Commodities & Precious Metals Weekly Report: Aug 4

Posted:

Key points

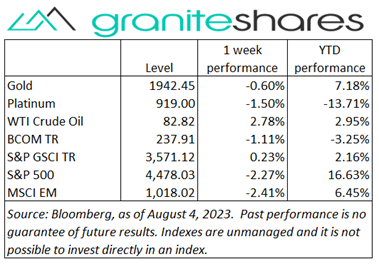

Energy prices mostly moved higher. WTI and Brent crude oil prices increased between 2% - 3% and heating oil and gasoil prices gained 4%. Natural gas prices fell 2% and gasoline prices decreased 4%.

Energy prices mostly moved higher. WTI and Brent crude oil prices increased between 2% - 3% and heating oil and gasoil prices gained 4%. Natural gas prices fell 2% and gasoline prices decreased 4%.- Wheat prices fell between 10% - 12%, corn prices lost 7% and soybean prices fell 4%.

- Spot gold and platinum prices decreased 1%. Silver prices fell 3%.

- Nickel and zinc prices edged slightly higher (less than ¼ percent) while copper and lead prices fell 1%. Nickel prices dropped 5%.

- The Bloomberg Commodity Index decreased 1.1%. Most of the decrease came from the grains sector with the base and precious metals sectors also detracting. Losses were offset by gains in the energy sector.

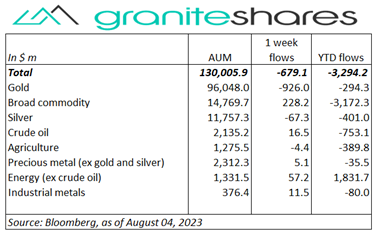

- Outflows last week, again mainly from gold ETPs and with a small outflow from silver ETPs. Decent inflows into broad commodity and energy ETPs.

Commentary

Stock markets moved lower last week with all 3 major indexes losing more than 1%. The Dow Jones Industrial Average noticeably outperformed the Nasdaq Composite and S&P 500 Indexes with the latter 2 indexes falling south of 2%. Rising Treasury yields appeared to be the primary culprit for last week’s losses, with investor interest seemingly tilting toward bond rather than stock investments (strong gains year to date also may be part of the dynamics). Treasury yields, up over 20bps through Thursday, moved markedly higher following the Treasuries much larger-than-expected funding announcement Wednesday. Fitch Ratings’ downgrade (Wednesday) of the U.S. credit rating (from AAA to AA+) may have been another factor contributing to higher Treasury yields and lower stock prices. Friday’s payroll report, showing a smaller-than-expected increase in payrolls but continued upward wage pressures, did little to reverse investor sentiment toward stocks but seemingly allayed “higher rates” expectations, moving the 10-year Treasury rate 14bps lower. For the week, the S&P 500 Index fell 2.3% to 4,478.03, the Nasdaq Composite Index dropped 2.9% to 13,909.24, the Dow Jones Industrial Average decreased 1.1% to 35,065.15, the 10-year U.S. Treasury rate increased 8bps to 4.04% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.4%.

Stock markets moved lower last week with all 3 major indexes losing more than 1%. The Dow Jones Industrial Average noticeably outperformed the Nasdaq Composite and S&P 500 Indexes with the latter 2 indexes falling south of 2%. Rising Treasury yields appeared to be the primary culprit for last week’s losses, with investor interest seemingly tilting toward bond rather than stock investments (strong gains year to date also may be part of the dynamics). Treasury yields, up over 20bps through Thursday, moved markedly higher following the Treasuries much larger-than-expected funding announcement Wednesday. Fitch Ratings’ downgrade (Wednesday) of the U.S. credit rating (from AAA to AA+) may have been another factor contributing to higher Treasury yields and lower stock prices. Friday’s payroll report, showing a smaller-than-expected increase in payrolls but continued upward wage pressures, did little to reverse investor sentiment toward stocks but seemingly allayed “higher rates” expectations, moving the 10-year Treasury rate 14bps lower. For the week, the S&P 500 Index fell 2.3% to 4,478.03, the Nasdaq Composite Index dropped 2.9% to 13,909.24, the Dow Jones Industrial Average decreased 1.1% to 35,065.15, the 10-year U.S. Treasury rate increased 8bps to 4.04% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.4%.

A somewhat volatile week for oil prices with prices up 2% Monday, falling 3% over Tuesday and Wednesday and then moving 4% higher over Thursday and Friday. Monday’s increase came on no new news, moving higher on continued Saudi production cutbacks and hopes of Chinese stimulus. The decline over Tuesday and Wednesday came as Fitch Ratings downgraded the U.S. credit rating, increased concerns of higher rates for longer and as the U.S. retracted its offer to buy 6 million barrels for the SPR. The decline came despite a much larger-than-expected drop in oil inventories. Prices moved higher Thursday and Friday, however, driven mainly by supply side concerns as Saudi Arabia and Russia announced production/export cutbacks would continue through September. Weak manufacturing activity in Europe and the U.S. and a mixed U.S. jobs report capped gains.

Spot gold prices moved lower last week (down 1%), reacting primarily to higher Treasury rates and a stronger U.S. dollar. While Fitch Ratings’ U.S. credit downgrade initially moved prices higher, the Treasury’s much larger-than-expected funding needs (as well as the downgrade itself) pushed Treasury yields markedly higher over Wednesday and Thursday, dampening demand for gold. Friday’s mixed jobs report, showing a smaller-than-expected increase in payrolls, ameliorated higher-rate concerns, moving rate and the U.S. dollar and, consequently, helping gold prices move higher. Platinum prices moved with gold prices while silver prices underperformed, falling 3%.

Copper prices moved lower last week, adversely affected by rising rates, a stronger dollar and weak Chinese demand. Weak Chinese economic data, spurring Chinese government stimulus pledges, continued to depress investor sentiment with markets waiting for China to announce and implement stimulus plans. Fitch Ratings' U.S credit downgrade also pressured copper prices lower. The U.S added copper to its “critical metals” list, perhaps helping prices move higher Thursday.

Wheat and corn prices moved sharply lower last week, falling every day but Friday. Favorable weather forecasts were the primary impetus for lower prices with a lull in Ukraine-Russia military activity also contributing. Wheat and corn prices moved higher Friday following reports of a Ukrainian attack on a Russian warship near a Black Sea port. Soybean prices also moved lower but not as sharply, also influenced by favorable weather forecasts. Rising soy meal prices helped floor soybean losses for the week.

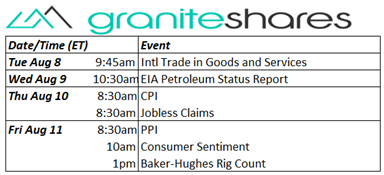

Coming Up This Week

Quiet week with CPI, on Thursday, the attention getter

Quiet week with CPI, on Thursday, the attention getter

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.