Commodities & Precious Metals Weekly Report: Jul 2 (1)

Posted:

Key points

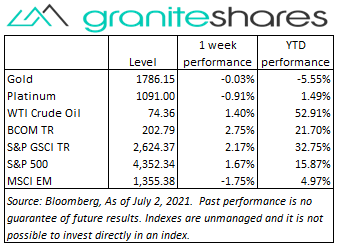

Energy prices once again ended the week higher. WTI and Brent crude oil prices increased between 1% and 1.5% and natural gas prices rose almost 5%. Gasoline prices increased 2%.

Energy prices once again ended the week higher. WTI and Brent crude oil prices increased between 1% and 1.5% and natural gas prices rose almost 5%. Gasoline prices increased 2%.- Grain prices all moved higher with corn and soybean prices experiencing double digit increases. Corn prices increased just under 12% and soybean prices rose just over 10% while soybean oil prices increased almost 9%. Chicago and Kansas wheat prices rose about 1 ¾ percent.

- Base metal prices were mixed. Aluminum prices increased 3% and zinc prices rose 1%. Copper prices fell under ½ percent and nickel prices lost 1%.

- Precious metal prices were mixed with gold prices unchanged, silver prices up about 1.5% and platinum prices lower by about 1%.

- The Bloomberg Commodity Index increased 2.8%, primarily from higher energy and grain prices. All sectors moved higher last week.

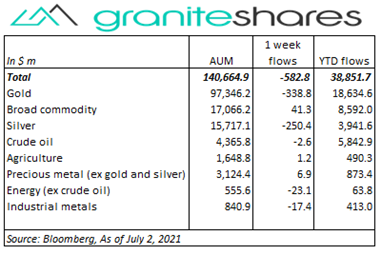

- About $600 million of ETP outflows last week mainly resulting from gold (-$339m) and silver (-$250m) ETP outflows. Broad commodity ETPs had small inflows of $41m.

Commentary

U.S stock markets rallied to all-time highs with all three major stock indexes reaching record levels. Strong economic data as represented by Friday’s mostly better-than-expected payroll report, Thursday’s post-pandemic low in jobless claims, climbing consumer confidence and surging home prices combined to push stock markets higher. Also helping stock prices was President Biden’s announcement he would sign the almost $1 trillion bipartisan infrastructure bill if it reached his desk. Ten-year U.S. Treasury rates fell 11bps last week pushed lower by diminished inflation concerns (the payroll report showed decreasing wages) and increasing expectations the Fed would not need to raise rates sooner than later. At week’s end, the S&P 500 Index increased 1.7% to 4,352.34, the Nasdaq Composite Index rose 1.9% to 14,639.33, the Dow Jones Industrial Average gained 1.0% to 34,786.35, the 10-year U.S. Treasury rate fell 11bps to 1.43% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.5% percent.

U.S stock markets rallied to all-time highs with all three major stock indexes reaching record levels. Strong economic data as represented by Friday’s mostly better-than-expected payroll report, Thursday’s post-pandemic low in jobless claims, climbing consumer confidence and surging home prices combined to push stock markets higher. Also helping stock prices was President Biden’s announcement he would sign the almost $1 trillion bipartisan infrastructure bill if it reached his desk. Ten-year U.S. Treasury rates fell 11bps last week pushed lower by diminished inflation concerns (the payroll report showed decreasing wages) and increasing expectations the Fed would not need to raise rates sooner than later. At week’s end, the S&P 500 Index increased 1.7% to 4,352.34, the Nasdaq Composite Index rose 1.9% to 14,639.33, the Dow Jones Industrial Average gained 1.0% to 34,786.35, the 10-year U.S. Treasury rate fell 11bps to 1.43% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.5% percent.

Down initially on demand-related concerns stemming from the Delta variant of coronavirus, oil prices moved higher the remainder of the week buoyed by OPEC+ forecasts of increasing demand and expectations OPEC+ would further decrease production cutbacks but at a slow pace. Meeting July 1, OPEC+ was unable to agree to production increases with the UAE preventing closure but with expectations an agreement will be reached this week.

Falling nearly 1% Tuesday following a record consumer confidence report, gold futures prices climbed steadily thereafter to finish the week up about ¼ percent. A slightly weaker-than-expected ISM Manufacturing Index release combined with Friday’s payroll report showing the unemployment rate increased slightly and that wages had fallen lent support to prices. Concerns surrounding the Delta variant of the coronavirus also provided support.

Copper prices slipped last week pressured by falling Chinese industrial profits, higher inventory levels and concerns surrounding the emergence of the Delta coronavirus variant. Aluminum prices, up 3%, gained on supply concerns in Russia and China as well as falling inventory levels. A stronger U.S. dollar limited base metal price gains.

Corn and soybean prices soared last week benefiting from Wednesday’s USDA Acreage report showing lower-than-expected acres planted. Corn prices traded limit up Wednesday. Grain prices were also supported by Monday’s crop condition report showing a deterioration in corn and soybean crops.

Coming up this week

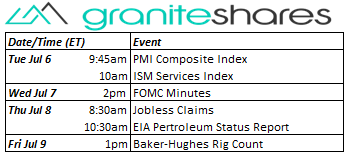

Light data-week accented by the release of FOMC minutes on Wednesday.

Light data-week accented by the release of FOMC minutes on Wednesday.- PM Composite Index and ISM Services Index on Tuesday.

- FOMC Minutes on Wednesday.

- Jobless Claims on Thursday.

- EIA petroleum status report on Thursday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.