Commodities & Precious Metals Weekly Report: Mar 3

Posted:

Key points

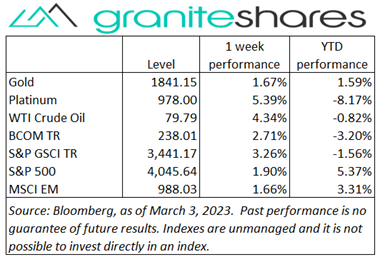

Energy prices all moved higher last week. WTI and Brent crude oi prices increased 4%, gasoil and heating oil prices increased 5% and gasoline prices rose 6%. Natural gas prices (May futures contract) rocketed 16% higher.

Energy prices all moved higher last week. WTI and Brent crude oi prices increased 4%, gasoil and heating oil prices increased 5% and gasoline prices rose 6%. Natural gas prices (May futures contract) rocketed 16% higher.- Grain prices were lower. Wheat and corn prices fell 2% and soybean prices were, again, almost unchanged but slightly lower.

- Precious metal prices were higher. Spot gold and silver prices increased 2.5%, spot platinum prices surged 8% and palladium prices rose 4%.

- Base metal prices were higher, too. Aluminum, copper and zinc prices increased 3%, lead prices rose 2% and nickel prices edged higher less than ¼ percent.

- The Bloomberg Commodity Index rose 2.7%. Gains in energy and base and precious metals were slightly offset by losses mainly in grains.

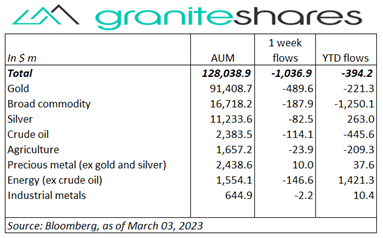

- $1 billion outflows from commodity ETPs last week, half coming from gold ETPs and the other half from a mixture of broad commodity, silver and energy ETPs. No significant inflows last week.

Commentary

An up-week for major stock market indexes with investor sentiment gently shifting from overarching concerns of a Fed-induced economic slowdown to guarded optimism of Fed restraint amidst a resilient economy. Indexes moved slightly lower through Wednesday, reacting to stronger-than-expected manufacturing activity, pending home sales and non-defense capital goods orders. Comments from Fed officials Thursday, however, supporting 25bp increment rate increases to allow time to ascertain effects from to-date accumulated increases, bolstered risk-on sentiment pushing indexes higher Thursday and Friday. Friday’s gains were the greatest and came despite much stronger-than-expected services sector activity (based on S&P Global U.S. Services PMI Index). 10-year Treasury rates also reflected the change in investor sentiment over the week, ending the week almost unchanged despite rising 11bps intraweek. Interestingly, a 13bp decline in 10-year real rates was offset entirely by a 14bp increase in 10-year inflation expectations. For the week, the S&P 500 Index increased 1.9% to 4,045.64, the Nasdaq Composite Index rose 2.6% to 11,689.01, the Dow Jones Industrial Average gained 1.7% to 33,390.35, the 10-year U.S. Treasury rate increased 1bp to 3.96% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.7%.

An up-week for major stock market indexes with investor sentiment gently shifting from overarching concerns of a Fed-induced economic slowdown to guarded optimism of Fed restraint amidst a resilient economy. Indexes moved slightly lower through Wednesday, reacting to stronger-than-expected manufacturing activity, pending home sales and non-defense capital goods orders. Comments from Fed officials Thursday, however, supporting 25bp increment rate increases to allow time to ascertain effects from to-date accumulated increases, bolstered risk-on sentiment pushing indexes higher Thursday and Friday. Friday’s gains were the greatest and came despite much stronger-than-expected services sector activity (based on S&P Global U.S. Services PMI Index). 10-year Treasury rates also reflected the change in investor sentiment over the week, ending the week almost unchanged despite rising 11bps intraweek. Interestingly, a 13bp decline in 10-year real rates was offset entirely by a 14bp increase in 10-year inflation expectations. For the week, the S&P 500 Index increased 1.9% to 4,045.64, the Nasdaq Composite Index rose 2.6% to 11,689.01, the Dow Jones Industrial Average gained 1.7% to 33,390.35, the 10-year U.S. Treasury rate increased 1bp to 3.96% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.7%.

WTI Crude oil prices moved higher every day but Monday last week. Monday’s decline came on the back of a greater-than-expected increase in ex-defense capital goods orders but losses were floored by Russia halting oil exports to Poland. Gains the remainder of the week were driven by stronger-than-expected Chinese manufacturing and services activity, growing optimism the Fed would adopt a more restrained, wait-and-see tightening approach and record high U.S. oil exports. Natural gas prices surged 16%, climbing 6% higher Monday and 8% higher Friday. Cold-weather forecasts for most of the U.S over the next 10 days, reduced production and reports of companies planning production cutbacks all moved prices higher.

Gold prices moved higher last week, increasing every day but Thursday. Gold prices rose despite better-than-expected PMI and ISM manufacturing and services indexes, falling jobless claims and rising 10-year Treasury rates. A weaker U.S. dollar and Fed officials’ comments calling for restraint to better gauge the effect of rate increases heretofore seemingly buoyed prices throughout the week and especially Friday. Friday saw gold prices increase 1% along side a weakening U.S. dollar and a sharply lower 10-year Treasury rate. Silver prices moved in line with gold prices while platinum prices surged 8%.

Base metal prices moved higher last week supported by expectations of increasing Chinese demand, a weaker U.S. dollar and hopes of a more restrained Fed. Chinese economic data showing much stronger-than-expected economic activity added to expectations of growing demand from China as did stimulus expectations surrounding the weekend’s “2-session meetings”.

Grain prices finished the week mostly lower though soybean prices were basically unchanged. Corn prices continue to suffer from weak exports and fund selling but did manage to increase Friday perhaps on the back of increasingly bearish Argentina crop production estimates. Wheat prices, likewise, continue to be hurt from Russian price undercutting and improved weather forecasts for southwestern Plains states. Soybean prices, down almost 3% through Tuesday, rallied the remainder of the weak on worsening outlook for Argentina’s crop, increased biofuel demand for bean oil and increasing meal prices.

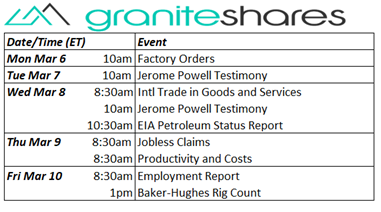

Coming up this week

Light week but accentuated by Fed Chair Powell testimony Tuesday and Wednesday and the Employment Report Friday.

Light week but accentuated by Fed Chair Powell testimony Tuesday and Wednesday and the Employment Report Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.