Researches By Pltm

The U.S. equity market has been kind to investors over the past two years, especially those who have been overweight to tech, growth and large caps. After weathering the most aggressive Fed rate hiking cycle in history, inflation has mostly normalized, and the economy has remained resilient throughout. It seemed unlikely early on, but the Fed may have actually pulled off the soft landing after all!

The GraniteShares 2025 Market Preview

02 January, 2025 | GraniteShares

The U.S. equity market has been kind to investors over the past two years, especially those who have been overweight to tech, growth and large caps. After weathering the most aggressive Fed rate hiking cycle in history, inflation has mostly normalized, and the economy has remained resilient throughout. It seemed unlikely early on, but the Fed may have actually pulled off the soft landing after all!

Platinum is one of the rarest metals found on our planet. It’s a hard, silvery metal discovered in 1735, thousands of years after gold due to its high melting point it is rarely found in its pure form.Formed millions of years ago, platinum occurs at very low concentrations deep in the Earth’s crust and is about 30 times rarer than gold. It is interesting to note that all of the platinum ever mined would only come up to your ankles in an Olympic swimming pool, whereas all the gold produced would fill more than three.

Topic: Commodities

Publication Type: Investment Cases

PLATINUM AN INVESTMENT CASE

16 September, 2020 | GraniteShares

Platinum is one of the rarest metals found on our planet. It’s a hard, silvery metal discovered in 1735, thousands of years after gold due to its high melting point it is rarely found in its pure form.Formed millions of years ago, platinum occurs at very low concentrations deep in the Earth’s crust and is about 30 times rarer than gold. It is interesting to note that all of the platinum ever mined would only come up to your ankles in an Olympic swimming pool, whereas all the gold produced would fill more than three.

A somewhat choppy week for U.S. stock markets with the S&P 500 Index striving for but not reaching record highs on Wednesday. Despite stronger-than-expected U.S. economic reports (including lower-than-expected weekly jobless claims, strong retail sales and industrial production reports) and a falling number of new Covid-19 cases and deaths, U.S. stock markets struggled to move higher last week. Concerns surrounding the legality of President Trump’s executive orders combined with still-stalled congressional coronavirus-related stimulus negotiations and, perhaps, higher-than-expected PPI, CPI and wage inflation numbers may have limited stock market gains. The 10-year U.S. Treasury rate moved higher all through the week, reacting to corporate and government supply pressures, higher-than-expected inflation numbers and strong U.S. economic reports. At week’s end the S&P 500 Index increased 0.6% to 3,372.85, the Nasdaq Composite index increased 0.1% to 11,019.30, the 10-year U.S. interest rate increased 14 bps to 71 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.4%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 14

17 August, 2020 | Jeff Klearman

A somewhat choppy week for U.S. stock markets with the S&P 500 Index striving for but not reaching record highs on Wednesday. Despite stronger-than-expected U.S. economic reports (including lower-than-expected weekly jobless claims, strong retail sales and industrial production reports) and a falling number of new Covid-19 cases and deaths, U.S. stock markets struggled to move higher last week. Concerns surrounding the legality of President Trump’s executive orders combined with still-stalled congressional coronavirus-related stimulus negotiations and, perhaps, higher-than-expected PPI, CPI and wage inflation numbers may have limited stock market gains. The 10-year U.S. Treasury rate moved higher all through the week, reacting to corporate and government supply pressures, higher-than-expected inflation numbers and strong U.S. economic reports. At week’s end the S&P 500 Index increased 0.6% to 3,372.85, the Nasdaq Composite index increased 0.1% to 11,019.30, the 10-year U.S. interest rate increased 14 bps to 71 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.4%.

Against a backdrop of better-than-expected economic reports and earning results and indications new Covid-19 cases may be falling, U.S. stock markets all moved higher again last week despite concerns over increased U.S.-China frictions and stalled congressional progess on additional coronavirus relief funds. Better-than-expected factory orders and ISM manufacturing and non-manufacturing index numbers combined with lower-than-expected weekly jobless claims and a stronger-than-expected payroll report helped move U.S. equity markets higher. Earning results reported last week were predominantly positive also helping move equity markets higher. Early-in-the-week optimism that congress would reach agreement on additional coronavirus-related relief funds faded as the week ended with no progress, but was slightly ameliorated with the Trump administration announcing the President may take executive action to extend existing programs. Both the U.S. dollar and the 10-year U.S. Treasury rate moved off their lows reached earlier in the week on stronger-than-expected economic reports and signs the number of new Covid-19 cases may be decreasing. At week’s end the S&P 500 Index and Nasdaq Composite index each increased 2.5% to 3,351.28 and 11,010.98, respectively. the 10-year U.S. interest rate increased 4 bps to 57 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) was unchanged.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 07

10 August, 2020 | Jeff Klearman

Against a backdrop of better-than-expected economic reports and earning results and indications new Covid-19 cases may be falling, U.S. stock markets all moved higher again last week despite concerns over increased U.S.-China frictions and stalled congressional progess on additional coronavirus relief funds. Better-than-expected factory orders and ISM manufacturing and non-manufacturing index numbers combined with lower-than-expected weekly jobless claims and a stronger-than-expected payroll report helped move U.S. equity markets higher. Earning results reported last week were predominantly positive also helping move equity markets higher. Early-in-the-week optimism that congress would reach agreement on additional coronavirus-related relief funds faded as the week ended with no progress, but was slightly ameliorated with the Trump administration announcing the President may take executive action to extend existing programs. Both the U.S. dollar and the 10-year U.S. Treasury rate moved off their lows reached earlier in the week on stronger-than-expected economic reports and signs the number of new Covid-19 cases may be decreasing. At week’s end the S&P 500 Index and Nasdaq Composite index each increased 2.5% to 3,351.28 and 11,010.98, respectively. the 10-year U.S. interest rate increased 4 bps to 57 bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) was unchanged.

All three major U.S. stock indexes ended higher (moving in a zig-zag fashion), the U.S. dollar continued to weaken and the 10-year U.S Treasury rate fell last week as investors digested earnings and economic reports, FOMC statements, growing Covid-19 cases and congressional stimulus bill progress. Earnings reports, though generally mixed, provided strong support for U.S. stock markets with four major technology companies reporting better-than-expected results after the market on Thursday. Apple results were particularly strong, pushing the share price of Apple over 10% higher on Friday and raising its market capitalization to over $1.8 trillion. Comments by Fed Chairman Jerome Powell following the end of a 2-day FOMC meeting on Wednesday reaffirmed the Fed’s commitment to maintain aggressive monetary policy to support maximum employment and price stability. Chairman Powell also said the U.S. economy faces a long road to recovery, that the virus will determine the path of that recovery and emphasized the importance of fiscal policy to support the economy. Economic reports last week were also mixed with pending home sales, consumer spending and durable goods orders reports all better-than-expected while weekly jobless claims were slightly higher than expected. The first estimate of 2nd quarter GDP, released Thursday, posted its all-time greatest quarterly contraction of 32.7%, though this was slightly better than expectations. Markets also focused on Friday’s expiration of supplemental unemployment benefits and congressional negotiations to extend them and implement a phase 4 coronavirus stimulus package. At week’s end the S&P 500 Index increased 1.7% to 3,271.12, the Nasdaq Composite Index rose 3.7% to 10,745.27, the 10-year U.S. interest rate fell 6 bps to 53bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened another 1.2%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 31

03 August, 2020 | Jeff Klearman

All three major U.S. stock indexes ended higher (moving in a zig-zag fashion), the U.S. dollar continued to weaken and the 10-year U.S Treasury rate fell last week as investors digested earnings and economic reports, FOMC statements, growing Covid-19 cases and congressional stimulus bill progress. Earnings reports, though generally mixed, provided strong support for U.S. stock markets with four major technology companies reporting better-than-expected results after the market on Thursday. Apple results were particularly strong, pushing the share price of Apple over 10% higher on Friday and raising its market capitalization to over $1.8 trillion. Comments by Fed Chairman Jerome Powell following the end of a 2-day FOMC meeting on Wednesday reaffirmed the Fed’s commitment to maintain aggressive monetary policy to support maximum employment and price stability. Chairman Powell also said the U.S. economy faces a long road to recovery, that the virus will determine the path of that recovery and emphasized the importance of fiscal policy to support the economy. Economic reports last week were also mixed with pending home sales, consumer spending and durable goods orders reports all better-than-expected while weekly jobless claims were slightly higher than expected. The first estimate of 2nd quarter GDP, released Thursday, posted its all-time greatest quarterly contraction of 32.7%, though this was slightly better than expectations. Markets also focused on Friday’s expiration of supplemental unemployment benefits and congressional negotiations to extend them and implement a phase 4 coronavirus stimulus package. At week’s end the S&P 500 Index increased 1.7% to 3,271.12, the Nasdaq Composite Index rose 3.7% to 10,745.27, the 10-year U.S. interest rate fell 6 bps to 53bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened another 1.2%.

