Commodities & Precious Metals Weekly Report: May 14

Posted:

Key points

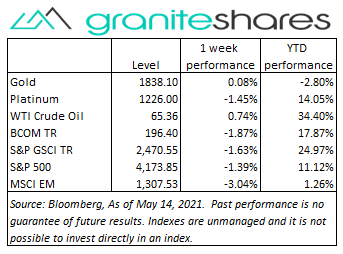

Energy prices were once again all higher last week. WTI crude oil prices rose ¾ percent and gasoline prices increased over 2%.

Energy prices were once again all higher last week. WTI crude oil prices rose ¾ percent and gasoline prices increased over 2%.- Grain prices were mixed with wheat and corn prices significantly lower and soybean prices only slightly lower. Chicago and Kansas wheat dropped 7% and 11%, respectively and corn prices fell over 12%. Soybean prices were down about ¼ percent while soybean oil prices increased almost 5%.

- Base metal prices were all lower falling between 2% and 3%. Copper prices were down 2%. Nickel, aluminum and zinc prices were all about 3% lower.

- Precious metal prices were mixed with gold prices rising and silver and platinum prices falling. Gold prices were only slightly higher on the week while platinum prices fell 1.5% and silver prices lost about ½ percent.

- The Bloomberg Commodity Index decreased almost 2%, hurt by falling grain, softs and base metal prices. The energy sector was the best performing sector, helping to offset index losses.

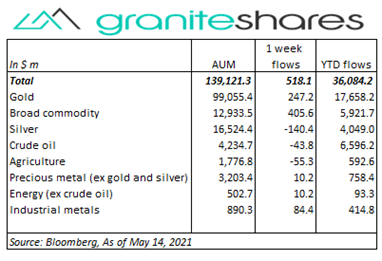

- Another week of decent inflows last with broad commodity and gold ETPs once again primarily responsible. Broad commodity ETPs led the way with $400 million inflows followed by gold ETPs with about $250 million inflows. Silver and crude oil ETPs saw outflows of about $140 million and $44 million, respectively and agriculture ETPs had $55 million outflows.

Commentary

A tale of two halves last week with stock markets selling off steeply through Wednesday and then rallying strongly Thursday and Friday to finish the week lower but well off of Wednesday’s lows. Rotation from growth to value stocks continued early last week as investors continued to be concerned about growth stock valuations in the face of inflation and increasing interest rates. Wednesday’s much greater-than-expected CPI release pushed both growth and value stocks lower with growing expectations the Fed would act to scale back its massive accommodative monetary policy sooner than later. A lower-than-expected jobless claims number and the CDC advising that those fully vaccinated no longer need to wear masks in most situations helped push stock markets significantly higher. The increase came despite a much greater-than-expected increase in the PPI release. Inflation concerns again were ameliorated by the Fed, stating inflation increases will be transitory and that more data would be needed to cause changes in policy. The 10-year U.S. rate rose to almost 1.7% following the CPI release but moved lower the remainder of the week. At week’s end, the S&P 500 Index decreased 1.4% to 4,173.85, the Nasdaq Composite Index fell 2.3% to 13,429.98, the Dow Jones Industrial Average decreased 1.1% to 34,832.13, the 10-year U.S. Treasury rate rose 6bps to 1.64% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.1%.

A tale of two halves last week with stock markets selling off steeply through Wednesday and then rallying strongly Thursday and Friday to finish the week lower but well off of Wednesday’s lows. Rotation from growth to value stocks continued early last week as investors continued to be concerned about growth stock valuations in the face of inflation and increasing interest rates. Wednesday’s much greater-than-expected CPI release pushed both growth and value stocks lower with growing expectations the Fed would act to scale back its massive accommodative monetary policy sooner than later. A lower-than-expected jobless claims number and the CDC advising that those fully vaccinated no longer need to wear masks in most situations helped push stock markets significantly higher. The increase came despite a much greater-than-expected increase in the PPI release. Inflation concerns again were ameliorated by the Fed, stating inflation increases will be transitory and that more data would be needed to cause changes in policy. The 10-year U.S. rate rose to almost 1.7% following the CPI release but moved lower the remainder of the week. At week’s end, the S&P 500 Index decreased 1.4% to 4,173.85, the Nasdaq Composite Index fell 2.3% to 13,429.98, the Dow Jones Industrial Average decreased 1.1% to 34,832.13, the 10-year U.S. Treasury rate rose 6bps to 1.64% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.1%.

Oil prices moved high last week supported by the Colonial Pipeline ransomware outage, growing demand expectations and declining U.S. inventory levels with falling exports. Up almost 2% through Wednesday, oil prices dropped almost 3.5% Thursday on news of the reopening of the Colonial pipeline, but then rallied 2.5% Friday on the back of strong demand optimism.

Up slightly through Tuesday, gold prices moved lower Wednesday following a much greater-than-expected CPI release, spurring investor concerns that the Fed would move to scale back its easy money policies sooner than expected, pressuring gold prices lower. The Fed once again eased inflation concerns saying it expected an increase in inflation but that it would be transitory creating no need to change policy helping gold prices move higher Thursday and Friday. Silver and platinum prices moved lower following base metal prices.

Copper prices fell for the first time since April, affected by inflation concerns and weakening Chinese demand. Concerns the Fed and other central banks may tighten monetary policy sooner than later, potentially slowing economic growth, and reports Chinese demand had slipped helped move copper prices lower early last week. Prices partially rebounded Thursday with supply dynamics and diminished inflation fears supporting prices.

A volatile week for grain prices with double-digit declines in wheat and corn prices and with corn prices trading limit down Thursday. The USDA WASDE report on Wednesday forecasted higher-than-expected global ending stocks for wheat and corn pressuring prices lower. A Mississippi river waterway blockage Thursday also moved corn prices lower while favorable US weather forecasts added to downward pressure for wheat prices. Soybean prices continue to be supported by strong demand.

Coming up this week

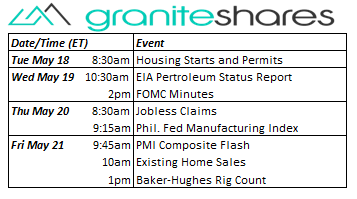

Light data-week with housing-related reports at the beginning and end of the week and the release of FOMC minutes on Wednesday.

Light data-week with housing-related reports at the beginning and end of the week and the release of FOMC minutes on Wednesday.- Housing Starts and Permits on Tuesday

- FOMC Minutes on Wednesday.

- Jobless Claims and Phil. Fed Manufacturing Index on Thursday.

- PMI Composite Flash and Existing Home Sales on Friday.

- EIA petroleum status report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.