Commodities & Precious Metals Weekly Report: Feb 3

Posted:

Key points

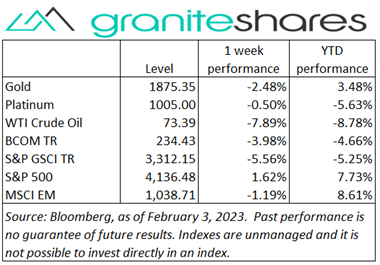

Energy prices were sharply lower last week. WTI and Brent crude oil prices fell 8% and 7%, respectively. Heating oil, gasoil and gasoline prices dropped between 11% and 12%. Natural gas prices (March futures contract) fell over 15%.

Energy prices were sharply lower last week. WTI and Brent crude oil prices fell 8% and 7%, respectively. Heating oil, gasoil and gasoline prices dropped between 11% and 12%. Natural gas prices (March futures contract) fell over 15%.- Grain prices were all mixed. Wheat prices moved about 1% higher and soybean prices gained 1.5%. Corn prices fell 1%. Soybean meal prices climbed 5% higher.

- Precious metal prices were lower. Spot gold and platinum prices fell 3% and spot silver prices lost 5%.

- Base metal prices were lower. Copper and lead prices fell 4%. Zinc prices lost 5% and nickel prices dropped 1%.

- The Bloomberg Commodity Index fell 4%. Three-quarters of the loss came from the energy sector with the base and precious metals responsible for the remaining 25%.

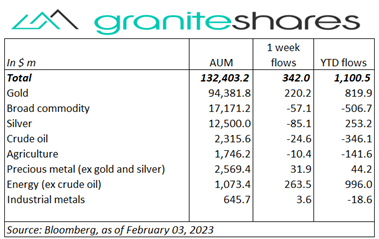

- About $350 million flows into commodity ETPs last week. Inflows into gold and energy (ex-crude oil) were partially offset by smaller outflows from all other commodity ETPs.

Commentary

Through Thursday, stock markets powered higher, propelled by an as-expected FOMC rate decision, the absence of direct, hawkish comments from Fed Chair Powell following the decision and indications wage inflation – a primary concern for the Fed – was slowing. META’s earnings beat helped as well, with META’s stock price surging 23% Thursday, lifting other tech stocks and, in particular, the Nasdaq Composite Index as well. After-the-close earnings reports Thursday from Alphabet, Apple and Amazon, however, cooled market enthusiasm overnight and then Friday morning’s much stronger-than-expected jobs report renewed concerns of continued Fed vigiliance, sending all 3 major stock market indexes lower on the day. While the indexes all closed lower Friday, the Nasdaq Composite and S&P 500 Indexes still registered gains on the week. 10-year Treasury rates, down almost 11bps through Thursday, reversed course Friday, jumping 12bps and leaving the 10-year Treasury rate 1bp higher on the week (an 11bp rise in 10-year real rates was offset by a 10bp fall in 10-year inflation expectations). The U.S. dollar behaved similarly, moving from slightly weaker through Thursday to stronger by 1% over the week. At week’s end, the S&P 500 Index increased 1.6% to 4,136.48, the Nasdaq Composite Index rose 3.3% to 12,006.96, the Dow Jones Industrial Average decreased 0.2% to 33,925.06, the 10-year U.S. Treasury rate rose 1bp to 3.52% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 1.0%.

Through Thursday, stock markets powered higher, propelled by an as-expected FOMC rate decision, the absence of direct, hawkish comments from Fed Chair Powell following the decision and indications wage inflation – a primary concern for the Fed – was slowing. META’s earnings beat helped as well, with META’s stock price surging 23% Thursday, lifting other tech stocks and, in particular, the Nasdaq Composite Index as well. After-the-close earnings reports Thursday from Alphabet, Apple and Amazon, however, cooled market enthusiasm overnight and then Friday morning’s much stronger-than-expected jobs report renewed concerns of continued Fed vigiliance, sending all 3 major stock market indexes lower on the day. While the indexes all closed lower Friday, the Nasdaq Composite and S&P 500 Indexes still registered gains on the week. 10-year Treasury rates, down almost 11bps through Thursday, reversed course Friday, jumping 12bps and leaving the 10-year Treasury rate 1bp higher on the week (an 11bp rise in 10-year real rates was offset by a 10bp fall in 10-year inflation expectations). The U.S. dollar behaved similarly, moving from slightly weaker through Thursday to stronger by 1% over the week. At week’s end, the S&P 500 Index increased 1.6% to 4,136.48, the Nasdaq Composite Index rose 3.3% to 12,006.96, the Dow Jones Industrial Average decreased 0.2% to 33,925.06, the 10-year U.S. Treasury rate rose 1bp to 3.52% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 1.0%.

Oil prices moved sharply lower last week only increasing Tuesday following an EIA report showing oil demand increased about 180,000 bpd in November. In the face of uncertainty regarding Wednesday’s FOMC rate decision and increased Russian production, oil prices dropped nearly 2% Monday. While prices rose about 1% Tuesday, Wednesday’s EIA oil petroleum status report revealing an outsized, much higher-than-expected build in crude oil, distillate and gasoline inventories pushed crude oil prices down over 3%. Slightly lower Thursday on no real news, oil prices dropped another 3% Friday after a much stronger-than-expected jobs report ignited fears of demand destruction due to continued aggressive Fed monetary policy. Heating oil and gasoline prices fell more sharply than crude oil prices, falling 11% to 12% versus crude price declines of 7% to 8%. Natural gas prices added to their losses last week, falling over 15% despite late-week/weekend subfreezing temperatures in parts of the U.S. with warm-weather forecasts for the next couple of weeks, ameliorating cold-weather supply and demand concerns, pushing prices to much lower levels.

Bolstered by hopes of less restrictive Fed monetary policy, gold prices edged higher through Tuesday. Wednesday’s as-expected 25bp rate increase accompanied by comments from Fed Chair Powell noting progress fighting inflation, pushed prices over 1% higher. After reaching a 9-month higher early in the day, gold prices fell sharply Thursday reacting to much smaller-than-expected initial jobless claims, a sharply strengthening U.S. dollar and, perhaps, to 50bp rate increases by both the BoE and ECB. Friday’s much stronger-than-expected jobs report increased expectations of continued aggressive Fed monetary policy, pushing gold prices another 2.5% lower. Gold prices, down 3.3% on the week, outperformed silver prices which fell over 5%. Platinum prices ended the week down 3.3% as well.

Base metal prices were all lower last week with zinc prices falling the most. Expectations of reviving Chinese demand were offset by falling manufacturing activity (as reported Wednesday by Caixin) and by increased concerns Fed monetary policy would remain restrictive following Friday’s much stronger-than-expected jobs report. A stronger U.S. dollar also pressured prices lower. Zinc prices were pressured by surging inventory levels in China.

Wheat and soybean prices moved higher last week while corn prices moved slightly lower. Wheat prices benefited from winterkill crop concerns in Nebraska and Kansas and by Russia-Ukraine war escalations. Wheat prices, hurt by reports of a record Russian crop, also benefited from a reduction in Russian crop estimates. Soybean prices moved higher on the back of flash sales and strong soybean meal demand. Argentina meal production (Argentina is the world’s largest exporter of soybean meal) has been affected by drought conditions and a large portion of its soybean crop rated as poor. Corn prices continue to suffer from weak exports and cheaper Brazil prices.

Coming up this week

A very light data-week. Fed Chair Powell speaks Tuesday, the highlight of the week.

A very light data-week. Fed Chair Powell speaks Tuesday, the highlight of the week.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.