Commodities & Precious Metals Weekly Report: Mar 24

Posted:

Key points

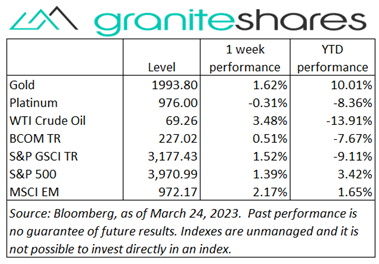

Energy prices were mostly higher last week. WTI and Brent crude oil price rose about 3%, gasoline prices increased 4% and heating oil prices rose 1%. Gasoil prices fell 1% and natural gas prices lost 3%.

Energy prices were mostly higher last week. WTI and Brent crude oil price rose about 3%, gasoline prices increased 4% and heating oil prices rose 1%. Gasoil prices fell 1% and natural gas prices lost 3%. - Grain prices were mixed. Chicago wheat prices fell 3% while Kansas City wheat prices gained 1.5%. Corn prices also rose 1.5% while soybean prices fell 3%. Soybean oil prices dropped 7%.

- Spot gold prices ended the week down ½ percent while spot silver prices climbed 3% higher. Platinum prices increased 1% and palladium prices were basically unchanged.

- Base metal prices were mostly higher. Copper prices rose 5%, aluminum prices gained 3% and lead prices increased 2%. Zinc prices were unchanged and nickel prices increased ½ percent.

- The Bloomberg Commodity Index increased 0.5% benefiting from higher energy and metals prices. Falling grain prices slightly offset gains.

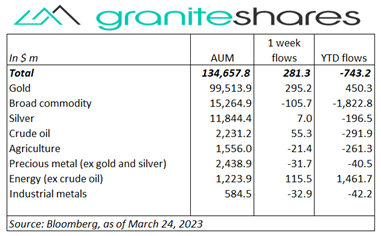

- $281 million net inflows into commodity ETPs last week. $300 billion inflows into gold ETPs and $115 million into energy (ex-crude oil) ETPs were partially offset by $106 million broad commodity ETP outflows.

Commentary

An up week for all 3 major stock market indexes, rising every day but Wednesday (FOMC announcement day) and despite hawkish Fed Chair Powell comments and lingering banking system concerns. The week opened with news of the UBS acquisition of Credit Suisse helping to slightly alleviate banking system concerns and moving stock markets higher. Concerns still remained, however, with First Republic Bank share prices falling nearly 50% (on Monday). All 3 major stock market indexes powered higher Tuesday on the back of diminished banking system concerns and expectations of a “supportive” Fed decision Wednesday. Treasury rates, steeply lower on the back of flight-to-quality investing, reflecting this same sentiment rose shareplyTuesday with the 2-year Treasury rate, for example, climbing 25 bps higher An as-expected 25bp rate hike accompanied by less-than-accommodative comments from Chairman Powell reversed Tuesday’s sentiment, sending stock indexes sharply lower and Treasury rates, once again, sharply lower. While Chairman Powell stated he expected one more 25bp rate increase this year, he also insisted he did not expect the Fed to ease in 2023 despite very possible restrictive credit conditions arising from the current health of the banking system. Risk-on sentiment returned Thursday, though, with markets more or less refuting Chairman Powell’s comments, believing the Fed would indeed ease in 2023, bolstering stock prices and moving Treasury rates lower through the end of the week. Fresh banking system concerns Friday, sending Deutsch Bank shares pronouncedly lower, moved larger bank stock prices lower (though not regional bank stock prices), capping index level gains. For the week, the S&P 500 Index increased 1.4% to 3,970.99 the Nasdaq Composite Index rose 1.7% to 11,823.96, the Dow Jones Industrial Average increased 1.2% to 32,238.15, the 10-year U.S. Treasury rate fell 7bps to 3.37% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.6%.

