Commodities & Precious Metals Weekly Report: Mar 11

Posted:

Key points

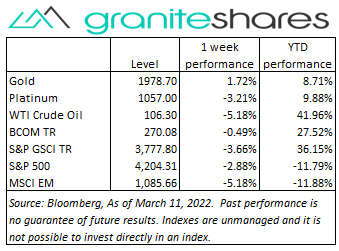

Energy prices moved lower last week. May WTI and Brent crude oil futures prices decreased close to 5%. Gasoil and gasoline prices fell about 5.5% and heating oil prices lost 8%. Natural gas prices decreased 5.5%.

Energy prices moved lower last week. May WTI and Brent crude oil futures prices decreased close to 5%. Gasoil and gasoline prices fell about 5.5% and heating oil prices lost 8%. Natural gas prices decreased 5.5%.- Grain prices were mixed with wheat prices falling and soybean and corn prices moving higher. Chicago and Kansas wheat prices fell 8.5% and 10.3%, respectively. Corn and soybean prices increased 1%.

- Precious metal prices were mixed, too. May gold futures prices increased 1% and May silver futures prices rose 1.5%. Spot Platinum prices fell 3.5%.

- Base metal prices, except for nickel prices, were all lower. Copper and zinc prices fell 6% and aluminum prices lost 10%. Nickel prices closed up 65% on the week though the LME suspended nickel trading Tuesday and remained suspended the rest of the week.

- The Bloomberg Commodity Index decreased 0.5%. The energy sector was predominantly responsible for its decrease. The grains sector was the only other sector to post a negative return last week.

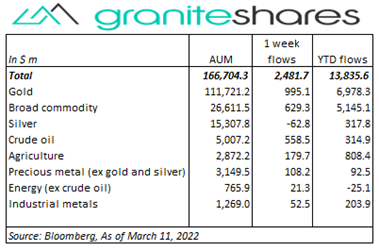

- More inflows into gold ($995m) and broad commodity ($625m) ETPs but also strong inflows into crude oil ($558m), agriculture ($180m) and precious metals (ex-gold and silver) ($108m) ETPs. Silver ETPs had the only outflows last week.

Commentary

Another turbulent week for U.S. stock markets as soaring commodity prices – a direct consequence of Russia’s invasion of Ukraine and the resulting sanctions on Russia – increased fears of stagflation and markedly slower economic growth. All three major U.S. stock indexes fell sharply Monday with the Nasdaq Composite Index shedding over 3.5% and the S&P 500 Index falling nearly 3%. Monday’s move lower was precipitated primarily by ever-higher-moving oil prices. U.S. stock markets rebounded strongly Wednesday, again predicated by oil prices (this time falling prices), with reports the UAE and Iraq would be willing to pump more oil to help offset the White House’s decision to ban Russian oil and gas imports. WTI and Brent crude oil prices fell between 12% and 13% Wednesday. Nonetheless, stock prices resumed their move lower Thursday and Friday directed by a 40-year high CPI release Thursday (increasing expectations of a more aggressive Fed), no letup in Russia’s Ukraine Invasion and continued stagflation concerns. 10-year U.S. Treasury rates rose 26bps over the week entirely driven by increasing inflation expectations. The 10-year breakeven inflation rate closed Friday at 2.98%, up 27bps from the previous Friday while 10-year real yields remained near recent lows (reflecting flight-to-quality demand) of -0.98%. For the week, the S&P 500 fell 2.9% to 4,204.31, the Nasdaq Composite Index dropped 3.5% to 12,843.81, the Dow Jones Industrial Average decreased 2.0% to 32,943.33, the 10-year U.S. Treasury rate increased 26bp to 2.00% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.5%.

Another turbulent week for U.S. stock markets as soaring commodity prices – a direct consequence of Russia’s invasion of Ukraine and the resulting sanctions on Russia – increased fears of stagflation and markedly slower economic growth. All three major U.S. stock indexes fell sharply Monday with the Nasdaq Composite Index shedding over 3.5% and the S&P 500 Index falling nearly 3%. Monday’s move lower was precipitated primarily by ever-higher-moving oil prices. U.S. stock markets rebounded strongly Wednesday, again predicated by oil prices (this time falling prices), with reports the UAE and Iraq would be willing to pump more oil to help offset the White House’s decision to ban Russian oil and gas imports. WTI and Brent crude oil prices fell between 12% and 13% Wednesday. Nonetheless, stock prices resumed their move lower Thursday and Friday directed by a 40-year high CPI release Thursday (increasing expectations of a more aggressive Fed), no letup in Russia’s Ukraine Invasion and continued stagflation concerns. 10-year U.S. Treasury rates rose 26bps over the week entirely driven by increasing inflation expectations. The 10-year breakeven inflation rate closed Friday at 2.98%, up 27bps from the previous Friday while 10-year real yields remained near recent lows (reflecting flight-to-quality demand) of -0.98%. For the week, the S&P 500 fell 2.9% to 4,204.31, the Nasdaq Composite Index dropped 3.5% to 12,843.81, the Dow Jones Industrial Average decreased 2.0% to 32,943.33, the 10-year U.S. Treasury rate increased 26bp to 2.00% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.5%.

