Commodities & Precious Metals Weekly Report: Mar 10

Posted:

Key points

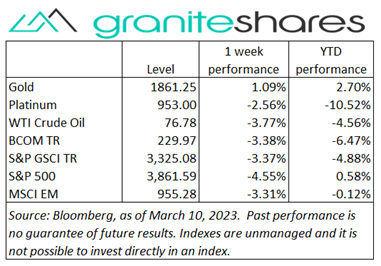

Energy prices were all lower last week. WTI and Brent crude oil, gasoline and gasoil prices decreased 4% and heating oil prices fell 5%. Natural gas prices (May futures contract) plummeted 19%.

Energy prices were all lower last week. WTI and Brent crude oil, gasoline and gasoil prices decreased 4% and heating oil prices fell 5%. Natural gas prices (May futures contract) plummeted 19%.- Grain prices were lower, too. Wheat prices dropped between 2% and 4%. Corn prices lost 4% and soybean prices decreased 1%. Soybean oil prices fell almost 8%.

- Precious metal prices were mixed. Spot gold prices ended the week up 0.7%, platinum prices fell 1.4% and silver prices dropped 3.3%. Palladium prices were down 4.7%.

- Base metal prices were all lower as well. Aluminum and zinc prices lost 4%, nickel prices dropped 8% and lead prices fell 2%. Copper prices fell 1%.

- The Bloomberg Commodity Index decreased 3.4%. Losses in the energy sector accounted for 2/3rds of the drop (the sharp decline in natural gas prices by itself was responsible for over 1/3rd of the Index decline) with losses in the grains and base metals sectors accounting for most of the remainder.

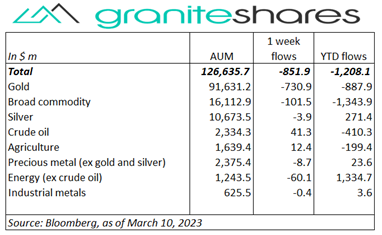

- $850 million outflows from commodity ETPs last week with $730 million coming from gold ETP outflows. Broad commodity and energy (ex-crude oil) ETPs were responsible for the remainder of the outflows. Crude oil ETPs saw the only significant (but small) inflows.

Commentary

U.S stock markets ended noticeably lower last week, pressured – initially – by growing Fed-induced recession concerns and – later – by contagion fears excited by the failure of Silicon Valley Bank on Friday. Fed Chair Powell’s testimony before the Senate on Tuesday added to expectations of a more aggressive Fed with Chairman Powell commenting that the strength of the jobs market, spending and factory production may warrant a faster pace of rate hikes. As a result, all 3 major stock indexes fell more than 1 ¼ percent. His testimony before the House on Wednesday seemed to slightly walk back Tuesday’s comments, with Chairman Powell saying no decision had been made regarding the size of the rate hike in this month’s upcoming meeting, lifting markets off their Tuesdays’ lows. All 3 major indexes fell sharply Thursday, ostensibly due to an initial jobless claims number, though greater than expected, still indicative of a tight jobs market, bolstering expectations of a strong jobs report Friday. News of Silicon Valley Bank’s distress (ie, needing to raise capital after its sale of assets left a significant shortfall) with its stock price plummeting 60%, may have also contributed to Thursday’s decline as well. Friday’s eagerly anticipated jobs report, though sending mixed signals, provided reason for the Fed to refrain from returning to its aggressive tightening policy and maintain its 25bp, wait-and-see approach. While jobs created increased more than expected, the unemployment rate ticked higher and wage pressures cooled. Stock indexes attempted to move higher following the report but news of Silicon Valley Bank’s failure (and the accompanying contagion fears) pushed all 3 major stock indexes over 1% lower. Treasury rates across the curve moved sharply lower, reacting to both safe-haven demand and growing sentiment the Fed, mindful of Silicon Valley Bank fallout, would need to ease sooner than previously expected. Similarly, The U.S. dollar, up over 1% through Wednesday, weakened significantly, also reacting to expectations of changing Fed monetary policy. For the week, the S&P 500 Index fell 4.5% to 3,861.59, the Nasdaq Composite Index dropped 4.7% to 11,138.89, the Dow Jones Industrial Average declined 4.4% to 31,109.96, the 10-year U.S. Treasury rate fell 26bp to 3.70% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.1%.

