Commodities & Precious Metals Weekly Report: Feb 11

Posted:

Key points

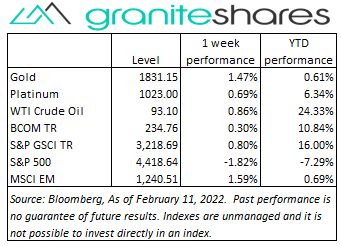

Energy prices, except for natural gas prices, moved higher again last week. WTI and Brent crude oil prices increased about 1%, gasoline prices rose 3% and heating oil prices gained 1.5%. Natural gas prices fell 14%.

Energy prices, except for natural gas prices, moved higher again last week. WTI and Brent crude oil prices increased about 1%, gasoline prices rose 3% and heating oil prices gained 1.5%. Natural gas prices fell 14%. - Grain prices were all higher. Chicago and Kansas wheat prices and corn prices rose between 4.5% and 5%. Soybean prices increased almost 2%.

- Precious metal prices increased again last week. April gold futures prices rose just shy of 2%, May silver futures prices increased 4% and platinum prices increased about ¾ percent.

- Base metal prices were all higher as well. Copper, zinc and nickel prices increased about ½ percent. Aluminum prices rose 2%.

- The Bloomberg Commodity Index increased 0.3% with losses from the energy sector (due to sharply lower natural gas prices) offset primarily by gains in the grains and precious metals sectors. Only the energy sector declined last week.

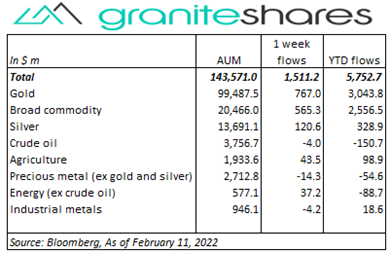

- Good inflows into gold ($767m), broad commodity ($565m) and silver ($121m) ETPs last week. Only small outflows from other ETPs (see table below).

Commentary

All three major U.S. stock indexes moved higher through Wednesday, energized by better-than-expected earnings reports (including Amazon’s from the previous week) and buy-the-dip investor sentiment. Thursday’s much higher-than-expected CP I release, showing CPI reaching a four decade high, reversed sentiment, pulling stock markets sharply lower. Sharply increased expectations of a more aggressive Fed raising rates 50bp in March and growing expectations of rate increases at every FOMC meeting this year drove stock prices markedly lower as investors grappled with the effects of higher rates on stock prices and with the possibility of continued elevated inflation levels. 10-year U.S. Treasury rates, reflecting these same concerns, moved 13bps higher through Thursday (closing at 2.04%) as 10-year real yields rose 8bps and 10-year inflation expectations increased 5bps. Friday’s late-afternoon White House announcement that Russia could invade Ukraine at any time diverted investor attention from Fed policy to economic and geopolitical repercussions of an invasion, dramatically increasing risk-off sentiment and driving stock prices sharply lower while increasing haven investment values such as gold, U.S. Treasuries and the U.S. dollar. All three major stock market indexes fell 1.5% or more Friday and the 10-year U.S. Treasury rate dropped 13bps to unchanged on the week. At week’s end, the S&P 500 fell 1.8% to 4,418.64, the Nasdaq Composite Index dropped 2.2% to 13,791.15, the Dow Jones Industrial Average decreased 1.0% to 34,737.47, the 10-year U.S. Treasury rate was unchanged at 1.92% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.6%.

