All about Exchange Traded Products (ETPs)

Posted:Exchange-Traded Product (ETP) Guide – Definition, Types, Benefits & More

Before we begin with more advanced and technical aspects, let us understand what Exchange Traded Products are and how they help investors risk and return aspects of trading. Let us dig in.

What are ETPs?

ETPs are exchange-listed investment vehicles. They are the type of securities that are designed to track the underlying security, an index, or other financial instruments. ETPs are just like stocks trade on the stock exchange or stock markets i.e., their prices fluctuate on a day-to-day basis and intraday.

These instruments are considered a low-cost alternative to mutual funds as well as actively managed funds. ETPs can be of a particular stock, indexes like NYSE ETPs, sector-specific indexes, or commodities like gold ETPs, and currencies.

Leveraged Returns:

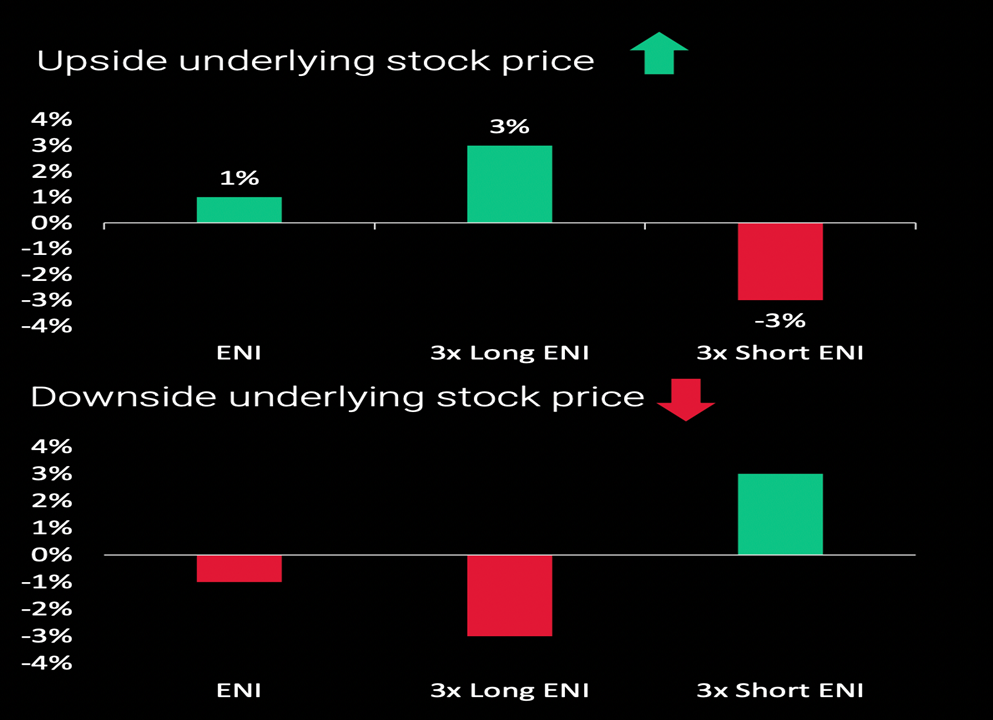

Leveraged returns help investors to magnify their daily returns. For example, if FTSE 100 goes up by 1% in a day and the investor has invested in let us say FTSE 100 3x Leverage Daily ETP will surge by 3%. However, if the same underlying index FTSE 100 instead of going up by 1% goes down by 1% then the FTSE 100 3x Leverage Daily ETP will go down by 3%.

Leveraged returns allow investors to either use less of their capital to achieve similar investments or to magnify returns using the same amount of capital and increasing their stakes.

Leveraged Exchange Traded Products (ETPs):

Leveraged ETPs are funds or notes that trade on exchange but have hugely distinctive characteristics from that of shares of stocks or Exchange Traded Funds (ETFs). ETPs typically use derivatives to multiply the returns of the underlying security or index. Leveraged ETPs also inverse leveraged ETPs mark the returns based on the daily performance of the underlying security or under. Leveraged ETP has the propensity to be more volatile as compared to its non-leveraged and non-inverse counterparts.

