Commodities & Precious Metals Weekly Report: Jul 7

Posted:

Key points

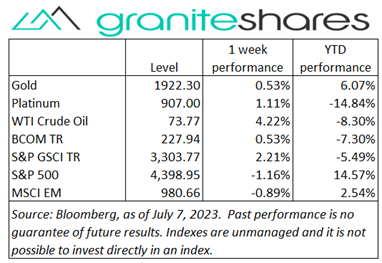

Energy prices, except for natural gas prices again, moved higher. WTI and Brent crude oil, heating oil and gasoil prices increased 4%. Gasoline prices rose 2%. Natural gas prices fell 7%.

Energy prices, except for natural gas prices again, moved higher. WTI and Brent crude oil, heating oil and gasoil prices increased 4%. Gasoline prices rose 2%. Natural gas prices fell 7%.- Grain prices were mainly lower. Corn and Chicago wheat moved marginally lower, declining about ¼ percent. Soybean prices fell 2%. Kansas City wheat prices rose 2%.

- Spot gold prices rose about ¼ percent. Spot silver and platinum prices increased 1.5%.

- Base metal prices were mixed. Nickel and copper prices increased 1%. Aluminum and zinc prices decreased 1% and lead prices fell 2%.

- The Bloomberg Commodity Index increased 0.5%. Gains in the energy, precious metals and softs sectors were partially offset primarily by losses in the grains sector.

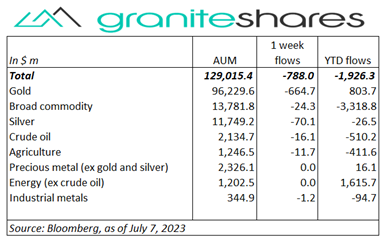

- More outflows last week with Gold ETPs once again losing the most. Small outflows from all other ETP categories.

Commentary

All 3 major stock indexes fell last week with the Dow Jones Industrial Average falling the most, followed by the S&P 500 Index and then by the NASDAQ Composite Index. Surprisingly, – given the over 20bps increase in the 10-year Treasury rate - the NASDAQ Composite Index outperformed the other two. The July 4th holiday-shortened week saw markets increase only Monday, moving higher on much better-than-expected TSLA sales and Rivian deliveries and on a weaker-than-expected ISM Mfg Index release. Markets moved lower the remainder of the week, reacting to a myriad of factors including hawkish FOMC minutes (released Wednesday), a stronger-than-expected ISM Services Index Thursday and a jobs report (released Friday) showing continued significant upward wage pressures and a drop in the unemployment rate (both negating a smaller-than-expected increase in payrolls). All of these factors increased market expectations of additional Fed rate hikes and, at the same time, lowered expectations of a Fed pivot in the near future. Reflecting these expectations, the 10-year Treasury rate rose 23bps with 21bps of that increase coming from higher 10-year real rates. Interestingly, the U.S. dollar weakened over the week, likely reflecting expectations of even tighter BoE and ECB monetary policy. For the week, the S&P 500 Index decreased 1.1% to 4,399.63, the Nasdaq Composite Index fell 0.9% to 13,660.72, the Dow Jones Industrial Average dropped 2.0% to 33,705.01, the 10-year U.S. Treasury rate increased 23bps to 4.07% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.6%.

All 3 major stock indexes fell last week with the Dow Jones Industrial Average falling the most, followed by the S&P 500 Index and then by the NASDAQ Composite Index. Surprisingly, – given the over 20bps increase in the 10-year Treasury rate - the NASDAQ Composite Index outperformed the other two. The July 4th holiday-shortened week saw markets increase only Monday, moving higher on much better-than-expected TSLA sales and Rivian deliveries and on a weaker-than-expected ISM Mfg Index release. Markets moved lower the remainder of the week, reacting to a myriad of factors including hawkish FOMC minutes (released Wednesday), a stronger-than-expected ISM Services Index Thursday and a jobs report (released Friday) showing continued significant upward wage pressures and a drop in the unemployment rate (both negating a smaller-than-expected increase in payrolls). All of these factors increased market expectations of additional Fed rate hikes and, at the same time, lowered expectations of a Fed pivot in the near future. Reflecting these expectations, the 10-year Treasury rate rose 23bps with 21bps of that increase coming from higher 10-year real rates. Interestingly, the U.S. dollar weakened over the week, likely reflecting expectations of even tighter BoE and ECB monetary policy. For the week, the S&P 500 Index decreased 1.1% to 4,399.63, the Nasdaq Composite Index fell 0.9% to 13,660.72, the Dow Jones Industrial Average dropped 2.0% to 33,705.01, the 10-year U.S. Treasury rate increased 23bps to 4.07% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.6%.

Falling Monday on weaker-than-expected global factory activity and on concerns of Chinese demand, oil prices rose the remainder of the week, increasing just over 4% on the week. Increased supply concerns were the primary impetus for the rise in prices with Saudi Arabia extending its voluntary production cuts through August, Russia announcing it intends to reduce production and Wednesday’s EIA report showing, once again, another larger-than-expected drop in inventory levels. A weaker U.S. dollar also supported prices. Natural gas prices fell over 7% last week, dropping on increased supplies and favorable weather forecasts.

Spot gold prices ended the week slightly higher thanks to Friday’s mixed jobs report. Down ½ percent through Thursday on hawkish FOMC minutes (released Wednesday) and a stronger-than-expected ISM Services release Thursday, gold prices rose ¾ percent Friday following a jobs report headlining a weaker-than-expected increase in payrolls. A weaker U.S. dollar (down over ¾ percent Friday) also supported prices. Silver and platinum prices moved higher as well, outperforming gold prices over the week.

Base metal prices moved lower week once again last week. The move lower came as global rate-hike expectations increased and on continued concerns regarding Chinese demand. Growing European recession concerns in the face of continued BoE and ECB tightening also pressured prices lower. Friday’s mixed jobs report headlining a smaller-than-expected increase in payrolls, helped moved prices higher Friday as the U.S. dollar weakened.

Grain prices ended lower as well last week, pressured by favorable weather forecasts and, for corn prices, continued fallout from last week’s USDA Planted Acres report. Wheat prices, up sharply Wednesday on fears of an attack on Ukraine’s Zaporizhzhia nuclear power plant, fell the remainder of the week as those fears subsided and on reports of a possible extension of the Black Sea export agreement.

Coming Up This Week

Light-but-important data week with focus on Wednesday’s CPI release.

Light-but-important data week with focus on Wednesday’s CPI release.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.