Commodities & Precious Metals Weekly Report: Jul 14

Posted:

Key points

Energy prices, except for natural gas prices (once again), moved higher. WTI and Brent crude oil and heating oil prices increased 2%. Gasoline and gasoil prices rose 3%. Natural gas prices fell 2%.

Energy prices, except for natural gas prices (once again), moved higher. WTI and Brent crude oil and heating oil prices increased 2%. Gasoline and gasoil prices rose 3%. Natural gas prices fell 2%.- Wheat prices increased 2% and corn and soybean prices increased 4%.

- Spot gold prices rose 2%. Spot silver and platinum prices climbed 8%.

- Copper, zinc, nickel and lead prices rose between 3% - 4%. Aluminum prices gained 6%.

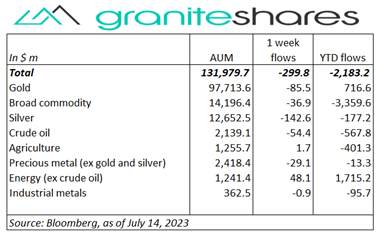

- The Bloomberg Commodity Index rose 2.7%. The grains and base and precious metals sectors combined were responsible for ¾ of the gain with the energy section contributing another 1/6th. All sectors were up on the week.

- Smaller outflows again last week this time mainly from silver ETPs but also from gold, crude oil and broad commodity ETPs. Small inflows into energy (ex-crude oil) ETPs.

Commentary

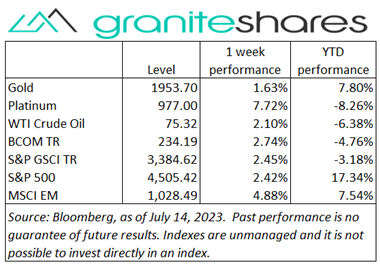

Stock markets moved higher last week, supported by strong economic data, decent bank earnings and falling inflation levels. All 3 major stock market indexes moved higher throughout the week, rising early in the week (before CPI and PPI releases) on continued indications of a resilient economy and, to some extent, positive earnings reports expectations. Wednesday’s CPI release showing both headline and core inflation slowed substantively added to market sentiment, boosting hopes of softer Fed monetary policy going forward and of a “soft landing”. Thursday’s better-than-expected PPI release added to this sentiment. Better-than-expected major bank earnings reports Friday were somewhat ameliorated by concerns regarding profits going forward and uncertainty regarding upcoming regional bank earnings reports. Unchanged (and very high) expectations of a Fed rate hike this month combined with hawkish comments from some Fed officials (stating one data point does not define a trend) contributed to this uncertainty, perhaps capping market gains on the week. Nonetheless, both the U.S. dollar and 10-year Treasury rates reflected growing expectations of a Fed pivot sooner than later, with the U.S. dollar sharply weakening and the 10-year Treasury rate dropping double digits. For the week, the S&P 500 Index increased 2.4% to 4,505.42, the Nasdaq Composite Index gained 3.3% to 14,113.70, the Dow Jones Industrial Average rose 2.3% to 34,510.22, the 10-year U.S. Treasury rate fell 24bps to 3.83% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 2.3%.

Stock markets moved higher last week, supported by strong economic data, decent bank earnings and falling inflation levels. All 3 major stock market indexes moved higher throughout the week, rising early in the week (before CPI and PPI releases) on continued indications of a resilient economy and, to some extent, positive earnings reports expectations. Wednesday’s CPI release showing both headline and core inflation slowed substantively added to market sentiment, boosting hopes of softer Fed monetary policy going forward and of a “soft landing”. Thursday’s better-than-expected PPI release added to this sentiment. Better-than-expected major bank earnings reports Friday were somewhat ameliorated by concerns regarding profits going forward and uncertainty regarding upcoming regional bank earnings reports. Unchanged (and very high) expectations of a Fed rate hike this month combined with hawkish comments from some Fed officials (stating one data point does not define a trend) contributed to this uncertainty, perhaps capping market gains on the week. Nonetheless, both the U.S. dollar and 10-year Treasury rates reflected growing expectations of a Fed pivot sooner than later, with the U.S. dollar sharply weakening and the 10-year Treasury rate dropping double digits. For the week, the S&P 500 Index increased 2.4% to 4,505.42, the Nasdaq Composite Index gained 3.3% to 14,113.70, the Dow Jones Industrial Average rose 2.3% to 34,510.22, the 10-year U.S. Treasury rate fell 24bps to 3.83% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 2.3%.

Oil prices rose last week, supported by falling inflation and strong demand expectations. Better-than-expected CPI and PPI releases (increasing expectations of looser Fed monetary policy going forward) along with EIA and IEA projections of increased demand and tighter supplies, helped move oil prices higher on the week. A weaker U.S. dollar (a byproduct of increased expectations of a sooner-than-later Fed pivot) also contributed to higher prices. Prices did move lower Friday, despite production disruptions in Libya and Nigeria, on the back of an appreciating U.S. dollar.

Spot gold prices also moved higher on the week, benefiting from the same factors as the U.S. stock market and oil prices. Better-than-expected CPI (headline and core) and PPI releases and increased expectations of a Fed pivot sooner than later, markedly depreciated the U.S. dollar, pushing gold prices higher throughout the week. Gold prices slightly retreated Friday on a marginally stronger U.S. dollar

Base metal prices also moved higher over the week. As with precious metal prices, better-than-expected CPI and PPI releases along with growing conviction Fed monetary policy will be less aggressive going forward, helped move prices higher throughout the week. China deflationary/demand concerns pressured prices lower early in the week, but stronger-than-expected China auto sales combined with a real estate stimulus package extension diminished China-related concerns, supporting prices as well.

A volatile week for grain prices. Wednesday’s USDA WASDE report pushed soybean and wheat prices sharply lower following much larger-than-expected increases in projected inventory and production levels. Corn prices, too, fell sharply Wednesday, with markets sharply discounting the report’s projections for unchanged inventory levels (the markets believe inventory levels will be much higher). Those losses, however, were more than reversed the remainder of the week on renewed drought-related concerns. Grain prices also benefited from a weaker U.S. dollar. India’s ban on rice exports and uncertainty surrounding an extension of the Black Sea export agreement also supported wheat prices.

Coming Up This Week

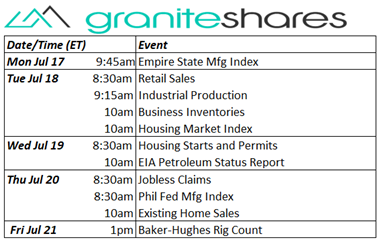

Busy data week punctuated with Empire State and Philadelphia Fed Manufacturing index releases, retail sales, housing starts and existing home sales.

Busy data week punctuated with Empire State and Philadelphia Fed Manufacturing index releases, retail sales, housing starts and existing home sales.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.