Commodities & Precious Metals Weekly Report: May 5

Posted:

Key points

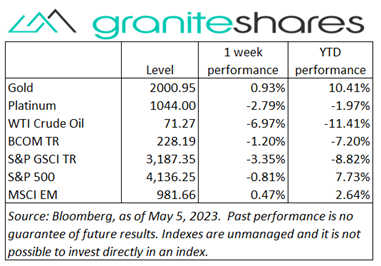

Energy prices were all lower again. Brent and WTI crude oil prices fell 6% and 7%, respectively, gasoline prices lost 6% and heating oil and gasoil prices gave up 3%. Natural gas prices lost 10%.

Energy prices were all lower again. Brent and WTI crude oil prices fell 6% and 7%, respectively, gasoline prices lost 6% and heating oil and gasoil prices gave up 3%. Natural gas prices lost 10%.- Grain prices were all higher. Chicago and Kansas City wheat prices gained 4% and 7%, respectively, corn prices 2% and soybean prices 1%.

- Spot gold and silver prices increased 1.5% and 2.5%, respectively. Spot platinum and palladium prices dropped 1%.

- Base metal prices were mixed. Copper prices were down less than ½ percent and lead and aluminum prices fell 2%. Zinc and nickel prices rose 1%.

- The Bloomberg Commodity Index decreased 1.2%. Energy sector losses were partially offset by gains in the grains and precious metals sectors.

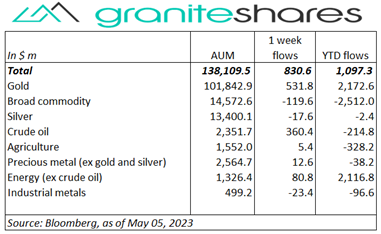

- Good inflows into commodity ETPs mainly comprised of inflows into gold and crude oil ETPs. Only substantive outflows were from broad commodity ETPs.

Commentary

A week defined by banking system concerns and uncertainty regarding the Fed’s future monetary policy. Monday’s seizure and sale of First Republic Bank barely moved markets with banking system concerns allayed by the swift and cauterizing move of the FDIC. Banking system concerns, however, resurfaced Tuesday (in front of Wednesday’s FOMC announcement) driving regional bank stock prices markedly lower and significantly contributing to the decline of all 3 major stock market indexes. Signs of economic weakness, starkly illustrated by falling job openings and sharply lower oil prices, also pressured index levels lower as did growing expectations of a 25bp rate hike. Wednesday’s FOMC announcement of a 25bp rate hike, along with language strongly suggesting the Fed would be “pausing”, initially moved stock prices higher. Fed Chair Jerome Powell’s comments denying the Fed was pausing, reversed sentiment and sent index levels sharply lower. Banking stocks again took center stage Thursday with stock prices of PacWest, Western Alliance Bancorp and First Horizon falling sharply on liquidity concerns. The ensuing risk-off sentiment once again sent major stock market index levels lower. Stock markets rallied sharply Friday, spurred by a much better-than-expected Apple earnings report, a significantly stronger-than-expected jobs report and noticeably lessened banking system concerns. All 3 major stock market indexes, down over 2% through Thursday, finished the week well off their lows with the Nasdaq Composite Index eking out a small gain. The 10-year Treasury rate had a volatile week but finished unchanged as did the 10-year real rate and 10-year inflation expectations. For the week, the S&P 500 Index decreased 0.8% to 4,136.25, the Nasdaq Composite Index increased 0.1% to 12,235.41, the Dow Jones Industrial Average fell 1.2% to 33,674.31, the 10-year U.S. Treasury rate was unchanged at 3.43% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.4%.

A week defined by banking system concerns and uncertainty regarding the Fed’s future monetary policy. Monday’s seizure and sale of First Republic Bank barely moved markets with banking system concerns allayed by the swift and cauterizing move of the FDIC. Banking system concerns, however, resurfaced Tuesday (in front of Wednesday’s FOMC announcement) driving regional bank stock prices markedly lower and significantly contributing to the decline of all 3 major stock market indexes. Signs of economic weakness, starkly illustrated by falling job openings and sharply lower oil prices, also pressured index levels lower as did growing expectations of a 25bp rate hike. Wednesday’s FOMC announcement of a 25bp rate hike, along with language strongly suggesting the Fed would be “pausing”, initially moved stock prices higher. Fed Chair Jerome Powell’s comments denying the Fed was pausing, reversed sentiment and sent index levels sharply lower. Banking stocks again took center stage Thursday with stock prices of PacWest, Western Alliance Bancorp and First Horizon falling sharply on liquidity concerns. The ensuing risk-off sentiment once again sent major stock market index levels lower. Stock markets rallied sharply Friday, spurred by a much better-than-expected Apple earnings report, a significantly stronger-than-expected jobs report and noticeably lessened banking system concerns. All 3 major stock market indexes, down over 2% through Thursday, finished the week well off their lows with the Nasdaq Composite Index eking out a small gain. The 10-year Treasury rate had a volatile week but finished unchanged as did the 10-year real rate and 10-year inflation expectations. For the week, the S&P 500 Index decreased 0.8% to 4,136.25, the Nasdaq Composite Index increased 0.1% to 12,235.41, the Dow Jones Industrial Average fell 1.2% to 33,674.31, the 10-year U.S. Treasury rate was unchanged at 3.43% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.4%.

Oil prices suffered from a litany of concerns last week, including weaker-than-expected Chinese factory activity, indications of a faltering U.S. economy, U.S banking system concerns, U.S. debt ceiling issues and Fed monetary policy. WTI crude oil prices, as a result, floundered through Thursday, dropping over 10%. The losses through Thursday included moves lower of over 4% both Tuesday and Wednesday. Friday’s stronger-than-expected jobs report, partial regional bank stock bounce back and Apple’s much better-than-expected earnings report pushed prices 4% higher. Nonetheless, for the week WTI prices lost nearly 7%. Natural gas prices also fell sharply, losing 10% on the week. Favorable weather and supply/production data provided the impetus for the move lower.

Spot gold prices moved oppositely to stock prices last week. Rallying on banking system, U.S. default and recession concerns, gold prices rose over 3% through Thursday. About half those gains were removed Friday following a stronger-than-expected U.S. jobs report and sharply lessened banking system concerns. For the week, spot gold prices rose just under 1.5% while spot silver prices gained about 2.5%. Platinum and palladium prices fell about 1%,

Copper prices finished the week only slightly lower but with a fair amount of fluctuation. Interestingly, copper prices moved about 1% higher Monday despite weaker-than-expected Chinese factor activity. Prices, however, fell sharply Tuesday and Wednesday on the heels of increased banking system concerns and indications of a weakening U.S. jobs market. Prices then moved higher Thursday and Friday, spurred by the possibility of a Fed pause, a stronger-than-expected jobs report and lessened banking system concerns.

An up-week for grain prices with wheat prices outperforming. Wheat prices, down over 4% through Tuesday on weak exports and favorable weather forecasts, moved sharply higher the remainder of the week, climbing 5% alone on Wednesday (following reports of a Ukraine drone attack on the Kremlin). Corn and soybean prices moved similarly to wheat prices but with lessened volatility. Short covering in the face of lessened recession concerns (affecting the entire commodity complex) and even lower estimates for Argentina’s soybean crop helped move both soybean and corn prices off their Tuesday’s lows.

Coming Up This Week

Light data-week but punctuated by CPI on Wednesday and PPI on Thursday.

Light data-week but punctuated by CPI on Wednesday and PPI on Thursday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.