Leveraged ETPs - Identifier

Leveraged ETPs usually have a multiplier in their product or funds name or have words such as 3x, “ultra” or “daily” in front of the fund or product's name. These ETPs deliver multiples of an index daily return. The number 3x acts as a multiplier which means if the underlying security or index goes up by 1% the ETP will move by approximately 3%. Investors should also consider the implication of both the upside and downside of the multipliers.

During the upside of the market, these multipliers are beneficial but when the tides are against it i.e., ETPs multipliers move the same when the market moves against the prediction. For example, +3x Long Apple Daily ETP by Graniteshates also written as 3LAE.

(Source: graniteshares.com)

Inverse ETP:

Inverse ETPs are products or funds that provide positive returns when the underlying market falls. These ETPs are constructed by using various derivatives to profit from a decline in the value of the underlying security or benchmark. Like Leveraged ETPs, Inverse ETPs mark returns based on the daily performance of the underlying security or index. This is one of the ways to hedge portfolios, they can be used to Profit when the market decides on the broad market index.

Inverse ETPs are usually denoted as either a negative number like -2x, -3x or terms like “short” or “inverse” in the name of funds or product name. For example -3x Short Apple Daily ETP from Graniteshares also written as 3SAE.

Why ETPs::

ETPs, as mentioned above, trade just like stocks and can be bought and sold throughout the day. They also have prices move throughout the day. Just like stocks, investors can buy the ETP in the morning and sell it by the end of the market close. For example, an investor can place an order to buy a specific ETP at a specific time and quantity with the broker.

ETPs have flexibility as well as liquidity as compared to other instruments like mutual funds. ETPs carry a lower expense ratio and lower brokerage costs as compared to others. Also, most highly liquid ETPs can be traded without commission change in all the major discount brokers.

