Commodities & Precious Metals Weekly Report: Aug 19

Posted:

Key points

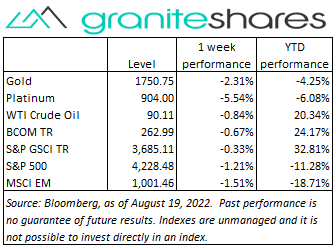

Energy prices were mainly higher last week though WTI and Brent crude oil prices finished the week a little less than 1 percent lower. Natural gas prices increased 6.5%, heating oil prices rose 4.7% and gasoil prices climbed 3.7%. Gasoline prices edged higher 0.4% higher.

Energy prices were mainly higher last week though WTI and Brent crude oil prices finished the week a little less than 1 percent lower. Natural gas prices increased 6.5%, heating oil prices rose 4.7% and gasoil prices climbed 3.7%. Gasoline prices edged higher 0.4% higher. - Grain prices were all lower. Wheat prices fell between 5% and 6%, soybean prices lost 3.5% and corn prices decreased 3.0%.

- Precious metal prices were all lower, too. Spot gold prices decreased 3.0%, spot silver prices fell 8.5% and spot platinum prices lost 6.6%.

- Base metal prices were lower as well. Nickel prices fell 3.4%, aluminum prices lost 2.0% and zinc prices decreased 2.6%. Copper prices edged lower 0.2%.

- The Bloomberg Commodity Index decreased 0.7%. Gains in the energy sector were primarily offset by losses in the grains and base and precious metals sectors.

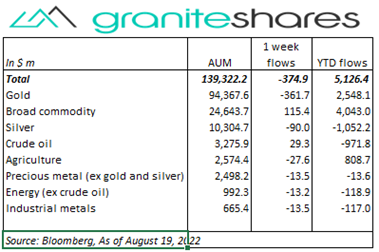

- $375 million outflows from commodity ETPs almost entirely from gold (-$362m) ETPs. Decent inflows into broad commodity ($115m) ETPs and small inflows into crude oil ($29m) ETPs. All other ETPs had small outflows.

Commentary

All three major stock indexes moved lower last week with the Nasdaq Composite Index significantly underperforming the other two. Early week sentiment of peaking inflation and a more benign Fed began reversing mid-week following Wednesday’s release of FOMC minutes. Increasing concerns the Fed may continue its aggressive tightening, perhaps hiking rates 75bps higher again in September, combined with hawkish comments from Fed officials and signs of a still resilient job market, moved stock prices markedly lower Friday. The 10-year Treasury rate, lower through Tuesday, climbed higher the rest of the week reflecting both inflation and Fed policy concerns. Similarly, the U.S. dollar powered higher last week with DXY index increasing just shy of 2.5%. For the week, the S&P 500 Index decreased 1.2% to 4,228.48, the Nasdaq Composite Index fell 2.6% to 12,705.21, the Dow Jones Industrial Average edged lower 0.2% to 33,706.15, the 10-year U.S. Treasury rate rose 14bps to 2.98% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 2.4%.

All three major stock indexes moved lower last week with the Nasdaq Composite Index significantly underperforming the other two. Early week sentiment of peaking inflation and a more benign Fed began reversing mid-week following Wednesday’s release of FOMC minutes. Increasing concerns the Fed may continue its aggressive tightening, perhaps hiking rates 75bps higher again in September, combined with hawkish comments from Fed officials and signs of a still resilient job market, moved stock prices markedly lower Friday. The 10-year Treasury rate, lower through Tuesday, climbed higher the rest of the week reflecting both inflation and Fed policy concerns. Similarly, the U.S. dollar powered higher last week with DXY index increasing just shy of 2.5%. For the week, the S&P 500 Index decreased 1.2% to 4,228.48, the Nasdaq Composite Index fell 2.6% to 12,705.21, the Dow Jones Industrial Average edged lower 0.2% to 33,706.15, the 10-year U.S. Treasury rate rose 14bps to 2.98% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 2.4%.

Falling 5.5% through Tuesday on weak Chinese economic data and global recession fears, oil prices moved higher the remainder of the week primarily buoyed by much larger-than-expected drawdowns in U.S. crude and gasoline inventories. U.S. oil exports reached a record high, powered by the deep discount of WTI crude oil prices to Brent crude oil prices. Nonetheless, oil prices finished the week down close to 1% with gains capped by recession uncertainty, a stronger U.S. dollar and the possibility of renewed Iranian oil exports.

Gold prices moved lower last week, falling every single day. Renewed expectations of an aggressive Fed (emboldened by Wednesday’s FOMC minutes release) resulting in a significantly stronger U.S. dollar combined to pressure gold prices lower. Strong labor market data added to concerns of an aggressive Fed by increasing expectations the economy could weather higher rates without falling into recession. 10-year Treasury rates increased 14bps with both real rates and inflation expectations contributing equally to the rise.

Initially lower on global recession fears and, in particular, weak Chinese economic data (especially in the property development sector), copper prices rose on hopes of Chinese stimulus increasing demand from the world’s largest copper consumer. The PBoC lowered rates and injected close to $60 billion into the financial system early last week. Despite additional zinc and aluminum smelter closures in Europe, zinc and aluminum prices finished 2% to 3% lower on the week on demand concerns spurred by global recession fears. A stronger U.S. dollar also pressured base metal prices lower.

Wheat prices fell every day but Friday last week pressured by slowing U.S. exports and increased shipments from both the Ukraine and Russia. Soybean prices, lower on improved weather forecasts, received some support from strong export levels.

Coming up this week

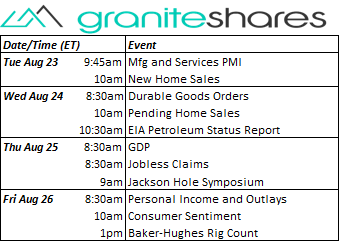

Mfg and Services PMIs, New and Pending Home Sales, GDP and the PCE Price Index highlight this week’s data.

Mfg and Services PMIs, New and Pending Home Sales, GDP and the PCE Price Index highlight this week’s data.- Mfg and Services PMIs and New Home Sales on Tuesday.

- Durable Goods Orders and Pending Home Sales on Wednesday.

- GDP, Jobless Claims and the start of Jackson Hole Symposium on Thursday.

- Personal Income and Outlays and Consumer Sentiment on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.