PLATINUM AN INVESTMENT CASE

Posted:

WHAT IS PLATINUM?

When most people think about “platinum”, it’s as a byword for exclusivity, style, and luxury.

Often, the rare precious metal that is the basis for the term is much less considered and not well understood.

So, what is platinum?

Platinum is one of the rarest metals found on our planet. It’s a hard, silvery metal discovered in 1735, thousands of years after gold due to its high melting point it is rarely found in its pure form.

Formed millions of years ago, platinum occurs at very low concentrations deep in the Earth’s crust and is about 30 times rarer than gold. It is interesting to note that all of the platinum ever mined would only come up to your ankles in an Olympic swimming pool, whereas all the gold produced would fill more than three.

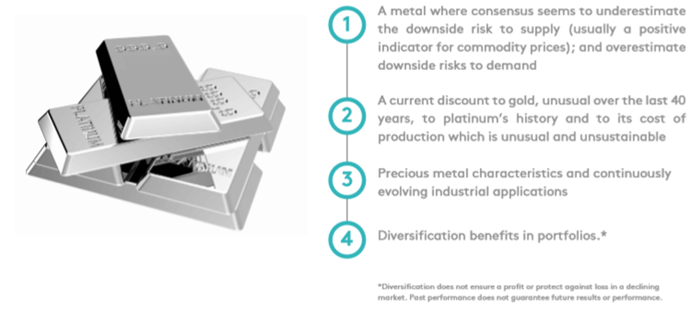

Platinum is a unique metal with potentially attractive supply and demand fundamentals and has exposure to both industrial and precious metal dynamics.

Platinum is special because of its physical properties, being ductile (easily drawn into wires), malleable (useful in jewelery making), rigid, dense, and very unreactive. Platinum is also prized for its catalytic properties; its ability to speed up a chemical reaction without itself being changed in the process.

Additionally, from an investment perspective, platinum has proven itself as a worthy diversifier in portfolios; increasing Sharpe ratios of a 60/40 equity/debt portfolio,including when gold is already present.

Its range of uses and applications are varied and extensive, yet unlike some other well- known metals like gold and silver, the investment case for platinum has not been aggressively made. The current price for platinum suggests that the metal’s attractive fundamentals may present a unique investment opportunity.

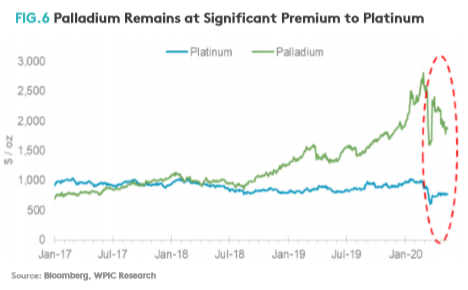

Additionally, we believe the risks of supply declines are underestimated and the downside risks to platinum demand are overestimated and therefore, we view platinum is undervalued against its past, its production cost, against gold and against palladium (a similar, but less effective metal).

Supply demand fundamentals are important

Conventional wisdom suggests the price of a commodity should reflect its supply demand fundamentals.

Platinum’s fundamentals are attractive, but as mentioned above, this does not seem to be reflected in the current price, presenting a unique opportunity. In 2018; supply is expected to decline, given the closure of some smaller South African platinum mines and jewelery recycling declining to a more ‘normal’ level. Automotive demand for platinum is expected to fall marginally, but 2018 is predicted to see the first increase in global jewelery demand for four years as demand from China stabilizes and India and China grow. Meanwhile, industrial demand is expected to grow strongly, after an unusually weak 2017.

PLATINUM SUPPLY

Where does platinum come from?

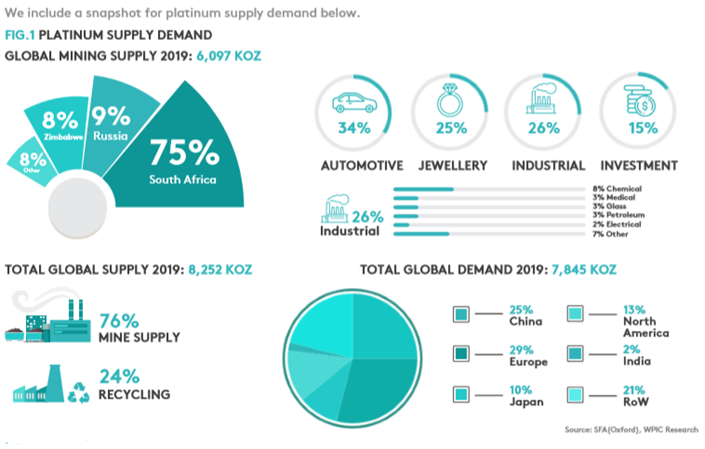

Platinum comes from two main sources; primary supply from mines and secondary supply from recycled products that contained platinum. The drivers of these two supply sources are quite different, and examined separately below.