Riding on the previous week’s momentum, U.S. stock markets moved higher on Monday with the Nasdaq Composite Index reaching another record high. Increased investor optimism spurred by the EU’s passage of an $860 billion coronavirus recovery fund, increased hopes of a phase 4 U.S. coronavirus stimulus package and positive developments regarding a Covid-19 vaccine helped move the S&P 500 Index higher through Wednesday. Despite a strong Microsoft earnings report after the close on Wednesday, both the S&P 500 and the Nasdaq Composite Index moved lower on Thursday with the Nasdaq Composite Index falling over 2%. A larger-than-hoped-for jobless claims number, new U.S-China frictions resulting in the closing of the China consulate in Houston, rising Covid-19 cases and the rotation out of tech into cyclical stocks all contributed to Thursday’s as well as Friday’s U.S. stock market declines. The U.S. dollar (as measured by the U.S. Dollar Index – DXY) weakened significantly over the week, pressured lower by increased concerns over the growing number of U.S. Covid-19 cases, uncertainty regarding a phase 4 coronavirus stimulus package and expectations EU GDP growth will significantly outpace U.S. GDP growth over the next year. At week’s end the S&P 500 Index decreased 0.3% to 3,215.63, the Nasdaq Composite Index fell 1.3% to 10,363.18, the 10-year U.S. interest rate fell 4 bps to 59bps and the U.S. dollar (as measured by the U.S. Dollar index - DXY) weakened 1.7%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 24

27 July, 2020 | Jeff Klearman

Riding on the previous week’s momentum, U.S. stock markets moved higher on Monday with the Nasdaq Composite Index reaching another record high. Increased investor optimism spurred by the EU’s passage of an $860 billion coronavirus recovery fund, increased hopes of a phase 4 U.S. coronavirus stimulus package and positive developments regarding a Covid-19 vaccine helped move the S&P 500 Index higher through Wednesday. Despite a strong Microsoft earnings report after the close on Wednesday, both the S&P 500 and the Nasdaq Composite Index moved lower on Thursday with the Nasdaq Composite Index falling over 2%. A larger-than-hoped-for jobless claims number, new U.S-China frictions resulting in the closing of the China consulate in Houston, rising Covid-19 cases and the rotation out of tech into cyclical stocks all contributed to Thursday’s as well as Friday’s U.S. stock market declines. The U.S. dollar (as measured by the U.S. Dollar Index – DXY) weakened significantly over the week, pressured lower by increased concerns over the growing number of U.S. Covid-19 cases, uncertainty regarding a phase 4 coronavirus stimulus package and expectations EU GDP growth will significantly outpace U.S. GDP growth over the next year. At week’s end the S&P 500 Index decreased 0.3% to 3,215.63, the Nasdaq Composite Index fell 1.3% to 10,363.18, the 10-year U.S. interest rate fell 4 bps to 59bps and the U.S. dollar (as measured by the U.S. Dollar index - DXY) weakened 1.7%.

U.S. stock markets continued to struggle with concerns over increasing U.S. Covid-19 cases versus strong economic reports and hopeful news regarding development of a Covid-19 vaccine. Covid-19 concerns - sharpened by Carlifornia reopening rollbacks - and anxiety surrounding earnings reports for major bank and tech stocks pushed U.S. stock markets lower on Monday, with the Nasdaq Compositie Index significantly underperforming the S&P 500 Index. Those losses were more than reversed on Tuesday and Wednesday after better-than-expected earnings releases from JPMorgan, Goldman Sachs and Morgan Stanley, positive Covid-19 vaccine news from 3 pharmaceutical/biotech companies, higher-than-expected CPI and stronger-than-expected industrial production reports. A much-larger-than expected increase in retail sales on Thursday was offset by continued high jobless claims with U.S. Stock markets mainly unchanged the remainder of the week. At week’s end the S&P 500 Index increased 1.3% to close at 3,224.73, the Nasdaq Composite Index fell 1.1% to 10,503.19, the 10-year U.S. interest rate fell 1 bp to 63bps and the U.S. dollar (as

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 17

20 July, 2020 | Jeff Klearman

U.S. stock markets continued to struggle with concerns over increasing U.S. Covid-19 cases versus strong economic reports and hopeful news regarding development of a Covid-19 vaccine. Covid-19 concerns - sharpened by Carlifornia reopening rollbacks - and anxiety surrounding earnings reports for major bank and tech stocks pushed U.S. stock markets lower on Monday, with the Nasdaq Compositie Index significantly underperforming the S&P 500 Index. Those losses were more than reversed on Tuesday and Wednesday after better-than-expected earnings releases from JPMorgan, Goldman Sachs and Morgan Stanley, positive Covid-19 vaccine news from 3 pharmaceutical/biotech companies, higher-than-expected CPI and stronger-than-expected industrial production reports. A much-larger-than expected increase in retail sales on Thursday was offset by continued high jobless claims with U.S. Stock markets mainly unchanged the remainder of the week. At week’s end the S&P 500 Index increased 1.3% to close at 3,224.73, the Nasdaq Composite Index fell 1.1% to 10,503.19, the 10-year U.S. interest rate fell 1 bp to 63bps and the U.S. dollar (as

A see-saw week for U.S. stock markets as investors struggled with optimism over economic recovery versus growing concerns over increasing Covid-19 cases. Coming off the July 4th holiday week, a surging Chinese stock market and stronger-than-expected PMI and ISM services index numbers, the S&P 500 Index increased 1.6% on Monday only to see most of those gains reversed on Tuesday after the Trump administration called for a much-smaller-than-talked-about additional stimulus package and U.S. Federal Reserve officials voiced concerns that a resurgence of coronavirus cases could derail economic recovery. The S&P 500 Index rose about 0.6% on Wednesday on no real news only to see those gains more than reversed on a larger-than-expected jobless claims report and continued concerns surrounding increasing Covid-19 cases. Data suggesting Gilead’s remdesivir may help reduce Covid-19 mortalities helped move the S&P 500 Index over 1% higher on Friday. At week’s end the S&P 500 Index increased 1.8% to close at 3,184.04, the Nasdaq Composite Index rose 4.0% to 10,617.44, the 10-year U.S. interest rate fell 3 bps to 64bps and the U.S. dollar (as measured by the U.S. Dollar index – DXY) weakened 0.7%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 10

13 July, 2020 | Jeff Klearman

A see-saw week for U.S. stock markets as investors struggled with optimism over economic recovery versus growing concerns over increasing Covid-19 cases. Coming off the July 4th holiday week, a surging Chinese stock market and stronger-than-expected PMI and ISM services index numbers, the S&P 500 Index increased 1.6% on Monday only to see most of those gains reversed on Tuesday after the Trump administration called for a much-smaller-than-talked-about additional stimulus package and U.S. Federal Reserve officials voiced concerns that a resurgence of coronavirus cases could derail economic recovery. The S&P 500 Index rose about 0.6% on Wednesday on no real news only to see those gains more than reversed on a larger-than-expected jobless claims report and continued concerns surrounding increasing Covid-19 cases. Data suggesting Gilead’s remdesivir may help reduce Covid-19 mortalities helped move the S&P 500 Index over 1% higher on Friday. At week’s end the S&P 500 Index increased 1.8% to close at 3,184.04, the Nasdaq Composite Index rose 4.0% to 10,617.44, the 10-year U.S. interest rate fell 3 bps to 64bps and the U.S. dollar (as measured by the U.S. Dollar index – DXY) weakened 0.7%.