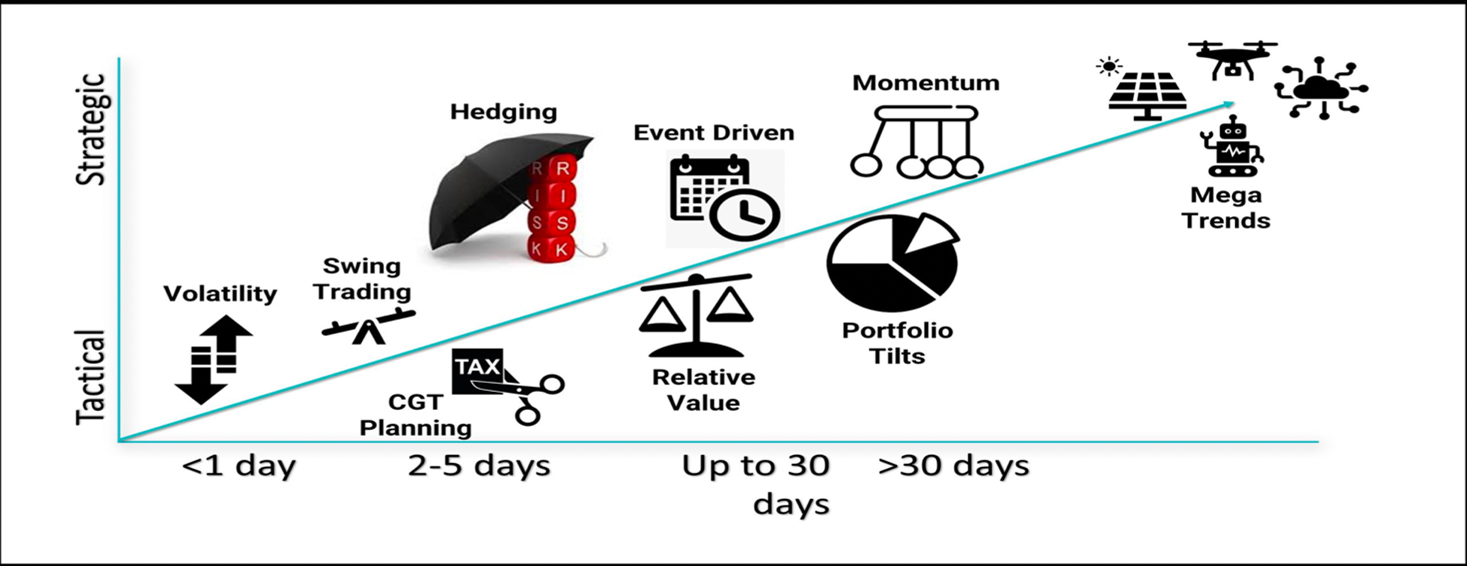

One Instrument Multiple Functions

(Source: graniteshares.com)

Daily Re-balancing:

Levered and Inverse daily ETPs rebalance their leverages at the end of every index trading day providing investors with 3x or -3x daily returns. The balancing of the ETPs is structured differently than using margins or buying and selling a futures contract to obtain leverage. Daily constant leverage is used in ETP products because an open-ended ETP allows for investors to buy and sell ETP on any day and still receive the leverage multiple mentioned.

Compounding Effect:

Just like all other investment strategies, returns over a period longer than one day are affected by compounding due to the daily market movements (as with the bank account that compounds the interest over interest for many months). Daily leveraged exposure means the compounding effect will be amplified and occur daily which can have positive and negative effects on returns over a longer period.

For example, if the FAANG ETP of Graniteshares100 trades at £100 and goes by 1%, the FAANG 100 3x Leverage Daily ETP will rise by 3% to £103 (excluding fees & adjustments). Later, if FAANG 100 then goes down by 1% the next day, then 3FAANG will fall to £99.91. Thus, over the two days, the average return is 0%, although, the 2-day compounded ETP return is -0.09%.

The Index would also have an average return of 0% but its price would be £99.99, and its 2-day compounded return would be -0.01%. The daily compounding effect for ETP may increase with the length of a holding period, index volatility, and leverage.

There are various occasions where leveraged or inverse ETPs could be useful for certain types of trading strategies for sophisticated and professional investors to capitalize on the movement in securities or indexes. It is immensely important to understand that when holding the ETPs for long will have a different return than that of holding them for just one day. Investors opting for trading via ETPs, or any investments should read the risk and return aspects of the trade before investing.

DISCLAIMER

Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.

This is a disclaimer stating that all trading and investing come with risks. Always do your research and do not invest more than you can afford to spend.

GraniteShares accepts no responsibility for any loss or damage resulting directly or indirectly from the use of this blog or the contents.

This blog does not constitute an offer to buy or sell or a solicitation of an offer to buy securities in any company. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be relied upon in making an investment or other decision. No recommendation is made positive or otherwise, regarding individual securities or investments mentioned herein.

Any summary list of risk factors does not purport to be a complete enumeration or explanation of the risks involved in a particular investment. Prospective clients must consult with their own legal, tax and financial advisers before deciding to invest.

This email contains the opinions of the author, and such opinions are subject to change without notice. The source of data is GraniteShares unless otherwise stated. No guarantee is made to the accuracy of the information provided which has been obtained from sources believed to be reliable.

This email and the information contained herein is intended only for the use of persons (or entities they represent) to whom it has been provided. Past performance is not a reliable indicator of future results. The value of an investment may go down as well as up and can result in losses, up to and including a total loss of the amount initially invested.

Investments may involve numerous risks including, among others, company risks, general market risks, credit risks, foreign exchange risks, interest rate risks, geopolitical risks, and liquidity risks. Please note that GraniteShares short and leveraged Exchange Traded Products are for sophisticated investors.