U.S stock markets ended noticeably lower last week, pressured – initially – by growing Fed-induced recession concerns and – later – by contagion fears excited by the failure of Silicon Valley Bank on Friday. Fed Chair Powell’s testimony before the Senate on Tuesday added to expectations of a more aggressive Fed with Chairman Powell commenting that the strength of the jobs market, spending and factory production may warrant a faster pace of rate hikes. As a result, all 3 major stock indexes fell more than 1 ¼ percent. His testimony before the House on Wednesday seemed to slightly walk back Tuesday’s comments, with Chairman Powell saying no decision had been made regarding the size of the rate hike in this month’s upcoming meeting, lifting markets off their Tuesdays’ lows. All 3 major indexes fell sharply Thursday, ostensibly due to an initial jobless claims number, though greater than expected, still indicative of a tight jobs market, bolstering expectations of a strong jobs report Friday. News of Silicon Valley Bank’s distress (ie, needing to raise capital after its sale of assets left a significant shortfall) with its stock price plummeting 60%, may have also contributed to Thursday’s decline as well. Friday’s eagerly anticipated jobs report, though sending mixed signals, provided reason for the Fed to refrain from returning to its aggressive tightening policy and maintain its 25bp, wait-and-see approach. While jobs created increased more than expected, the unemployment rate ticked higher and wage pressures cooled. Stock indexes attempted to move higher following the report but news of Silicon Valley Bank’s failure (and the accompanying contagion fears) pushed all 3 major stock indexes over 1% lower. Treasury rates across the curve moved sharply lower, reacting to both safe-haven demand and growing sentiment the Fed, mindful of Silicon Valley Bank fallout, would need to ease sooner than previously expected. Similarly, The U.S. dollar, up over 1% through Wednesday, weakened significantly, also reacting to expectations of changing Fed monetary policy. For the week, the S&P 500 Index fell 4.5% to 3,861.59, the Nasdaq Composite Index dropped 4.7% to 11,138.89, the Dow Jones Industrial Average declined 4.4% to 31,109.96, the 10-year U.S. Treasury rate fell 26bp to 3.70% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.1%.

WTI crude oil prices moved lower last week, mainly affected by concerns of slowing global growth due to central bank tightening. Hawkish comments from Fed Chair Powell as well as from ECB officials (the ECB meets next week) helped move prices lower throughout the week. Prices did move higher Friday with growing expectations the Fed would need to scale back its tightening plans given the potential weakness in the banking system following the failure of Silicon Valley Bank. Friday’s jobs report also contributed to those expectations, with cooling wage pressures and a higher-than-expected unemployment rate. Natural gas prices plunged 19% last week, falling over 13% on Monday alone. Warm-weather forecasts combined with oversupply concerns (aggravated by high levels of production) were responsible for the sharp fall in prices.

Gold prices moved higher last week, overcoming an early week drop, in the face of changing Fed policy expectations. Down over 2% through Tuesday, predominantly due to hawkish testimony by Fed Chair Powell, gold prices rose sharply Thursday and Friday following news of Silicon Valley Bank’s distress (Thursday) and then failure on Friday. Growing expectations the Fed would need to dial back its tightening plans in the face of uncertainty surrounding the banking industry as well as on a dovish jobs report Friday, pushed 10-year Treasury rates markedly lower and weakened the U.S. dollar, both supportive of gold prices. 10-year real rates, up 23 bps through Wednesday, ended the week unchanged while the U.S. dollar, up over 1% through Wednesday, ended the week almost unchanged. Silver and platinum prices ended down on the week, following base metal prices.

Base metal prices moved lower last week, affected by Chinese demand and central bank tightening concerns. Smaller-than-expected Chinese GDP growth targets combined with hawkish ECB and Fed officials’ comments pressured base metal prices lower throughout most of the week. The failure of Silicon Valley Bank, despite lessening expectations of Fed tightening, increased concerns of contagion, adding to uncertainty surrounding economic growth and, as a result, base metal demand. Copper prices fell the least last week, declining 1% while nickel prices fell the most, falling 8%.

Grains finished lower last week with corn prices falling the most. Corn prices were mainly pushed lower by Wednesday’s WASDE report reducing forecasted exports and, as a result, increasing U.S. ending stock levels. Soybean prices, only marginally lower, were hurt by sharply lower bean oil prices (due to lower crude oil prices) but were supported by falling Argentina harvest estimates and Brazilian harvest problems. Wheat prices moved lower on reported fund selling, poor exports and expectations of the extension of the Black Sea export agreement.

Coming up this week

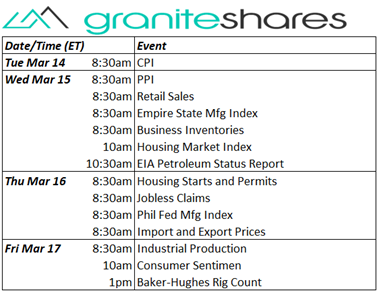

Busy data-week focused on Tuesday’s CPI release, Wednesday’s PPI and retail sales numbers and Thursday’s initial jobless claims.

Busy data-week focused on Tuesday’s CPI release, Wednesday’s PPI and retail sales numbers and Thursday’s initial jobless claims.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.