Commodities & Precious Metals Weekly Report: Mar 4

Posted:

Key points

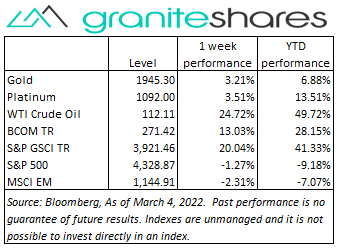

Energy prices soared last week. May WTI and Brent crude oil futures prices increased 25%. Gasoil and heating oil prices rose 30% and gasoline prices gained 22%. Natural gas prices increased 12%.

Energy prices soared last week. May WTI and Brent crude oil futures prices increased 25%. Gasoil and heating oil prices rose 30% and gasoline prices gained 22%. Natural gas prices increased 12%.- Grain prices all rose as well with wheat prices rocketing higher. Chicago and Kansas wheat prices soared 41% and 36%, respectively. Corn prices rose 15% and soybean prices increased 5%.

- Precious metal prices all higher as well. April gold futures prices increased 4.2% and May silver futures prices rose 7.4%. Spot Platinum prices gained 7%.

- Base metal prices were all sharply higher. Aluminum and nickel prices jumped 15% and 19% higher, respectively. Copper and zinc prices rose 10% and 12%, respectively.

- The Bloomberg Commodity Index climbed 13%. The energy, grains and base metals sectors were the primary reason for the gains. Only the livestock sector fell last week.

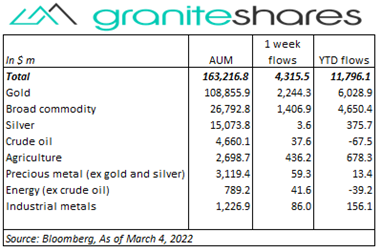

- Large inflows into gold ($2,244m) and broad commodity ($1,407m) ETPs as well as agriculture ($436m) ETPs. No outflows last week.

Commentary

U.S. stock markets continued to be dominated by the Russia-Ukraine conflict (and ensuing Western sanctions) with stock prices moving lower amidst higher-volatility, a significantly stronger U.S dollar, falling longer-term U.S. Treasury rates and sharply rising commodity prices. Fed Chairman Powell’s comments Wednesday before Congress stating rate increases were likely to begin in March but would proceed with caution in light of the Russia-Ukraine conflict engendered the only positive day for stock markets with all three major stock indexes increasing more than 1 ½ percent. Oil and wheat prices, up almost 25% and 40%, respectively, on the week, increased fears of slower global economic growth adding to downward pressure on stock prices. Increased demand for haven investments moved gold prices and the U.S. dollar higher and U.S. Treasury rates lower over the week. Friday’s much stronger-than-expected Non-Farm Payroll Report was overshadowed by Russia’s bombing of a Ukraine nuclear power plant pushing oil prices 7% higher, 10-year U.S Treasury rate 10bps lower and strengthening the U.S. dollar 0.9%. For the week, the S&P 500 decreased 1.3% to 4,328.87, the Nasdaq Composite Index dropped 2.8% to 13,313.44, the Dow Jones Industrial Average lost 1.3% to close at 33,614.67, the 10-year U.S. Treasury rate fell 23bp to 1.74% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 2.1%.

U.S. stock markets continued to be dominated by the Russia-Ukraine conflict (and ensuing Western sanctions) with stock prices moving lower amidst higher-volatility, a significantly stronger U.S dollar, falling longer-term U.S. Treasury rates and sharply rising commodity prices. Fed Chairman Powell’s comments Wednesday before Congress stating rate increases were likely to begin in March but would proceed with caution in light of the Russia-Ukraine conflict engendered the only positive day for stock markets with all three major stock indexes increasing more than 1 ½ percent. Oil and wheat prices, up almost 25% and 40%, respectively, on the week, increased fears of slower global economic growth adding to downward pressure on stock prices. Increased demand for haven investments moved gold prices and the U.S. dollar higher and U.S. Treasury rates lower over the week. Friday’s much stronger-than-expected Non-Farm Payroll Report was overshadowed by Russia’s bombing of a Ukraine nuclear power plant pushing oil prices 7% higher, 10-year U.S Treasury rate 10bps lower and strengthening the U.S. dollar 0.9%. For the week, the S&P 500 decreased 1.3% to 4,328.87, the Nasdaq Composite Index dropped 2.8% to 13,313.44, the Dow Jones Industrial Average lost 1.3% to close at 33,614.67, the 10-year U.S. Treasury rate fell 23bp to 1.74% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 2.1%.

Oil prices soared last week propelled by oil buyers shunning Russian produced oil as a result of its invasion of Ukraine and amid growing concerns Russia oil and natural gas exports could be restricted by additional sanctions. Oil prices, already supported by strong demand in the face of tight supply, soared 25% last week with WTI crude oil prices reaching levels not seen in over a decade. Oil prices moved close to 7% higher every day last week excluding Monday and Thursday, with prices increasing 4% on Monday. Prices fell 2% Thursday on reports of good progress in Iran nuclear agreement negotiations but expectations of increased oil supply from Iran were quickly pushed aside on news of Russia’s attack on Ukraine’s largest nuclear power facility Friday.

Palladium prices soared last week, jumping 27% to levels not seen since May 2021, on growing concerns of Russia’s inability or refusal to export the metal. Russia produces 40% of the world’s palladium. Spot platinum prices climbed 6%, supported by Palladium’s rise and because of increased demand as a haven investment. Spot gold and silver prices, buoyed by investor demand for haven investments, increased 4% and 6%, respectively.

Base metal prices moved markedly higher last week with copper and aluminum prices hitting all-time highs and zinc and nickel prices reaching levels not seen in over a decade. Aluminum and nickel prices surged 19% and 15%, respectively, last week while copper and and zinc prices jumped 10% and 12%, respectively. Sanctions on Russia, while not directly affecting metal production, have prevented exports because of shipping-related restrictions. Russia is a major aluminum and nickel producer and a significant producer of copper. Lower-than-expected copper production in Chile and existing low inventory levels for most base metals continue to support base metal prices.

Grain prices surged with wheat prices leading the way. Chicago wheat futures prices closed limit up every day last week except for Monday. Corn futures prices closed limit up Monday and Tuesday. For the week, Chicago and Kansas City wheat prices surged 40% and 36%, respectively, while corn prices rose 15%. Black Sea ports, closed due to the Russian-Ukraine conflict, have prevented wheat exports from Ukraine and Russia, greatly reducing supply and driving prices sharply higher. Greatly increased concerns over Ukraine’s ability to plant its next wheat crop have added to price pressures. Russia and Ukraine account for a significant portion of the world’s wheat exports.

Coming up this week

Very light data week with CPI on Thursday of most note.

Very light data week with CPI on Thursday of most note.- Intl Trade in Goods and Services on Tuesday.

- CPI and Jobless Claims on Thursday.

- Consumer Sentiment on Friday.

- EIA Petroleum Status Report Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.