Commodities & Precious Metals Weekly Report: Jan 7

Posted:

Key points

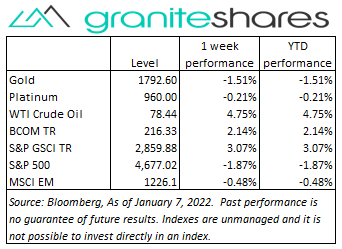

Energy prices were all higher again last week. WTI and Brent crude oil prices increased 4.8% and 5.1%, respectively. Gasoline and gasoil prices increased 6.1% percent. Natural gas prices rose 4.8% and gasoline prices increased 3.5%.

Energy prices were all higher again last week. WTI and Brent crude oil prices increased 4.8% and 5.1%, respectively. Gasoline and gasoil prices increased 6.1% percent. Natural gas prices rose 4.8% and gasoline prices increased 3.5%.- Grain prices were mixed. Chicago and Kansas wheat prices decreased 1.6% and 3.3%, respectively. Corn prices increased 2.3% and soybean prices gained 5.3%.

- Precious metal prices were lower. February gold and March silver futures prices fell 1.7% and 4.0%, respectively. Platinum prices eased 0.2%.

- Base metal prices, except for aluminum prices, were lower. Copper prices fell 1.2%. Zinc and nickel prices decreased 0.1%. Aluminum prices rose 3.8%.

- The Bloomberg Commodity Index increased 2.1%, primarily benefiting from higher energy and corn and soybean prices. The precious metals sector detracted from index performance.

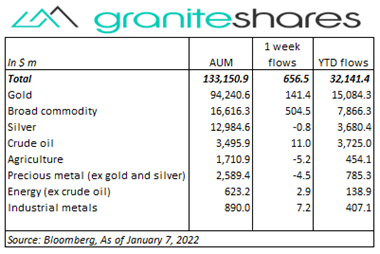

- Over $650 million of inflows into commodity ETPS mainly from broad commodity ETPs ($505m) and gold ($141m). Only small flows in the remaining sectors.

Commentary

Starting the new year strong, with the S&P 500 Index and the Dow Jones Industrial Average setting new records, stock prices reversed course, propelled by the release of FOMC minutes Wednesday, and headed lower the remainder of the week. The FOMC minutes revealed Fed governors were more concerned about inflation than estimated and were considering not only a faster tapering pace – leading to sooner-than-expected rate increases – but also were contemplating reducing the Fed balance sheet concomitant with rate increases. The minutes pushed 10-year U.S. Treasury rates higher and facilitated the rotation from tech/growth stocks into cyclical/value stocks with the Nasdaq Composite Index significantly underperforming both the Dow Jones Industrial Average and the S&P 500 Index. Friday’s weaker-than-expected non-farm payroll report, showing a pickup of only 200,000 jobs, did little to reverse Fed-tightening fears with both the S&P 500 and the Nasdaq Composite Indexes moving lower. 10-year U.S. real rates moved significantly higher, rising 34bps to -0.77%. At week’s end, the S&P 500 Index decreased 1.9% to 4,677.02, the Nasdaq Composite Index dropped 4.5% to 14,935.90, the Dow Jones Industrial Average decreased 0.3% to 36,231.53, the 10-year U.S. Treasury rate increased 26bps to 1.77% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.3%.

Starting the new year strong, with the S&P 500 Index and the Dow Jones Industrial Average setting new records, stock prices reversed course, propelled by the release of FOMC minutes Wednesday, and headed lower the remainder of the week. The FOMC minutes revealed Fed governors were more concerned about inflation than estimated and were considering not only a faster tapering pace – leading to sooner-than-expected rate increases – but also were contemplating reducing the Fed balance sheet concomitant with rate increases. The minutes pushed 10-year U.S. Treasury rates higher and facilitated the rotation from tech/growth stocks into cyclical/value stocks with the Nasdaq Composite Index significantly underperforming both the Dow Jones Industrial Average and the S&P 500 Index. Friday’s weaker-than-expected non-farm payroll report, showing a pickup of only 200,000 jobs, did little to reverse Fed-tightening fears with both the S&P 500 and the Nasdaq Composite Indexes moving lower. 10-year U.S. real rates moved significantly higher, rising 34bps to -0.77%. At week’s end, the S&P 500 Index decreased 1.9% to 4,677.02, the Nasdaq Composite Index dropped 4.5% to 14,935.90, the Dow Jones Industrial Average decreased 0.3% to 36,231.53, the 10-year U.S. Treasury rate increased 26bps to 1.77% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 0.3%.

Oil prices moved markedly higher last week bolstered by supply disruptions in Libya, Nigeria and Angola, unrest in Kazakhstan and expectations of strong demand despite recent weakness due to increased Omicron cases. OPEC+ agreed, as expected, to maintain its planned 400,000 bpd increase in February though it is unlikely realization of that increase will occur due to OPEC country production difficulties. While U.S oil inventories fell last week, gasoline inventories increased a greater-than-expected 10 million barrels, increasing on the back of depressed demand due to Omicron. Oil prices increased every day last week but Friday when the weaker-than-expected U.S. non-farm payroll report moved prices lower.

A volatile week for gold prices, falling sharply Monday and Thursday while moving ½ percent higher or more Tuesday, Wednesday and Friday. Short-lived risk-on sentiment, spurred by easing Omicron concerns, moved prices lower Monday with rising Omicron concerns and increased inflation concerns driving gold prices higher Tuesday, recouping almost half of Monday’s losses. Wednesday’s release of FOMC minutes, revealing Fed intentions to more aggressively tighten, pushed prices sharply lower Thursday with inflation expectations – as measured by the 10-year breakeven inflation rate – finally decreasing on the week and as 10-year U.S real yields moved significantly higher. Gold prices moved higher Friday following a weaker-than-expected non-farm payroll report. For the week, U.S 10-year real rates increased 34bps to -0.77% and the 10-year breakeven inflation rate decreased 8bps to 2.54%.

Aluminum prices continued their move higher, increasing 3.8% last week, as high energy prices in Europe continue to force production scale backs. Copper prices moved lower following Wednesday’s FOMC minutes release revealing Fed plans to more aggressively tighten, falling almost 2.5% through Thursday. Friday’s weaker-than-expected non-farm payroll report, however, moved copper prices higher reducing the week’s losses to 1.2%.

Wheat prices continued to move lower last week, pressured by favorable crop expectations in South America and Australia. Corn and soybean prices moved higher driven by deteriorating weather conditions in South America. Favorable weather conditions through mid December (benefiting South American wheat crops) with weekly rainfalls has shifted to hot and dry conditions negatively affecting soybean and corn crops.

Coming up this week

CPI, PPI and Fed Chair Powell testimony before the Joint Economic Committee highlight this week’s events and data.

CPI, PPI and Fed Chair Powell testimony before the Joint Economic Committee highlight this week’s events and data.- Jerome Powell Testimony on Tuesday.

- CPI on Wednesday.

- Jobless Claims and PPI on Thursday.

- Retail Sales, Industrial Production and Consumer Sentiment on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.