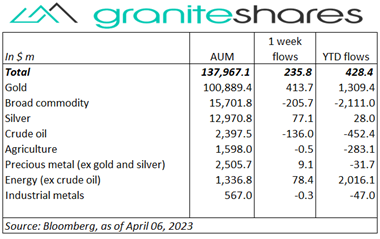

- More but smaller inflows into commodity ETPs last week with gold ETP inflows dominating. $414 million inflows into gold ETPs and $80 million into both energy (ex-crude oil) and silver ETPs were partially offset by $206 million broad commodity and $135 million crude oil ETP outflows.

Commentary

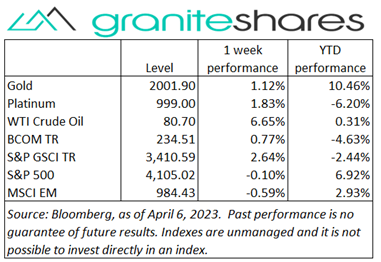

A mixed week for stocks with the Nasdaq Composite Index ending lower on the week, the S&P 500 Index basically unchanged and the Dow Jones Industrial Average finishing the week slightly higher. Monday opened to the news of OPEC+’s surprise 1.2 million bpd production cutback, sending oil prices sharply higher and, as a result, pushing oil stocks and the Dow Jones Industrial Average and S&P 500 Index higher as well. Weak economic data throughout the week while increasing expectations of less aggressive Fed monetary policy also raised the specter of recession, resulting in mixed effects on stock prices. Weaker-than-expected ISM Manufacturing and Services Index releases, a pronounced drop in job openings and higher-than-expected initial jobless claims all helped to move Treasury rates lower while arousing concerns regarding earnings (especially for growth stocks) and economic growth. Higher oil prices – up almost 7% on the week – added to economic growth and inflation concerns, capping stock price gains. Reflecting growth concerns and expectations of easier Fed monetary policy, 10-year Treasury rates fell 18bps (with real rates and inflation expectations falling equally) and the U.S. dollar weakened. For the week, the S&P 500 Index decreased 0.1% to 4,105.02, the Nasdaq Composite Index dropped 1.1% to 12,087.96, the Dow Jones Industrial Average increased 0.6% to 33,485.35, the 10-year U.S. Treasury rate fell 18bps to 3.30% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.6%.

A mixed week for stocks with the Nasdaq Composite Index ending lower on the week, the S&P 500 Index basically unchanged and the Dow Jones Industrial Average finishing the week slightly higher. Monday opened to the news of OPEC+’s surprise 1.2 million bpd production cutback, sending oil prices sharply higher and, as a result, pushing oil stocks and the Dow Jones Industrial Average and S&P 500 Index higher as well. Weak economic data throughout the week while increasing expectations of less aggressive Fed monetary policy also raised the specter of recession, resulting in mixed effects on stock prices. Weaker-than-expected ISM Manufacturing and Services Index releases, a pronounced drop in job openings and higher-than-expected initial jobless claims all helped to move Treasury rates lower while arousing concerns regarding earnings (especially for growth stocks) and economic growth. Higher oil prices – up almost 7% on the week – added to economic growth and inflation concerns, capping stock price gains. Reflecting growth concerns and expectations of easier Fed monetary policy, 10-year Treasury rates fell 18bps (with real rates and inflation expectations falling equally) and the U.S. dollar weakened. For the week, the S&P 500 Index decreased 0.1% to 4,105.02, the Nasdaq Composite Index dropped 1.1% to 12,087.96, the Dow Jones Industrial Average increased 0.6% to 33,485.35, the 10-year U.S. Treasury rate fell 18bps to 3.30% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.6%.

Oil prices moved higher again last week, this time powered by OPEC+’s surprise 1.2 million bpd production cutback. Up over 6% Monday following news of the cutback, prices more-or-less remained unchanged through the remainder of the week. Weaker-than-expected manufacturing activity and larger-than-expected initial jobless claims increased concerns of falling demand, stifling any further gains from the OPEC+ cutback despite larger-than-expected declines in oil and gasoline inventories. Natural gas prices fell again, falling over 9%, reacting to April warm-weather forecasts and favorable supply conditions.

Powered by weaker-than-expected economic data, spot gold prices moved 2% higher last week, closing above $2000/Ounce Tuesday, Wednesday and Thursday. A 2-year low in job openings, sharply declining factory activity and larger-than-expected initial jobless claims increased expectations of less aggressive Fed monetary policy, strongly supporting gold prices. In addition, oil-price-related inflation concerns also supported gold prices. Spot silver and platinum prices also moved higher on the week with silver prices outperforming both gold and platinum prices, increasing close to 4%.

Base metal prices moved lower last week, pressured by weak U.S. and China manufacturing activity and unexpected indications of a weakening U.S. jobs market. OPEC+’s surprise 1.2 million bpd production cutback also pushed prices lower, with higher oil prices adding to demand/economic growth concerns. Thursday’s much better-than-expected Caixin/S&P Global composite PMI reading (for China) seemingly had little effect on prices.

Grain prices were lower last week with soybean prices falling the least. Soybean prices, up 1% on follow through from last week’s stock and acreage report and on sharply higher oil prices, fell the remainder of the week. Growing Brazil harvest forecasts, Argentina subsidies for soybean producers and falling exports, however, led to lower prices the remainder of the week. Corn prices moved lower each day last week, hurt by favorable weather forecasts in the U.S. and slow exports and despite continued poor Argentina crop conditions. Wheat prices fell over the weak despite weather-related hindrances in the U.S., uncertainty surrounding Ukraine and Russian exports and historically low acres planted.

Coming Up This Week

Light data-week with all eyes on Wednesday’s CPI release. PPI Thursday and consumer sentiment Friday also of interest.

Light data-week with all eyes on Wednesday’s CPI release. PPI Thursday and consumer sentiment Friday also of interest.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.