An up week for all 3 major stock market indexes, rising every day but Wednesday (FOMC announcement day) and despite hawkish Fed Chair Powell comments and lingering banking system concerns. The week opened with news of the UBS acquisition of Credit Suisse helping to slightly alleviate banking system concerns and moving stock markets higher. Concerns still remained, however, with First Republic Bank share prices falling nearly 50% (on Monday). All 3 major stock market indexes powered higher Tuesday on the back of diminished banking system concerns and expectations of a “supportive” Fed decision Wednesday. Treasury rates, steeply lower on the back of flight-to-quality investing, reflecting this same sentiment rose shareplyTuesday with the 2-year Treasury rate, for example, climbing 25 bps higher An as-expected 25bp rate hike accompanied by less-than-accommodative comments from Chairman Powell reversed Tuesday’s sentiment, sending stock indexes sharply lower and Treasury rates, once again, sharply lower. While Chairman Powell stated he expected one more 25bp rate increase this year, he also insisted he did not expect the Fed to ease in 2023 despite very possible restrictive credit conditions arising from the current health of the banking system. Risk-on sentiment returned Thursday, though, with markets more or less refuting Chairman Powell’s comments, believing the Fed would indeed ease in 2023, bolstering stock prices and moving Treasury rates lower through the end of the week. Fresh banking system concerns Friday, sending Deutsch Bank shares pronouncedly lower, moved larger bank stock prices lower (though not regional bank stock prices), capping index level gains. For the week, the S&P 500 Index increased 1.4% to 3,970.99 the Nasdaq Composite Index rose 1.7% to 11,823.96, the Dow Jones Industrial Average increased 1.2% to 32,238.15, the 10-year U.S. Treasury rate fell 7bps to 3.37% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.6%.

Oil prices rose sharply through Wednesday last week, bolstered by reduced banking-system concerns and growing expectations the Fed would ease before year’s end (despite the contrary view promulgated by Fed Chair Powell). Prices fell Thursday, pressured by comments by the U.S. energy secretary refuting claims of an imminent replenishment of the SPR, stating it may take years before reserves reach pre-release levels. Friday saw prices fall as well on the back of newly emerging European banking concerns. Price moves lower, however, were floored by sharply falling gasoline inventories and, according to some analysts, surging Chinese demand.

Gold prices ended lower for the week (about ½ percent lower) but significantly off lows sent Tuesday. Down almost 2.5% on diminished banking concerns Tuesday, gold prices rallied following an as-an expected FOMC rate hike and despite hawkish Fed Chair Powell comments. Powell, following the announcement in his press conference, stated he did not expect the Fed to ease this year. Markets, however, thought otherwise, pricing in at least 1 rate decrease in 2023, moving gold prices markedly higher Wednesday and Thursday. Prices fell Friday perhaps on increased risk-on sentiment and on a stronger U.S. dollar.

Base metal prices moved higher last week, bolstered by a range of factors. Growing expectations of increased Chinese demand compounded by falling inventory levels help lift base metal prices as did diminished banking sector concerns and increased market sentiment the Fed would ease at this year. Nickel prices moved sharply higher Friday following reports of markedly lower Chinese inventories. Other base metal prices fell Friday, however, on re-emerging European banking system concerns.

Grain prices moved noticeably lower through Thursday precipitated by fund selling, strong Brazil harvests and uncertainty surrounding Chinese demand. A surge in Chinese African swine fever cases lowered demand expectations for soybean meal pressuring both meal and soybean prices lower. Prices, however, moved sharply higher Friday, ostensibly due to reports Russia was planning on suspending wheat and sunflower product exports. Chicago SRW down almost 7% through Thursday, for example, ended the week down just over 3%. Kansas City HRW, benefiting from drought conditions in the southwestern Plains states, rose almost 4% Friday to end the week up 1.5%.

Coming up this week

A lighter week with attention turned to Friday’s PCE Price Index release

A lighter week with attention turned to Friday’s PCE Price Index release

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.