Monday’s and Tuesday’s much-stronger-than-expected pending home sales and consumer confidence numbers combined with Boeing’s successful 737 Max test flight propelled the S&P 500 and the Nasdaq Composite Index to their best quartly performance since 1998 and 2001, respectively. Better-than-expected PMI and ISM manufacturing index releases on Wednesday and a much-stronger than-expected payroll report on Thursday pushed U.S. stock markets higher the remainder of the holiday-shortened week, though gains were muted because of growing concerns surrounding increasing COVID-19 cases. At week’s end the S&P 500 Index increased 4.0% to 3,130.01, the Nasdaq Composite Index increased 4.6% to 10,207.63, the 10-year U.S. Treasury rate increased 2bps to 0.67% and the U.S. dollar (as measured by the DXY Index) weakened 0.4%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 2

06 July, 2020 | Jeff Klearman

Monday’s and Tuesday’s much-stronger-than-expected pending home sales and consumer confidence numbers combined with Boeing’s successful 737 Max test flight propelled the S&P 500 and the Nasdaq Composite Index to their best quartly performance since 1998 and 2001, respectively. Better-than-expected PMI and ISM manufacturing index releases on Wednesday and a much-stronger than-expected payroll report on Thursday pushed U.S. stock markets higher the remainder of the holiday-shortened week, though gains were muted because of growing concerns surrounding increasing COVID-19 cases. At week’s end the S&P 500 Index increased 4.0% to 3,130.01, the Nasdaq Composite Index increased 4.6% to 10,207.63, the 10-year U.S. Treasury rate increased 2bps to 0.67% and the U.S. dollar (as measured by the DXY Index) weakened 0.4%.

Better-than-expected economic reports and continued optimism regarding a V-shaped economic recovery pushed S&P 500 Index 1.1% higher through Tuesday and helped the Nasdaq Composite Index reach new record closing levels. Reports of increasing Covid-19 cases, Trump administration threats of EU import tariffs and the IMF’s updated and significantly lower global economic growth forecast calling for a contraction of nearly 5% caught the market’s attention on Wednesday pushing the S&P 500 Index down 2.6%. Though a portion of those losses were reversed on Thursday as banks stocks rallied on news bank regulators would be relaxing certain capital restrictions, record daily increases in Covid-19 cases and reports that Florida and Texas would be rolling back some easing measures on Friday increased concerns regarding the strength and speed of the recovery of US and global economies pushing the S&P 500 Index down another 2.4%. At week’s end the S&P 500 Index fell 2.9% to 3,009.05, the 10-year U.S. Treasury rate decreased 5bps to 0.65% and the U.S. dollar (as measured by the DXY Index) weakened slightly, falling 0.1%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 26

29 June, 2020 | Jeff Klearman

Better-than-expected economic reports and continued optimism regarding a V-shaped economic recovery pushed S&P 500 Index 1.1% higher through Tuesday and helped the Nasdaq Composite Index reach new record closing levels. Reports of increasing Covid-19 cases, Trump administration threats of EU import tariffs and the IMF’s updated and significantly lower global economic growth forecast calling for a contraction of nearly 5% caught the market’s attention on Wednesday pushing the S&P 500 Index down 2.6%. Though a portion of those losses were reversed on Thursday as banks stocks rallied on news bank regulators would be relaxing certain capital restrictions, record daily increases in Covid-19 cases and reports that Florida and Texas would be rolling back some easing measures on Friday increased concerns regarding the strength and speed of the recovery of US and global economies pushing the S&P 500 Index down another 2.4%. At week’s end the S&P 500 Index fell 2.9% to 3,009.05, the 10-year U.S. Treasury rate decreased 5bps to 0.65% and the U.S. dollar (as measured by the DXY Index) weakened slightly, falling 0.1%.

Garnering support from the U.S. Federal Reserve Bank’s widening of its corporate buyback program to include individual bonds and much-stronger-than-expected retail sales and and industrial production reports, the S&P 500 increased almost 3% through Tuesday. Fed Chairman Jerome Powell’s testimony in front of the Senate and House on Tuesday and Wednesday imploring congress to continue its fiscal stimulus efforts as well as increased fears of a coronavirus second wave (exacerbated by the W.H.O’s proclamation that the coronavirus has entered a new and dangerous phase) pushed the S&P 500 lower the remainder of week. At week’s end the S&P 500 Index increased 1.9% to 3,097.74, the 10-year U.S. Treasury rate was unchanged at 0.70% and the U.S. dollar (as measured by the DXY Index) strengthened 0.3%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 19

22 June, 2020 | Jeff Klearman

Garnering support from the U.S. Federal Reserve Bank’s widening of its corporate buyback program to include individual bonds and much-stronger-than-expected retail sales and and industrial production reports, the S&P 500 increased almost 3% through Tuesday. Fed Chairman Jerome Powell’s testimony in front of the Senate and House on Tuesday and Wednesday imploring congress to continue its fiscal stimulus efforts as well as increased fears of a coronavirus second wave (exacerbated by the W.H.O’s proclamation that the coronavirus has entered a new and dangerous phase) pushed the S&P 500 lower the remainder of week. At week’s end the S&P 500 Index increased 1.9% to 3,097.74, the 10-year U.S. Treasury rate was unchanged at 0.70% and the U.S. dollar (as measured by the DXY Index) strengthened 0.3%.

Momentum from the previous Friday’s much-stronger-than-expected employment report pushed the S&P 500 Index 1.2% higher on Monday and into the black for the year and moved the Nasdaq Composite Index to a record high. Anxiety surrounding the 2-Day FOMC meeting moved U.S. stock markets lower on Tuesday and Fed Chairman Powell’s comments on Wednesday – voicing deep uncertainty about the strength and timing of the recovery of the U.S. economy – pushed the S&P 500 Index off its Monday’s highs to unchanged for the week. U.S. stock markets plummeted Thursday on continued follow through from Powell’s comments as well as increased concerns of a coronavirus second wave only to see some of those losses recouped on Friday on no real news. 10-year Treasury rates steadily moved lower last week, fading with increased concerns of the timing and strength of economic recovery in the U.S. At week’s end the S&P 500 Index fell 4.8% to 3,041.31, the 10-year U.S. Treasury rate decreased 20bps to 0.70% and the U.S. dollar (as measured by the DXY Index) strengthened 0.2%

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 12

15 June, 2020 | Jeff Klearman

Momentum from the previous Friday’s much-stronger-than-expected employment report pushed the S&P 500 Index 1.2% higher on Monday and into the black for the year and moved the Nasdaq Composite Index to a record high. Anxiety surrounding the 2-Day FOMC meeting moved U.S. stock markets lower on Tuesday and Fed Chairman Powell’s comments on Wednesday – voicing deep uncertainty about the strength and timing of the recovery of the U.S. economy – pushed the S&P 500 Index off its Monday’s highs to unchanged for the week. U.S. stock markets plummeted Thursday on continued follow through from Powell’s comments as well as increased concerns of a coronavirus second wave only to see some of those losses recouped on Friday on no real news. 10-year Treasury rates steadily moved lower last week, fading with increased concerns of the timing and strength of economic recovery in the U.S. At week’s end the S&P 500 Index fell 4.8% to 3,041.31, the 10-year U.S. Treasury rate decreased 20bps to 0.70% and the U.S. dollar (as measured by the DXY Index) strengthened 0.2%

Overcoming concerns brought about by violent protests, fears of a second coronovirus wave and increasing U.S.-China tensions, U.S. stock markets marched higher last week, only pausing momentarily on Thursday, supported by growing optimism of a faster-than-expected economic recovery due to easing lockdown restrictions at home and abroad. An unexpected 2.5 million increase in non-farm payrolls (expectations were for a loss of about 8 million jobs) was the proverbial icing on the cake, pushing U.S. stock markets 2%-3% higher on Friday. Throughout the week the 10-year U.S. Treasury rate climbed higher as well, moving with increasing expectations of stronger, faster U.S. economic growth while the U.S. dollar weakened significantly mainly as result of lessening coronavirus concerns decreasing demand for U.S. dollars. At week’s end the S&P 500 Index increased 4.9% to 3,193.93, the 10-year U.S. Treasury rate rose 24bps to 0.90% and the U.S. dollar (as measured by the DXY Index) weakened 1.4%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 5

08 June, 2020 | Jeff Klearman

Overcoming concerns brought about by violent protests, fears of a second coronovirus wave and increasing U.S.-China tensions, U.S. stock markets marched higher last week, only pausing momentarily on Thursday, supported by growing optimism of a faster-than-expected economic recovery due to easing lockdown restrictions at home and abroad. An unexpected 2.5 million increase in non-farm payrolls (expectations were for a loss of about 8 million jobs) was the proverbial icing on the cake, pushing U.S. stock markets 2%-3% higher on Friday. Throughout the week the 10-year U.S. Treasury rate climbed higher as well, moving with increasing expectations of stronger, faster U.S. economic growth while the U.S. dollar weakened significantly mainly as result of lessening coronavirus concerns decreasing demand for U.S. dollars. At week’s end the S&P 500 Index increased 4.9% to 3,193.93, the 10-year U.S. Treasury rate rose 24bps to 0.90% and the U.S. dollar (as measured by the DXY Index) weakened 1.4%.

