Commodities & Precious Metals Weekly Report: Nov 6

Posted:

Key points

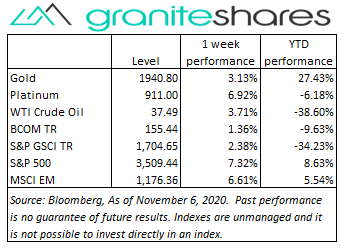

Except for natural gas prices, energy prices were all higher last week, increasing between 4% and a little over 5%. WTI and Brent crude oil prices increased approximately 4% and gasoline and heating oil prices rose about 5%. Natural gas prices dropped 12.5%.

Except for natural gas prices, energy prices were all higher last week, increasing between 4% and a little over 5%. WTI and Brent crude oil prices increased approximately 4% and gasoline and heating oil prices rose about 5%. Natural gas prices dropped 12.5%.- Grain prices all moved higher with soybean prices gaining the most, increasing over 4%. Corn prices followed, increasing 2% and wheat prices rose between 0.6% (Chicago wheat) and 2.6% (Kansas wheat).

- Base metal prices were all higher as well. Zinc prices rose the most, increasing almost 4.5%, followed by copper prices which rose 3.5%, Aluminum prices increased over 2.5% and nickel prices gained 1.5%.

- Gold prices increased over 3%, platinum prices rose 7% and silver prices were up 8.5%.

- The Bloomberg Commodity increased 1.36%. All sectors, except for the energy sector, moved higher last week. The precious metals sector increased the most followed by the grains and base metals sectors.

Commentary

Rebounding off their worst weekly performance since March the previous week, U.S stock markets powered higher last week recording their best election-week performance since 1932. Tech stocks lead the week’s rally, with stocks apparently rising on the back of strong economic reports but more importantly as a result of a likely divided, gridlocked Congress. The U.S. dollar weakened significantly, falling as investor risk-on appetite increased and global equity markets rose and, perhaps, on Fed Chairman Powell’s comments that the Fed had plenty of ammunition remaining. 10-year U.S. Treasury rates moved lower, reacting, in part, to reduced expectations of a large stimulus package in the coming year. At week’s end the S&P 500 Index jumped 7.3% to 3,509.44, the Nasdaq Composite Index surged 9.0% to 11,895.23, the 10-year U.S. Treasury rate fell 6bps to 82bps and the U.S. dollar (as measured by the ICE U.S. Dollar index - DXY) weakened 1.9%.

Up over 5% through Tuesday on much greater-than-expected declines in U.S. oil inventories and reports Russia would consider extending production cutbacks, WTI oil prices fell the remainder of the week with increased coronavirus-related demand concerns and falling expectations of a large U.S. stimulus package. Brent crude oil prices behaved similarly, increasing almost 9% through Wednesday but finishing the week up 4%.

Gold prices moved higher last week, increasing early in the week on U.S. election uncertainty and then moving higher again later in the week as the U.S. dollar weakened significantly. Increased risk-on investor sentiment and Fed Chairman Powell’s comments after Thursday’s FOMC meeting may have helped the U.S. dollar weaken and, as a result, gold prices rise. Silver and platinum prices followed suit but with greater gains.

Base metal prices, too, moved higher last week, supported by much stronger-than-expected manufacturing activity in the U.S., China and the EU. A weaker U.S. dollar also supported base metal prices.

Soybean prices powered higher last week, buoyed by continued dry weather in South America, strong Chinese demand and reduced yield expectations in the U.S. Corn and wheat prices, moving higher with soybean prices, also benefited from weather concerns and strong demand as well as a weaker U.S. dollar.

Coming up this week

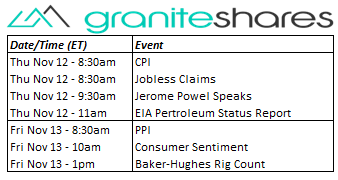

Very light data-week with CPI and PPI released Thursday and Friday, respectively and Jerome Powell speaking on Thursday.

Very light data-week with CPI and PPI released Thursday and Friday, respectively and Jerome Powell speaking on Thursday.- CPI, Jobless Claims and Jerome Powell Speaks on Thursday.

- PPI and Consumer Sentiment on Friday.

- EIA petroleum report on Thursday and Baker-Hughes rig count on Friday.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.