Commodities & Precious Metals Weekly Report: Jan 13

Posted:

Key points

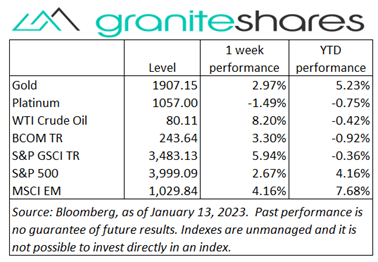

Energy prices, except for natural gas prices, all moved sharply higher. WTI and Brent crude oil prices and heating oil and gasoil prices increased north of 8%. Gasoline prices rose 13%. Natural gas prices (March futures contract) fell 6%.

Energy prices, except for natural gas prices, all moved sharply higher. WTI and Brent crude oil prices and heating oil and gasoil prices increased north of 8%. Gasoline prices rose 13%. Natural gas prices (March futures contract) fell 6%.- Grain prices were all higher last week.

Wheat prices increased 1%, corn prices rose 3% and soybean prices gained 2%. - Precious metal prices were mixed. Spot gold and silver prices increased 3% and 2% percent, respectively. Spot platinum prices decreased 2%.

- Base metal prices also were mixed. Aluminum and zinc prices increased 13% and 10%, respectively. Copper prices rose 8% and lead prices increased 2%. Nickel prices fell 5%.

- The Bloomberg Commodity Index rose 3.3%. Almost half the gain came from the energy sector and another half from the base and precious metals sectors.

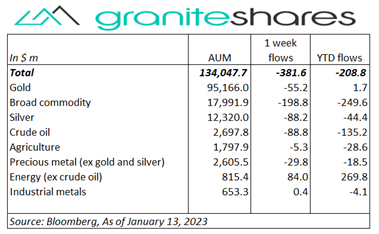

- Small outflows last week led by flows out of broad commodity ETPs. Only energy (ex-crude oil) ETPs had inflows.

Commentary

Stock markets moved higher last week propelled by growing expectations of peak and falling inflation and, as a result, a signficant easing of Fed monetary policy. All 3 major stock indexes rose prior to Thursday’s CPI release, all but ignoring Fed Chair Jerome Powell’s (and other Fed officials’) hawkish comments reminding the market that the Fed would sacrifice growth over inflation. Thursday’s slightly better-than-expected CPI release showed YoY headline and core inflation fell to 6.5% and 6.1%, respectively (MoM headline CPI actually decreased 0.1%). And while the Fed has warned Fed fund rates will remain high for a while, expectations of the Fed actually easing before year end have grown. Better=than-expected bank earnings reports (from JP Morgan and Bank of America) helped move stock prices higher Friday as well. While the U.S. dollar significantly weakened last week, the 10-year Treasury rate only moved slightly lower. 10-year Treasury rates fell 6bps with 10-year real rates dropping 18bps and 10-year inflation expectation increasing 12bps. At week’s end, the S&P 500 Index rose 2.7% to 3,999.09, the Nasdaq Composite Index increased 4.8% to 11,079.16, the Dow Jones Industrial Average gained 2.0% to close at 34,302.81, the 10-year U.S. Treasury rate fell 6bps to 3.50% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 1.7%.

Stock markets moved higher last week propelled by growing expectations of peak and falling inflation and, as a result, a signficant easing of Fed monetary policy. All 3 major stock indexes rose prior to Thursday’s CPI release, all but ignoring Fed Chair Jerome Powell’s (and other Fed officials’) hawkish comments reminding the market that the Fed would sacrifice growth over inflation. Thursday’s slightly better-than-expected CPI release showed YoY headline and core inflation fell to 6.5% and 6.1%, respectively (MoM headline CPI actually decreased 0.1%). And while the Fed has warned Fed fund rates will remain high for a while, expectations of the Fed actually easing before year end have grown. Better=than-expected bank earnings reports (from JP Morgan and Bank of America) helped move stock prices higher Friday as well. While the U.S. dollar significantly weakened last week, the 10-year Treasury rate only moved slightly lower. 10-year Treasury rates fell 6bps with 10-year real rates dropping 18bps and 10-year inflation expectation increasing 12bps. At week’s end, the S&P 500 Index rose 2.7% to 3,999.09, the Nasdaq Composite Index increased 4.8% to 11,079.16, the Dow Jones Industrial Average gained 2.0% to close at 34,302.81, the 10-year U.S. Treasury rate fell 6bps to 3.50% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 1.7%.

Oil prices sharply increased last week, reversing most of the previous week’s losses. The primary driving force behind the gain was China’s reopening of its borders. The reopening along with increased Chinese crude imports increased demand expectations pushing prices higher. Also buoying prices were the EIA’s forecast of record global petroleum consumption for 202, growing expectations of easing Fed monetary policy following Thursday’s slightly better-than-expected U.S. CPI release and a weaker U.S. dollar.

Gold prices rose again last week with spot prices climbing almost 3%. Growing expectations of peak inflation and a less aggressive fund – supported by Thursday’s slightly better-than-expected CPI release pushed gold prices higher every day but Wednesday last week. A markedly weaker U.S. dollar and falling longer-term real rates also helped move prices higher. Silver prices moved higher with gold prices while platinum prices fell a little over 2% perhaps as a result of profit taking.

Increased demand expectations driven by China’s reopening of its borders, pushed most base metal prices higher last week. Increased expectations of a less aggressive Fed, bolstered by a slightly better-than-expected CPI release, also supported prices as did a markedly weaker U.S. dollar. Aluminum and zinc prices also benefited from low inventory levels and, in addition, may have benefited from buying resulting from last week’s rebalancing of the Bloomberg Commodity Index.

Grain prices moved higher last week propelled mainly by a bullish USDA WASDE report released Thursday. Prior to the report, aggressive Russian wheat pricing, expectations of a record Brazilian soybean crop (and large corn crop) and depressed corn export levels either pressured prices lower or capped gains. Thursday’s WASDE report showing an unexpected decline in U.S. ending stock levels for both corn and soybeans bolstered those prices through the end of the week while historically low ending stock levels and Black Sea shipping concerns supported wheat prices. Reports suggesting a lower-than-expected Argentinian corn and soybean crop (due to weather) also supported prices.

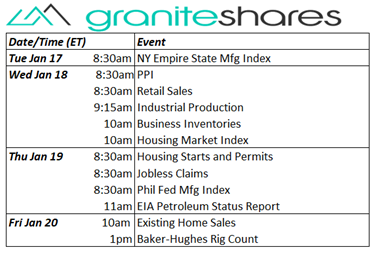

Coming up this week

A slew of housing-related data, PPI and retail sales punctuate this coming week.

A slew of housing-related data, PPI and retail sales punctuate this coming week.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.