Commodities & Precious Metals Weekly Report: Oct 13

Posted:

Key points

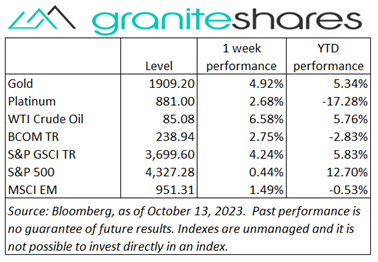

Energy prices, except for natural gas prices, were sharply higher. WTI and Brent crude oil prices rose 7%, heating oil and gasoil prices increased 9% and gasoline prices gained 5%. Natural gas prices decreased 1%.

Energy prices, except for natural gas prices, were sharply higher. WTI and Brent crude oil prices rose 7%, heating oil and gasoil prices increased 9% and gasoline prices gained 5%. Natural gas prices decreased 1%.- Grain prices were mostly higher. Chicago wheat prices rose 2%, corn prices increased less than ½ percent and soybean prices added 1%. Kansas City wheat prices declined 1%.

- Spot gold and silver prices rose 5% and spot platinum prices increased 1%.

- Copper and aluminum prices fell 2%, zinc prices lost 3% and lead prices dropped 5%. Nickel prices fell less than ½ percent.

- The Bloomberg Commodity Index rose 2.8%. Gains were almost entirely from the energy and precious metals sectors. Other sectors experienced offsetting, small gains and losses.

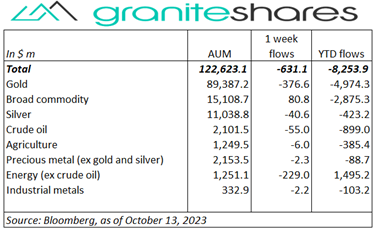

- $630 million net outflows, mainly from gold and energy ETPs. Broad commodity ETPs had small inflows.

Commentary

Stock prices moved noticeably higher early last week with all 3 major stock indexes gaining north of 1%. The increase came on the back of dovish comments from Fed officials, opining higher longer-term rates would likely make unnecessary additional rate increases. 10-year Treasury rates, reacting to these comments, fell over 25bps through Wednesday. A slightly better-than-expected PPI release (Wednesday), increasing hopes of cooling inflation added to the upward momentum. Sentiment changed, however, following a lukewarm CPI release Thursday, re-igniting higher-rates-for-longer concerns, pushing the 10-year Treasury rate almost 15bps higher and pressuring stock prices lower. That pressure continued through Friday with risk-off sentiment dominating markets on growing concerns surrounding Israel’s counteroffensive against Hamas terror attacks. The Nasdaq Composite and S&P 500 Indexes moved markedly lower while haven asset prices moved sharply higher. For the week, the S&P 500 Index increased 0.4% to 4,327.28, the Nasdaq Composite Index fell 0.2% to 13,407.23, the Dow Jones Industrial Average rose 0.8% to 33,670.29 the 10-year U.S. Treasury rate fell 19bps to 4.62% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.6%.

Stock prices moved noticeably higher early last week with all 3 major stock indexes gaining north of 1%. The increase came on the back of dovish comments from Fed officials, opining higher longer-term rates would likely make unnecessary additional rate increases. 10-year Treasury rates, reacting to these comments, fell over 25bps through Wednesday. A slightly better-than-expected PPI release (Wednesday), increasing hopes of cooling inflation added to the upward momentum. Sentiment changed, however, following a lukewarm CPI release Thursday, re-igniting higher-rates-for-longer concerns, pushing the 10-year Treasury rate almost 15bps higher and pressuring stock prices lower. That pressure continued through Friday with risk-off sentiment dominating markets on growing concerns surrounding Israel’s counteroffensive against Hamas terror attacks. The Nasdaq Composite and S&P 500 Indexes moved markedly lower while haven asset prices moved sharply higher. For the week, the S&P 500 Index increased 0.4% to 4,327.28, the Nasdaq Composite Index fell 0.2% to 13,407.23, the Dow Jones Industrial Average rose 0.8% to 33,670.29 the 10-year U.S. Treasury rate fell 19bps to 4.62% and the U.S. dollar (as measured by the ICE U.S. Dollar index – DXY) strengthened 0.6%.

Oil prices rose last week, driven by growing contagion concerns of the Israel-Hamas war. Prices rose almost 4% Monday but then drifted lower as initial concerns receded and on Thursday’s EIA report showing a much larger-than-expected build in inventories. Friday saw prices sharply rise following reports of Israel commencing its ground offensive in Gaza. Natural gas prices fell slightly on no real news.

Spot gold prices moved similarly to oil prices, moving significantly higher Mondy and Friday. Flight-to-quality was the primary force behind the move higher, brought about by concerns surrounding the Israel-Hamas war. Dovish comments from Fed officials indicating the Fed may not need to raise rates going forward also contributed to the rise in gold prices. Thursday’s lukewarm CPI release seemingly had no real effect on gold prices. Silver prices moved in step with gold prices.

Copper prices moved lower last week after initially moving higher on the reopening of Chinese markets following the end of the Golden Week holiday. Chinese property market concerns pushed prices lower with Country Garden (another Chinese property developer) announcing it would have difficulties making offshore debt payments. Reports of additional Chinese stimulus plans helped support prices but did not halt the move lower.

Grain prices moved lower through Wednesday in front of Thursday’s USDA WASDE report. Favorable weather forecasts and good harvest expectations were the primary reasons. Thursday’s WASDE report bolstered prices, however, with ending stocks, production and yield generally coming in lower than expected. Rising oil prices also lent support, aiding corn (ethanol) and soybean oil prices.

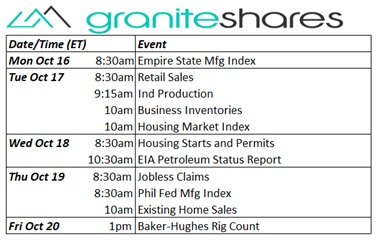

Coming Up This Week

Retail Sales, industrial production and housing data punctuate this week’s data.

Retail Sales, industrial production and housing data punctuate this week’s data.

Who is Jeff Klearman in our research team? Jeff has over 20 years experience working as a trader, structurer, marketer and researcher. Most recently, Jeff was the Chief Investment Officer for Rich Investment Services, a company which created, listed and managed ETFs. Prior to Rich Investment Services, Jeff headed the New York Commodities Structuring desk at Deutsche Bank AG. From 2004 to 2007, he headed the marketing and structuring effort for rates based structured products at BNP Paribas in New York. He worked at AIG Financial Products from 1994 to 2004 trading rates-based volatility products as well as marketing and structuring. Jeff received his MBA in Finance from NYU Stern School of Business and his Bachelors of Science in Chemical Engineering from Purdue University.