Gold's Investment Case: New Record Highs

Posted:

The ongoing pandemic injected unparalleled uncertainty into the global economy, in a fashion that no model or market forecast could have possibly predicted. The impacts of the worldwide shutdown nearly defy human comprehension, marshalling unprecedented change into our economic outlook, our way of life, and importantly, our investments. With nearly 50 million Americans having applied for unemployment, hard assets, gold in particular, have enjoyed a resurgent enthusiasm as investors seek sources of potential stability amidst one of the most profound crises on record.

As the World’s Oldest Asset, gold may tackle some of the complex investment challenges with a simple, inexpensive solution. The GraniteShares Gold Trust BAR is one of the lowest cost means for physical gold investment (only a 0.1749% management fee) with each share backed by 1/100th an ounce of physical gold in a secure London domiciled vault. Before discussing the BAR product specifics, an understanding of gold’s role in an investment portfolio, during market conditions both fair and foul, may be essential. During the current market climate specifically, these three contentions encapsulate the case for gold:

- Potential Safe Haven Investment

- Significant Diversification Benefits

- Dollar Insecurity in the New Fed Paradigm

While these three arguments for long term gold investment are applicable throughout all stages of the market cycle, the COVID-19 pandemic has amplified their significance. Indeed, this global crisis has prompted a societal rethink on all matter of subjects, and yet the case for gold, though not without risk, may be the most ebullient in generations of market history. With a mindset backed in hard data, we will explore how the current economic uncertainty intersects with each of these three rationales for gold investment.

Potential Safe Haven and Asset Stability

Quite simply, there is a reason even after abandoning the gold standard global central banks continue to hold over 30,000 tons of gold in reserve—the precious metal has carried enduring value for millennia. Worth over $1.5 trillion, these gold holdings prove that gold’s legacy as a monetary metal continue into the present day, providing an asset that is scarce, highly liquid and uncorrelated to broader markets.

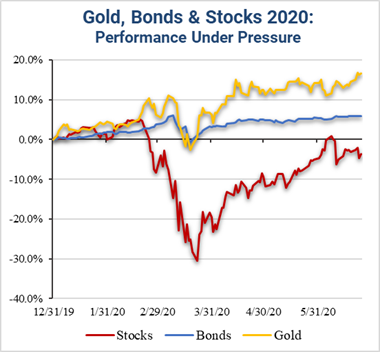

Notes: The performance of stocks is represented by the S&P 500 Index,

and the performance of bonds by the Bloomberg Aggregate Bond Index.

Total returns through 6/25/20. One cannot invest directly in an index. Past

performance is not a guarantee of future returns. Source: Bloomberg data.

Yet it is gold’s capacity as a potential safe-haven that often garners investor interest, as during periods of severe market stress, gold has historically benefited from “flight to quality” inflows. In other words, when going defensive, one may be hard pressed to beat the gold standard of gold itself. As can be seen in the chart above, gold has outperformed both stocks and bonds throughout the depths of the sell off on a year to date basis, and has continued to make new highs on the year.

Amid the 2008 financial crisis, gold was one of the few assets to end the year in positive territory, up 5.8% compared to the stock market’s -37% collapse. Gold’s security as an investment stems from its status as one of the few assets that is not someone else’s liability, and can never go bankrupt. Given that the COVID-19 pandemic has prompted an unprecedented wave of non-payment, default and bankruptcy, the benefits to holding real assets not subject to counterparty risk should not be undervalued. Yet importantly, this potential security has not come at the cost of long term performance, with gold having appreciated at a compounded rate of 8.3% annually from $35/oz. in 1971 to $1,765/oz. in 2020—a 50-fold increase in value.

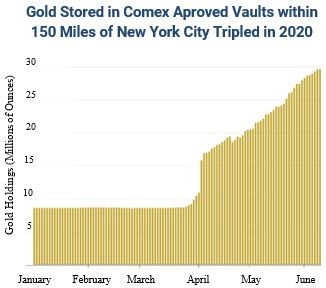

Amidst the age of Coronavirus, gold exemplified this historic safe-haven characteristic; not only is gold firmly in the green, but it has also been one of the best performing assets for the year (as of 6/30/20). With the physical economy shut down, assets in gold Exchange Traded Funds (ETFs) swelled to a record high of over $90 billion as investors fled from risk assets. Indeed, as depicted in the chart below, 20 million ounces of gold were flown into New York to accommodate the surge in gold trading demand, an episode financial history may soon recall as the “New York Airlift.” In essence, when a crisis unlike any other struck that questioned the value of paper assets, gold was one of the few investments that not only safeguarded wealth, but actually increased it.