Buoyed by increasing hopes regarding a coronavirus vaccine and increasing expectations of economic recovery spurred by easing lockdown restrictions, the S&P 500 Index increased 2.7% through Wednesday. Concerns surrounding U.S.-China tensions, inflamed by China’s Hong Kong security restrictions, pushed the S&P 500 Index off Wednesday’s high on Thursday only to see those losses recouped on Friday after President Trump’s announcement of measures against China were less harsh and encompassing than originally feared. Markets all but ignored weak economic reports last week, including an almost 14% decline in consumer spending reported Friday, with investors focusing instead on increased hopes and expectations of economic recovery. Jerome Powell, speaking Friday, said the fundamentals of the U.S. economy remain strong but with the coronavirus posing risks to growth and said the U.S. Federal Reserve Bank continues to use its tools to support the economy. At week’s end the S&P 500 Index increased 3.0% to 3,044.31, the 10-year U.S. Treasury rate was unchanged at 0.66% and the U.S. dollar (as measured by the DXY Index) weakened 1.6%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: May 29

01 June, 2020 | Jeff Klearman

Buoyed by increasing hopes regarding a coronavirus vaccine and increasing expectations of economic recovery spurred by easing lockdown restrictions, the S&P 500 Index increased 2.7% through Wednesday. Concerns surrounding U.S.-China tensions, inflamed by China’s Hong Kong security restrictions, pushed the S&P 500 Index off Wednesday’s high on Thursday only to see those losses recouped on Friday after President Trump’s announcement of measures against China were less harsh and encompassing than originally feared. Markets all but ignored weak economic reports last week, including an almost 14% decline in consumer spending reported Friday, with investors focusing instead on increased hopes and expectations of economic recovery. Jerome Powell, speaking Friday, said the fundamentals of the U.S. economy remain strong but with the coronavirus posing risks to growth and said the U.S. Federal Reserve Bank continues to use its tools to support the economy. At week’s end the S&P 500 Index increased 3.0% to 3,044.31, the 10-year U.S. Treasury rate was unchanged at 0.66% and the U.S. dollar (as measured by the DXY Index) weakened 1.6%.

Up over 3% Monday on positive news regarding Moderna’s development of a coronavirus vaccine, the S&P 500 Index zigzagged the rest of the week finishing very close to Monday’s level. Initial optimism over Moderna’s progress was partially offset by doubts and questions over the value of the initial results on Tuesday, pushing the S&P 500 Index about 1% lower on the day. Continued easing of restrictions throughout the U.S. with increasing expectations of stronger economic growth moved the S&P 500 Index higher by almost 2% on Wednesday only to see some of those gains reversed on Thursday with the weekly jobless claims report showing initial claims of 2.4 million. The S&P 500 Index closed the week up 3.2% at 2,955.46, the 10-year U.S. Treasury rate rose 1bp to 0.66% and the U.S. dollar (as measured by the DXY Index) gave up last weeks gains, weakening 0.6%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: May 22

26 May, 2020 | Jeff Klearman

Up over 3% Monday on positive news regarding Moderna’s development of a coronavirus vaccine, the S&P 500 Index zigzagged the rest of the week finishing very close to Monday’s level. Initial optimism over Moderna’s progress was partially offset by doubts and questions over the value of the initial results on Tuesday, pushing the S&P 500 Index about 1% lower on the day. Continued easing of restrictions throughout the U.S. with increasing expectations of stronger economic growth moved the S&P 500 Index higher by almost 2% on Wednesday only to see some of those gains reversed on Thursday with the weekly jobless claims report showing initial claims of 2.4 million. The S&P 500 Index closed the week up 3.2% at 2,955.46, the 10-year U.S. Treasury rate rose 1bp to 0.66% and the U.S. dollar (as measured by the DXY Index) gave up last weeks gains, weakening 0.6%.

Continued concerns of U.S. economic growth negatively affected by lower global growth and statements of some Federal Reserve Bank officials indicating it’s too soon to consider lowering rates, limited U.S. stock market gains and helped push commodity markets lower through Wednesday last week

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Mar 29

28 March, 2020 | Jeff Klearman

Continued concerns of U.S. economic growth negatively affected by lower global growth and statements of some Federal Reserve Bank officials indicating it’s too soon to consider lowering rates, limited U.S. stock market gains and helped push commodity markets lower through Wednesday last week

Positive economic reports from both the U.S. and China combined with increased optimism over a U.S.-China trade agreement pushed U.S stock and commodity markets higher last week.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities and Precious Metals Update (Week Ending Apr. 5)

28 March, 2020 | GraniteShares

Positive economic reports from both the U.S. and China combined with increased optimism over a U.S.-China trade agreement pushed U.S stock and commodity markets higher last week.

Initially falling early in the week on the IMF’s reduced global and U.S. economic growth forecast for 2019, commodity and U.S. stocks markets finished the week higher after strong U.S. bank earnings and Chinese trade and lending reports on Friday.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Apr 12

28 March, 2020 | Jeff Klearman

Initially falling early in the week on the IMF’s reduced global and U.S. economic growth forecast for 2019, commodity and U.S. stocks markets finished the week higher after strong U.S. bank earnings and Chinese trade and lending reports on Friday.

A holiday-shortened trading week and mixed U.S. and weak German economic reports left U.S. stock markets unchanged and commodity markets lower despite continued U.S-China trade agreement optimism and stronger-than-expected Chinese GDP growth and industrial production numbers released on Tuesday.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Apr 19

28 March, 2020 | Jeff Klearman

A holiday-shortened trading week and mixed U.S. and weak German economic reports left U.S. stock markets unchanged and commodity markets lower despite continued U.S-China trade agreement optimism and stronger-than-expected Chinese GDP growth and industrial production numbers released on Tuesday.

Thirty times rarer than gold, platinum occurs at very low concentrations in the Earth’s crust. There are only four countries in the world that have platinum mining operations of any significance and of these South Africa has the largest platinum resources by far.

Topic: Commodities

Publication Type: Investment Cases

Where Does Platinum Come From?

28 March, 2020 | GraniteShares

Thirty times rarer than gold, platinum occurs at very low concentrations in the Earth’s crust. There are only four countries in the world that have platinum mining operations of any significance and of these South Africa has the largest platinum resources by far.

espite the previous week’s strong GDP report and Friday’s strong payroll report, concerns of stubbornly low price and wage inflation combined with concerns of sluggish consumer spending and business investment led the FOMC to keep the Fed Funds target rate unchanged while indicating there is no strong reason to adjust rates either way.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities and Precious Metals Update (Week Ending May 3)

27 March, 2020 | Jeff Klearman

espite the previous week’s strong GDP report and Friday’s strong payroll report, concerns of stubbornly low price and wage inflation combined with concerns of sluggish consumer spending and business investment led the FOMC to keep the Fed Funds target rate unchanged while indicating there is no strong reason to adjust rates either way.

Recent changes to the Chinese government’s New Energy Vehicle program have shifted the focus away from the subsidies awarded to battery electric vehicles towards FCEV roll-out and, importantly, the development of the country’s hydrogen refueling infrastructure.

Topic: Commodities

Publication Type: Investment Cases

Fuel Cell Electric Vehicles in China

27 March, 2020 | GraniteShares

Recent changes to the Chinese government’s New Energy Vehicle program have shifted the focus away from the subsidies awarded to battery electric vehicles towards FCEV roll-out and, importantly, the development of the country’s hydrogen refueling infrastructure.

