Gold Market Sentiments for the Entire Year

Posted:Gold performance year to date

Gold is often though of as a hedge against inflation. With inflation reaching 40-year highs, some analysts may have expected gold to perform well. However, after a strong start of the year, mostly attributed to its role as safe-haven asset at the start of the Ukrainian war, the gold price retreated to its pre-covid 19 level. As of November 08, 2022, the price of gold is down 6.4% year to date (source Bloomberg).

Source: Bloomberg. XAU Curncy represents the gold price in USD

US price inflation and US dollar up

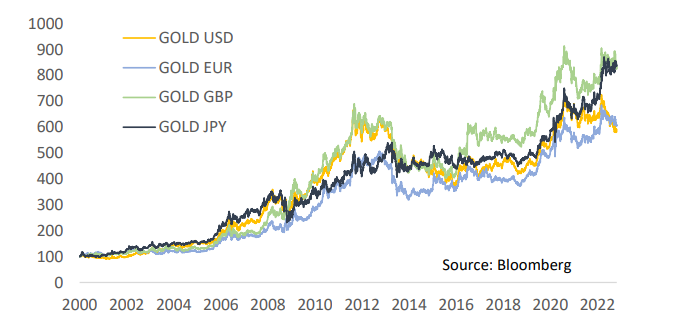

While inflation has surged in the US, the general sentiment is that G7 economies could significantly underperform the US resulting in the US dollar (USD) strongly outperforming most of the other G7 currencies. While inflation has eroded the purchasing power of the USD, the situation has been substantially worse for other currencies, in particular for the Euro (EUR), the British Pound (GBP) and Japanese Yen (JPY).

Source: Bloomberg. USDUPX is the Deutsche Bank US Dollar Long Future index which represent a long position in USD against a basket of other G7 currencies

Historically the gold price in dollars, has been negatively correlated to the USD. When the USD appreciates against other currencies, the gold price generally falls and vice versa. The strengthening of the USD through October of this year certainly helped push the USD gold price lower. This point can be illustrated by looking at the gold price expressed in other currencies which are at or close to their historical highest levels.

Would gold have been good diversifier in 2022?

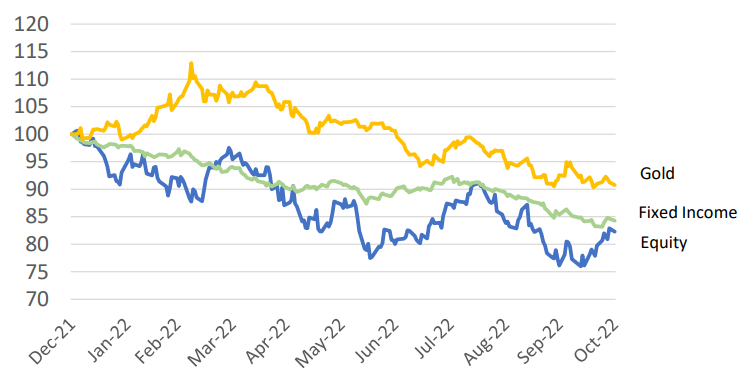

Despite negative performance year to date1, gold has outperformed both the equity2 and fixed income3 markets. The simultaneous drop in equity and fixed income markets, though unusual, occurred because both share a similar exposure to interest rate risk. On that basis adding gold to a portfolio would have had improved its performance and reduced its overall risk4.

Source: Bloomberg and GraniteShares. Equity is measured by the S&P 500 performance and fixed income is measured by the Bloomberg US aggregate bond index. All data are on a total return basis.

Too much interest rate risk in the system

Since 2008 the Federal Reserve has maintained an extremely accommodative monetary policy producing a low interest rate environment resulting in higher fixed income security prices. With interest rates near 0% - as was the case at the start of this year – the risk of falling fixed income securities prices was substantive. That is exactly what has happened so far this year as the Federal Reserve started to increase rates. The year-to-date performance of fixed income securities is its worst since 19315.

Similarly, the low interest rate environment produced elevated valuations of growth companies. Some of these companies tend to behave akin to zero-coupon bonds, with little or no net incomes, but only riskier as the terminal value is unknown and can fluctuate substantially. As a result, as interest rates have increased this year growth stocks have fallen sharply. As of November 04, 2022, several tech stocks saw their market capitalizations cut in half or worse since the beginning of the year6.

The combination of both the equity and fixed income markets performing poorly at the same time is a rare event. According to Bank of America, 2022 is the worst year for a 60/40 portfolio since 1927.

Is gold still relevant in the current environment?

Gold’s relevance in a portfolio remains dependent on one’s view about the US dollar, price inflation, and the US Federal Reserve policy.

US dollar outlook</strong

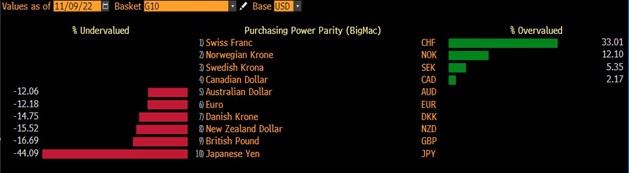

Based on the purchasing power parity, the USD seems overvalued against other currencies such as the EUR, GBP and JPY.

Source: Bloomberg

Although the outlook for the EU, UK and Japan economies is generally negative, there is an open question whether the USD value will continue to strengthen and, if so, at what pace.

A stronger USD has historically had negative impacts for equity, fixed income, and gold prices, but more so for gold prices. Hence if the USD slowed its pace of strengthening or even weakened, gold prices may stand to benefit.

Historical correlation between change in USD value and performance

|

|

Correlation7 |

|

US equity |

-0.179 |

|

US bond |

-0.145 |

|

Gold |

-0.305 |

How far will the US Federal Reserve go?

