How Short & Leveraged ETPs Work

07 Mar, 2023 | GraniteShares

Leverage the daily return of Airbus (AIR) stocks with 3x Long Airbus ETP Securities.

GraniteShares 3x Long Airbus Daily ETP Securities is a collateralised, Exchange-Traded Product (ETP). The ETP tracks, excluding fees and other adjustments, the performance of the Solactive Daily Leveraged 3x long Airbus Index that seeks to provide 3 times the daily performance of Airbus shares.

For example, if Airbus rises by 1% over a day, then the ETP will rise by 3%, excluding fees and other adjustments. However, if Airbus falls by 1% over a day, then the ETP will fall by 3%, excluding fees and other adjustments.

GraniteShares +3x Airbus Securities is available in EUR,GBP

07 Mar, 2023 | GraniteShares

16 Dec, 2020 | GraniteShares

04 Jul, 2022 | GraniteShares

07 Oct, 2022 | GraniteShares

| Exchange | Trading Currency |

Ticker | ISIN | SEDOL | WKN |

|---|---|---|---|---|---|

| Euronext Paris | EUR | 3LAR | XS2376933375 | BMW5LG9 | |

| London Stock Exchange | GBP | LAR3 | XS2376933375 | BMHWFM9 |

| 1 Month | 3 Months | YTD | 1 Year | 3 Year | Since Inception |

|---|

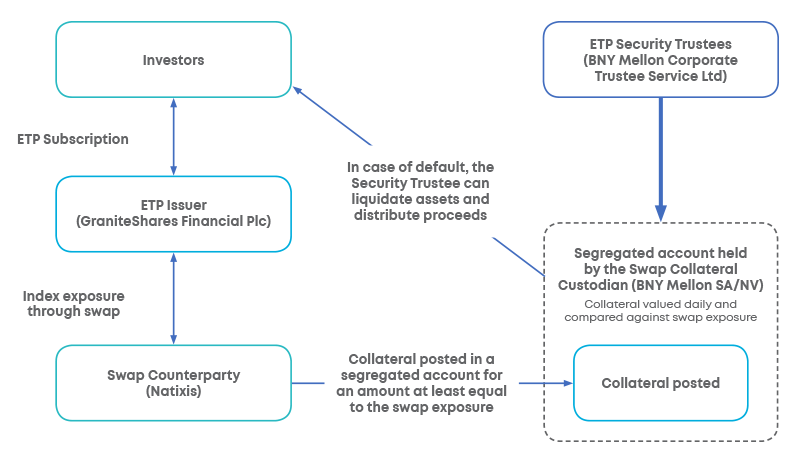

Collateralised ETP Securities are backed with collateral, subject to eligibility criteria, to protect investors in event of default. The amount of collateral posted by the Swap Counterparty is held and valued by an independent custodian in a segregated account and is adjusted daily and reflects the collateralised ETPs' change in value and in the outstanding number of securities. The Bank of New York Mellon SA/NV serves as the Swap Collateral Custodian.