Commodities & Precious Metals Weekly Report: Nov 26

Posted:

Key points

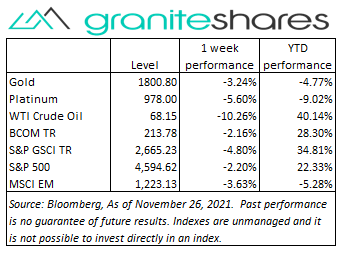

Energy prices, except for natural gas prices, were all sharply lower last week. WTI crude oil prices fell over 10%, Brent crude oil prices fell 8%, gasoline prices declined 8% and heating oil prices fell 8.5%. Natural gas prices increased 6.5%.

Energy prices, except for natural gas prices, were all sharply lower last week. WTI crude oil prices fell over 10%, Brent crude oil prices fell 8%, gasoline prices declined 8% and heating oil prices fell 8.5%. Natural gas prices increased 6.5%.- Grain prices were mixed. Kansas wheat prices gained 3.6% and Chicago wheat prices increased ¾ percent. Corn prices increased 2.5% while soybean prices fell 0.8%.

- Precious metal prices finished the week lower. February gold futures prices lost 3.5%, silver prices dropped almost 7% and platinum prices fell 5.5%.

- Base metal prices were all lower as well. Aluminum and copper prices fell 2.5%, zinc prices decreased 1.3% and nickel prices edged lower by 0.4%.

- The Bloomberg Commodity Index fell 2.2% percent. Once again, negative energy, base and precious metals sector performance was partially offset by positive performance in the agriculture sector.

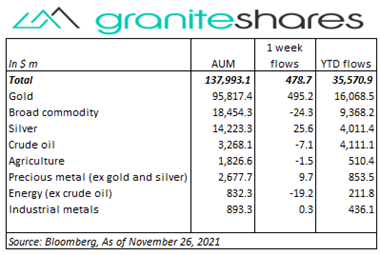

- Continued inflows into commodity ETPs ($479m) driven primarily by inflows into gold ($495m) ETP inflows. Only smaller ETP inflows and outflows in the other sectors.

Commentary

An eventful, holiday-shortened trading week with concerns of a more aggressive Fed quickly and suddenly laid to the side as fears of a more contagious South African Covid strain dominated markets Friday. Fed Chairman Powell’s renomination Monday, an over 50-year low in jobless claims, unexpectedly strong home sales, hawkish comments from Fed Governors and FOMC minutes expressing inflation concerns increased expectations the Fed may tighten monetary policy more aggressively, advancing its timetable for raising rates. As a result, 10-year U.S. Treasury rates moved 10bps higher and the Nasdaq Composite Index – the most sensitive to rising interest rates – fell 1.3%, both through Wednesday (the S&P 500 Index was unchanged and the Dow Jones Industrial Average was up ½ percent through Wednesday). News Friday of a potentially more infectious Covid strain, originating from South Africa, drastically increased Covid-related lockdown concerns, driving stock markets and interest rates significantly lower with all 3 major indexes falling near 2.5% and the 10-year U.S Treasury rate dropping 16bps from Wednesday’s closing levels. Interestingly, the U.S. dollar, stronger by almost 1% through Wednesday, weakened significantly Friday to end the week almost unchanged. At week’s end, the S&P 500 Index decreased 2.2% to 4,594.62, the Nasdaq Composite Index fell 3.5% to 15,491.70, the Dow Jones Industrial Average declined 2.0% to 34,908.10, the 10-year U.S. Treasury rate decreased 7bps to 1.48% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened less than 0.1%.