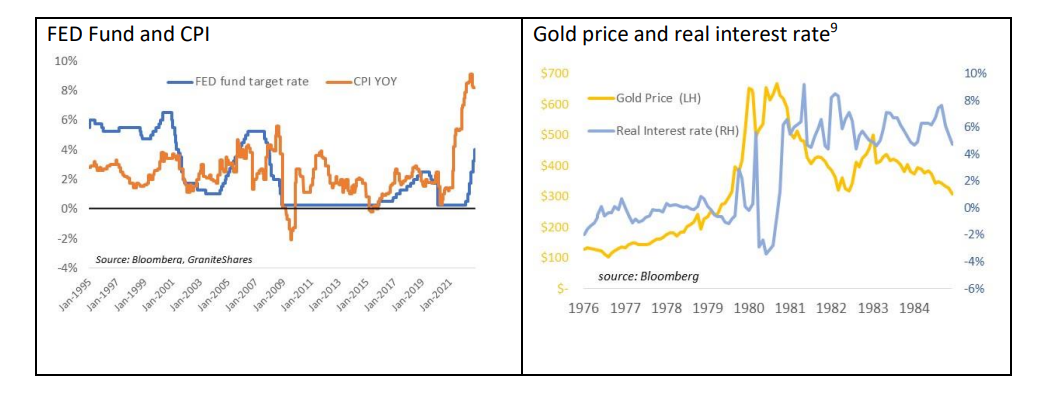

Although the US Federal Reserve has dramatically increased the Fed funds target rate and has been vocal about its commitment to fighting inflation, the real interest rate remains substantially negative8. The US central bank is in a difficult position not knowing the potential consequences on the economy and financial markets of its fight against inflation.

Looking back at the second half of 70s, though inflation was extremely high at that time, real interest rates were never as negative as they are now. During that period the gold price moved from $120 per ounce to

$600 per ounce.

With Paul Volcker as its chairman in 1979, the central bank adopted a significantly more hawkish position towards inflation pushing real interest rates above 8%. By the end of 1984, after the economic recession of 1981, real interest rates were still above 5% at which point the gold price was trading at $300 per ounce.

Based on the September 2022 CPI level of 8.2%, if the US Federal Reserve were to bring the real interest rate to the level of the early 80s that would imply a Fed fund rate ranging between 12% to 16% versus 4%

as of November 2022. That would likely be extremely detrimental to the equity and fixed income markets. It could also trigger a severe economic recession while substantially increasing the cost of servicing the federal debt. The potential combination of a reduction in tax revenues and an increase in interest payments would likely result in strong political pressures against the US central bank.

Source: Bloomberg

The next economic crisis

As the Fed increases rates and tightens financial conditions, the consequences of these actions are unknown. Market commentators speculate about whether it will lead to a crash or a “hard landing” where the economy is pushed into a deep recession. Those more optimistic speculate that it may result in a “soft landing” perhaps even avoiding recession altogether. Looking at data from the U.S. housing market, housing may already be in a recession and indeed, may be the catalyst that pushes the broader economy into recession just like it did in 1981 and 2008. Mortgage demand is the lowest it has been for 25 years according to the Mortgage Bankers Association. Homebuilder confidence has dropped for 10 consecutive months according to National Association of Homebuilders (NAHB). The number of buyers touring new single family homes has also dropped to the lowest level since 2012 according to NAHB. Whether the housing sector will trigger the next economic crisis remains to be seen but if we do end up in a deep recession, gold may perform in a similar way to how it did in 2008. In 2008, gold prices ended the year positive largely on the back of strong demand from investors worried about credit risk and a market collapse. While currencies and interest rates will always be important factors influencing the gold price, the fear of loss is perhaps a larger motivating factor of all and may help drive the gold price even against a backdrop of USD strength.

Diversification will always matter

While the gold price performance might have been disappointing so far in 2022, it occurred as the USD strongly appreciated, a factor that has historically been negative for the gold price. Nonetheless, it still managed to outperform the equity and fixed income markets which still face significant interest rate risk.

Looking at Q4 2022 and beyond, there is potential for the USD to appreciate at a slower pace against other major currencies. Meanwhile, it remains to be seen how committed the US Federal Reserve will be in its fight against inflation. It seems unlikely it will push real interest rates to the same levels as it did back in the early 1980s, especially if the consequences are severe recession or worse.

Under these assumptions gold could still act as an important efficient portfolio diversifier, potentially helping to improve risk adjusted performance.

Disclaimer

Opinions expressed are those of GraniteShares as of November 08, 2022, and are subject to change,

not guaranteed and should not be considered investment advice. Information and opinions are not

necessarily all-inclusive and are not guaranteed as to accuracy. To the extent any investment

information in this material is deemed to be a recommendation, it is not meant to be investment

advice. Diversification is a method used to manage risks; it cannot ensure a profit or protect against

loss in a declining market. Past performance is not a guarantee of future results.

Sources

- 1 As of November 04, 2022

- 2 As measured by the S&P 500 Index

- 3 As measured by the Bloomberg US aggregate bond index

- 4 Risk is measured by the standard deviation of the returns over the period considered

- 5 Source: New York University, Forbes

- 6 According to Bloomberg, Meta Platforms was down 73%, Netflix down 57%, PayPal down 60% and Zoom down 58%

- 7 Source: Bloomberg and GraniteShares. Period considered: November 2006 to November 2011. US Equity market as measured by the S&P 500 index. US Bond market as measured by the Bloomberg US aggregate bond index.

- 8 As of November 4, 2022, the real interest rate was -4.20%, as measured by the difference between the FED Fund rate and the CPI. Source: Bloomberg

- 9 Real interest rates measured by the difference between the Fed fund rates and the CPI. Source Bloomberg.