Volatile week spurred by renewed U.S.-China trade tensions and escalating U.S. – Iran frictions. President Trump’s start-of-the-week tweet threatening more and increased tariffs on Chinese goods increased global growth concerns pushing U.S. stock markets and U.S. Treasury yields lower and the U.S. dollar higher.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities and Precious Metals Update (Week Ending May 10)

27 March, 2020 | Jeff Klearman

Volatile week spurred by renewed U.S.-China trade tensions and escalating U.S. – Iran frictions. President Trump’s start-of-the-week tweet threatening more and increased tariffs on Chinese goods increased global growth concerns pushing U.S. stock markets and U.S. Treasury yields lower and the U.S. dollar higher.

It is the wedding band on your ring finger. It is with you every time you’re travelling by car, three grams at least. This is the story of platinum, a metal that follows us and underlies our lives in subtle, yet profound ways.

Topic: Commodities

Publication Type: Investment Cases

You May Know Gold, but Do You Know Platinum?

27 March, 2020 | GraniteShares

It is the wedding band on your ring finger. It is with you every time you’re travelling by car, three grams at least. This is the story of platinum, a metal that follows us and underlies our lives in subtle, yet profound ways.

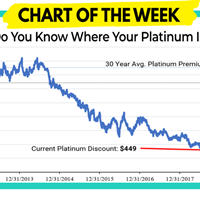

Historically, platinum has been known as the “Rich Man’s Gold,” trading at an average premium to gold of $132 over the last 30 years. Will the current $449 discount to gold ever revert to the long-term average?

Topic: Commodities

Publication Type: Investment Cases

Do You Know Where Your Platinum Is? – Chart of the Week

27 March, 2020 | GraniteShares

Historically, platinum has been known as the “Rich Man’s Gold,” trading at an average premium to gold of $132 over the last 30 years. Will the current $449 discount to gold ever revert to the long-term average?

The S&P 500 index, down 2.4% on Monday on renewed U.S-China trade tensions, regained most of its losses through Friday as off-again-on-again optimism of U.S.-China trade progress along with President Trump’s delay of EU and Japan auto tariffs moved the S&P 500 of its lows.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities and Precious Metals Update (Week Ending May 17)

27 March, 2020 | Jeff Klearman

The S&P 500 index, down 2.4% on Monday on renewed U.S-China trade tensions, regained most of its losses through Friday as off-again-on-again optimism of U.S.-China trade progress along with President Trump’s delay of EU and Japan auto tariffs moved the S&P 500 of its lows.

Increased concerns over U.S.-China trade frictions and weaker-than-expected EU, U.S. and Chinese economic reports pushed commodity and U.S. stock markets lower last week.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities and Precious Metals Update (Week ending May 24)

27 March, 2020 | Jeff Klearman

Increased concerns over U.S.-China trade frictions and weaker-than-expected EU, U.S. and Chinese economic reports pushed commodity and U.S. stock markets lower last week.

Continued concerns of weaker global and U.S. growth, driven by U.S-China trade frictions and economic reports pointing to slowdowns in the EU, China and the U.S, helped push commodity and stock markets lower last week.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities and Precious Metals Update (Week ending May 31)

27 March, 2020 | Jeff Klearman

Continued concerns of weaker global and U.S. growth, driven by U.S-China trade frictions and economic reports pointing to slowdowns in the EU, China and the U.S, helped push commodity and stock markets lower last week.

Continued concerns of weaker global and U.S. growth, driven by U.S-China trade frictions and economic reports pointing to slowdowns in the EU, China and the U.S, helped push commodity and stock markets lower last week.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 7

27 March, 2020 | Jeff Klearman

Continued concerns of weaker global and U.S. growth, driven by U.S-China trade frictions and economic reports pointing to slowdowns in the EU, China and the U.S, helped push commodity and stock markets lower last week.

il tanker attacks attributed to Iran by both the U.S. and Britain, better-than-expected U.S and weaker than expected China economic rerpots combined to push the U.S. dollar higher and leave both 10-year U.S. Treasury rates and the S&P 500 index practically unchanged from the previous week.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 14

27 March, 2020 | Jeff Klearman

il tanker attacks attributed to Iran by both the U.S. and Britain, better-than-expected U.S and weaker than expected China economic rerpots combined to push the U.S. dollar higher and leave both 10-year U.S. Treasury rates and the S&P 500 index practically unchanged from the previous week.

The Platinum Group Metals (PGMs) – platinum, palladium, rhodium, ruthenium, iridium and osmium – are a family of six individual elements that are chemically, physically and anatomically similar. They have unique properties and are used in many industrial processes – making, for example, auto-components, electronics, fertilizer and glass – as well as in medical treatments.

Topic: Commodities

Publication Type: Investment Cases

Platinum Metals: A Lightbulb Moment

27 March, 2020 | GraniteShares

The Platinum Group Metals (PGMs) – platinum, palladium, rhodium, ruthenium, iridium and osmium – are a family of six individual elements that are chemically, physically and anatomically similar. They have unique properties and are used in many industrial processes – making, for example, auto-components, electronics, fertilizer and glass – as well as in medical treatments.

Despite ECB statements indicating more stimulus would be needed and greatly increased tensions between the U.S. and Iran precipitated by Iran’s shooting down of a U.S. drone on Thursday, the U.S. dollar sharply weakened following U.S. Federal Reserve Bank Chairman Jerome Powell’s comments – at the end of the 2-day FOMC meeting – that the Fed would act as needed to sustain economic growth.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 21

27 March, 2020 | Jeff Klearman

Despite ECB statements indicating more stimulus would be needed and greatly increased tensions between the U.S. and Iran precipitated by Iran’s shooting down of a U.S. drone on Thursday, the U.S. dollar sharply weakened following U.S. Federal Reserve Bank Chairman Jerome Powell’s comments – at the end of the 2-day FOMC meeting – that the Fed would act as needed to sustain economic growth.

Comments from U.S Federal Reserve Bank officials, including Fed Chairman Jerome Powell, lowered expectations of of two rate cuts this year, pushing U.S stock markets slightly lower while leaving the U.S. dollar practically unchanged.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jun 28

27 March, 2020 | Jeff Klearman

Comments from U.S Federal Reserve Bank officials, including Fed Chairman Jerome Powell, lowered expectations of of two rate cuts this year, pushing U.S stock markets slightly lower while leaving the U.S. dollar practically unchanged.

Increased optimism on Monday resulting from a reported U.S.-China trade truce following the G-20 conference followed by a stronger-than-expected employment report on Friday moved U.S. stock markets higher, strengthened the U.S. dollar and increased the 10-year U.S. Treasury rate.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 5

27 March, 2020 | Jeff Klearman

Increased optimism on Monday resulting from a reported U.S.-China trade truce following the G-20 conference followed by a stronger-than-expected employment report on Friday moved U.S. stock markets higher, strengthened the U.S. dollar and increased the 10-year U.S. Treasury rate.

Increased optimism on Monday resulting from a reported U.S.-China trade truce following the G-20 conference followed by a stronger-than-expected employment report on Friday moved U.S. stock markets higher, strengthened the U.S. dollar and increased the 10-year U.S. Treasury rate.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 12

27 March, 2020 | Jeff Klearman

Increased optimism on Monday resulting from a reported U.S.-China trade truce following the G-20 conference followed by a stronger-than-expected employment report on Friday moved U.S. stock markets higher, strengthened the U.S. dollar and increased the 10-year U.S. Treasury rate.

Despite much-better-than-expected retail sales numbers on Monday, concerns of weak growth in the EU and China helped pushed commodity and U.S. Stock markets lower last week.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Jul 19

27 March, 2020 | Jeff Klearman

Despite much-better-than-expected retail sales numbers on Monday, concerns of weak growth in the EU and China helped pushed commodity and U.S. Stock markets lower last week.

Key points

Except for natural gas, energy component futures prices were all higher last week. WTI and Brent crude oil prices increased 0.8% and 1.5% respectively. Gasoil and gasoline prices increased 1.4% and 1.5%, respectively, and heating oil prices gained 0.9%. Natural gas prices fell 3.5%

Grain prices were all lower last week. Chicago and Kansas wheat prices decreased 1.3% and 1.8%, respectively, and soybean and corn prices fell 2.0% and 3.8%, respectively.

Base metal prices, except for zinc prices, all fell last week. Nickel prices decreased 4.2%, copper prices decreased 2.5%, and aluminum prices decreased 2.6%. Zinc prices increased 0.6%.

