Commodities & Precious Metals Weekly Report: Jan 8

Posted:

Key points

Energy prices moved sharply higher last week with WTI crude oil prices rising above $50/barrel. WTI and Brent crude oil prices increased approximately 8% and gasoline prices rose almost 9%. Natural gas prices gained 5%.

Energy prices moved sharply higher last week with WTI crude oil prices rising above $50/barrel. WTI and Brent crude oil prices increased approximately 8% and gasoline prices rose almost 9%. Natural gas prices gained 5%.- Wheat prices were lower last week while corn and soybean prices increased. Wheat prices fell between ¼% and 1.5%. Corn prices increased 2.5% and soybean prices increased almost 5%.

- Base metal prices were all higher last week with nickel prices increasing the most. Nickel prices rose almost 6.5%, followed by copper prices, up almost 4.5%. Aluminum and zinc prices increased about 2%.

- Gold and silver prices were lower last week. Gold prices fell 1.5% and silver prices dropped about 6.5%. Platinum prices increased almost 3.5%.

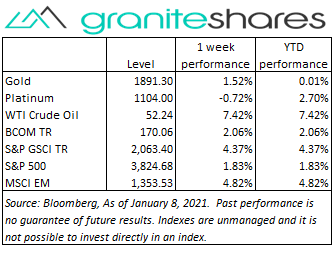

- The Bloomberg Commodity finished the week higher again last week, increasing 2.1%. The increase was driven primarily by the energy sector though the base metals and grains sectors also meaningfully contributed. The precious metals sector detracted from the index’s return.

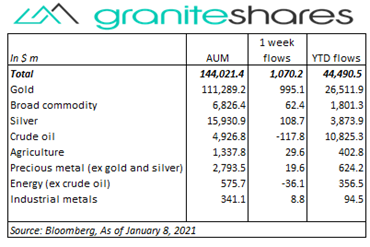

- Total assets in commodity ETPs increased $435 million last week, predominately from inflows into gold and silver ETPs. Crude oil ETP outflows were the only outflows last week.

- Decent inflows into commodity ETPs with assets increasing almost $1.1 billion last week. The lion’s share of the inflows - almost $1 billion- were into gold ETPs. Silver ETP inflows of about $100 million were offset by crude oil ETP outflows of $118 million.

Commentary

U.S. stock markets moved higher last week after starting the week and the year with a sharp selloff. Coronavirus-related concerns and uncertainty surrounding Georgia Senate runoff elections present on Monday were diminished after Democrat wins in Georgia and Joe Biden being declared the next president of the U.S. Expectations of increased stimulus spending and Saudi Arabia’s announcement it would unilaterally reduce oil production helped power oil prices, global stock markets and longer-term U.S. interest rates higher while also strengthening the U.S. dollar despite a weaker-than-expected employment report. At week’s end the S&P 500 Index increased 1.8% to 3,824.68, the Nasdaq Composite Index increased 2.4% to 13,201.98, the 10-year U.S. Treasury rate jumped 20bps to 1.12% and the dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened .2%.

U.S. stock markets moved higher last week after starting the week and the year with a sharp selloff. Coronavirus-related concerns and uncertainty surrounding Georgia Senate runoff elections present on Monday were diminished after Democrat wins in Georgia and Joe Biden being declared the next president of the U.S. Expectations of increased stimulus spending and Saudi Arabia’s announcement it would unilaterally reduce oil production helped power oil prices, global stock markets and longer-term U.S. interest rates higher while also strengthening the U.S. dollar despite a weaker-than-expected employment report. At week’s end the S&P 500 Index increased 1.8% to 3,824.68, the Nasdaq Composite Index increased 2.4% to 13,201.98, the 10-year U.S. Treasury rate jumped 20bps to 1.12% and the dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened .2%.

Mirrowing U.S. stock markets, oil prices started the week and the year falling sharply only to rally almost 10% over the remainder of the week. Concerns over stalled OPEC+ production talks gave way to bullish optimism with Saudi Arabia announcing unilateral production cutbacks of a 1 million barrels/day beginning February. WTI crude oil prices, down almost 2% Monday (March futures contract), increased almost 5% and closed above $50/barrel on Tuesday following Saudi Arabia’s announcement. A larger-than-expected drawdown in U.S. oil inventories and strong Asian demand also supported oil prices with WTI crude oil prices finishing the week almost 8% higher.

Performing oppositely to U.S. stock markets, gold prices rallied Monday only to move lower the remainder of the week with growing concerns of increasing real yields precipitated by expectations of increased U.S government stimulus spending. 10-year U.S real yields moved off of historical lows last week increasing from -1.08% to -0.93% while the U.S. dollar strengthened strongly from its low of the week Tuesday. Silver prices followed gold prices but fell more sharply. Platinum prices increased benefiting from higher base metal prices.

Supported by expectations of increased stimulus spending in the U.S. as well as by continued positive news regarding Covid-19 vaccinations, base metal prices moved sharply higher last week though prices did fall Friday, moving off the highs of the week. Nickel prices also benefited from bullish expectations of sales and production of electric vehicles.

Corn and soybean prices continued to be supported by adverse, dry weather conditions as well as by concerns of labor unrest in South America. Wheat prices, initially supported by news Argentina would limit wheat exports, moved lower following reports restrictions would not be implemented.

Coming up this week

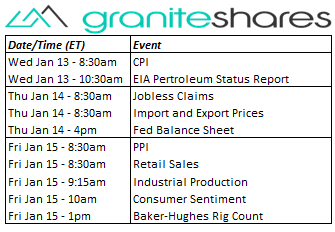

Quiet data-week with most data released on Friday.

Quiet data-week with most data released on Friday.- CPI on Wednesday.

- Jobeless claims, Import and Export Prices and the Fed Balance Sheet on Thursday.

- PPI, Retail Sales, Industrial Production and Consumer Sentiment on Friday.

- EIA petroleum status report on Wednesday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.