An eventful, holiday-shortened trading week with concerns of a more aggressive Fed quickly and suddenly laid to the side as fears of a more contagious South African Covid strain dominated markets Friday. Fed Chairman Powell’s renomination Monday, an over 50-year low in jobless claims, unexpectedly strong home sales, hawkish comments from Fed Governors and FOMC minutes expressing inflation concerns increased expectations the Fed may tighten monetary policy more aggressively, advancing its timetable for raising rates. As a result, 10-year U.S. Treasury rates moved 10bps higher and the Nasdaq Composite Index – the most sensitive to rising interest rates – fell 1.3%, both through Wednesday (the S&P 500 Index was unchanged and the Dow Jones Industrial Average was up ½ percent through Wednesday). News Friday of a potentially more infectious Covid strain, originating from South Africa, drastically increased Covid-related lockdown concerns, driving stock markets and interest rates significantly lower with all 3 major indexes falling near 2.5% and the 10-year U.S Treasury rate dropping 16bps from Wednesday’s closing levels. Interestingly, the U.S. dollar, stronger by almost 1% through Wednesday, weakened significantly Friday to end the week almost unchanged. At week’s end, the S&P 500 Index decreased 2.2% to 4,594.62, the Nasdaq Composite Index fell 3.5% to 15,491.70, the Dow Jones Industrial Average declined 2.0% to 34,908.10, the 10-year U.S. Treasury rate decreased 7bps to 1.48% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened less than 0.1%.

A tale-of-two-cities for oil prices last week. Up over 3% through Wednesday on the back of Tuesday’s smaller-than-expected global strategic oil release and growing concerns OPEC+ could reduce output (OPEC+ meets this week). Wednesday’s EIA release showing a larger-than-expected increase in U.S. inventories was offset by a sharp decline in U.S. Strategic Petroleum Reserve inventory levels. Reports Friday of a new Covid variant, potentially resistant to existing vaccines, drove oil prices sharply lower with the January WTI crude oil futures contract falling 13%. For the week, WTI crude oil prices were lower by just over 10%.

Gold prices moved sharply lower Monday and Tuesday, falling 3.5%, pressured by Fed Chairman Powell’s renomination and growing expectations the Fed would accelerate its tapering program enabling the Fed to raise rates sooner. 10-year U.S. Treasury real rates, reflecting these expectations, increased 11bps through Wednesday. The U.S. dollar behaved similarly, strengthening almost 1% through Wednesday. Gold prices rallied nearly 1% Friday morning as investors sought haven investments as stock and commodity prices fell sharply due to fears of a new, potentially vaccine resistant, Covid variant but ended the day almost unchanged. 10-year real rates, however, fell 9bps Friday to -1.09% and the U.S. dollar weakened ¾ percent. For the week, gold prices were lower by 3.5%.

Tight supplies, strong U.S. housing numbers, a strengthening U.S. dollar and actions by China to support its housing market helped moved copper prices almost 2% higher through Wednesday. Friday’s news of an emergent coronavirus strain, possibly vaccine resistant, drove copper prices (and other base metal prices) sharply lower. Copper prices, for example, dropped 4% Friday to end the week down almost 2.5%.

Weather and crop condition concerns as well tight global supplies continued to support wheat prices last week though prices retreated Wednesday (presumably profit taking before Thanksgiving) and Friday (coronavirus-related pressures). Stronger-than-expected exports (released in Friday’s USDA report) supported corn prices with prices rising over 1% Friday. Soybean prices moved lower over the week mainly as a result of improved South American weather and weather forecasts.

Coming up this week

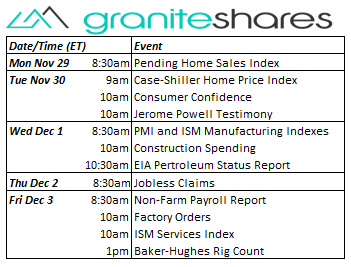

Decent data week with Fed Chairman testifying before Congress Tuesday, PMI and ISM Manufacturing Indexes Wednesday and the Non-Farm Payroll Report Friday.

Decent data week with Fed Chairman testifying before Congress Tuesday, PMI and ISM Manufacturing Indexes Wednesday and the Non-Farm Payroll Report Friday.- Pending Home Sales Index on Monday.

- Case-Shiller Home Price Index, Consumer Confidence and Jerome Powell Testimony on Tuesday.

- PMI and ISM Manufacturing Indexes and Construction Spending on Wednesday.

- Jobless Claims on Thursday.

- Non-Farm Payroll Report, Factory Orders and ISM Services Index on Friday.

- EIA Petroleum Status Report and Baker-Hughes Rig Count on Wednesday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.