Gold as a Portfolio Diversifier

Diversification may be one of the most important, but most frequently misunderstood concepts in finance, and is one of the most compelling arguments for gold investment. Perhaps the central idea behind diversification is that, since the future cannot be anticipated, much less controlled, including assets that respond differently to market shocks can help reduce overall portfolio volatility. In other words, layering many distinct bets into an investment portfolio may not only lessen the blow from any one bet failing, but the different bets may work to in part cancel out each other’s movements, producing a potentially smoother ride.

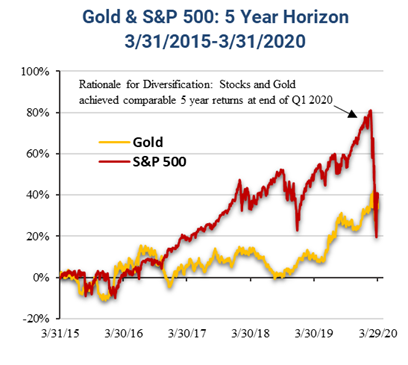

Source: Bloomberg Data. Notes: 5-Year gold total returns 33.4%, stocks 38.4%.

Source: Bloomberg Data. Notes: 5-Year gold total returns 33.4%, stocks 38.4%.

The real challenge with diversification, however, is that almost everything in finance is influenced by other factors; investments that are truly independent are a scarcity. In the COVID-19 market crash of February and March, stocks, bonds, real estate, credit, utilities, emerging market, private equity—it did not matter—all these separate asset classes sold off together in the massive flight to safety.

Yet gold is different, and the data substantiate this point. The chart above depicts the performance of the S&P 500 and gold over a 5-year period ending Q1 2020, near the stock market bottom. The key point is not that gold achieved a similar return to stocks over this specific period (33.4% vs 38.5%), but to show the potential folly of betting on one type of asset. Blending different types of risks is one of the best strategies for managing overall risk— diversification is a classic case of the whole is more than the sum of its parts.

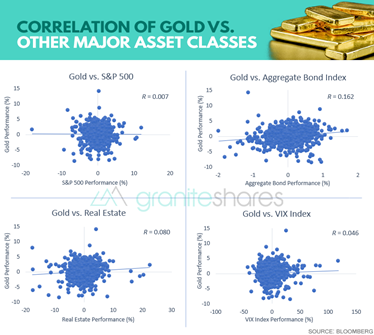

Mathematically, gold is predictably unpredictable, and it is precisely this characteristic that renders gold a prime candidate for diversification. Even if an investor were to know precisely, with cold certainty, what the stock market were to do over the next month, year or decade, she would still have zero information to predict gold’s movement. As the matrix of charts illustrate above, gold is uncorrelated against many other major assets and risk factors, achieving zero or near zero correlation over a 15-year time horizon (2004 through 2019). By maintaining low correlations to stocks, bonds and real estate, the value of gold rests not in being a better investment, but merely a different investment.

Common questions on diversification consist of, how much of a diversifying asset such as gold is appropriate in a portfolio, and what are the potential gains from optimal diversification in dollar terms? Moreover, diversification is often perceived as a defensive strategy, when its benefits extend through the market cycle as a balanced approach to risk.

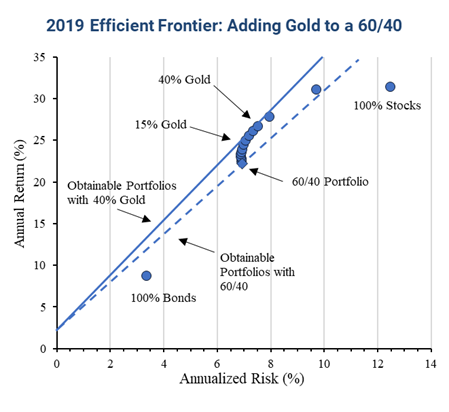

Notes: Time period under analysis is 12/31/2018 to 12/31/2019. Performance of stocks is represented by the S&P 500 Index, and 60/40 is allocated between 60% of the former and 40% of the Bloomberg Aggregate Bond Index. Real Estate is represented by the Down Jones REIT Index. Past performance is not guarantee of future returns. Source: Bloomberg data and GraniteShares Research.