Primary platinum supply – concentrated and challenged

Platinum mining isn’t simple as it is very rarely found in isolation. Instead it’s found alongside other metals, primarily palladium and rhodium (collectively referred to as Platinum Group Metals or PGMs), gold and base metals.

80% of the world’s economically viable platinum-bearing deposits are in South Africa.2 Platinum is extracted and purified through a complex series of physical and chemical processes. Mining is the most challenging and costly stage, as the mines are deep and the process is labor intensive with a high fixed cost base.

Platinum mine supply is affected by:

• Mine economics – the profitability of a platinum mine is driven by its production, commodity prices of the metals, the South African Rand (ZAR), and costs. In South African mining, unit costs have historically increased by at least 8-10% per year which means revenues need to increase similarly to maintain margins.3 Mine revenues have lagged in the past decade, leading miners to suffer a margin squeeze and cut capex significantly.

• Labor – South Africa’s mining labour force is highly unionized. Unions handle wage negotiations and protected strikes have become normal over the past 20 years during these processes. During a strike, mine production is stopped or reduced significantly. 2014 saw a protected strike which lasted an unprecedented five months, and significant production losses and led to financial stress for platinum miners. Safety is a key concern, and the government has authority to stop production at a mine they believe is unsafe.

• Regulatory / legal environment – In South Africa, mineral deposits are owned by the government and companies have mining rights allowing them to operate. The Mining Charter is the key set of mining rules in South Africa. A recent proposed rule change could lead to lower profitability, lower production and further job losses, though this is yet to be implemented.

The South African Rand (ZAR) and why it’s important

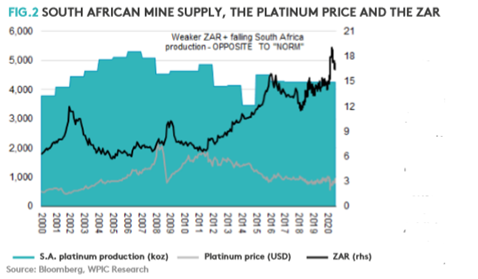

The ZAR is a key driver of mine economics mentioned above, given most platinum production takes place in South Africa, and at least 80% of a mines operating costs are locally denominated.

There is a perception that the ZAR should have a strong effect on the platinum price. This is expected because if the ZAR weakens, the platinum miners’ costs fall in US dollar terms so miners should be incentivized to produce more. This should weaken the supply/demand balance, and therefore the platinum price in US dollars should decrease. The market treats this as a reality, as the USD platinum price has historically fallen when the ZAR has weakened.

Platinum miners don’t have the luxury to opportunistically increase platinum production even in a weak ZAR environment. Figure 2 shows the South African platinum supply has fallen since 2011, despite a generally weaker ZAR. This is because of operational constraints, a limit to how much platinum raw material can be mined at one time, and geological constraints, including the inability to target areas of high platinum concentration. Additionally, on average only around 60% of a platinum mine’s revenue is from platinum versus other metals.

Secondary platinum supply – stable growth

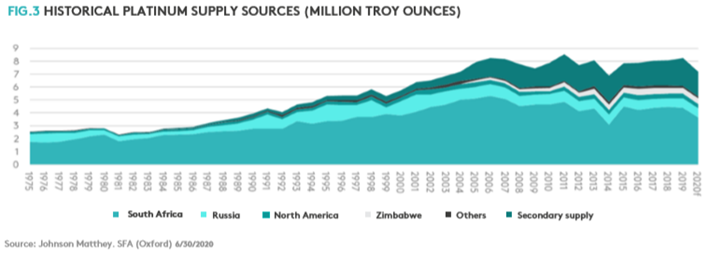

Platinum is highly recyclable and therefore when products containing platinum reach their end-of-life, the metal can be recycled and reused. Logically, secondary supply is essentially a function of historical platinum consumption as shown in Fig. 3 above.

