Commodities & Precious Metals Weekly Report: Aug 6

Posted:

Key points

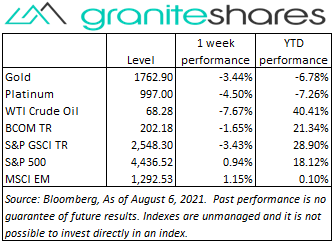

Energy prices, except for natural gas prices, were sharply lower last week. WTI crude oil prices fell the most, decreasing almost 8%, followed by Brent crude oil prices, down nearly 6%. Gasoline prices declined 3.3% and heating oil prices fell 5%. Natural gas prices rose almost 6%.

Energy prices, except for natural gas prices, were sharply lower last week. WTI crude oil prices fell the most, decreasing almost 8%, followed by Brent crude oil prices, down nearly 6%. Gasoline prices declined 3.3% and heating oil prices fell 5%. Natural gas prices rose almost 6%. - Grain prices were mixed with wheat and corn prices increasing and soybean prices decreasing. Chicago and Kansas wheat prices increased almost 2% and 5%, respectively and corn prices increased 1 ½ percent. Soybean prices decreased 1%.

- Base metal prices all moved lower. Copper prices fell 3%, nickel and zinc prices decreased 1 ¾ percent and aluminum prices fell ¾ percent.

- Precious metal prices all finished lower on the week. Gold prices fell about 3.5% and silver and platinum prices lost 4.5%.

- The Bloomberg Commodity Index decreased 1.7%, falling due to decreasing energy and base and precious metal prices. The grain, livestock and softs sectors all had small positive returns.

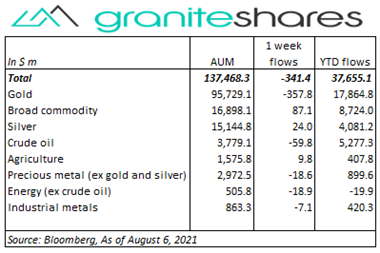

- Commodity ETPs experienced $340 million outflows last week, Gold (-$358m) and crude oil (-$60m) ETP outflows were partially offset by broad commodity ($87m) and silver ($24m) ETP inflows.

Commentary

A volatile week for U.S. stock markets with stock prices pushed and pulled by strong earnings and economic reports on the one hand and the Delta variant and “peak” economy concerns on the other. Still, all three major U.S. stock indexes ended higher on the week with both the Dow Jones Industrial Average and the S&P 500 Index setting new highs. As-expected jobless claims with declining continuing claims, strong service purchasing manager index releases and a much better-than-expected non-farm payroll report supported stock prices while growing Covid infections, a weak ADP report and peak-growth concerns restrained price gains. The U.S. dollar strengthened and the 10-year U.S. Treasury rate rose, both reacting mainly to the non-farm payroll report, recouping most or all of their previous week’s losses. At week’s end, the S&P 500 Index increased 0.9% to 4,436.52, the Nasdaq Composite Index rose 1.1% to 14,835.76, the Dow Jones Industrial Average increased 0.8% to 35,208.51, the 10-year U.S. Treasury rate increased 5bps to 1.29% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.7% percent.

A volatile week for U.S. stock markets with stock prices pushed and pulled by strong earnings and economic reports on the one hand and the Delta variant and “peak” economy concerns on the other. Still, all three major U.S. stock indexes ended higher on the week with both the Dow Jones Industrial Average and the S&P 500 Index setting new highs. As-expected jobless claims with declining continuing claims, strong service purchasing manager index releases and a much better-than-expected non-farm payroll report supported stock prices while growing Covid infections, a weak ADP report and peak-growth concerns restrained price gains. The U.S. dollar strengthened and the 10-year U.S. Treasury rate rose, both reacting mainly to the non-farm payroll report, recouping most or all of their previous week’s losses. At week’s end, the S&P 500 Index increased 0.9% to 4,436.52, the Nasdaq Composite Index rose 1.1% to 14,835.76, the Dow Jones Industrial Average increased 0.8% to 35,208.51, the 10-year U.S. Treasury rate increased 5bps to 1.29% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.7% percent.

Oil prices fell sharply last week pressured by surging Delta-variant coronavirus cases, weak Chinese economic reports, a surprise increase in U.S. oil inventories and a stronger U.S. dollar. Mid-East tension pushed prices higher Thursday but those gains were all but erased with Friday’s move lower.

Strong service PMI releases and as-expected jobless claims with declining continuing claims helped move gold prices lower almost ½ percent through Thursday, despite Covid-19 concerns and the Fed’s continuation of its ultra-aggressive accommodative monetary policy. Friday’s much stronger-than-expected non-farm payroll report- strengthening the U.S. dollar - sent prices sharply lower with increasing expectations the Fed would tighten monetary policy sooner than later.

Copper prices fell last week with prices suffering from weaker-than-expected Chinese manufacturing activity, increased Chinese copper scrap imports and Chinese efforts to limit copper price increases. Threats of a strike at Chile’s Escondida copper mine, the world’s largest, supported prices later in the week.

Wheat prices moved higher last week buoyed by a sharp reduction in the forecasted size of Russia’s wheat crop and adverse whether concerns in the U.S. Corn prices also moved higher mainly reacting to less-than-favorable weather forecasts over the next couple of weeks. Soybean prices, however, decreased last week, falling sharply Tuesday mainly on favorable weather-forecasts and improving crop conditions. Soybean prices moved higher the remainder of the weak with changing weather and improving demand forecasts.

Coming up this week

Light data week with CPI and PPI releases Wednesday and Thursday.

Light data week with CPI and PPI releases Wednesday and Thursday.- Productivity and Costs on Monday.

- CPI on Wednesday.

- Jobless Claims and PPI on Thursday.

- Import and Export Prices and Consumer Sentiment on Friday.

- EIA Petroleum Status Report on Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.