Commodities & Precious Metals Weekly Report: Jan 27

Posted:

Key points

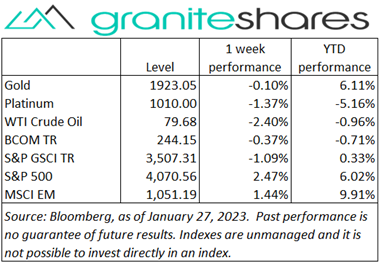

Energy prices all moved lower last week. WTI and Brent crude oil prices fell 2%. Heating oil and gas oil prices dropped 5% and 4%, respectively, and gasoline prices decreased 2%. Natural gas prices (March futures contract) fell 6%.

Energy prices all moved lower last week. WTI and Brent crude oil prices fell 2%. Heating oil and gas oil prices dropped 5% and 4%, respectively, and gasoline prices decreased 2%. Natural gas prices (March futures contract) fell 6%.- Grain prices were all higher. Wheat prices moved 1% to 2% higher, corn prices increased 1% and soybean prices increased less than ½ percent.

- Precious metal prices were mixed. Spot gold prices were basically unchanged while spot silver and platinum prices fell 1% and 3%, respectively.

- Base metal prices were mixed. Aluminum and nickel prices increased less than ½ percent and lead prices gained 5%. Copper prices dropped 1% and zinc prices fell less than ½ percent.

- The Bloomberg Commodity Index decreased 0.4%. Losses in the energy sector were partially offset by gains in the grains and soft sectors.

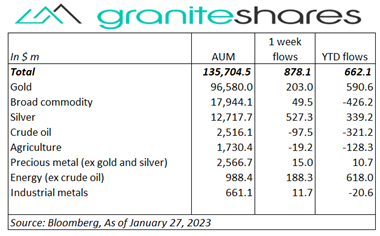

- Almost $900 million flowed into commodity ETP assets last week. Silver ETPs led the way receiving over $500 million, followed by $200 million each into gold and energy (ex-crude oil) ETPs.

Commentary

Major stock market indexes ended the week higher with the Nasdaq Composite Index strongly outperforming both the S&P 500 Index and the Dow Jones Industrial Average. Markets moved higher Monday on growing expectations the Fed would tighten by 25bps this week, acting as a prelude to less aggressive Fed monetary policy and perhaps easing later this year. Indexes remained range bound Tuesday and Wednesday but moved higher Thursday following the first estimate Q4 GDP release. Though the headline number was better than expected, the increase was driven by a build in business inventories but offset by increasing-but-slowing consumer spending and business investment. Durable Goods Orders and New Home Sales (also released Thursday), however, came in stronger than expected. Nonetheless, indexes again moved higher on expectations of easing Fed monetary policy. Friday’s PCE price index released showed a YoY increase of 4.4% and 0.1 MoM, less than expected but the core PCE Price Index registered a 0.3% MoM increase adding to uncertainty regarding future Fed policy. Stock indexes increased Friday, perhaps bolstered by lower-than-expected household spending (part of the personal income and expenditures report), but closed well off intraday highs. The 10-year Treasury rate, moved 3bps higher with an 8bps increase in 10-year inflation expectation offset by a 5bp decline in 10-year real rates. (10-year real rates fell to 1.19% while 10-year inflation expectation increased to 2.32%). At week’s end, the S&P 500 Index gained 2.5% to close at 4,070.56, the Nasdaq Composite Index jumped 4.3% to 11,621.71, the Dow Jones Industrial Average increased 1.8% to 33,976.08 the 10-year U.S. Treasury rate rose 3bps to 3.51% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.1%.