Oil prices continued their move higher early last week boosted by companies refusing to buy Russia oil and by the U.S. and UK announcements banning imports of Russian oil (the UK ban was not immediate but would phase in through the end of the year). Adding to oil price pressures was the collapse of the Iran nuclear agreement talks resulting from Russia’s demand to be able to freely trade with Iran. Wednesday’s announcement by the UAE that it would work to increase production sent oil prices skidding with WTI and Brent crude oil prices falling between 12% and 13%. Prices moved another 2% lower Thursday before rallying 3% on Friday with the UAE backtracking on its willingness to pump more oil and as supply concerns returned. Still, oil prices ended the week lower, falling about 5% though prices remained north of $100/barrel. The number of working U.S rigs, as reported in the Baker-Hughes Rig Count report Friday, increased again, rising by 13.

Precious metal prices moved sharply higher through Tuesday benefiting from safe-haven investment demand and stagflation concerns. Palladium prices, boosted by supply concerns as well (Russia produces 40% of the world’s palladium), reached an all-time high Tuesday, closing at $3,180/ounce while gold prices closed at $2,052/ounce. Prices then fell sharply Wednesday following a steep decline in oil prices and as safe-haven investor demand plateaued. Palladium prices, up 6% through Tuesday, ended the week down 6%. Gold prices, up over 4% through Tuesday, closed the week up 1%. And Platinum prices, up almost 3% through Tuesday, finished the week down 3.4%.

An extremely volatile week for base metal prices led by nickel prices. Nickel prices, up 65% Monday, doubled Tuesday morning before the LME suspended trading and canceled all nickel trades posted on Tuesday. Growing concerns that access to Russian nickel production (Russia produces over 10% of the world’s nickel) would be banned or severely restricted combined with large nickel purchases to close a large short position held by Chinese producer Tsingshan pushed nickel prices into the stratosphere. Aluminum and copper prices, weakened by Germany’s refusal to ban Russia energy imports on Monday, fell further following the LME’s suspension of nickel trading. Aluminum prices, down close to 15% through Wednesday, for example, rose the remainder of the week on continued supply concerns (Russia is a larger produce of aluminum as well) to end the week down 9.5%. Copper prices, which reached all-time highs intraday Monday, finished the weak down 6.3%.

Tremendous volatility in the wheat markets last week, precipitated by supply concerns (Russia and Ukraine account for about 25% of the world’s wheat exports) and exacerbated by short positions looking to close positions. Limit up Monday (up 7% on the day), Chicago wheat prices moved lower Tuesday, reaching limit down intraday (-10% on extended limits) before closing down 0.6% for the day. Chicago wheat prices then fell 6.6% Wednesday pushed lower by larger-than-expected stocks shown in Wednesday’s USDA WASDE report. Chicago wheat continued lower Thursday, closing limit down (down almost 10%) before moving almost 2% higher Friday to end the week down almost 10%. Corn prices, up about 1% on the week were supported by increased export and ethanol demand. Soybean prices, also up about 1%, benefited from lower Brazilian crop size estimates.

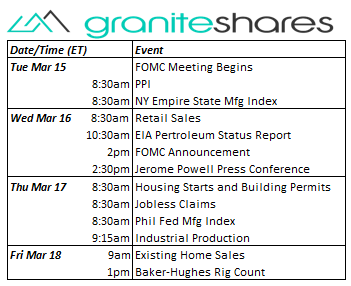

Coming up this week

Decent data week with Fed Chair Powell testifying Wednesday and Thursday, PMI and ISM manufacturing and service indexes Tuesday and Thursday and the Employment Report on Friday.

Decent data week with Fed Chair Powell testifying Wednesday and Thursday, PMI and ISM manufacturing and service indexes Tuesday and Thursday and the Employment Report on Friday.- International Trade in Goods and Chicago PMI Monday.

- PMI and ISM Manufacturing Indexes and Construction Spending on Tuesday.

- Fed Chair Powell Testimony on Wednesday.

- Jobless Claims, Productivity and Costs, Fed Chair Powell Testimony, Factory Orders and ISM Services Index on Thursday.

- Employment Report on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.