Commodities & Precious Metals Weekly Report: Nov 5

Posted:

Key points

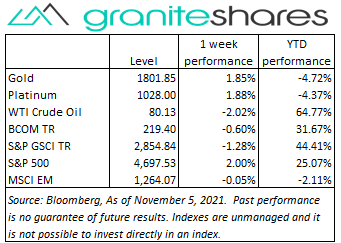

Energy prices were mainly lower again last week. WTI and Brent crude oil and gasoline prices decreased between 1% and 2%. Natural gas prices increased 1.8%.

Energy prices were mainly lower again last week. WTI and Brent crude oil and gasoline prices decreased between 1% and 2%. Natural gas prices increased 1.8%.- Grain prices moved lower last week. Corn prices decreased 2.7%, soybean prices fell 3.5% and wheat prices decreased 0.8%.

- Precious metal prices ended the week higher with gold and platinum prices increasing 1.9% and silver prices rising 0.9%.

- Base metal prices moved lower last week with aluminum and zinc prices falling the most. Aluminum prices fell 6.0% and zinc prices lost 4.5%. Copper prices were down about ½ percent and nickel prices were lower by 0.1%.

- The Bloomberg Commodity Index fell 0.6% last week. Negative performance in the grains, base metal and energy sectors was partially offset by positive performance in the livestock, softs and precious metals sectors.

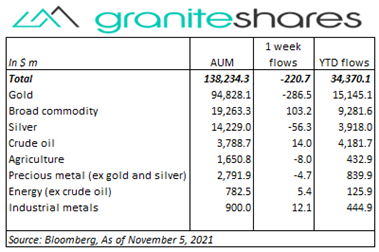

- Decent inflows ($527m) into commodity ETPs last week. Gold ($228m), broad commodity ($323m) and base metal ($56m) ETP inflows were partially offset by crude oil (-$112m) ETP outflows.

Commentary

U.S. stock markets powered higher again last week with all 3 major indexes setting record highs. While strong earnings and economic reports helped move stock markets higher, Wednesday’s FOMC announcement also contributed to this week’s increase. The Fed, as expected, announced it would begin reducing its $120 billion/month bond buyback program by $15 billion/month beginning this month (subject to changes if needed) but also indicated the timing of rate increases was uncertain given the Fed’s view its full-employment goals have not been reached, increasing sentiment the Fed would maintain its easy-money policies longer than expected. Friday’s October Non-Farm Payroll report, stronger than expected with respect to jobs and the unemployment rate, seemingly had little effect on markets with investor uncertainty regarding the strength of future job gains and an unchanged labor participation rate overriding the headline strength of the report. The 10-year U.S. Treasury rate, reflecting this sentiment, ended the week 11bps lower with almost all the decrease coming from falling 10-year real rates (down 8bps over the week). The U.S. dollar, stronger on the week, rose on the back of Thursday’s BoE announcement leaving rates unchanged. At week’s end, the S&P 500 Index rose 2.0% to 4,697.53, the Nasdaq Composite Index gained 3.0% to 15,971.60, the Dow Jones Industrial Average increased 1.4% to 36,329.07, the 10-year U.S. Treasury rate fell 11bps to 1.45% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.2%.

U.S. stock markets powered higher again last week with all 3 major indexes setting record highs. While strong earnings and economic reports helped move stock markets higher, Wednesday’s FOMC announcement also contributed to this week’s increase. The Fed, as expected, announced it would begin reducing its $120 billion/month bond buyback program by $15 billion/month beginning this month (subject to changes if needed) but also indicated the timing of rate increases was uncertain given the Fed’s view its full-employment goals have not been reached, increasing sentiment the Fed would maintain its easy-money policies longer than expected. Friday’s October Non-Farm Payroll report, stronger than expected with respect to jobs and the unemployment rate, seemingly had little effect on markets with investor uncertainty regarding the strength of future job gains and an unchanged labor participation rate overriding the headline strength of the report. The 10-year U.S. Treasury rate, reflecting this sentiment, ended the week 11bps lower with almost all the decrease coming from falling 10-year real rates (down 8bps over the week). The U.S. dollar, stronger on the week, rose on the back of Thursday’s BoE announcement leaving rates unchanged. At week’s end, the S&P 500 Index rose 2.0% to 4,697.53, the Nasdaq Composite Index gained 3.0% to 15,971.60, the Dow Jones Industrial Average increased 1.4% to 36,329.07, the 10-year U.S. Treasury rate fell 11bps to 1.45% and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) strengthened 0.2%.

Up almost 1% Monday on continued strong demand and restrained production, WTI crude oil prices fell 3.5% following Wednesday’s EIA report showing a much larger-than-expected increase in U.S. oil stocks. OPEC+’s decision to leave production increases unchanged Thursday, while supportive of the market, was offset by reports Saudi Arabia production will soon surpass 10 million barrels/day for the first time since the onset of the Covid-19 pandemic. OPEC+, however, has had difficulties reaching its planned output goals due to involuntary production decreases from some OPEC+ members. Prices moved higher Friday, recouping all and more of Thursday’s losses.

Gold prices moved higher last week buoyed by Fed Chairman Powell’s comments Wednesday expressing concern over the strength of labor markets and maintaining the transitory nature of current high inflation. Friday’s October Non-Farm Payroll report also supported gold prices, with investor uncertainty regarding the strength of future job gains and an unchanged labor participation rate overriding the headline strength of the report. The 10-year U.S. Treasury rate ended the week 11bps lower with almost all the decrease coming from falling 10-year real rates (down 8bps over the week), reflecting sentiment Fed changes to monetary policy will be moderate and cautious, supporting gold prices as well.

Lower coal prices and slowing Chinese economic activity moved base metal prices lower last week with aluminum and zinc prices falling the most. Copper prices, down a little over ½ percent, were supported by tight supply conditions and Peru mining disruptions due to labor-organized roadblocks.

Grain prices finished lower last week led by decreases in soybean and corn prices. Wheat prices, up nearly 10% since the end of September, started the week strong jumping over 3% Monday on continued concerns of global supply shortages and elevated fertilizer cost. Wheat prices fell the remainder of the week with declining oil prices and perhaps on profit taking. Corn prices, supported by increased ethanol demand, moved lower with falling oil prices as well despite strong export demand.

Coming up this week

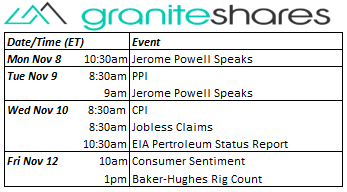

Light bank-holiday-shortened data week. Jerome Powell speaks Monday and Tuesday and PPI and CPI Tuesday and Wednesday, respectively.

Light bank-holiday-shortened data week. Jerome Powell speaks Monday and Tuesday and PPI and CPI Tuesday and Wednesday, respectively. - Jerome Powell speaks on Monday.

- PPI and Jerome Powell speaks on Tuesday.

- CPI and Jobless Claims on Wednesday.

- Consumer Sentiment on Friday.

- EIA Petroleum Status Report on Wednesday and Baker-Hughes Rig Count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.