Commodities & Precious Metals Weekly Report: Feb 26

Posted:

Key points

Energy prices, except for natural gas prices, were all higher again last week. WTI and Brent crude oil prices increased 4% and gasoline and heating oil prices increased 3% and 2%, respectively. Natural gas prices fell 6.5%.

Energy prices, except for natural gas prices, were all higher again last week. WTI and Brent crude oil prices increased 4% and gasoline and heating oil prices increased 3% and 2%, respectively. Natural gas prices fell 6.5%.- Grain prices were mostly higher last week with corn and wheat prices increasing 1% and soybean prices increasing just under 2%. Kansas wheat prices diverged from Chicago wheat prices falling just under 1%.

- Base metal prices were mixed with aluminum and copper prices increasing and zinc and nickel prices decreasing. Aluminum prices rose 1%, copper prices rose under ½ percent while zinc prices lost 3% and nickel prices fell 5%.

- Precious metal prices fell last week with gold and silver prices falling about 3% and platinum prices losing 7%.

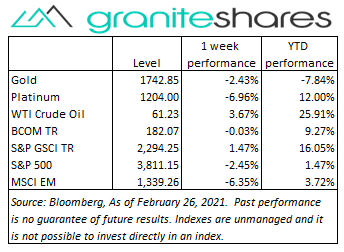

- The Bloomberg Commodity Index was unchanged on the week. Positive performance in the energy and grains sectors was offset by negative performance in the precious and base metals sectors.

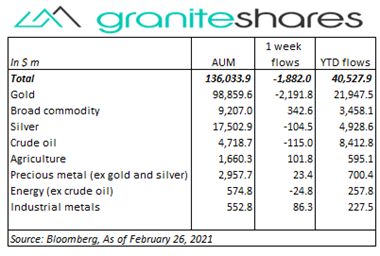

- Almost $2 billion outflows from commodity ETPs last week predominantly from gold ETPs. $2.2 billion gold outflows along with $100 million each of silver and crude oil ETP outflows were partially offset by $340 million of broad commodity and $90 million of industrial metal ETP inflows.

Commentary

Falling on increased concerns surrounding rising longer-term interest rates, major broad-market U.S. stock indexes all ended the week lower with the tech heavy Nasdaq Composite Index faring the worst. Intraday volatility increased last week with the S&P 500 and Nasdaq Composite Indexes reversing significant losses on Tuesday and Wednesday following comments from Fed Chairman Powell before Congress assuring markets that inflation was under control and that the Fed would continue its accommodative monetary policy. Nonetheless, lower-than-expected jobless claims and much higher-than-expected durable goods orders drove the 10-year U.S. Treasury rate to above 1.5%, precipitating a sharp selloff in U.S. stock markets. The U.S. dollar, down ¼ percent through Thursday, strengthened almost 1% on Friday reflecting market uncertainty with stock market levels. At week’s end the S&P 500 Index decreased 2.5% to 3,811.15, the Nasdaq Composite Index fell 4.9% to 13,192.35, The Dow Jones Industrial Average fell 1.8% to 30,932.27, the 10-year U.S. Treasury rate increased 8bps to 1.42% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.6%.

Falling on increased concerns surrounding rising longer-term interest rates, major broad-market U.S. stock indexes all ended the week lower with the tech heavy Nasdaq Composite Index faring the worst. Intraday volatility increased last week with the S&P 500 and Nasdaq Composite Indexes reversing significant losses on Tuesday and Wednesday following comments from Fed Chairman Powell before Congress assuring markets that inflation was under control and that the Fed would continue its accommodative monetary policy. Nonetheless, lower-than-expected jobless claims and much higher-than-expected durable goods orders drove the 10-year U.S. Treasury rate to above 1.5%, precipitating a sharp selloff in U.S. stock markets. The U.S. dollar, down ¼ percent through Thursday, strengthened almost 1% on Friday reflecting market uncertainty with stock market levels. At week’s end the S&P 500 Index decreased 2.5% to 3,811.15, the Nasdaq Composite Index fell 4.9% to 13,192.35, The Dow Jones Industrial Average fell 1.8% to 30,932.27, the 10-year U.S. Treasury rate increased 8bps to 1.42% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.6%.

Though up nearly 26% YTD and almost 4% for the week, WTI crude oil prices fell 2.5% Friday as rising U.S. and global interest rates increased concerns of slower economic growth. Friday’s strengthening of the U.S. dollar (up nearly 1%) and uncertainty surrounding the OPEC+ meeting later this week also contributed to Friday’s decline. Wednesday’s EIA report showing an increase in U.S. oil inventories and a significant decline in distillate inventories had little effect on oil prices with the aftermath of frigid weather conditions in Texas continuing to support oil prices.

Up almost 2% Monday, gold prices moved lower the remainder of the week falling sharply on Friday. Rising U.S. interest rates and stronger-than-expected economic reports pressured prices lower during the week while the U.S. dollar’s 1% strengthening on Friday also contributed to its decline. Platinum and silver prices followed gold prices lower.

Though base metal price changes were mixed last week, all base metal prices fell between 3% and 4% Friday as the U.S. dollar strengthened and amid increasing concerns of the effect of rising interest rates. Copper prices, up almost 5% through Thursday (and at 10-year highs) on expectations of post-pandemic economic growth and on concerns of supply shortages, fell 4% on Friday. Nickel prices, up just under a percent through Wednesday, ended the week down over 5%, possibly also affected by Elon Musk’s Thursday’s tweet saying Tesla would be switching some cars to iron-based batteries away from nickel-based.

Grain prices were mainly higher last week with corn, wheat and soybean prices increasing strongly through Wednesday on continued strong demand and weak supply conditions. Grain prices declined significantly Thursday and Friday with some of the decline attributable to profit taking and some to weaker-than-expected export numbers released by the USDA on Friday.

Coming up this week

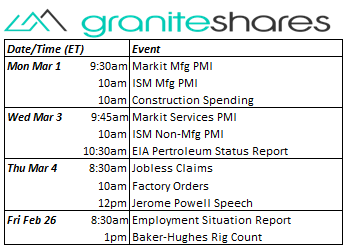

A data-week characterized by Markit and ISM PMI releases highlighted by the Employment Situation Report on Friday.

A data-week characterized by Markit and ISM PMI releases highlighted by the Employment Situation Report on Friday.- Markit and ISM Manufacturing PMIs and Construction Spending on Monday.

- Markit Services and ISM Non-Mfg PMIs on Wednesday.

- Jobless claims, Factory Orders and Jerome Powell speech on Thursday.

- Employment Situation Report on Friday.

- EIA petroleum status report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.