All three major U.S. stock indexes moved higher through Wednesday, energized by better-than-expected earnings reports (including Amazon’s from the previous week) and buy-the-dip investor sentiment. Thursday’s much higher-than-expected CP I release, showing CPI reaching a four decade high, reversed sentiment, pulling stock markets sharply lower. Sharply increased expectations of a more aggressive Fed raising rates 50bp in March and growing expectations of rate increases at every FOMC meeting this year drove stock prices markedly lower as investors grappled with the effects of higher rates on stock prices and with the possibility of continued elevated inflation levels. 10-year U.S. Treasury rates, reflecting these same concerns, moved 13bps higher through Thursday (closing at 2.04%) as 10-year real yields rose 8bps and 10-year inflation expectations increased 5bps. Friday’s late-afternoon White House announcement that Russia could invade Ukraine at any time diverted investor attention from Fed policy to economic and geopolitical repercussions of an invasion, dramatically increasing risk-off sentiment and driving stock prices sharply lower while increasing haven investment values such as gold, U.S. Treasuries and the U.S. dollar. All three major stock market indexes fell 1.5% or more Friday and the 10-year U.S. Treasury rate dropped 13bps to unchanged on the week. At week’s end, the S&P 500 fell 1.8% to 4,418.64, the Nasdaq Composite Index dropped 2.2% to 13,791.15, the Dow Jones Industrial Average decreased 1.0% to 34,737.47, the 10-year U.S. Treasury rate was unchanged at 1.92% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.6%.

Increased expectations of a renewed Iran nuclear agreement helped move oil prices lower early last week with the March WTI crude oil contract falling over 2.5% through Tuesday. Wednesday's much larger-than-expected drawdown in U.S. oil inventories and increase in product supplied (as reported by the EIA), reversed oil’s slide lower, pushing prices about 1% higher. Friday’s White House announcement regarding the possibility of an imminent Russian invasion of Ukraine drove WTI and Brent crude oil prices almost 3% higher to 8-year highs with heightened concerns Russian oil exports would be negatively affected. Oil prices continue to be affected by chronic OPEC+ underproduction in the face of rising demand. Natural gas prices dropped 14% on warm-weather forecasts and increasing supplies.

Gold prices moved higher every single day last week energized by heightened elevated inflation concerns and by the possibility of an imminent Russian invasion of Ukraine. Despite significantly increased expectations of aggressive Fed tightening this year – spurred by Thursday’s much greater-than-expected CPI release – gold prices moved higher with increasing concerns of continued high levels of inflation (10-year breakeven inflation rates rose 5bps last week). Friday’s White House announcement that Russia could invade Ukraine at any time increased haven demand for gold as U.S. stock markets moved sharply lower, moving gold price higher despite a stronger U.S. dollar.

Base metal prices finished the week higher but well off mid-week highs. Aluminum prices, buoyed by restricted supply due to high energy costs, surged to a 14-year high Monday. Base metal prices fell sharply Friday, succumbing to risk-off sentiment exhibited in falling U.S. equity markets precipitated by Russia-Ukraine tensions and continued elevated inflation. Aluminum prices, for example, up nearly 6% through Thursday, fell almost 3.5% Friday. And copper prices, up almost 4% through Thursday, fell more than 3% Friday.

Grain prices were all higher last week with wheat and corn prices outperforming soybean prices. Grain prices continue to be supported by falling South America soybean and corn production due to dry weather combined with strong demand. Wednesday’s WASDE report held no surprises, allowing markets to continue higher. Thursday was a volatile day for grains with soybean prices rising sharply in the morning on lower production numbers from Brazil and then falling sharply to close the day over 1% lower on rumors of China canceling buy orders and on falling U.S. equity markets. Grain prices moved markedly higher Friday with wheat prices climbing 3% on the White House’s announcement Russia could invade Ukraine imminently.

Coming up this week

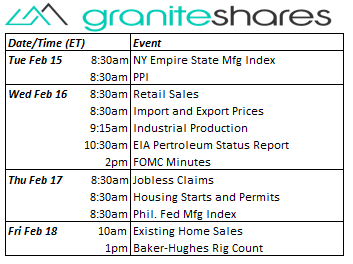

PPI, retail sales and FOMC minutes headline this week’s data releases

PPI, retail sales and FOMC minutes headline this week’s data releases- NY Empire State Mfg Index and PPI on Tuesday.

- Retail Sales, Import and Export Prices, Industrial Production and FOMC Minutes on Wednesday.

- Jobless Claims, Housing Starts and Permits and Phil. Fed Mfg Index on Thursday.

- Existing Home Sales on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.