Silver and platinum prices moved higher last week while gold prices fell. Silver and platinum prices both rose 1.3% while gold prices fell 1.3%.

The S&P GSCI outperformed the Bloomberg Commodity Index last week with the S&P GSCI increasing 0.23% versus the Bloomberg Commodity Index decreasing 0.76%. The S&P GSCI’s larger exposure to energy but smaller exposure to natural gas, grains and base metals was the primary reason for its underperformance.

Total assets in commodity ETPs decreased $157.0m last week. Broad commodity (-$397.8m), crude oil (-$38.3m) and agriculture (-$15.7m) ETP outflows were offset partially by gold ($128.0m) and silver ($174.4m) ETP inflows.

Commentary

Friday’s stronger-than-expected first estimate of Q2 GDP helped reduce concerns of a weaker U.S. economy brought about by a much-weaker-than-expected existing home sales number and a slew of other slightly-less-than-expected economic numbers released earlier in the week. Strong Indications the ECB is ready and willing to reduce rates and restart its bond buying program helped increased expectations of stronger EU and global economic growth as did reports U.S. and China trade talks would resume this coming week. At week’s end the U.S. dollar strengthened 0.9%, 10-year U.S. Treasury rates increased 2bp to 2.07% and the S&P 500 index increased 1.7%.

Up 1.8% through Tuesday, oil prices moved higher spurred by concerns over Iran’s seizure of a British oil tanker the previous week and expectations of a large drawdown in U.S. oil inventories. Wednesday’s EIA inventory report showing a large drawdown (as expected) was dismissed as a one-time “Hurricane Barry” effect with concerns of reduced oil demand due to weaker global growth prevailing and pushing oil prices off their highs of the week.

Base metal prices moved lower last week as a result of a stronger U.S. dollar and continued concerns of weaker Chinese and global growth. Aluminum prices down 1.4% through Thursday fell another 1.2% on Friday after the world’s largest alumina refinery, Norsk Hydro, lowered its demand growth forecasts for aluminum for a second time this year citing weaker global growth and U.S. – China trade frictions. Nickel prices gave up some of their recent large gains after analysts warned prices had moved too high.

Gold prices moved lower as expectations of the number and size of U.S. rate decreases were slightly lowered on the back of a stronger-than-expected U.S. GDP report on Friday. Silver and platinum prices increased supported by inflows into ETPs.

Grain prices moved lower last week mainly as a result of improved weather conditions and increased expectations of improved harvest yields. Corn prices also suffered from lower-than-expected export numbers and reduced demand for ethanol. Soybean prices increased slightly on Friday after reports U.S.- China trade talks would resume this coming week.

Coming up this week

Busy data week highlighted by the 2-day FOMC meeting beginning Tuesday and the employment situation report on Friday.

Personal income and outlays and consumer confidence on Tuesday.

Employment cost index and FOMC meeting announcement followed by Fed Chair Jerome Powell press conference on Wednesday.

Jobless claims, ISM and PMI manufacturing indexes on Thursday.

Employment situation report and international trade on Friday.

EIA petroleum report on Wednesday and Baker-Hughes rig count on Friday.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: July 26

27 March, 2020 | GraniteShares

Key points

Except for natural gas, energy component futures prices were all higher last week. WTI and Brent crude oil prices increased 0.8% and 1.5% respectively. Gasoil and gasoline prices increased 1.4% and 1.5%, respectively, and heating oil prices gained 0.9%. Natural gas prices fell 3.5%

Grain prices were all lower last week. Chicago and Kansas wheat prices decreased 1.3% and 1.8%, respectively, and soybean and corn prices fell 2.0% and 3.8%, respectively.

Base metal prices, except for zinc prices, all fell last week. Nickel prices decreased 4.2%, copper prices decreased 2.5%, and aluminum prices decreased 2.6%. Zinc prices increased 0.6%.

Silver and platinum prices moved higher last week while gold prices fell. Silver and platinum prices both rose 1.3% while gold prices fell 1.3%.

The S&P GSCI outperformed the Bloomberg Commodity Index last week with the S&P GSCI increasing 0.23% versus the Bloomberg Commodity Index decreasing 0.76%. The S&P GSCI’s larger exposure to energy but smaller exposure to natural gas, grains and base metals was the primary reason for its underperformance.

Total assets in commodity ETPs decreased $157.0m last week. Broad commodity (-$397.8m), crude oil (-$38.3m) and agriculture (-$15.7m) ETP outflows were offset partially by gold ($128.0m) and silver ($174.4m) ETP inflows.

Commentary

Friday’s stronger-than-expected first estimate of Q2 GDP helped reduce concerns of a weaker U.S. economy brought about by a much-weaker-than-expected existing home sales number and a slew of other slightly-less-than-expected economic numbers released earlier in the week. Strong Indications the ECB is ready and willing to reduce rates and restart its bond buying program helped increased expectations of stronger EU and global economic growth as did reports U.S. and China trade talks would resume this coming week. At week’s end the U.S. dollar strengthened 0.9%, 10-year U.S. Treasury rates increased 2bp to 2.07% and the S&P 500 index increased 1.7%.

Up 1.8% through Tuesday, oil prices moved higher spurred by concerns over Iran’s seizure of a British oil tanker the previous week and expectations of a large drawdown in U.S. oil inventories. Wednesday’s EIA inventory report showing a large drawdown (as expected) was dismissed as a one-time “Hurricane Barry” effect with concerns of reduced oil demand due to weaker global growth prevailing and pushing oil prices off their highs of the week.

Base metal prices moved lower last week as a result of a stronger U.S. dollar and continued concerns of weaker Chinese and global growth. Aluminum prices down 1.4% through Thursday fell another 1.2% on Friday after the world’s largest alumina refinery, Norsk Hydro, lowered its demand growth forecasts for aluminum for a second time this year citing weaker global growth and U.S. – China trade frictions. Nickel prices gave up some of their recent large gains after analysts warned prices had moved too high.

Gold prices moved lower as expectations of the number and size of U.S. rate decreases were slightly lowered on the back of a stronger-than-expected U.S. GDP report on Friday. Silver and platinum prices increased supported by inflows into ETPs.

Grain prices moved lower last week mainly as a result of improved weather conditions and increased expectations of improved harvest yields. Corn prices also suffered from lower-than-expected export numbers and reduced demand for ethanol. Soybean prices increased slightly on Friday after reports U.S.- China trade talks would resume this coming week.

Coming up this week

Busy data week highlighted by the 2-day FOMC meeting beginning Tuesday and the employment situation report on Friday.

Personal income and outlays and consumer confidence on Tuesday.

Employment cost index and FOMC meeting announcement followed by Fed Chair Jerome Powell press conference on Wednesday.

Jobless claims, ISM and PMI manufacturing indexes on Thursday.

Employment situation report and international trade on Friday.

EIA petroleum report on Wednesday and Baker-Hughes rig count on Friday.

Following somewhat stronger-than-expected U.S. economic and inflation reports (including the previous Friday’s GDP report), the FOMC voted on Wednesday to reduce the Fed Funds target rate 25bp to between 2.00% – 2.25%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 2

27 March, 2020 | Jeff Klearman

Following somewhat stronger-than-expected U.S. economic and inflation reports (including the previous Friday’s GDP report), the FOMC voted on Wednesday to reduce the Fed Funds target rate 25bp to between 2.00% – 2.25%.

U.S. stock markets and the 10-year U.S. Treasury rate fell sharply on Monday (S&P 500 Index down 3%, 10-year U.S. Treasury rate 14bps lower) after the Chinese yuan weakened to above 7 yuan/dollar, greatly increasing fears of an all-out trade and, perhaps, currency war between the U.S. and China.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 09

27 March, 2020 | Jeff Klearman

U.S. stock markets and the 10-year U.S. Treasury rate fell sharply on Monday (S&P 500 Index down 3%, 10-year U.S. Treasury rate 14bps lower) after the Chinese yuan weakened to above 7 yuan/dollar, greatly increasing fears of an all-out trade and, perhaps, currency war between the U.S. and China.

A volatile week for U.S. stock markets and U.S. interest rates resulting from quickly changing expectations of global growth and U.S-China trade relations.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 16

27 March, 2020 | Jeff Klearman

A volatile week for U.S. stock markets and U.S. interest rates resulting from quickly changing expectations of global growth and U.S-China trade relations.