The challenging mine economics outlined above and ongoing low capital expenditure has the potential to negatively impact mine supply in the future. South African mine supply is expected to fall in to 3.7 million troy ounces in 2020, from 5.3 million troy ounces in 2006.5 Secondary supply will likely increase, but not by enough to offset the mine declines.

PLATINUM DEMAND

What is platinum used for?

Platinum’s physical and catalytic properties mean it has a wide range of applications.

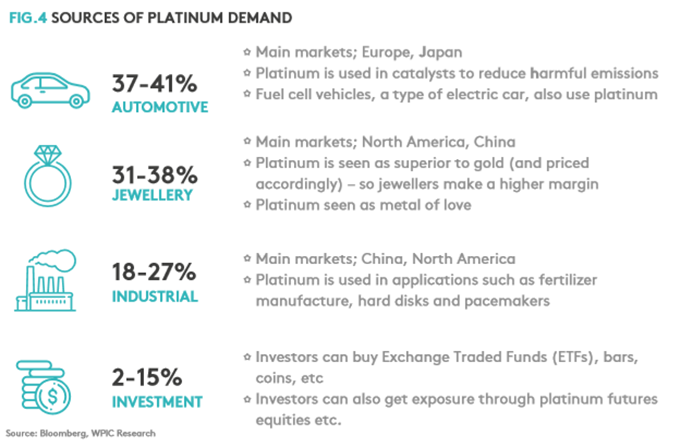

Currently, the automotive industry represents the highest end use for platinum followed by jewellery, other industrial applications, and physically backed investments. See Fig. 4.

Automotive demand – Platinum is used in vehicle after treatment systems to reduce harmful emissions. Given automotive is the largest source of end demand, perceptions of automotive trends may have a disproportionate effect on the perception of platinum’s fundamentals. Platinum demand from the automotive industry is determined by:

- Vehicle numbers - more vehicles mean more platinum demand

- Vehicle sizes - bigger vehicles have larger engines which need more platinum

- Mix of different types of vehicles - diesel vehicles use lots of platinum

- Technological changes – e.g. emissions legislation, in which countries apply successively more stringent regulation, requires more platinum for after treatment

Jewellery demand - Unlike gold, platinum use in jewellery is relatively recent. Nevertheless, platinum’s precious properties are similar to gold, it is considered “precious” depending given its rarity, its composition and its value. As such, the platinum jewellery market developed over the past few decades. Jewellery demand is driven by:

- Economic growth – more disposable income to spend on jewellery

- Social traditions – A large portion of platinum jewellery demand comes from the bridal market

- Advertising and promotion – Advertising can be very effective in stimulating platinum jewellery demand

- Price of platinum (especially relative to gold) – There should be a negative correlation between price and demand

- Industrial demand - platinum has a broad variety of applications in the industrial sector, even excluding automotive. Generally, there is a positive relationship between platinum industrial demand and global GDP. Industrial demand is broken into chemical, electrical, glass, medical and petroleum, with fuel cells becoming an interesting emerging use with significant potential, especially in passenger vehicles.

Are electric vehicles a significant threat to platinum demand?

Electric Vehicles

The move towards “Electric Vehicles” (EVs) is a development likely to continue to play out over the next few decades. Given the automotive industry is a large part of platinum demand, there is concern that this trend may pose a threat. This threat has yet to affect demand as traditional internal combustion engine cars are most prevalent, with EVs representing only 5% of new car purchases in Europe. In the US, low fuel prices and range concerns are expected to limit EV penetration, while EV adoption in China is expected to storm ahead (though the associated risk to platinum demand is low, given China automotive is only a modest consumer of platinum).

In fact, many vehicles which the market calls “electric” are hybrids of some form, which still contain a combustion engine, and therefore require platinum or other platinum group metals (PGMs) in the aftertreatment system. The only EV that doesn’t contain any PGMs is the Battery Electric Vehicle which requires significant infrastructure investment to gain the expected market share.

Additionally, the market seems to ignore the potential for Fuel Cell Electric Vehicles, which have the advantage of a longer range and quicker refuelling time than Battery Electric Vehicles (BEV). Fuel Cell Electric Vehicles require several times more platinum than a traditional car. Fuel Cell Electric Vehicles currently have a low market share (less than 1%). However, if that market share were to grow to a modest 6%; it would consume over 3.5 million troy ounces of platinum; this would be enough to replace all of the platinum currently used in autos (3.4 million troy ounces in 2017).

