Commodities & Precious Metals Weekly Report: Feb 18

Posted:

Key points

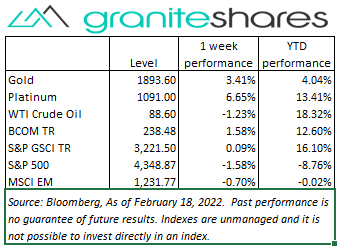

Energy prices, except for natural gas prices, moved lower last week. WTI and Brent crude oil prices increased decreased about 1 ¼ percent and gasoline prices rose just under 2%. Heating oil prices fell 1%. Natural gas prices rose 11%.

Energy prices, except for natural gas prices, moved lower last week. WTI and Brent crude oil prices increased decreased about 1 ¼ percent and gasoline prices rose just under 2%. Heating oil prices fell 1%. Natural gas prices rose 11%. - Grain prices were higher or unchanged. Kansas wheat prices gained 1.5%, soybean prices rose 1% and corn prices increased about 1/3 percent.

- Precious metal prices once again increased. April gold futures prices increased just over 3%, May silver futures prices increased 2.5% and platinum prices jumped just shy of 7%.

- Base metal prices were mainly higher. Aluminum and nickel prices rose 4% and 5%, respectively and copper prices increased about 1/3 percent. Zinc prices declined almost 1.5%.

- The Bloomberg Commodity Index increased 1.6% with gains from the energy (due to sharply higher natural gas prices) and precious metals sectors providing most of the increase. Only the softs sector declined last week.

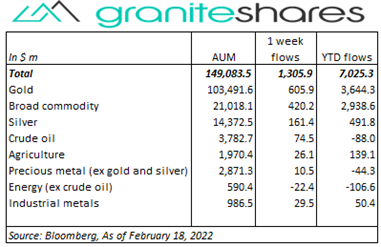

- More inflows into commodity ETPs mainly from gold ($605m), broad commodity ($420m), silver ($161m) and crude oil ($75m) ETPs. Only energy (ex-crude oil) ETPs had outflows (see table below).

Commentary

A high-volatility week with U.S. stock markets pushed and pulled by Russia-Ukraine-U.S. tensions and all but ignoring inflation and Fed monetary policy concerns. All three major stock indexes fell by 1.5% or more last week with daily moves of ¾ percent or more occurring 3 times for each index. U.S. stock prices continued their move lower Monday following the previous Friday’s sell off spurred by a White House announcement that Russia’s invasion of Ukraine was imminent. Markets reversed course Tuesday, moving higher on Russian reports of troop withdrawal from Ukraine’s border and growing hopes of de-escalation of tensions (and were mostly unchanged Wednesday following the release of FOMC minutes). Those hopes were dashed Thursday as NATO rebuffed Russian claims of troop withdrawal and as the White House again warned a Russian invasion of Ukraine was imminent causing all three major indexes to move sharply lower over Thursday and Friday. 10-year U.S. Treasury rates mirrored stock markets, rising 13bps through Tuesday with increasing hopes of Russian de-escalation and then falling 12bps the remainder of the week as those hopes faded. At week’s end, the S&P 500 fell 1.6% to 4,348,87, the Nasdaq Composite Index dropped 1.8% to 13,548.07, the Dow Jones Industrial Average lost 1.9% falling to 34,079.12, the 10-year U.S. Treasury rate increased 1bp to 1.93% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) was practically unchanged.

A high-volatility week with U.S. stock markets pushed and pulled by Russia-Ukraine-U.S. tensions and all but ignoring inflation and Fed monetary policy concerns. All three major stock indexes fell by 1.5% or more last week with daily moves of ¾ percent or more occurring 3 times for each index. U.S. stock prices continued their move lower Monday following the previous Friday’s sell off spurred by a White House announcement that Russia’s invasion of Ukraine was imminent. Markets reversed course Tuesday, moving higher on Russian reports of troop withdrawal from Ukraine’s border and growing hopes of de-escalation of tensions (and were mostly unchanged Wednesday following the release of FOMC minutes). Those hopes were dashed Thursday as NATO rebuffed Russian claims of troop withdrawal and as the White House again warned a Russian invasion of Ukraine was imminent causing all three major indexes to move sharply lower over Thursday and Friday. 10-year U.S. Treasury rates mirrored stock markets, rising 13bps through Tuesday with increasing hopes of Russian de-escalation and then falling 12bps the remainder of the week as those hopes faded. At week’s end, the S&P 500 fell 1.6% to 4,348,87, the Nasdaq Composite Index dropped 1.8% to 13,548.07, the Dow Jones Industrial Average lost 1.9% falling to 34,079.12, the 10-year U.S. Treasury rate increased 1bp to 1.93% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) was practically unchanged.

A volatile week for oil prices as well. Prices moved 2% higher Monday on Russia-Ukraine tensions then dropped 3.5% Tuesday on Russian reports of troop withdrawals. Wednesday saw prices climb almost 2% higher with NATO and the U.S. refuting Russian claims of withdrawals and as the EIA reported strong oil-related demand. Reports of significant progress in talks with Iran, increasing expectations of increased oil supply from Iran, reversed Wednesday’s gains pushing oil prices almost 2% lower. Oil prices moved ½ percent higher Friday on news removal of sanctions on Iran would not be immediate even upon a renewed agreement. Natural gas prices rose 11% last week on cold weather throughout the Midwest and Northeast and on longer-term forecasts of colder-than-normal weather through the first half of March.

