Commodities & Precious Metals Weekly Report: Sep 16

Posted:

Key points

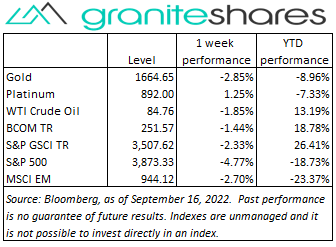

Energy prices moved lower last week. Crude oil prices fell close to 2%, natural gas prices dropped nearly 3% and gasoline prices fell about 1%. Heating oil prices fell almost 11%.

Energy prices moved lower last week. Crude oil prices fell close to 2%, natural gas prices dropped nearly 3% and gasoline prices fell about 1%. Heating oil prices fell almost 11%.- Grain prices were mixed. Kansas City wheat prices were up about 1% while Chicago prices fell 1%. Corn prices were 1% lower and soybean prices were almost 3% higher.

- Precious metal prices were mixed as well. Spot gold prices fell 2.4%, while spot silver prices rose 4.3% and spot platinum prices gained 3.0%.

- Base metal prices were mainly lower. Aluminum and zinc prices decreased around ½ percent and copper prices fell 1.5%. Nickel prices moved higher, rising almost 5.5%.

- The Bloomberg Commodity Index decreased 1.4% almost entirely as result of losses in the energy sector.

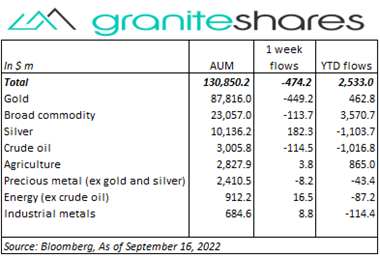

- $474 million outflows from commodity ETPs last week. Gold (-$449m), broad commodity (-$114m) and crude oil (-$115m) outflows were partially offset by silver ($182m) ETP inflows.

Commentary

All three major stock indexes fell sharply last week with the lion’s share of the move lower occurring Tuesday following a much worse-than-expected CPI release. Increasing Monday on hopes of a favorable CPI release, stock prices nosedived Tuesday after Tuesday’s CPI release showed higher-than-expected inflation levels overall and a sharply higher increase in core prices (ie, prices excluding food and energy). The Nasdaq Composite index was the loss leader, falling south of 5% Tuesday, with the S&P 500 Index and Dow Jones Industrial Average both losing around 4%. The sharp decline in index levels came as concerns of the magnitude of rate hikes increased with growing expectations the Fed would increase the Fed funds target rate by a minimum of 75bps in next week’s FOMC meeting.. Stock markets edged higher Wednesday only to continue to their move lower Thursday and Friday following a weaker-than-expected FedEx earnings report and warnings of layoffs by Goldman Sachs and office closures by FedEx. The 10-year U.S. Treasury rate continued its climb higher, increasing 14bps on the week powered by rising 10-year real rates (up 19bps). 10-year inflation expectations fell slightly, decreasing 5bps to 2.37%. For the week, the S&P 500 Index lost 4.8% to close at 3,873.33, the Nasdaq Composite Index fell 5.5% to 11,448.40, the Dow Jones Industrial Average dropped 4.1% to 30,821.50, the 10-year U.S. Treasury rate rose 14bps to 3.45% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.6%.

All three major stock indexes fell sharply last week with the lion’s share of the move lower occurring Tuesday following a much worse-than-expected CPI release. Increasing Monday on hopes of a favorable CPI release, stock prices nosedived Tuesday after Tuesday’s CPI release showed higher-than-expected inflation levels overall and a sharply higher increase in core prices (ie, prices excluding food and energy). The Nasdaq Composite index was the loss leader, falling south of 5% Tuesday, with the S&P 500 Index and Dow Jones Industrial Average both losing around 4%. The sharp decline in index levels came as concerns of the magnitude of rate hikes increased with growing expectations the Fed would increase the Fed funds target rate by a minimum of 75bps in next week’s FOMC meeting.. Stock markets edged higher Wednesday only to continue to their move lower Thursday and Friday following a weaker-than-expected FedEx earnings report and warnings of layoffs by Goldman Sachs and office closures by FedEx. The 10-year U.S. Treasury rate continued its climb higher, increasing 14bps on the week powered by rising 10-year real rates (up 19bps). 10-year inflation expectations fell slightly, decreasing 5bps to 2.37%. For the week, the S&P 500 Index lost 4.8% to close at 3,873.33, the Nasdaq Composite Index fell 5.5% to 11,448.40, the Dow Jones Industrial Average dropped 4.1% to 30,821.50, the 10-year U.S. Treasury rate rose 14bps to 3.45% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.6%.

WTI crude oil prices, about 2% higher through Wednesday, ended the weak almost 2% lower. Initially higher on EU plans to implement price caps on Russian oil, increased doubts of an Iran nuclear deal and fallout from a possible rail workers strike, prices moved lower Thursday with the rail workers strike averted and renewed concerns of slowing economic growth. Prices moved slightly higher Friday following news of an Iraq oil spill hindering Iraqi oil exports. Though the IEA said gas-to-oil switching would increase over the near term, it also called for slowing oil demand due to faltering economic growth especially in China. The much worse-than-expected CPI release Tuesday also pressured oil prices, increasing expectations of a Fed-induced recession and by strengthening the U.S. dollar. Natural gas prices jumped 10% higher Wednesday, mainly as a byproduct of a possible rail workers strike but also on low-storage level concerns. Natural gas prices, however, fell sharply the remainder of the week finishing almost 3% lower after the rail workers strike was averted.

Gold prices moved lower last week hurt by increased expectations of continued aggressive Fed tightening following Tuesday’s much worse-than-expected CPI release. Rising 10-year real rates and a stronger U.S. dollar also pressured gold prices lower. Silver and platinum prices, on no real news, moved oppositely to gold prices, increasing 4.2% and 3.0%, respectively.

Base metal prices moved lower last week hurt by rising expectations of slowing global economic growth or recession precipitated by Tuesday’s much worse-than-expected U.S. CPI release. Continued Covid-related restrictions in China also contributed to lower prices. Nickel prices, however, moved higher once again benefiting from good demand and low inventory levels.

A mixed week for grain prices with corn prices finishing slightly lower and soybean prices slightly higher. Grain prices were pushed and pulled by competing forces: supported by U.S. corn-belt drought concerns along with falling inventory levels but pressured by slowing global economic growth/demand concerns.

Coming up this week

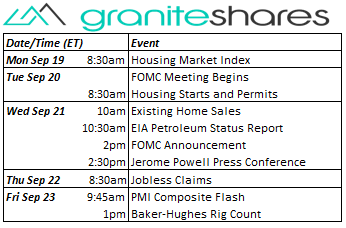

A data week stoked with housing data releases and charged with a 2-day FOMC meeting beginning Tuesday.

A data week stoked with housing data releases and charged with a 2-day FOMC meeting beginning Tuesday.- Housing Market Index on Monday.

- FOMC Meeting Begins and Housing Starts and Permits on Tuesday.

- Existing Home Sales, FOMC Announcement and Jerome Powell Press Conference on Wednesday.

- Jobless Claims on Thursday.

- PMI Composite Flash on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.