Is the decline of european diesel a significant threat to platinum demand?

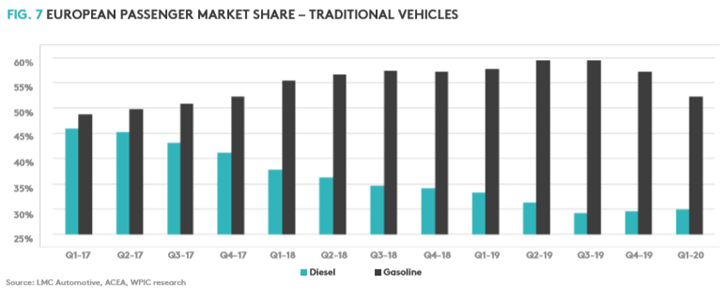

Post the VW scandal, diesel vehicles have suffered from higher scrutiny and general negative sentiment. As a result, European consumers are increasingly buying gasoline vehicles rather than diesel. This trend is often cited as the single biggest headwind to platinum demand. European diesel represents about 15% of total platinum demand.

Ironically, the switch from diesel to gasoline has been partly prompted by emissions concerns, but this dynamic creates its own new emissions problem.

Gasoline vehicles emit more CO2 than diesel. Importantly, European automakers face large fines if they do not meet fleet-wide CO2 reduction targets by 2021, but the switch from diesel to gasoline is causing CO2 emissions to increase; making these targets harder to reach. This issue can only be solved if automakers either sell a much higher percentage of BEVs, challenging given infrastructure needs; sell a much higher percentage of hybrids; or clean up diesel vehicles, actually requiring significantly more platinum. In the medium term it is possible that European diesel market share may be higher than currently expected.

Does platinum trade like an industrial metal or a precious metal?

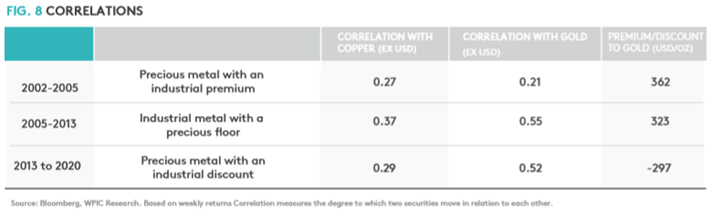

Platinum has characteristics similar to precious metals and many industrial varied end- uses too. Below are three simple metrics to show that platinum has traded in three distinct patterns over the past 15+ years:

•A precious metal with an industrial premium – correlation with gold, lower correlation with copper, increasing premium to gold (2002 – 2005)

•An industrial metal with a precious floor – correlation with gold, higher correlation with copper, premium to gold, and responsiveness to risk appetite (2005 – 2013)

•Currently, platinum seems to be trading like a precious metal with an industrial discount – given the higher correlation to gold, high and increasing discount to gold, subsiding correlation with copper (data from 2013 – 2020)

HOW TO INVEST IN PLATINUM

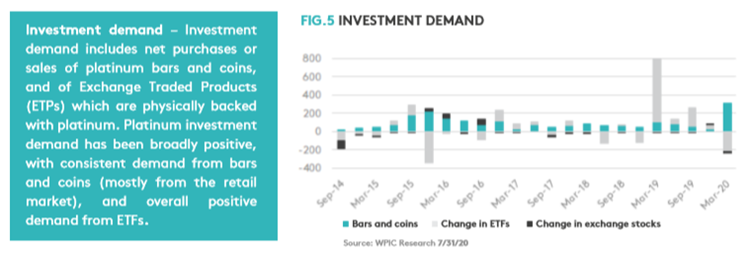

Financial exposure to platinum can be obtained through purchase of Platinum Exchange Traded Funds (ETFs) that are backed by physical platinum. A new share in a platinum ETF represents a purchase of physical platinum to be delivered into a vault. Physical platinum ETFs offer direct price exposure, and provide an avenue for resale given their exchange traded nature. ETFs do charge expenses or sponsor fee and typically, ownership of the ETF does not confer the right to take possession of the physical platinum. ETF holdings in platinum have been historically stable, despite price volatility.

PLATINUM - A UNIQUE METAL AND A UNIQUE OPPORTUNITY

In summary, platinum may offer interesting investment characteristics and a unique opportunity in this environment.

