Commodities & Precious Metals Weekly Report: Jun 30

Posted:

Key points

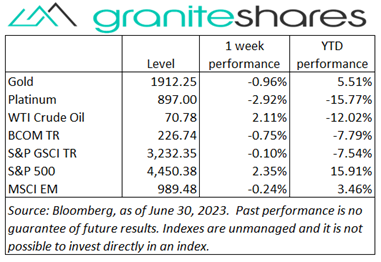

Energy prices, except for natural gas prices, moved higher. WTI and Brent crude oil prices increased 2% and gasoline and heating oil prices rose 4% and 3%, respectively. Natural gas prices fell 2%.

Energy prices, except for natural gas prices, moved higher. WTI and Brent crude oil prices increased 2% and gasoline and heating oil prices rose 4% and 3%, respectively. Natural gas prices fell 2%.- Grain prices were mixed. Chicago and Kansas City wheat prices fell 13% and 7%, respectively and corn prices dropped 17%. Soybean prices increased 3%.

- Spot gold fell less than 1/10th of a percent. Spot silver prices rose 2%. Platinum prices fell 2%.

- Base metal prices were mainly lower. Nickel prices fell 4%. Aluminum and copper and lead prices decreased 1%. Zinc prices rose 1%.

- The Bloomberg Commodity Index decreased 0.8%. Gains in the energy sector were primarily offset by declines in the grains sector.

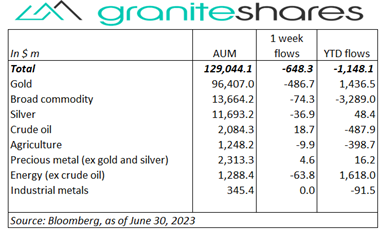

- Additional outflows last week with Gold ETPs losing the most. Broad commodity, energy (ex-crude oil) and silver ETPS had smaller outflows. Silver ETPs had small inflows.

Commentary

Stock markets registered gains last week with all 3 major indexes rising 2% or more. The gains occurred even as Fed Chairman Jerome Powell continued to voice hawkish views regarding the Fed’s fight against inflation in the face of strong economic data. Fed fund futures are now pricing a near certain rate increase in July’s FOMC meeting though with sharply diminishing probability of a rate increase priced into the September meeting. Expectations of a recession or even markedly slower growth faded progressively last week, despite the overhang of tight monetary policy, with data showing falling inflation (a lower-than-expected PCE Price Index release) accompanied by resilient job and housing markets, expanding GDP and robust consumer confidence. 10-year Treasury rates rose last week with the increase coming almost entirely from rising real rates reflecting, it seems, the Fed’s inclination to maintain higher rates while inflation falls and the economy hums along. For the week, the S&P 500 Index rose 2.4% to 4,450.38, the Nasdaq Composite Index increased 2.2% to 13,787.92, the Dow Jones Industrial Average added 2.0% to finish at 34,405.99, the 10-year U.S. Treasury rate increased 10bps to 3.84% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) was unchanged.

Stock markets registered gains last week with all 3 major indexes rising 2% or more. The gains occurred even as Fed Chairman Jerome Powell continued to voice hawkish views regarding the Fed’s fight against inflation in the face of strong economic data. Fed fund futures are now pricing a near certain rate increase in July’s FOMC meeting though with sharply diminishing probability of a rate increase priced into the September meeting. Expectations of a recession or even markedly slower growth faded progressively last week, despite the overhang of tight monetary policy, with data showing falling inflation (a lower-than-expected PCE Price Index release) accompanied by resilient job and housing markets, expanding GDP and robust consumer confidence. 10-year Treasury rates rose last week with the increase coming almost entirely from rising real rates reflecting, it seems, the Fed’s inclination to maintain higher rates while inflation falls and the economy hums along. For the week, the S&P 500 Index rose 2.4% to 4,450.38, the Nasdaq Composite Index increased 2.2% to 13,787.92, the Dow Jones Industrial Average added 2.0% to finish at 34,405.99, the 10-year U.S. Treasury rate increased 10bps to 3.84% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) was unchanged.

Oil prices moved higher last week propelled by sharply falling inventory levels and stronger-than-expected U.S. economic data. The increase came even as the Fed, ECB and BoE reiterated the need for higher rates for longer. Demand expectations rose, however, occurring as U.S. inflation fell more than expected (the PCE Price Index release Friday was lower-than-expected) with economic data indicating both a strong job and housing market and robust consumer confidence. Natural gas prices end the week about 2% lower but well off intraweek lows.

Spot gold prices ended the week almost unchanged (down slightly, falling 0.1%), recovering from intraweek lows recorded following Fed Chair Powell’s hawkish comments in Portugal. Strong economic data (including fewer-than-expected initial jobless claims, greater-than-expected new home sales and climbing consumer confidence) also dampened gold prices, adding to expectations of continued rate increases. Gold prices, stable Thursday, moved higher Friday following a PCE Price Index release showing a larger-than-expected drop in inflation. Silver prices moved higher over the week while platinum prices fell.

Base metal prices moved lower last week again last week, again affected by falling demand expectations. Smaller-than-expected Chinese industrial firm profits and contracting Chinese factory activity were the primary driving force behind the lower prices, though central bank rate-hike concerns also pressured prices lower. The decrease in copper prices occurred despite falling LME inventory levels and production disruptions in Chile. Prices did move higher Friday, reacting to a better-than-expected PCE Price Index release.

Another mixed week for grain prices with wheat and corn prices sharply lower and soybean prices moderately higher. Better-than-expected weather forecasts (divining rain over the next week or so) drove all grain prices lower early in the week while the USDA’s Planted Acres report strongly affected prices Friday. Corn prices, reacting to a much greater-than-expected planted acres number fell sharply. Soybean prices, however, rose sharply as a result of a smaller-than-expected planted acres number. Wheat prices were also pushed lower by reports of Russia’s willingness to extend the Black Sea export agreement and by increased estimates of global production.

Coming Up This Week

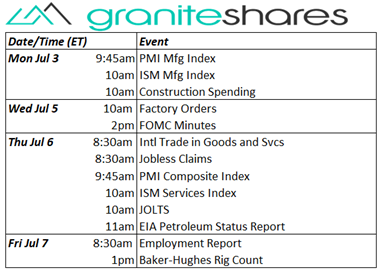

Friday’s Employment Report is the highlight of the week. PMI and ISM Manufacturing and Services Index Monday and Thursday (respectively) and FOMC minutes Tuesday also punctuate the week.

Friday’s Employment Report is the highlight of the week. PMI and ISM Manufacturing and Services Index Monday and Thursday (respectively) and FOMC minutes Tuesday also punctuate the week.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.