U.S. stock markets and the U.S. dollar were higher through Thursday last week following the Trump administration’s positive statements and actions regarding U.S-China trade frictions and following the release of FOMC minutes and Jerome Powell’s comments at Jackson Hole confirming the U.S. Federal Reserve Bank will act to maintain economic expansion.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 23

27 March, 2020 | Jeff Klearman

U.S. stock markets and the U.S. dollar were higher through Thursday last week following the Trump administration’s positive statements and actions regarding U.S-China trade frictions and following the release of FOMC minutes and Jerome Powell’s comments at Jackson Hole confirming the U.S. Federal Reserve Bank will act to maintain economic expansion.

A mix of stronger-than-expected U.S. economic reports and statements from China seemingly de-escalating trade frictions moved U.S. stock markets higher while also strengthening the U.S. dollar.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Aug 30

27 March, 2020 | Jeff Klearman

A mix of stronger-than-expected U.S. economic reports and statements from China seemingly de-escalating trade frictions moved U.S. stock markets higher while also strengthening the U.S. dollar.

Returning Tuesday from a long holiday weekend, U.S. stock and commodity markets moved lower as global and U.S. growth concerns, prompted by tweets from President Trump, increased.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 06

27 March, 2020 | Jeff Klearman

Returning Tuesday from a long holiday weekend, U.S. stock and commodity markets moved lower as global and U.S. growth concerns, prompted by tweets from President Trump, increased.

Despite President Trump’s tweets requesting the U.S Federal Reserve Bank dramatically lower rates, higher-than-expected CPI and PPI numbers and better-than-expected retail sales, chain-store sales, consumer sentiment and business inventories reports pushed 10-year interest rates higher by over 30bps and reduced the probability of a rate increase at this week’s FOMC meeting.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 13

27 March, 2020 | Jeff Klearman

Despite President Trump’s tweets requesting the U.S Federal Reserve Bank dramatically lower rates, higher-than-expected CPI and PPI numbers and better-than-expected retail sales, chain-store sales, consumer sentiment and business inventories reports pushed 10-year interest rates higher by over 30bps and reduced the probability of a rate increase at this week’s FOMC meeting.

Dominated by news of attacks on Saudi oil processing facilities, U.S. Federal Reserve Bank repo operations and the FOMC meeting, U.S. stock markets and the U.S. dollar remained relatively calm while 10-year U.S. interest rates moved lower off their recent highs.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 20

27 March, 2020 | Jeff Klearman

Dominated by news of attacks on Saudi oil processing facilities, U.S. Federal Reserve Bank repo operations and the FOMC meeting, U.S. stock markets and the U.S. dollar remained relatively calm while 10-year U.S. interest rates moved lower off their recent highs.

Weak economic reports in Europe and Asia along with the what may be the beginning of impeachment proceedings against President Trump pushed U.S. and global stock markets lower, strengthened the U.S. dollar and moved U.S. Treasury rates lower.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Sep 27

27 March, 2020 | Jeff Klearman

Weak economic reports in Europe and Asia along with the what may be the beginning of impeachment proceedings against President Trump pushed U.S. and global stock markets lower, strengthened the U.S. dollar and moved U.S. Treasury rates lower.

A bevy of weak U.S. economic reports on Tuesday and Wednesday, including a very weak ISM manufacturing index release on Tuesday and extremely disappointing auto sales numbers on Wednesday, drove U.S. stock markets, U.S. Treasury rates and the U.S. dollar lower last week. Concerns of a slowing U.S. economy increased Thursday after the release of a weaker-than-expected ISM non-manufacturing index number, a weaker-than-expected ADP private payroll report as well as by a mediocre employment report on Friday. Despite Thursday’s and Friday’s reports, U.S. stock markets rebounded off their lows with increasing market expectations of more U.S. Federal Reserve Bank rate reductions . The S&P 500 Index, down more 2.5% through Wednesday, finished the week only 0.3% lower at 2,952.01. 10-year U.S. Treasury rates fell 15bps over the week to 1.53% and the U.S. dollar (as measured by the DXY index) weakened 0.3% over the week.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Oct 4

27 March, 2020 | Jeff Klearman

A bevy of weak U.S. economic reports on Tuesday and Wednesday, including a very weak ISM manufacturing index release on Tuesday and extremely disappointing auto sales numbers on Wednesday, drove U.S. stock markets, U.S. Treasury rates and the U.S. dollar lower last week. Concerns of a slowing U.S. economy increased Thursday after the release of a weaker-than-expected ISM non-manufacturing index number, a weaker-than-expected ADP private payroll report as well as by a mediocre employment report on Friday. Despite Thursday’s and Friday’s reports, U.S. stock markets rebounded off their lows with increasing market expectations of more U.S. Federal Reserve Bank rate reductions . The S&P 500 Index, down more 2.5% through Wednesday, finished the week only 0.3% lower at 2,952.01. 10-year U.S. Treasury rates fell 15bps over the week to 1.53% and the U.S. dollar (as measured by the DXY index) weakened 0.3% over the week.

Concerns of weak U.S. economic growth spurred by the previous week’s weaker-than-expected ISM manufacturing report and exacerbated by growing concerns of increased trade frictions between the U.S. and China pushed U.S. stock markets lower and strengthened the U.S. dollar early last week. The release of FOMC minutes on Wednesday, comments from various Fed officials reaffirming the U.S. Federal Reserve Bank would continue to act to maintain the expansion and the Fed’s announcement it would increase its balance sheet by buying short-term Treasuries helped move U.S. stock markets off their intra-week lows through the remainder of the week. Reports on Thursday that President Trump would meet with Vice Premier Liu on Friday and the announcement that a partial trade agreement had been reached with China on Friday, pushed U.S. stock markets and U.S. Treasury rates higher and weakened the U.S. dollar.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Oct 11

27 March, 2020 | Jeff Klearman

Concerns of weak U.S. economic growth spurred by the previous week’s weaker-than-expected ISM manufacturing report and exacerbated by growing concerns of increased trade frictions between the U.S. and China pushed U.S. stock markets lower and strengthened the U.S. dollar early last week. The release of FOMC minutes on Wednesday, comments from various Fed officials reaffirming the U.S. Federal Reserve Bank would continue to act to maintain the expansion and the Fed’s announcement it would increase its balance sheet by buying short-term Treasuries helped move U.S. stock markets off their intra-week lows through the remainder of the week. Reports on Thursday that President Trump would meet with Vice Premier Liu on Friday and the announcement that a partial trade agreement had been reached with China on Friday, pushed U.S. stock markets and U.S. Treasury rates higher and weakened the U.S. dollar.

Stronger-than-expected U.S. earnings reports overcame a weaker-than-expected retail sales report and reduced expectations of a U.S-China “partial” trade agreement last week. The S&P 500 Index, lower on Monday after China announced it wanted more talks before signing any trade agreement, rallied through Thursday on the back of stronger-than-expected U.S. earnings reports despite weaker-than-expected retail sales numbers released on Wednesday. U.S. stock markets lost some ground on Friday after weaker-than-expected Chinese economic data and a couple of “missed” U.S. earnings reports. At week’s end the S&P 500 index was up 0.5% at 2986.20, 10-year U.S. Treasury rates were up 2.5bps at 1.75% and the dollar weakened 1.0 % as measured by the DXY index.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Oct 18

27 March, 2020 | Jeff Klearman

Stronger-than-expected U.S. earnings reports overcame a weaker-than-expected retail sales report and reduced expectations of a U.S-China “partial” trade agreement last week. The S&P 500 Index, lower on Monday after China announced it wanted more talks before signing any trade agreement, rallied through Thursday on the back of stronger-than-expected U.S. earnings reports despite weaker-than-expected retail sales numbers released on Wednesday. U.S. stock markets lost some ground on Friday after weaker-than-expected Chinese economic data and a couple of “missed” U.S. earnings reports. At week’s end the S&P 500 index was up 0.5% at 2986.20, 10-year U.S. Treasury rates were up 2.5bps at 1.75% and the dollar weakened 1.0 % as measured by the DXY index.

GraniteShares is an independent, fully funded ETF company headquartered in New York City. GraniteShares’ ETF suite includes one of the lowest-cost physical gold ETFs (BAR), a broad-based commodity ETF (COMB), an ETF that seeks to exclude U.S. large cap companies most likely to suffer from technological disruption over the long term (XOUT), a high alternative income-focused fund that invests in pass-through securities (HIPS) and the lowest-cost* physical platinum ETF (PLTM). GraniteShares has experienced robust growth in 2019, recently surpassing $700 million in total assets under management.