IMPORTANT INFORMATION AND RISKS

The GraniteShares Platinum Trust (PLTM) must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. To obtain a prospectus visit the link: https://graniteshares.com/media/gwrbh3ah/pltm-prospectus-20191029.pdf

Shares of the Trust are not insured by the Federal Deposit Insurance Corporation (“FDIC”), may lose value and have no bank guarantee. PLTM is not a mutual fund or any other type of Investment Company within the meaning of the Investment Company Act of 1940, as amended, and is not subject to regulation thereunder.

The Trust is not a commodity pool for purposes of the Commodity Exchange Act of 1936, as amended.

The Trust is recently formed and has a limited history of operations. There can be no assurances that its objective will be met.

Trust shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the platinum held by the Trust (less its expenses), and fluctuations in the price of platinum could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the platinum represented by them. Shares of the Trust are bought and sold at market price and not individually redeemed from the Trust. Brokerage commissions will reduce returns.

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

NAV: The dollar value of a single share, based on the value of the underlying assets of the Trust minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day.

Physical Replication: The Trust owns the underlying assets of the index whether they are stocks, bonds, or in this case, platinum bars. The objective of the Trust is for the value of the Shares to reflect, at any given time, the value of the assets owned by the Trust at that time less the Trust’s accrued expenses and liabilities as of that time. The Shares are intended to constitute a simple and cost-effective means of making an investment similar to an investment in platinum. An investment in allocated physical platinum bullion requires expensive and sometimes complicated arrangements in connection with the assay, transportation and warehousing of the metal. Traditionally, such expense and complications have resulted in investments in physical platinum bullion being efficient only in amounts beyond the reach of many investors. The Shares have been designed to remove the obstacles represented by the expense and complications involved in an investment in physical platinum bullion, while at the same time having an intrinsic value that reflects, at any given time, the price of the assets owned by the Trust at such time less the Trust expenses and liabilities. Although the Shares are not the exact equivalent of an investment in platinum, they provide investors with an alternative that allows a level of participation in the platinum market through the securities market.

The Sponsor of the Trust is GraniteShares LLC.

FORESIDE FUND SERVICES, LLC, PROVIDES MARKETING SERVICES TO THE TRUST. GRANITESHARES IS NOT AFFILIATED WITH FORESIDE FUND SERVICES, LLC.

PLTM RISKS

Investing in the shares involves significant risks, including possible loss of principal. You could lose money on an investment in the Trust.

Commodities generally are volatile and are not suitable for all investors. Trusts focusing on a single commodity generally experience greater volatility.

The value of the Shares relates directly to the value of the platinum held by the Trust and fluctuation in the price of platinum could materially adversely affect an investment in the Shares.

The price of platinum has fluctuated widely over the past several years. Several factors may affect the price of platinum, including: Global platinum supply, which is influenced by such factors as production and cost levels in major platinum producing countries such as South Africa. Recycling, autocatalyst demand, industrial demand, jewelry demand and investment demand are also important drivers of platinum supply and demand; Investors' expectation with respect to the rate of inflation; Currency exchange rate; Interest rates; Investment and trading activities of hedge funds and commodity funds; and Global or regional political, economic or financial events and situations.

In addition, investors should be aware that there is no assurance that platinum will maintain its long-term value in terms of purchasing power in the future. In the event that the price of platinum declines, the Sponsor expects the value of an investment in the Shares to decline proportionately.

The amount of platinum represented by each share will decrease over the life of the Trust due to the sales of platinum necessary to pay the Sponsor’s Fee and Trust expenses. Without increases in the price of platinum sufficient to compensate for that decrease, the price of the Shares will also decline and you will lose money on your investment in shares.

The Trust is a passive investment vehicle. The price received upon the sale of shares may be less than the value of the platinum represented by them.

The Trust is not a diversified investment, it may be more volatile than other investments.

The Trust may be forced to sell platinum earlier than anticipated if expenses are higher than expected.

Please refer to the prospectus for complete information regarding all risks associated with the Trust.

Platinum Benchmark - LBMA Platinum Price PM. ICE Benchmark Administration (IBA) is the administrator for the LBMA Platinum Price

2020 GraniteShares Inc. All rights

GraniteShares Trusts, and the GraniteShares logo are registered and unregistered trademarks of GraniteShares Inc., in the United States and elsewhere.

All other marks are the property of their respective owners.