Gold prices moved higher again last week as the Russia-Ukraine conflict continued and investor demand for haven investments increased. Like other markets, gold prices moved lower on Tuesday following Russian reports of troop withdrawals but then resumed their march higher the remainder of the week. FOMC minutes, released Wednesday, were also supportive of gold prices with the minutes deemed as more dovish than hawkish regarding Fed monetary policy. Silver and platinum prices moved higher as well.

Nickel and aluminum prices moved markedly higher. Fears of a Russian invasion of Ukraine resulting in severe sanctions against Russian metals companies was the primary reason for the price increases. Aluminum prices were also supported by low supply and reduced production due to soaring energy costs in Europe and China. Copper prices were up slightly, benefiting from Chinese fiscal stimulus.

Grain prices all moved higher last week buoyed by unfavorable weather conditions and forecasts in South America (soybeans and corn) and the Russia-Ukraine conflict (wheat). Russian reports of troop withdrawals drove wheat prices 2.5% lower Tuesday but those losses were recouped as tensions continued and the U.S. warned of of an imminent Russian invasion of Ukraine.

A high-volatility week with U.S. stock markets pushed and pulled by Russia-Ukraine-U.S. tensions and all but ignoring inflation and Fed monetary policy concerns. All three major stock indexes fell by 1.5% or more last week with daily moves of ¾ percent or more occurring 3 times for each index. U.S. stock prices continued their move lower Monday following the previous Friday’s sell off spurred by a White House announcement that Russia’s invasion of Ukraine was imminent. Markets reversed course Tuesday, moving higher on Russian reports of troop withdrawal from Ukraine’s border and growing hopes of de-escalation of tensions (and were mostly unchanged Wednesday following the release of FOMC minutes). Those hopes were dashed Thursday as NATO rebuffed Russian claims of troop withdrawal and as the White House again warned a Russian invasion of Ukraine was imminent causing all three major indexes to move sharply lower over Thursday and Friday. 10-year U.S. Treasury rates mirrored stock markets, rising 13bps through Tuesday with increasing hopes of Russian de-escalation and then falling 12bps the remainder of the week as those hopes faded. At week’s end, the S&P 500 fell 1.6% to 4,348,87, the Nasdaq Composite Index dropped 1.8% to 13,548.07, the Dow Jones Industrial Average lost 1.9% falling to 34,079.12, the 10-year U.S. Treasury rate increased 1bp to 1.93% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) was practically unchanged.

A volatile week for oil prices as well. Prices moved 2% higher Monday on Russia-Ukraine tensions then dropped 3.5% Tuesday on Russian reports of troop withdrawals. Wednesday saw prices climb almost 2% higher with NATO and the U.S. refuting Russian claims of withdrawals and as the EIA reported strong oil-related demand. Reports of significant progress in talks with Iran, increasing expectations of increased oil supply from Iran, reversed Wednesday’s gains pushing oil prices almost 2% lower. Oil prices moved ½ percent higher Friday on news removal of sanctions on Iran would not be immediate even upon a renewed agreement. Natural gas prices rose 11% last week on cold weather throughout the Midwest and Northeast and on longer-term forecasts of colder-than-normal weather through the first half of March.

Gold prices moved higher again last week as the Russia-Ukraine conflict continued and investor demand for haven investments increased. Like other markets, gold prices moved lower on Tuesday following Russian reports of troop withdrawals but then resumed their march higher the remainder of the week. FOMC minutes, released Wednesday, were also supportive of gold prices with the minutes deemed as more dovish than hawkish regarding Fed monetary policy. Silver and platinum prices moved higher as well.

Nickel and aluminum prices moved markedly higher. Fears of a Russian invasion of Ukraine resulting in severe sanctions against Russian metals companies was the primary reason for the price increases. Aluminum prices were also supported by low supply and reduced production due to soaring energy costs in Europe and China. Copper prices were up slightly, benefiting from Chinese fiscal stimulus.

Grain prices all moved higher last week buoyed by unfavoarable weather conditions and forecasts in South America (soybeans and corn) and the Russia-Ukraine conflict (wheat). Russian reports of troop withdrawals drove wheat prices 2.5% lower Tuesday but those losses were recouped as tensions continued and the U.S. warned of of an imminent Russian invasion of Ukraine.

Coming up this week

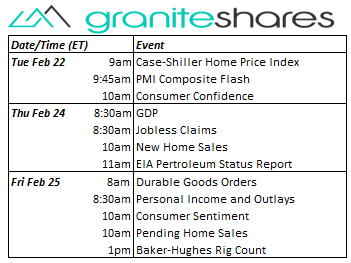

Holiday-shortened data week accentuated by PMI Composite Index Monday and GDP (Q1 2nd estimate) Thursday.

Holiday-shortened data week accentuated by PMI Composite Index Monday and GDP (Q1 2nd estimate) Thursday.- Case-Shiller Home Price Index, PMI Composite Flash and Consumer Confidence on Tuesday.

- GDP, Jobless Claims, New Home Sales on Thursday.

- Durable Goods Orders, Personal Income and Outlays, Consumer Sentiment and Pending Home Sales on Friday.

- EIA Petroleum Status Report Thursday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.