Topic: Income

Publication Type: Investment Cases

GraniteShares Announces Change in ETF Lineup

27 March, 2020 | GraniteShares

GraniteShares is an independent, fully funded ETF company headquartered in New York City. GraniteShares’ ETF suite includes one of the lowest-cost physical gold ETFs (BAR), a broad-based commodity ETF (COMB), an ETF that seeks to exclude U.S. large cap companies most likely to suffer from technological disruption over the long term (XOUT), a high alternative income-focused fund that invests in pass-through securities (HIPS) and the lowest-cost* physical platinum ETF (PLTM). GraniteShares has experienced robust growth in 2019, recently surpassing $700 million in total assets under management.

Buoyed by increased optimism of a U.S.-China trade agreement, overall better-than-expected U.S. earnings reports and continued expectations of U.S. Federal Reserve Bank easing, the S&P 500 Index, increased 1.2% to 3022.55, just shy of its record in late July of 3025.86. The U.S. dollar strengthened over the week, despite U.S. Federal Reserve Bank easing expectations, on the back of weak economic reports from the EU and China. At week’s end the U.S. dollar (as measured by the DXY index) strengthened 0.6% and 10-year U.S Treasury rates increased 4.5bps to 1.0%

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Oct 25

27 March, 2020 | Jeff Klearman

Buoyed by increased optimism of a U.S.-China trade agreement, overall better-than-expected U.S. earnings reports and continued expectations of U.S. Federal Reserve Bank easing, the S&P 500 Index, increased 1.2% to 3022.55, just shy of its record in late July of 3025.86. The U.S. dollar strengthened over the week, despite U.S. Federal Reserve Bank easing expectations, on the back of weak economic reports from the EU and China. At week’s end the U.S. dollar (as measured by the DXY index) strengthened 0.6% and 10-year U.S Treasury rates increased 4.5bps to 1.0%

Starting the week with strong expectations of a partial trade agreement between the U.S.- and China, U.S. stock markets and the 10-year Treasury rate both moved higher early in the week. With Wednesday’s FOMC decision to once again lower the Fed Fund’s target rate 25bps while at the same time hinting the Federal Reserve Bank would pause further rate reductions combined with a lackluster 3rd quarter GDP report, 10-year U.S Treasury rates moved off their intraweek highs while the U.S. stock markets seemed unphased. Weaker-than-expected consumer spending number and reduced expectations of a U.S.-China trade agreement partially reversed gains in U.S. stock markets and pushed the 10-year Treasury even rate lower on Thursday. Friday’s much-stronger-than-expected employment situation report -despite weaker-than-expected manufacturing data -pushed U.S. stock markets even higher and slightly increased the 10-year U.S. Treasury rate. At week’s end the S&P 500 was up almost 1.5% to 3066.91, the 10-year U.S. Treasury was lower 8bps at 1.71% and the U.S. dollar (as measured by the DXY index) was weaker 0.6%.

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 1

27 March, 2020 | Jeff Klearman

Starting the week with strong expectations of a partial trade agreement between the U.S.- and China, U.S. stock markets and the 10-year Treasury rate both moved higher early in the week. With Wednesday’s FOMC decision to once again lower the Fed Fund’s target rate 25bps while at the same time hinting the Federal Reserve Bank would pause further rate reductions combined with a lackluster 3rd quarter GDP report, 10-year U.S Treasury rates moved off their intraweek highs while the U.S. stock markets seemed unphased. Weaker-than-expected consumer spending number and reduced expectations of a U.S.-China trade agreement partially reversed gains in U.S. stock markets and pushed the 10-year Treasury even rate lower on Thursday. Friday’s much-stronger-than-expected employment situation report -despite weaker-than-expected manufacturing data -pushed U.S. stock markets even higher and slightly increased the 10-year U.S. Treasury rate. At week’s end the S&P 500 was up almost 1.5% to 3066.91, the 10-year U.S. Treasury was lower 8bps at 1.71% and the U.S. dollar (as measured by the DXY index) was weaker 0.6%.

Stronger-than-expected U.S. economic and earnings reports – and despite increased expectations that the next rate move by the U.S. Federal Reserve bank will be a move higher – pushed the S&P 500 Index up 0.85% to an all-time high of 3093.08 while moving the 10-year U.S Treasury rate higher by 23 bps to 1.94% and strengthened the U.S. dollar by 1.2% (as measured by the DXY index).

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 8

27 March, 2020 | Jeff Klearman

Stronger-than-expected U.S. economic and earnings reports – and despite increased expectations that the next rate move by the U.S. Federal Reserve bank will be a move higher – pushed the S&P 500 Index up 0.85% to an all-time high of 3093.08 while moving the 10-year U.S Treasury rate higher by 23 bps to 1.94% and strengthened the U.S. dollar by 1.2% (as measured by the DXY index).

Renewed optimism over a U.S.-China trade agreement spurred by Trump administration comments and stronger-expected retail sales on Friday, pushed the S&P 500 Index almost a percent higher and moved 10-year U.S. Treasury rates a couple of basis points off their lows of the week. At week’s end the S&P 500 increased 0.9% to 3120.46, 10-year U.S. Treasury rates fell 11bps to 1.83% and the U.S. dollar weakened 0.4% (as measured by the DXY index).

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 15

27 March, 2020 | Jeff Klearman

Renewed optimism over a U.S.-China trade agreement spurred by Trump administration comments and stronger-expected retail sales on Friday, pushed the S&P 500 Index almost a percent higher and moved 10-year U.S. Treasury rates a couple of basis points off their lows of the week. At week’s end the S&P 500 increased 0.9% to 3120.46, 10-year U.S. Treasury rates fell 11bps to 1.83% and the U.S. dollar weakened 0.4% (as measured by the DXY index).

Comments by Chinese President Xi Jinping calling for increased communications between the U.S. and China, positive comments from President Trump regarding U.S.-China trade frictions and stronger-than-expected economic reports on Friday moved U.S. stock markets, 10-year U.S. Treasury rates and the U.S. dollar off their lows of the week. At week’s end the S&P 500 was down 0.3% to 3110.29, 10-year U.S. Treasury rates fell 6bps to 1.77% and the U.S. dollar strengthened (all on Friday) 0.3% (as measured by the DXY index). ).

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 22

27 March, 2020 | Jeff Klearman

Comments by Chinese President Xi Jinping calling for increased communications between the U.S. and China, positive comments from President Trump regarding U.S.-China trade frictions and stronger-than-expected economic reports on Friday moved U.S. stock markets, 10-year U.S. Treasury rates and the U.S. dollar off their lows of the week. At week’s end the S&P 500 was down 0.3% to 3110.29, 10-year U.S. Treasury rates fell 6bps to 1.77% and the U.S. dollar strengthened (all on Friday) 0.3% (as measured by the DXY index). ).

Supported by indications of progress on a U.S.-China trade agreement and strong U.S. economic reports (including new home sales and 2nd estimate Q3 GDP), the S&P 500 Index moved 1.4% higher through Wednesday to close at 3153.63, another all-time high. President Trump’s signing of legislation supporting Hong Kong protesters along with falling energy prices pushed U.S. stock markets slightly lower with the S&P 500 Index slipping 0.4%. At week’s end the S&P 500 was up 1% to 3140.98, 10-year U.S. Treasury rates gained 1bp to 1.78% and the U.S. dollar was unchanged (as measured by the DXY index).

Topic: Gold , Commodities

Publication Type: Market Commentaries

Commodities & Precious Metals Weekly Report: Nov 29

27 March, 2020 | Jeff Klearman

Supported by indications of progress on a U.S.-China trade agreement and strong U.S. economic reports (including new home sales and 2nd estimate Q3 GDP), the S&P 500 Index moved 1.4% higher through Wednesday to close at 3153.63, another all-time high. President Trump’s signing of legislation supporting Hong Kong protesters along with falling energy prices pushed U.S. stock markets slightly lower with the S&P 500 Index slipping 0.4%. At week’s end the S&P 500 was up 1% to 3140.98, 10-year U.S. Treasury rates gained 1bp to 1.78% and the U.S. dollar was unchanged (as measured by the DXY index).