Commodities & Precious Metals Weekly Report: Sep 2

Posted:

Key points

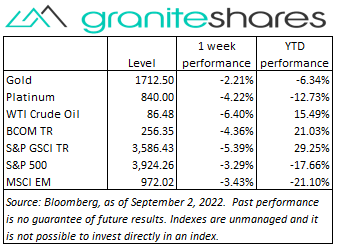

Energy prices were sharply lower last week. Crude oil prices were down 6%, gasoline prices 8% and heating oil prices 9%. Natural gas prices fell 5%.

Energy prices were sharply lower last week. Crude oil prices were down 6%, gasoline prices 8% and heating oil prices 9%. Natural gas prices fell 5%.- Grain prices were mixed. Chicago wheat prices were up 1% and corn prices were almost unchanged. Soybean prices fell 3%.

- Precious metal prices finished the week lower. Spot gold prices were down about 1.5%, spot silver prices 4.5% and spot platinum prices 2.5%.

- Base metal prices were sharply lower as well. Aluminum and copper prices fell 8% and nickel prices dropped 5%. Zinc prices fell 12%.

- The Bloomberg Commodity Index 4.4% with 60% of the decline coming from the energy sector and another 25% coming from the base metals sector. No sector had positive performance last week.

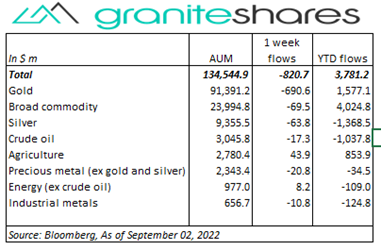

- $820 million outflows from commodity ETPs with most coming from gold (-$691m) ETP outflows. Small inflows into agriculture and energy (ex-crude oil) ETPs.

Commentary

Stock markets moved declined again last week, continuing their trend lower following Fed Chairman Jerome Powell’s Jackson Hole comments the previous Friday. Indications of a resilient economy, including a better-than-expected ISM Manufacturing PMI and lower-than-expected jobless claims, added to sentiment the Fed would likely continue its aggressive tightening policies. Friday’s Employment Report showing as-expected job gains but lower-than-expected wage increases and a higher-than-expected unemployment rate, initially moved stock prices higher on hopes the report would give the Fed room to be less aggressive. Those hopes faded throughout the day, however, with all 3 major stock market indexes finishing the day lower. The 10-year Treasury rate, reflecting higher-rate expectations, rose 16bps over the week with 10-year real rates rising 26bps and 10-year inflation expectations falling 10bps. The U.S. dollar, also reflecting higher-rate expectations, strengthened ¾ percent. For the week, the S&P 500 Index fell 3.3% to 3,924.26, the Nasdaq Composite Index dropped 4.2% to 11,630.86, the Dow Jones Industrial Average declined 3.0% to 31,318.84, the 10-year U.S. Treasury rate rose 16bps to 3.19% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.7%.

Stock markets moved declined again last week, continuing their trend lower following Fed Chairman Jerome Powell’s Jackson Hole comments the previous Friday. Indications of a resilient economy, including a better-than-expected ISM Manufacturing PMI and lower-than-expected jobless claims, added to sentiment the Fed would likely continue its aggressive tightening policies. Friday’s Employment Report showing as-expected job gains but lower-than-expected wage increases and a higher-than-expected unemployment rate, initially moved stock prices higher on hopes the report would give the Fed room to be less aggressive. Those hopes faded throughout the day, however, with all 3 major stock market indexes finishing the day lower. The 10-year Treasury rate, reflecting higher-rate expectations, rose 16bps over the week with 10-year real rates rising 26bps and 10-year inflation expectations falling 10bps. The U.S. dollar, also reflecting higher-rate expectations, strengthened ¾ percent. For the week, the S&P 500 Index fell 3.3% to 3,924.26, the Nasdaq Composite Index dropped 4.2% to 11,630.86, the Dow Jones Industrial Average declined 3.0% to 31,318.84, the 10-year U.S. Treasury rate rose 16bps to 3.19% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.7%.

Rising 4% Monday on increased expectations of OPEC+ production cutbacks, oil prices moved sharply lower through Thursday on growing demand concerns. Renewed Chinese Covid-related restrictions amidst falling Chinese factory activity, global recession concerns, reports of Venezuela working with Chevron to restart oil production and positive noise surrounding an Iran nuclear deal all combined to move oil prices markedly lower. Oil prices moved slightly higher Friday following a mixed U.S. employment report, renewed hopes of OPEC+ cutbacks and increased skepticism of an Iran deal.

Expectations of aggressive global central bank tightening spurred by decades high inflation in the U.S., the euro zone and the UK moved gold prices lower through Thursday last week. Thursday’s better-than-expected jobless claims added to gold price weakness coming in front of Friday’s employment report, lending increased support for a more aggressive Fed. Friday’s mixed employment report showing as-expected job gains but a higher unemployment rate and lower wage pressures, increased hopes for a less aggressive Fed, moving gold prices almost a percent higher. Spot gold prices finished the week about 1.5% lower. Silver prices fell over 4%, moving lower with base metal prices.

Base metal prices moved moved markedly lower last week weakened by contracting Chinese factory activity and fears of U.S., euro zone and UK recessions in the face of high levels of inflation and aggressive central bank tightening. Renewed Chinese Covid-related restrictions and only moderate Chinese stimulus added to downward price pressures. A stronger U.S. dollar contributed to weaker prices as well.

Grain prices were mostly flat to slightly higher. Upward price pressure caused by declining crop ratings and adverse weather conditions were offset by central bank-induced recession concerns and, for wheat, greater-than-expected shipments from Ukraine. Soybean prices ended the week about 3% lower, pressured by weak demand.

Coming up this week

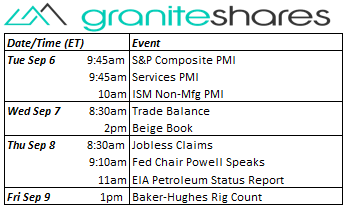

Holiday-shortened data week front loaded with services PMIs.

Holiday-shortened data week front loaded with services PMIs. - S&P Composite PMI, Services PMI and ISM Non-Mfg PMI on Tuesday.

- Trade Balance and Beige Book on Wednesday.

- Jobless Claims and Fed Chair Powell Speaks on Thursday.

- EIA Petroleum Status Report Thursday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.