The year 2019 is a prime example for how diversification with gold can enhance investment results even in buoyant markets, indeed one of the best years for both stocks and bonds on record. The diagram above depicts how strategically blending assets in 2019 improved even on the time-tested model of the 60/40 portfolio, replacing the fixed income allocation with gold in graduated amounts. The chart depicts mean annualized returns on the vertical axis against portfolio volatility (standard deviation of returns) on the horizontal axis; consequently points towards the upper left corner are the most attractive and towards the lower right the least. Significantly, the blue line shows the range of attainable efficient portfolios from combining the 3-month treasury with the optimal stock/bond/gold mix the line intersects (solid blue is gold-backed 60/40, dashed blue is its traditional counterpart).

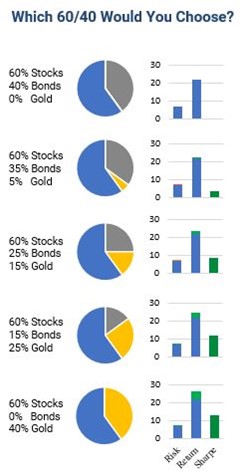

A couple of conclusions are immediately recognizable; the benefits to adding gold to a 60/40 portfolio at the expense of fixed income exposure were noticeable with allocations as small as 1% gold. As tabulated in the chart below, each successive addition of gold to the portfolio bolstered not only total returns, but impressively, risk-adjusted returns.

Notes: Comparison of various 60/40 portfolio frameworks in 2019. Sharpe Gains indicates percentage improvement over the conventional 60/40’s Sharpe ratio of 2.94. Source: Bloomberg data, GraniteShares Research.

Strikingly, the optimized level of gold in the portfolio occurred not at 5% or even 10% of assets, but at a walloping 40% of portfolio assets. Such is the diversifying potential of gold that even in sharply upward markets, a 40% allocation to gold added 4.5% additional return for less than 0.6% more risk over the base 60/40 model. Significantly, even more modest gold holdings captured significant portions of the optimal gains. For instance, a 25% gold allocation still achieved 89% of the optimized risk enhancement effect, and a 20% allocation 75% of the efficiency improvements.

|

Model Portfolio |

Risk (%) |

Return (%) |

Sharpe Ratio |

|

60/40 |

6.94 |

22.18 |

2.94 |

|

Gold 2.5% |

6.91 |

22.46 |

2.99 |

|

Gold 5% |

6.90 |

22.75 |

3.04 |

|

Gold 10% |

6.89 |

23.31 |

3.12 |

|

Gold 15% |

6.92 |

23.88 |

3.19 |

|

Gold 20% |

6.98 |

24.45 |

3.25 |

|

Gold 25% |

7.07 |

25.01 |

3.29 |

|

Gold 30% |

7.19 |

25.57 |

3.31 |

|

Gold 35% |

7.34 |

26.14 |

3.32 |

|

Gold 40% |

7.52 |

26.70 |

3.32 |

Notes: Tabulated statistical data for model portfolios in 2019. Risk indicates annualized standard deviation of daily returns. Source: Bloomberg data, GraniteShares Research.

These data are not intended to dictate personal investment solutions—portfolio models ultimately must be adapted to the interests of end human investors. What this experiment does illustrate, however is the power of adding non-correlating assets as a complement to conventional portfolio models. Most importantly, this model demonstrates the potential for diversifying with gold across a range of market conditions, from the most favorable on record in 2019, to the most disruptive in 2020.

Dollar Insecurity & New Fed Paradigm

The previous sections illustrate two classical arguments for gold throughout the market cycle, namely serving as a potential safe-haven asset and as a potent diversifier of market risk. Gold’s ability to act as a hedge against a falling dollar, however, is a third and perhaps the most immediately resonating rationale for gold ownership as the Federal Reserve enters a new paradigm in managing the dollar. Quite simply, the principal economic response by the U.S. Government to thwart a COVID-19 depression has been massive currency debasement—the largest money printing event in history to be precise.

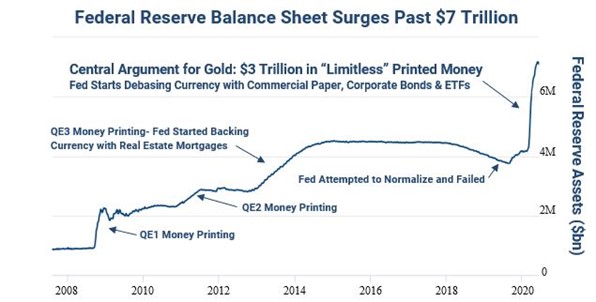

Source: U.S. Federal Reserve

While many are familiar with $2 trillion CARES Act, which provided for stimulus checks and expanded unemployment benefits, fewer are aware of the colossal, and more concerning actions by the Federal Reserve. As the figure below depicts, since the outbreak of COVID-19, the Fed has expanded its balance sheet by over $3 trillion—simply paper money injected into circulation, as if by magic. Nobel Laureate economist Milton Friedman famously described this type of action as “helicopter money,” as it is economically equivalent to helicopters swarming the land, throwing freshly printed dollars from the sky.

