Commodities & Precious Metals Weekly Report: Mar 31

Posted:

Key points

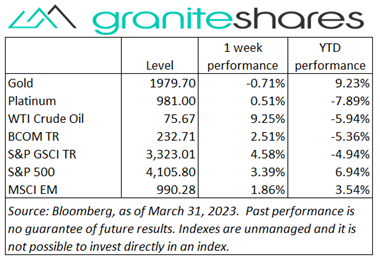

Energy prices, except for natural gas prices, were all higher. WTI and Brent crude oil price rose 9% and 7%, respectively, and gasoline prices increased 5%. Heating oil and gasoil prices rose 2%. Natural gas prices fell 6%.

Energy prices, except for natural gas prices, were all higher. WTI and Brent crude oil price rose 9% and 7%, respectively, and gasoline prices increased 5%. Heating oil and gasoil prices rose 2%. Natural gas prices fell 6%. - Grain prices were all higher. Chicago wheat prices increased 1%, Kansas City wheat prices rose 4%, corn prices 3% and soybean prices gained 5%.

- Spot gold prices ended the week down less than ½ percent while spot silver prices rose 4%. Platinum prices increased 2% and palladium prices rose 4%.

- Base metal prices were mostly higher. Aluminum prices rose 3%, copper prices ½ percent and zinc and nickel prices increased 1%. Lead prices were down 1%.

- The Bloomberg Commodity Index increased 2.5% with all sectors contributing to the gain. The biggest contributors were the energy and grains sectors.

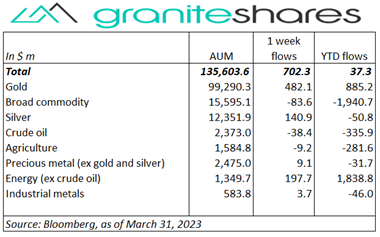

- $700 million net inflows into commodity ETPs last week. $480 million inflows into gold ETPs, $200 million into energy (ex-crude oil) ETPs and 140 million into silver ETPs were partially offset by $85 million broad commodity and $40 million crude oil ETP outflows.

Commentary

Except for Tuesday, major stock market indexes moved higher each day last week with the S&P 500 Index, Nasdaq Composite Index and the Dow Jones Industrial Average registering almost identical performances. Last week’s move higher mainly centered on lessened banking-sector concerns (with the week starting on news First Citizens Bank purchased Silicon Valley Bank) and on increased expectations the Fed would pause rate increases (and perhaps even ease this year). Continued low initial jobless claims, greater-than-expected pending home sales and a better-than-expected PCE Price Index release (Friday) added to risk-on sentiment as well. 10-year Treasury rates moved 11bps higher last week, reflecting diminished safe-haven demand as rates moved off their recent lows while the U.S. dollar continued to weaken. For the week, the S&P 500 Index increased 3.4% to 4,105.80 the Nasdaq Composite Index also increased 3.4% to 12,221.91, the Dow Jones Industrial Average increased 3.2% to 33,273.10, the 10-year U.S. Treasury rate rose 11bps to 3.48% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.5%.

Except for Tuesday, major stock market indexes moved higher each day last week with the S&P 500 Index, Nasdaq Composite Index and the Dow Jones Industrial Average registering almost identical performances. Last week’s move higher mainly centered on lessened banking-sector concerns (with the week starting on news First Citizens Bank purchased Silicon Valley Bank) and on increased expectations the Fed would pause rate increases (and perhaps even ease this year). Continued low initial jobless claims, greater-than-expected pending home sales and a better-than-expected PCE Price Index release (Friday) added to risk-on sentiment as well. 10-year Treasury rates moved 11bps higher last week, reflecting diminished safe-haven demand as rates moved off their recent lows while the U.S. dollar continued to weaken. For the week, the S&P 500 Index increased 3.4% to 4,105.80 the Nasdaq Composite Index also increased 3.4% to 12,221.91, the Dow Jones Industrial Average increased 3.2% to 33,273.10, the 10-year U.S. Treasury rate rose 11bps to 3.48% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) weakened 0.5%.

Oil prices continued to move higher this week with WTI crude oil prices climbing over 9%. Monday’s news of the disruption of Kurdistan-produced oil exports through Turkey (amounting to 450,000bpd) provided the primary impetus for higher prices with the May WTI futures contract price increasing over 5%. Lessened banking-sector concerns and increased expectations of less aggressive Fed monetary policy bolstered prices as well. Wednesday’s unexpected sharp decline in oil inventories (expectations were for a slight gain) and a larger-than-expected decrease in gasoline inventories also buoyed prices. WTI crude oil prices outperformed all other energy sector components with gasoline prices the next best performing component, increasing 5%. Natural gas moved lower on weather-related and supply factors, decreasing 6% over the week.

Gold prices moved slightly lower again last week, pressured by diminished banking-sector concerns and a mixed PCE Price Index release Friday. See-sawing throughout the week, gold prices through Thursday were up less than ¼ percent. Friday’s PCE Price Index release, coming in below expectations, initially moved gold prices higher but emerging concerns surrounding core and services prices (remaining on the higher side) pushed spot prices about ½ percent lower on the day and, as a result, for the week as well. Silver prices moved noticeably higher, gaining 4% and platinum prices rose 2%, both following base metal prices higher.

Base metal prices, for the most part, moved higher again last week. The primary force behind the price moves were lessened banking-sector concerns, expectations of less aggressive Fed monetary policy and a weaker dollar. Expectations of revived Chinese demand were dampened by a decline in Chinese factory activity, capping gains on the week.

Grain prices were all higher last week with soybean prices increasing the most. A large percentage of the week’s gains occurred Friday following the release of the USDA acreage and stock report. Soybean prices in particular benefited from the report which showed both acreage planted and stocks below expectations. Kansas City wheat prices outperformed Chicago wheat prices, with Kansas City HRW wheat prices continuing to benefit from adverse weather conditions in the southwestern Plains States. Corn prices moved higher on continued announced China sales and adverse weather affecting potentially affecting spring planting.

Coming Up This Week

Manufacturing and Services indexes filling out most of the week but with Friday’s Employment Report dominating attention.

Manufacturing and Services indexes filling out most of the week but with Friday’s Employment Report dominating attention.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.