Major stock market indexes ended the week higher with the Nasdaq Composite Index strongly outperforming both the S&P 500 Index and the Dow Jones Industrial Average. Markets moved higher Monday on growing expectations the Fed would tighten by 25bps this week, acting as a prelude to less aggressive Fed monetary policy and perhaps easing later this year. Indexes remained range bound Tuesday and Wednesday but moved higher Thursday following the first estimate Q4 GDP release. Though the headline number was better than expected, the increase was driven by a build in business inventories but offset by increasing-but-slowing consumer spending and business investment. Durable Goods Orders and New Home Sales (also released Thursday), however, came in stronger than expected. Nonetheless, indexes again moved higher on expectations of easing Fed monetary policy. Friday’s PCE price index released showed a YoY increase of 4.4% and 0.1 MoM, less than expected but the core PCE Price Index registered a 0.3% MoM increase adding to uncertainty regarding future Fed policy. Stock indexes increased Friday, perhaps bolstered by lower-than-expected household spending (part of the personal income and expenditures report), but closed well off intraday highs. The 10-year Treasury rate, moved 3bps higher with an 8bps increase in 10-year inflation expectation offset by a 5bp decline in 10-year real rates. (10-year real rates fell to 1.19% while 10-year inflation expectation increased to 2.32%). At week’s end, the S&P 500 Index gained 2.5% to close at 4,070.56, the Nasdaq Composite Index jumped 4.3% to 11,621.71, the Dow Jones Industrial Average increased 1.8% to 33,976.08 the 10-year U.S. Treasury rate rose 3bps to 3.51% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.1%.

Oil prices moved lower last week pressured by global recession concerns and increased Russian production. Unchanged to slightly higher Monday on expectations of increased demand from China’s reopening, prices moved markedly lower Tuesday on expectations of a strong build in U.S. oil inventories and continued contraction in U.S. economic activity. Prices rebounded partially Thursday, supported by stronger-than-expected economic data only to see those gains and more erased by greatly increased Russian oil production (as indicated by a significant increase of Baltic seaport tanker loadings). Natural gas prices continued to move lower (down 6% on the week), pressured by moderate (warm weather related) demand and healthy production levels.

Up over 1% through Wednesday on growing expectations of a more benign Fed due to continued contracting U.S. economic activity, gold prices fell Thursday – giving up most of the intraweek gains – following stronger-than-expected U.S. GDP growth, Durable Goods Orders and New Home Sales (as reported Thursday). (Interestingly, the GDP growth came primarily from increased business inventories but with slowing consumer spending and business investment, all-in-all not necessarily indicative of economic strength.). Silver prices finished the week down 1%, simply not performing as well as gold prices while platinum prices, down 3%, suffered from falling sharply weaker palladium prices.

Base metal prices were mainly slightly lower last week. Uncertainty surrounding this week’s FOMC and ECB decisions and decreased trading due to the Chinese New Year holiday subdued market activity.

Grain prices moved higher last week. Corn prices benefited from increased export demand, lowered Argentinian corn crop estimates and Ukraine-Russia war escalations. Wheat prices were supported as well by Russia-Ukraine war escalations but also by continued weather concerns in the southern Plains states and Oklahoma and Kansas. The USDA stating that Russia’s wheat crop estimate was grossly overstated also supported prices. Soybean prices moved higher on good export demand and uncertainty surrounding Argentina’s crop estimates.

Coming up this week

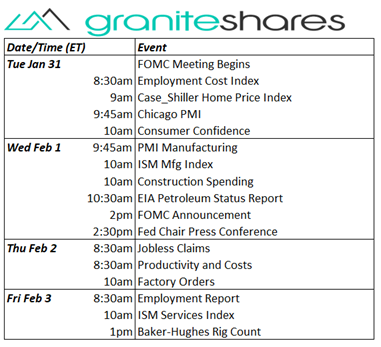

A congested week primarily centered on the FOMC Announcement Wednesday and the Employment Report Friday but also looking to PMI and ISM Manufacturing Indexex, Consumer Confidence and the ISM Services Index.

A congested week primarily centered on the FOMC Announcement Wednesday and the Employment Report Friday but also looking to PMI and ISM Manufacturing Indexex, Consumer Confidence and the ISM Services Index.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.