When Fed Chair Jerome Powell announced his “limitless” expansion of the money supply on March 23rd, 2020, the concept of the dollar as we once knew it effectively ended. These actions may directly threaten the dollar’s status as the global reserve currency, as the assets that back these $3 trillion in printed money include mortgages, commercial paper, risky corporate debt and even ETFs. It therefore may be unwise to rely exclusively on the dollar to act as a store of value, given that the Fed has made a firm and likely irreversible departure from the past 50 years of monetary history.

Source: U.S. Federal Reserve

Source: U.S. Federal Reserve

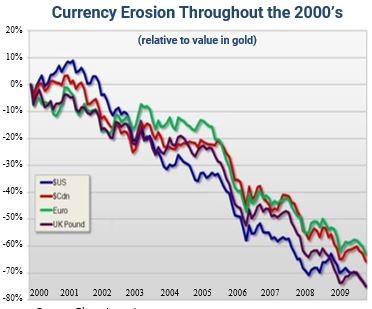

The immutable reality is that all currencies have suffered extreme depreciation over the past century as fiat money is subject to continual inflation through money printing, as observed in the first chart above. Indeed, paper currency has lost substantially all of its value over time. If a 100-year time horizon seems abstract, even over the short run span of a decade (second chart) fiat currency suffered severe losses as inflation eroded currency's purchasing power; the dollar witnessed a 73% loss of value.

In the new Fed paradigm, the playbook is systematic currency debasement to paper over the immense, staggering losses in the real economy. This dual effort of swelling both the federal debt and the Fed balance sheet through money printing explicitly undermine the credibility of the dollar, an assumption that can no longer be held outright.

Historically, gold has rallied in the face of unsound monetary policy, such as easing interest rates, emergency rate cuts or yield curve inversions. In fact, gold appreciated on average 14.9%, 26.1%, and 53.4% over a 24-months span after each of these events, respectively, ever since gold became a free- floating asset. The current situation however, dwarfs these conventional signs of monetary irresponsibility, as the Fed is now backing the dollar with assets with substantial risk of default—a scenario completely without precedent. Indeed, the only analogous event was the start of quantitative easing in response to the financial crisis, after which gold surged 83.5% over 36 months subsequent to this first action. Given that the current Fed balance sheet expansion is 2.3 times larger than this initial precedent, gold may serve a paramount role in the new Fed paradigm.

New Standard for the Gold Standard

Gold’s unique status as an asset that combines characteristics of a commodity and a currency lend it potentially unique value as the global economy attempts a reset from the COVID-19 tumult. Not only has gold acted as a historic store of value during times of crisis, but it can offer potent diversification benefits and potentially hedge against a falling dollar. Significantly, while these arguments have traditionally augured the investment case for gold, the COVID-19 pandemic magnified their significance.

A global rethink is underway, in our civil societies, our economy, our investments and even our conception of money itself. The GraniteShares Gold Trust BAR is a physically-backed, low cost gold ETF carrying sponsor fee of only 0.1749—the list of physical gold holdings is published daily with each gold bar identified by serial number. With the London domiciled vault inspected twice annually, once at random, BAR offers an innovative, low-cost means of physical gold access via a brokerage account and can be traded intra-day like an ordinary stock. As the world’s oldest asset, gold may tackle complex problems with a simple, inexpensive solution.

Important Information and Risks

Investing involves risk including the possible loss of principal.

The GraniteShares Gold Trust (BAR) must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. To obtain a prospectus visit the links: Prospectus-GraniteShares-Gold-Trust.pdf

The Sponsor of the Trust is GraniteShares LLC. Foreside Fund Services, LLC, provides marketing services to the Trust. Trust shares of BAR trade like stocks, are subject to investment risk and will fluctuate in market value. The value of Trust shares relates directly to the value of the gold held by the Trust (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. Shares of the Trust are bought and sold at market price. Brokerage commissions will reduce returns.

Past performance does not guarantee future returns. One cannot invest directly in an index.

Exclusion or inclusion of asset in a model analysis is not a recommendation or solicitation to buy, hold or sell any security. Diversification does not guarantee a profit nor protect against loss in a declining market.

Sharpe Ratio: A measure used to evaluate risk-adjusted returns that calculates the average return in excess of the risk free rate per unit of risk, measured in terms of portfolio standard deviation. All else equal, a higher Sharpe ratio indicates a more efficient use of risk in generating returns.